Digital Banking Market Trends, Share, Growth, Size, Analysis and Forecast 2032

Digital Banking Market by Banking Type (Retail Banking, Corporate Banking, and Investment Banking), by Solution (Payments, Processing Services, Customer and Channel Management, and Risk Management), by Organization Size (Small- and Medium-Sized Enterprises and Large-Sized Enterprises), by Technology (BaaS, BaaP, Cloud-Based, White Label Banking, and Chatbots), and by Payment Vertical (Banking Cards, Unstructured Supplementary Service Data, Uniform Payment Interface, Mobile Wallets, Point of Sale, Mobile Banking, Internet Banking, and Micro ATMs): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032.

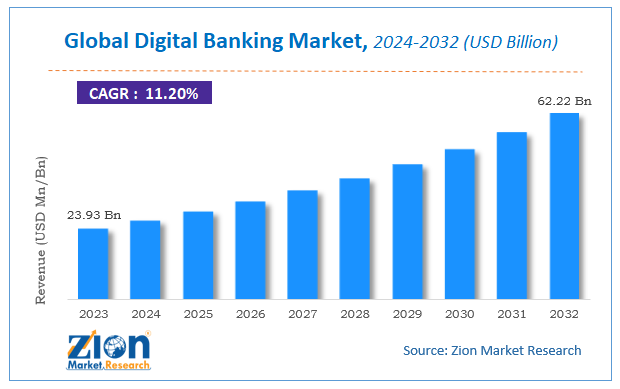

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.93 Billion | USD 62.22 Billion | 11.2% | 2023 |

Digital Banking Market: Size

The global Digital Banking market size was worth around USD 23.93 billion in 2023 and is predicted to grow to around USD 62.22 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.2% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Digital Banking market on a global and regional level.

Digital Banking Market: Overview

Digital banking is the digitization of the banking sector, where all the banking services and activities can be accessed by users over the internet. All the activities and programs offered by banks are usually available to the customers of a particular branch through designated representatives. However, with the advent and growth of digital banking, customers can now access their financial data and enjoy personalized banking services through their mobiles or desktops. Digital banking includes high levels of automation process and web-based services. It includes APIs (Application Programming Interface) that enables cross-institutional service composition for delivering banking products and performs transactions efficiently. They support businesses to transfer payments easily from one account to another.

The increasing use of digital devices in managing a business, rising demand for cloud-based solutions, and the growing number of smartphones are some major factors that are driving the market digital banking market. Technological advancements along with the advent of AI-based smart solutions have resulted in an increased number of companies opting for these digital solutions. It saves time and provides customers with new solutions at their comfort and discretion. However, the lack of organized internet infrastructure and several security issues may hamper the overall growth of the digital banking market over the forecast period. Change in technological solutions along with the higher emphasis on comfort through connected devices will provide new opportunities for the digital banking market globally.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis, the product portfolio of various companies according to regions.

Digital Banking Market: Segmentation

The study provides a decisive view of the digital banking market by segmenting it based on banking type, solution, technology, organization size, payment vertical, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of banking type, the market for digital banking is divided into retail, corporate, and investment banking.

By solution, the market comprises payments, processing services, customer and channel management, and risk management. The organization sizes of this market include small- and medium-sized enterprises and large-sized enterprises.

Based on technology, the digital banking market is divided into BaaS (banking as a service), BaaP (banking as a platform), cloud-based, white label banking, and chatbots. Banking cards, uniform payment interface (UPI), the point of sale (POS), mobile wallets, unstructured supplementary service data (USSD), mobile banking, internet banking, and micro ATMs form the payment vertical of the global digital banking market.

Digital Banking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Banking Market |

| Market Size in 2023 | USD 23.93 Billion |

| Market Forecast in 2032 | USD 62.22 Billion |

| Growth Rate | CAGR of 11.2% |

| Number of Pages | 110 |

| Key Companies Covered | ACI Worldwide, Ally Financial Inc., Backbase, Capital Banking Solution, CR2, Digiliti Money, Inc., Fiserv, Inc., Infosys Ltd., Innofis, JPMorgan Chase & Co., Kony, Inc., Microsoft Corporation, Oracle, Tata Consultancy Services, Technisys, Temenos Headquarters SA, TRG Mobilearth Inc., and Urban FT |

| Segments Covered | By banking type, By solution, By technology, By organization size, By payment vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Banking Market: Regional Analysis

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

By region, North America holds the maximum share of the digital banking market and is likely to grow significantly over the forecast time period. Technological advancements and the increasing use of AI-based solutions across multiple business sectors are the major growth drivers of the digital banking market in the Asia Pacific region.

Digital Banking Market: Competitive Players

Some major players of the global digital banking market are:

- ACI Worldwide

- Ally Financial Inc.

- Backbase

- Capital Banking Solutions

- CR2

- Digiliti Money Inc.

- Fiserv Inc.

- Infosys Ltd.

- Innofis

- JPMorgan Chase & Co.

- Kony Inc.

- Microsoft Corporation

- Oracle

- Tata Consultancy Services

- Technisys

- Temenos Headquarters SA

- TRG Mobilearth Inc.

- Urban FT

The Global Digital Banking Market is segmented as follows:

Global Digital Banking Market: Banking Type Analysis

- Retail Banking

- Corporate Banking

- Investment Banking

Global Digital Banking Market: Solution Analysis

- Payments

- Processing Services

- Customer and Channel Management

- Risk Management

Global Digital Banking Market: Organization Size Analysis

- Small- and Medium-Sized Enterprises

- Large-Sized Enterprises

Global Digital Banking Market: Technology Analysis

- BaaS (Banking as a Service)

- BaaP (Banking as a Platform)

- Cloud-Based

- White Label Banking

- Chatbots

Global Digital Banking Market: Payment Vertical Analysis

- Banking Cards

- Unstructured Supplementary Service Data (USSD)

- Uniform Payment Interface (UPI)

- Mobile Wallets

- Point of Sale (POS)

- Mobile Banking

- Internet Banking

- Micro ATMs

Global Digital Banking Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Digital banking is the digitization of the banking sector, where all the banking services and activities can be accessed by users over the internet.

According to study, the Digital Banking Market size was worth around USD 23.93 billion in 2023 and is predicted to grow to around USD 62.22 billion by 2032.

The CAGR value of Digital Banking Market is expected to be around 11.2% during 2024-2032.

North America has been leading the Digital Banking Market and is anticipated to continue on the dominant position in the years to come.

The Digital Banking Market is led by players like ACI Worldwide, Ally Financial Inc., Backbase, Capital Banking Solutions, CR2, Digiliti Money, Inc., Fiserv, Inc., Infosys Ltd., Innofis, JPMorgan Chase & Co., Kony, Inc., Microsoft Corporation, Oracle, Tata Consultancy Services, Technisys, Temenos Headquarters SA, TRG Mobilearth Inc., and Urban FT.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed