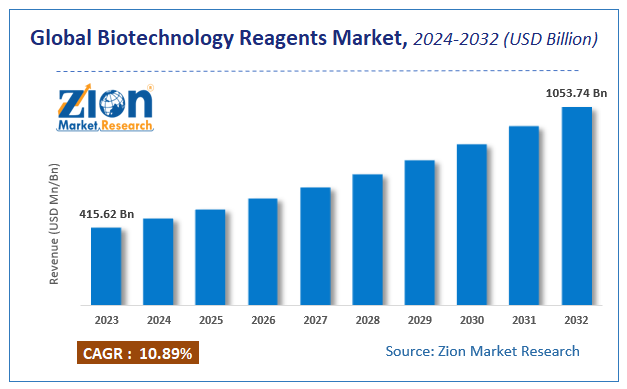

Biotechnology Reagents Market Size, Share Report, Analysis, Trends, Growth 2032

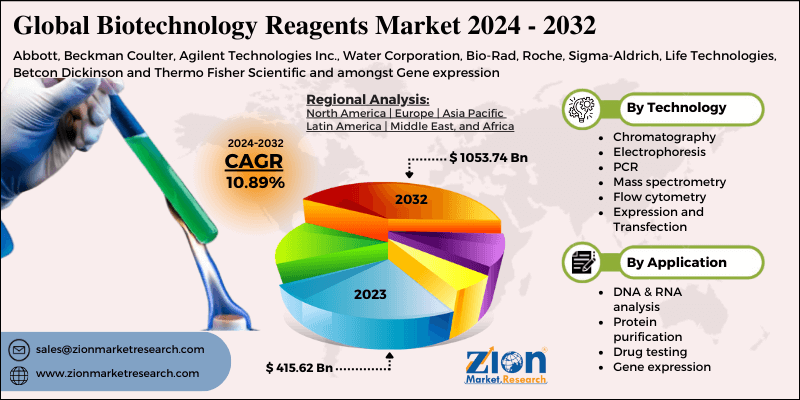

Biotechnology Reagents Market By Technology (Chromatography, Electrophoresis, PCR, Mass Spectrometry, Flow Cytometry, Expression & Transfection) For DNA & RNA Analysis, Protein Purification, Drug Testing, Gene Expression And By End User: Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends And Forecast, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 415.62 Billion | USD 1053.74 Billion | 10.89% | 2023 |

Biotechnology Reagents Market Insights

Zion Market Research has published a report on the global Biotechnology Reagents Market, estimating its value at USD 415.62 Billion in 2023, with projections indicating that it will reach USD 1053.74 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 10.89% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Biotechnology Reagents Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Biotechnology reagents are compounds or substances used to synthesize, analyse, or detect the presence of another material to enable test reading in the fields of diagnosis, genetics, analysis, molecular biology, education, immunology, and bioscience. Fluorescence microscopy, DNA analysis, immuno phenotyping, and cell cycle analysis are some of the applications of biotechnology reagents. In the time of increasing research, exploration, and publishing in industry and academic research, biotechnological reagents play an important role. Several advanced research are being performed in healthcare-related labs, where a lot of study focuses around genes, proteins, peptides, antibodies, and cell lines, resulting in a high demand for biotechnological reagents.

Biotech industries' comprehensive R&D activities would fuel demand for biotechnology reagents even more. Biotechnology reagents industry growth is expected to be boosted in the coming years by consistent product advancement in the food & beverage, agro-biotech, and pharmaceuticals industries.

The reagent can be a compound, substance or mixture, used for testing the presence of another compound or substance in the solution by chemical reaction. Reagents can be organic or inorganic depends on the composition. Grignard reagent Fenton's reagent and Collins reagent are the examples of organic reagents. Biotechnology reagents are used to detect other compound or substance present in the biological solutions. Biotechnology reagents are utilized in the field of bioscience, diagnosis, research, and education.

The increase in R&D expenditure by biotechnology firms witness the growth biotechnology reagent market. Biotechnology reagents are used in basic research, therapeutics, biomedical and commercialization and constant product development by the food and beverage. Pharmaceuticals and agro-biotech trigger the demand for biotechnology reagent market. Conventional techniques such as combinatorial chemistry, DNA chips, high through put screening and proteomics likely contribute to the splendid growth of biotechnology reagent market. However, the high cost of biopharmaceutical products and huge research and development expenditure hinder the growth of biotechnology reagent market. Widespread environment applications and untapped opportunities are likely to open new market avenues in the near future.

COVID-19 Impact Analysis

The global biotechnology reagents market has witnessed a slight decline in the growth for short term to the lockdown enforcement placed by governments in order to contain COVID spreading. But, to avoid contamination, the lockdown compliance procedures advised R&D staff as well as clinical trial researchers to stay home. This impacted on the use of biotechnology reagents and hence its production and supply.

The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the global markets are slowly opening to their full potential and theirs a surge in demand of auto parts of the vehicles. The market would remain bullish in upcoming year. The significant decrease in the global biotechnology reagents market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Growth Factors

Biotechnology reagents are being used in a wide range of areas, including basic science, biomedical research, and therapeutics. Furthermore, biotech companies' significant R&D budgets would fuel demand for biotechnology reagents. Various sectors, such as pharmaceutical/biopharmaceutical, agri-biotech, and food and beverages, are constantly developing new products, which is expected to help the market expand. However, that biopharmaceutical product costs, as well as significant R&D spending, are expected to obstruct the growth of the biotechnology reagents industry in the coming years.

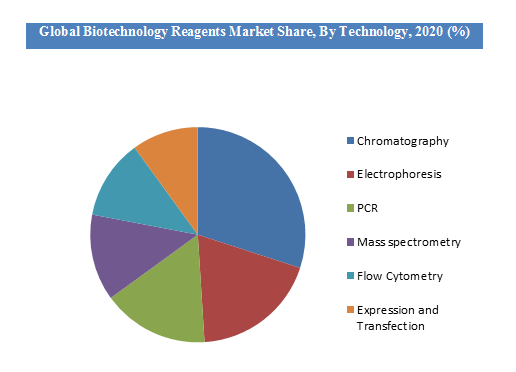

The biotechnology reagent market can be segmented on the basis of technology, application, end-user and region. Technology segment includes chromatography, electrophoresis, PCR, mass spectrometry, flow cytometry, expression, and transfection. Tissue culture and chromatography reagents are expected to exhibit strong growth in the estimated period due to numerous inventions in biotechnology industries. Applications of biotechnology reagents can be segmented into DNA & RNA analysis, protein purification, drug testing, and gene expression. Protein purification followed by drug testing and gene expression hold the highest share in 2014 due to immense demand from life science stream for developing new products. The end users for biotechnology reagents include biotech companies, pharmaceuticals, research institutes and diagnostic centers among others. Biotech companies emerged as potential segment due to high demand for R&D section.

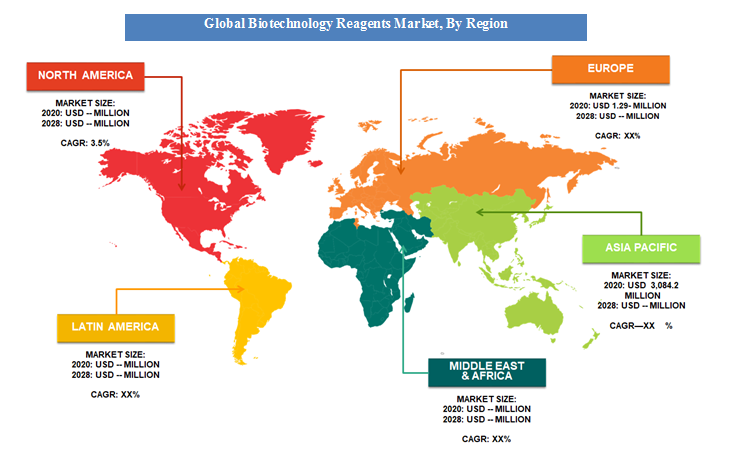

The biotechnology reagents market has been classified into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. With the largest shares in total consumption, biotechnology reagent market was dominated by North America in 2014. This region is expected to be the fastest-growing market in near future owing to the development of new products, government support, advanced healthcare sector and large investments for biotechnology reagents. This growth was mainly supported by U.S. due to successfully completion of human genome project and increased use of reagents in molecular biology. Moreover, biotechnology reagents market in Asia Pacific is likely to witness high growth during the forecast period because of the rise in R&D sector.

Biotechnology Reagents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biotechnology Reagents Market |

| Market Size in 2023 | USD 415.62 Billion |

| Market Forecast in 2032 | USD 1053.74 Billion |

| Growth Rate | CAGR of 10.89% |

| Number of Pages | 120 |

| Key Companies Covered | Abbott, Beckman Coulter, Agilent Technologies Inc., Water Corporation, Bio-Rad, Roche, Sigma-Aldrich, Life Technologies, Betcon Dickinson and Thermo Fisher Scientific and amongst Gene expression |

| Segments Covered | By Technology, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Technology Segment Analysis Preview

Chromatography is a separation technique that is primarily used in drug development to verify drug precision, sensitivity, and purity. Chromatography is expected to witness a strong market share of around 30 % share of the total market share because for drugs and biologics, it's often used to validate analytical techniques and processes. Since chromatography methods are widely used around the world, demand for their reagents is still strong for a variety of pathological and academic applications. Additionally, expanded support for biotechnology research is helping to drive segment expansion.

Application Segment Analysis Preview

Protein synthesis is the development of new proteins by biological cells. The measures that involve an active gene product may be a target of regulatory bodies in most gene sequencing. For nucleic acid detection and biotech applications, DNA and RNA chromatography is widely used. Drug testing is one of the most popular uses for biotech reagents. The biotechnology reagents demand is expected to be driven by all of these applications, drug testing holding the largest market share.

Key Market Players & Competitive Landscape

Some of the major players of global Biotechnology Reagents market includes-

- Abbott

- Beckman Coulter

- Agilent Technologies Inc.

- Water Corporation

- Bio-Rad

- Roche

- Sigma-Aldrich

- Life Technologies

- Betcon Dickinson

- Thermo Fisher Scientific

- amongst Gene expression.

The global biotechnology reagents market is segmented as follows:

By Technology

- Chromatography

- Electrophoresis

- PCR

- Mass spectrometry

- Flow cytometry

- Expression and Transfection

By Application

- DNA & RNA analysis

- Protein purification

- Drug testing

- Gene expression

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Biotechnology Reagents Market market size valued at US$ 415.62 Billion in 2023

Biotechnology Reagents Market market size valued at US$ 415.62 Billion in 2023, set to reach US$ 1053.74 Billion by 2032. CAGR of about 10.89% from 2024 to 2032.

Biotech companies' significant R&D budgets would fuel demand for biotechnology reagents. Various sectors, such as pharmaceutical/biopharmaceutical, agri-biotech, and food and beverages, are constantly developing new products. All these aforementioned factors are likely to spur the market growth.

Because of the booming pharmaceutical industry and rising government investment in life science-based research, North America is predicted to have the largest market share by 2028. Due to massive investment of life science-based studies by government institutions, the United States region leads the industry. Over the forecast period, Asia-Pacific also has encouraging growth potential.

Some of the major players of global Biotechnology Reagents market includes Abbott, Beckman Coulter, Agilent Technologies Inc., Water Corporation, Bio-Rad, Roche, Sigma-Aldrich, Life Technologies, Betcon Dickinson and Thermo Fisher Scientific amomgst Gene expression

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed