Refrigerated Vehicle Market Size, Share, Growth, and Forecast Report 2032

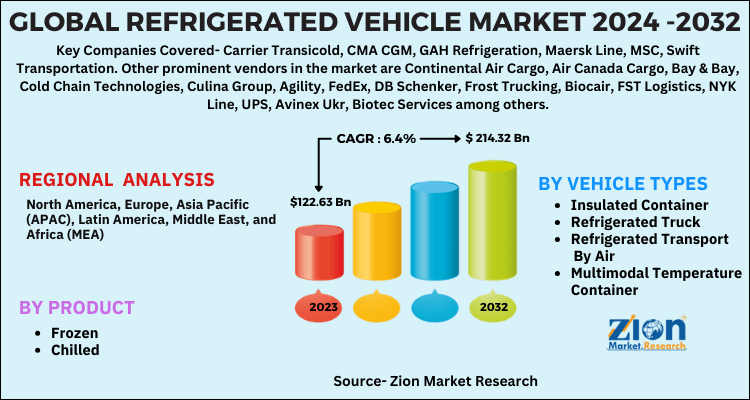

Refrigerated Vehicle Market by Vehicle Type (Insulated Container, Refrigerated Truck, Refrigerated Transport by Air, Multimodal Temperature Container, and Atmosphere Controlled Container), By Product (Frozen and Chilled), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

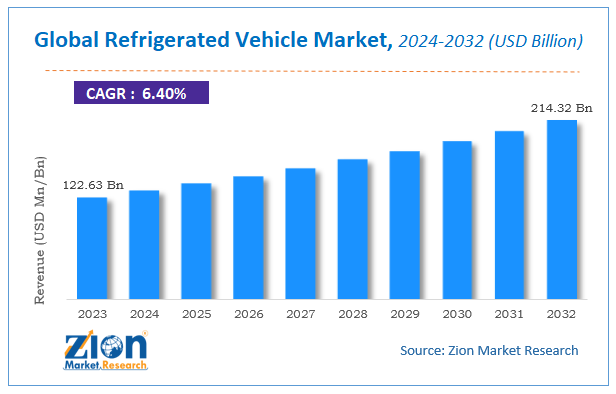

| USD 122.63 Billion | USD 214.32 Billion | 6.4% | 2023 |

Refrigerated Vehicle Market Size

According to a report from Zion Market Research, the global Refrigerated Vehicle Market was valued at USD 122.63 Billion in 2023 and is projected to hit USD 214.32 Billion by 2032, with a compound annual growth rate (CAGR) of 6.4% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Refrigerated Vehicle Market industry over the next decade.

Global Refrigerated Vehicle Market: Overview:

The refrigerated vehicle is temperature maintained vehicles carrying the products which get affected by outside temperature. It maintains the temperature ranges from -30oc to 400c. It is necessary to increase the shelf life of the product and protect it from external environmental conditions and maintain their chemical and biological properties.

Furthermore, it is helpful for transport of vegetable, food products, pharmaceutical and healthcare products. Owing to which, the refrigerated vehicle has huge demand worldwide. Thus, it is expected to spurt the growth of refrigerated vehicle market over the forecast period.

COVID-19 Impact Analysis

The Global Refrigerated Vehicle market has witnessed a slight decline during the pandemic. The restrictions imposed by various nations to contain COVID had stopped the production, resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and there's a surge in demand.

The market would remain lucrative in the upcoming year. The decrease in the global Refrigerated Vehicle market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Refrigerated Vehicle Market: Growth Factors

The refrigerated vehicle market is expected to witness substantial growth within the forecast period. The market is driven by increasing demand for frozen food and ready to eat foods. Moreover, various pharmaceutical and biotech products need protection from heat and sunlight to maintain their formulation, which is positively affecting refrigerated vehicle market. However, the increasing oil prices globally may restrain the growth of this market.

Manufacturers are focusing on expanding customer base geographically or through new services, R&D, and joint venture. For instance, global leader Maersk Line launched new service between Asia and Latin America in Jan 2018 to improve its product offering in the region connecting Asia to Colombia, the Caribbean, and Pecem. This offered greater port coverage and reduced transit time. Moreover, two leading manufacturers Carrier transicold and Singamas Container Holdings Ltd. has developed a new refrigerated shipping container PrimeLINE ONE. Thus, new innovations and launches will leverage the potential of the global refrigerated vehicle market.

Refrigerated Vehicle Market: Segmentation

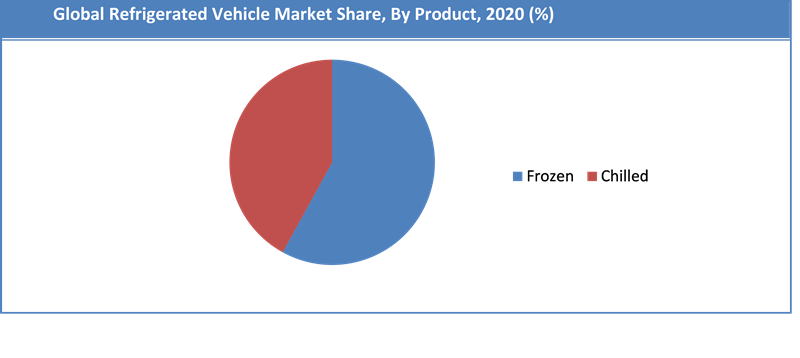

On the basis of the type of product, the global refrigerated vehicle market is segmented into frozen and chilled. As frozen foods are convenient to eat and are also time-saving, the increase in demand for frozen foods is expected to boost growth rate for refrigerated vehicle market. In addition, changing dietary pattern of consumers, increase in cold-chain infrastructure and globalization in food trades is anticipated to affect the market positively.

On the basis of vehicle type, the global refrigerated vehicle market is segmented into an insulated container, refrigerated truck, atmosphere-controlled container, refrigerated transport by air, multimodal temperature container and others. Of which refrigerated container is the fastest growing segment of all.

Refrigerated Vehicle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Refrigerated Vehicle Market |

| Market Size in 2023 | USD 122.63 Billion |

| Market Forecast in 2032 | USD 214.32 Billion |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 145 |

| Key Companies Covered | Carrier Transicold, CMA CGM, GAH Refrigeration, Maersk Line, MSC, Swift Transportation. Other prominent vendors in the market are Continental Air Cargo, Air Canada Cargo, Bay & Bay, Cold Chain Technologies, Culina Group, Agility, FedEx, DB Schenker, Frost Trucking, Biocair, FST Logistics, NYK Line, UPS, Avinex Ukr, Biotec Services among others |

| Segments Covered | By Vehicle, By Product And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

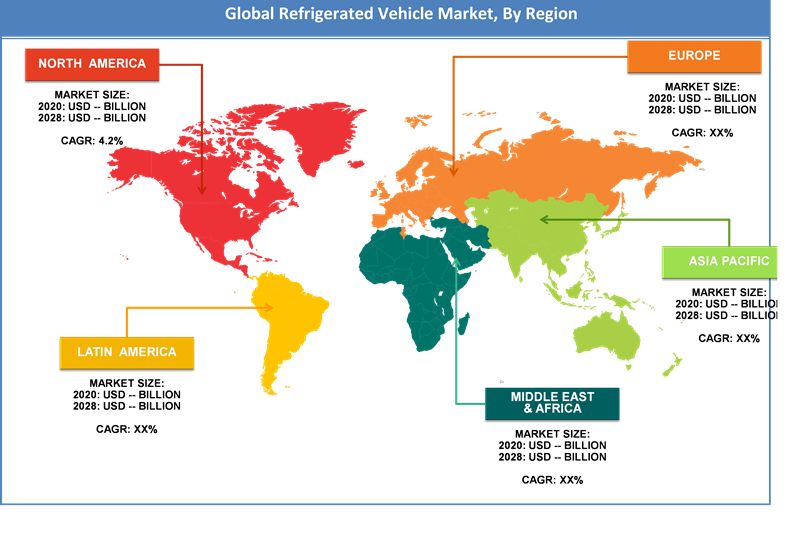

Refrigerated Vehicle Market: Regional Analysis

In 2020, Europe was the largest market for refrigerated vehicles. This growth is mainly due to the busy lifestyle of people, changing food habits and increasing awareness regarding benefits of nutrition value of frozen foods. Moreover, increasing population with high disposable income is expected to boost the demand for refrigerated vehicle in Asia Pacific region. North America is another key regional market and is expected to show significant growth in the near future on account of increasing demand for frozen foods and healthcare products. The Middle East & Africa is expected to be the fastest growing refrigerated vehicle market owing to increasing middle-class population, which is projected to increase demand for frozen foods.

Refrigerated Vehicle Market: Competitive Players

Some of the major players of the global Refrigerated Vehicle market include:

- Carrier Transicold

- CMA CGM

- GAH Refrigeration

- Maersk Line

- MSC

- Swift Transportation

- Continental Air Cargo

- Air Canada Cargo

- Bay & Bay

- Cold Chain Technologies

- Culina Group

- Agility

- FedEx

- DB Schenker

- Frost Trucking

- Biocair

- FST Logistics

- NYK Line

- UPS

- Avinex Ukr

- Biotec Services among others.

The global Refrigerated Vehicle Market is segmented as follows:

By Vehicle Types

- Insulated Container

- Refrigerated Truck

- Refrigerated Transport By Air

- Multimodal Temperature Container

- Atmosphere Controlled Container

By Product

- Frozen

- Chilled

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A refrigerated vehicle is a specially designed transport vehicle equipped with a refrigeration system to maintain a controlled, low-temperature environment. It is commonly used for transporting perishable goods such as food, pharmaceuticals, and flowers, ensuring product quality and safety during transit.

According to study, the Refrigerated Vehicle Market size was worth around USD 122.63 billion in 2023 and is predicted to grow to around USD 214.32 billion by 2032.

The CAGR value of Refrigerated Vehicle Market is expected to be around 6.4% during 2024-2032.

Europe has been leading the Refrigerated Vehicle Market and is anticipated to continue on the dominant position in the years to come.

The Refrigerated Vehicle Market is led by players like Carrier Transicold, CMA CGM, GAH Refrigeration, Maersk Line, MSC, Swift Transportation. Other prominent vendors in the market are Continental Air Cargo, Air Canada Cargo, Bay & Bay, Cold Chain Technologies, Culina Group, Agility, FedEx, DB Schenker, Frost Trucking, Biocair, FST Logistics, NYK Line, UPS, Avinex Ukr, Biotec Services among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed