Cold Chain Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

Cold Chain Market By Type (Refrigerated Storage And Transport), By Temperature Type (Chilled And Frozen), And By Application (Dairy & Frozen Desserts; Meat, Fish, And Seafood, Fruits & Vegetables, Bakery & Confectionery, Pharmaceuticals, And Others), and By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

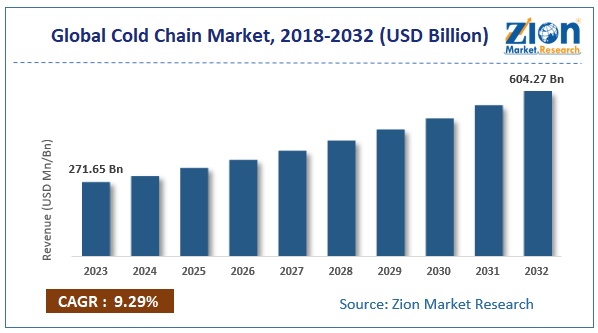

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 271.65 Billion | USD 604.27 Billion | 9.29% | 2023 |

Cold Chain Industry Perspective:

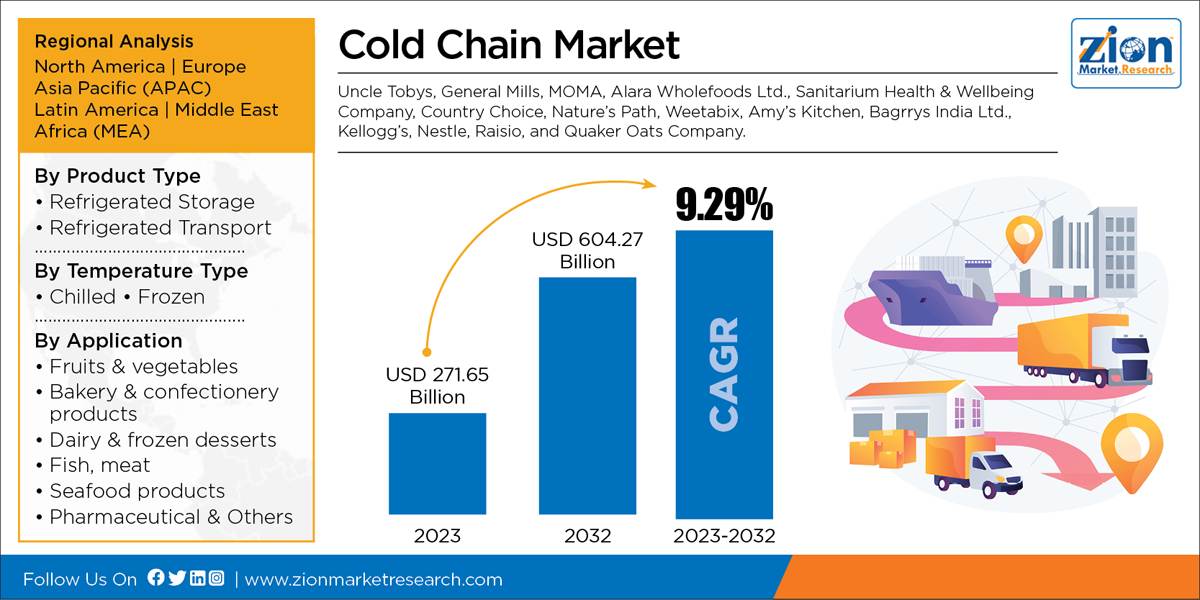

The global Cold Chain Market size was worth around USD 271.65 Billion in 2023 and is predicted to grow to around USD 604.27 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.29% between 2024 and 2032.

The report analyzes the global Cold Chain Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Cold Chain industry.

To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the cold chain market has also been included. The study encompasses a market attractiveness analysis, wherein type, temperature type, and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

Cold Chain Market: Overview

A system of interconnected storage and transportation facilities that is designed to ensure the integrity and quality of temperature-sensitive products across their entire supply chain is referred to as the Cold Chain Market. These products include pharmaceuticals, vaccines, food, and chemicals. It is essential to have this specific infrastructure in order to maintain the efficiency and safety of perishable items. This is accomplished by managing and monitoring the temperature conditions throughout the entire process, beginning with production or manufacturing and continuing all the way through distribution for the final consumer.

In sectors where it is essential to keep a particular temperature range in order to guarantee product quality and conformity with regulatory standards, the Cold Chain Market plays a crucial function in the industry. A wide variety of technologies, such as refrigeration, cold storage facilities, temperature-controlled transportation, and monitoring systems, are included in the market. These technologies all collaborate with one another to ensure that temperature-sensitive products maintain their integrity throughout the supply chain movement. Numerous factors are contributing to the expansion of the Cold Chain Market on a global scale. These factors include the growing need for fresh and frozen food, the expansion of the pharmaceutical and biotechnology sectors, and the growing requirement for effective vaccine delivery.

Cold Chain Market: Growth Factors

Several important factors are contributing to the significant expansion that the Cold Chain Market is experiencing. The growing need for temperature-sensitive products, notably in the pharmaceutical and biotechnology industries, is one of the key factors that is driving this trend. The growth of the cold chain infrastructure has been spurred by the requirement for dependable storage and transit solutions to preserve the efficacy of vaccines, biologics, and other medicinal items.

There has been an increase in the demand for effective cold chain logistics in the food industry as a result of the growing global population as well as the increased demands of consumers for fresh and perishable items. As a result of the proliferation of e-commerce and the globalization of supply chains, the significance of preserving a continuous cold chain has been further magnified. This is because items now travel greater distances and are exposed to a wider range of climates before they are delivered to end consumers.

Regulatory regulations that are particularly stringent for the transportation and storage of pharmaceuticals and food goods are another factor that contributes to the expansion of the market. This is because businesses are striving to meet quality standards and guarantee the safety of their products. In general, the Cold Chain Market is well positioned for continuous expansion as a result of the fact that industries are becoming more aware of the significant role it plays in maintaining the quality and integrity of temperature-sensitive items along the supply chain.

Cold Chain Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gluten-Free Product Market Research Report |

| Market Size in 2023 | USD 7.07 Billion |

| Market Forecast in 2032 | USD 16.49 Billion |

| Growth Rate | CAGR of 9.87% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Uncle Tobys, General Mills, MOMA, Alara Wholefoods Ltd., Sanitarium Health & Wellbeing Company, Country Choice, Nature’s Path, Weetabix, Amy’s Kitchen, Bagrrys India Ltd., Kellogg’s, Nestle, Raisio, and Quaker Oats Company. |

| Segments Covered | By Product, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cold Chain Market: Segmentation

The study provides a decisive view of the cold chain market by segmenting the market based on type, temperature type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. Based on product type, the market is segmented into refrigerated storage and transport. Based on temperature type, the market is segmented into chilled and frozen. Based on application, the market is segmented into fruits & vegetables, bakery & confectionery products, dairy & frozen desserts, fish, meat, and seafood products, and pharmaceutical & others.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, and the Rest of the World with its further classification into major countries including the U.S., Germany, France, the UK, China, Japan, India, and Brazil.

Cold Chain Market: Competitive Space

The key players in this industry are

- AGRO Merchants

- Lineage Logistics

- Preferred Freezer

- Burris Logistics

- Nichirei Logistics

- Americold Logistics

- Kloosterboer

- Interstate Warehousing

- VersaCold Logistics

- Swire Cold Storage

The detailed description of players includes parameters such as company overview, financial overview, business strategies, and recent developments of the company.

This report segments the Global Cold Chain Market as follows:

By Product Type

- Refrigerated Storage

- Refrigerated Transport

By Temperature Type

- Chilled

- Frozen

By Application

- Fruits & vegetables

- Bakery & confectionery products

- Dairy & frozen desserts

- Fish, meat

- seafood products

- Pharmaceutical & Others

Global Cold Chain Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A cold chain stores and transports temperature-sensitive products like medications, vaccines, and perishables in a controlled environment to ensure quality. Refrigerated storage, cold transportation, and monitoring systems keep products within temperature ranges throughout the supply chain.

Several reasons drive Cold Chain Market expansion. First, pharmaceutical and biotechnology companies require reliable cold-chain logistics to meet rising demand for temperature-sensitive products.

According to a study, the global cold chain industry size was $271.65 Billion in 2023 and is projected to reach $604.27 Billion by the end of 2032.

The global cold chain market is anticipated to record a CAGR of nearly 9.29% from 2024 to 2032.

Asia-Pacific is predicted to boost the Cold Chain Market due to its growing population, healthcare infrastructure, and cold chain logistics need. Market dynamics might vary, so consult the newest industry publications for the latest information.

The key players in this industry are AGRO Merchants, Lineage Logistics, Preferred Freezer, Burris Logistics and Nichirei Logistics, Americold Logistics, Kloosterboer, Interstate Warehousing, VersaCold Logistics, and Swire Cold Storage.

The global cold chain market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed