Global Protein Purification & Isolation Market Size, Share, Growth Analysis Report - Forecast 2034

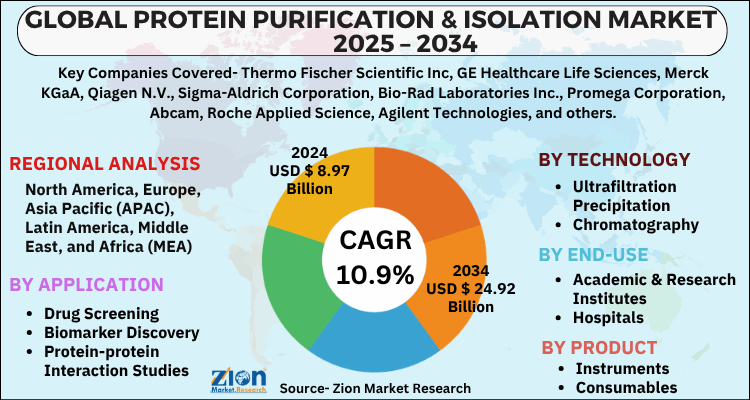

Protein Purification & Isolation Market By Product (Instruments and Consumables), By Technology (Ultrafiltration Precipitation, Chromatography, Electrophoresis, Western Blotting, and Others), Application (Drug Screening, Biomarker Discovery, Protein-protein Interaction Studies, and Diagnostics), End-Use (Academic & Research Institutes, Hospitals, Pharmaceutical & Biotechnological Companies, and CROs), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

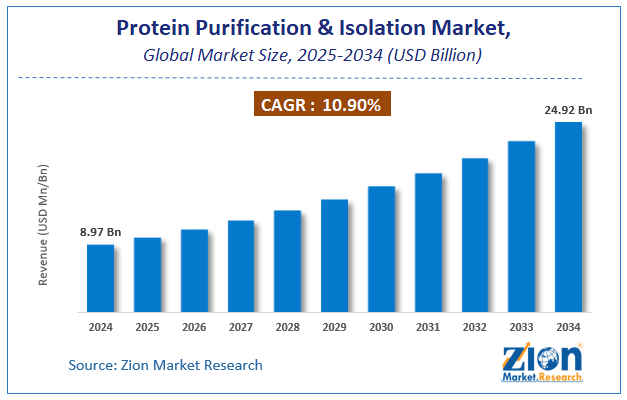

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.97 Billion | USD 24.92 Billion | 10.9% | 2024 |

Protein Purification & Isolation Industry Perspective

The global protein purification & isolation market size was worth around USD 8.97 Billion in 2024 and is predicted to grow to around USD 24.92 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.9% between 2025 and 2034. The report analyzes the global protein purification & isolation market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the protein purification & isolation industry.

Protein Purification & Isolation Market: Overview

Protein purification & isolation refer to a set of processes for isolating a type of protein from a complex mixture of tissues, cells, or organisms. The expanding relevance of generating novel ligands, including such protein-based pharmaceutical compounds, is one of the key drivers driving demand for protein purifying & isolation. Additionally, the market is expected to expand due to increased demand for purification kits in quick screen testing. Furthermore, protein purification & isolation sales are increasing due to a move toward technologically complex protein purification instruments and the development of the proteomic market. All of these factors, as well as increased R&D in the biopharmaceutical industry, are expected to raise the global protein purification & isolation market share throughout the forecast period. Protein purifying & isolation sales are expected to rise as untapped growth opportunities, and protein therapies benefit the sector.

Furthermore, the growing usage of automated analyzers is expected to increase the demand for protein purifying & isolation equipment. Due to ongoing technological advancements, protein purification & separation products are in high demand. Recent developments in the protein purifying & separation industry include the increasing popularity of agar beads, alternative polymers, magnetic & protein beads, and ligand tagging methods. However, low instrument acceptance rates, the difficulties of maintaining purification kits that fulfill all proposals, and high tool costs limit the market growth.

Key Insights

- As per the analysis shared by our research analyst, the global protein purification & isolation market is estimated to grow annually at a CAGR of around 10.9% over the forecast period (2025-2034).

- Regarding revenue, the global protein purification & isolation market size was valued at around USD 8.97 Billion in 2024 and is projected to reach USD 24.92 Billion by 2034.

- The protein purification & isolation market is projected to grow at a significant rate due to rising demand for biologics and biosimilars, advancements in chromatography and filtration technologies, increasing R&D in pharmaceuticals, and growing focus on precision medicine.

- Based on Product, the Instruments segment is expected to lead the global market.

- On the basis of Technology, the Ultrafiltration Precipitation segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Drug Screening segment is projected to swipe the largest market share.

- By End-Use, the Academic & Research Institutes segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Protein Purification & Isolation Market: Growth Drivers

Rising affinity chromatography adoption is propelling the global market growth

According to the National Center for Biotechnology Information (NCBI), affinities chromatography was used in more than 60% of all purification techniques in 2020. It relies on a molecule bonded to a column to recognize the target molecule. The target protein is isolated using affinity chromatography by its particular binding characteristics to an immobilized ligand. Furthermore, affinity chromatography is based on a protein's selective and reversible binding to a matrix-bound ligand. Affinity chromatography, proteomics, immunoprecipitation, and enzymatic assay are a few frequently used techniques for protein purification & isolation.

Protein Purification & Isolation Market: Restraints

Lower acceptance rates for instruments and difficulty in maintaining one size fits all purifying kits may hamper the global market growth

Several affinity tags can be employed for protein purification & isolation. In terms of size, binding power, and impact on protein stability and solubility, affinity tags come in a wide range of sizes. In addition, affinity purifying tags are frequently linked to a target recombinant protein as native protein purification & isolation can be challenging, allowing the tag to be utilized to identify or detect the target protein. Thus, instruments that result in a lower adoption rate and the difficulties of sustaining purification kits that match all proposals operate as roadblocks to global protein purification & isolation market growth.

Protein Purification & Isolation Market: Opportunities

Continuous technological advancements in protein purification & isolation products bring up several growth opportunities

One of the important developments in the protein purifying & isolation market is the advancement of single-use technologies as well as automated purification equipment. Protein purification & isolation technologies are widely utilized in applications such as drug screening, ion-exchange chromatography, gel electrophoresis, biomarkers discovery, protein therapies, and target identification. Comparing it to alternatives, chromatography is among the most precise and sensitive technologies for protein purifying & isolation. Various companies are thus concentrating on commercializing new products relying on this technology to extend their product line. Ongoing technical breakthroughs develop new growth prospects for protein purifying & isolation solutions in the industry.

Protein Purification & Isolation Market: Challenges

The high price of protein isolation and purification kits continues to be a global challenge

The increasing demand for advanced instruments and test kits that provide fast, reliable, and reproducible protein purification at a low cost is driving up the price of these kits and making it difficult for new companies to enter the market, which is one of the major factors limiting the global protein purification & isolation market growth. For instance, protein purification & isolation kits vary from USD 450 to USD 2000. However, the high cost of protein purifying & isolation equipment and the scarcity of qualified workers are factors challenging industry expansion.

Protein Purification & Isolation Market: Segmentation

The global protein purification & isolation market is segregated by product, technology, application, end-use, and region.

Based on Product, the global protein purification & isolation market is divided into Instruments and Consumables.

On the basis of Technology, the global protein purification & isolation market is bifurcated into Ultrafiltration Precipitation, Chromatography, Electrophoresis, Western Blotting, and Others.

By Application, the global protein purification & isolation market is split into Drug Screening, Biomarker Discovery, Protein-protein Interaction Studies, and Diagnostics.

In terms of End-Use, the global protein purification & isolation market is categorized into Academic & Research Institutes, Hospitals, Pharmaceutical & Biotechnological Companies, and CROs.

Protein Purification & Isolation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Protein Purification & Isolation Market |

| Market Size in 2024 | USD 8.97 Billion |

| Market Forecast in 2034 | USD 24.92 Billion |

| Growth Rate | CAGR of 10.9% |

| Number of Pages | 254 |

| Key Companies Covered | Thermo Fischer Scientific Inc, GE Healthcare Life Sciences, Merck KGaA, Qiagen N.V., Sigma-Aldrich Corporation, Bio-Rad Laboratories Inc., Promega Corporation, Abcam, Roche Applied Science, Agilent Technologies, and others. |

| Segments Covered | By Product, By Technology, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Protein Purification & Isolation Market: Regional Landscape

Increasing use of drug screening procedures is likely to help North America dominate the global market

North America dominates the global protein purification & isolation market and accounted for more than 45% of the global revenue in 2021. The region's increased use of drug screening procedures is propelling the industry forward. High funding for life science research, a developed research infrastructure, and the presence of major elements is increasing protein purification & isolation sales in the area. The growth in biopharmaceutical drug development in the United States is another factor likely to drive the regional protein purification & isolation market over the forecast period. Improving application areas, including protein-protein interaction studies, detection and tracking, drug screening, protein treatments, biomarker discovery, sickness tracking, and diagnostic imaging are boosting demand for technologically upgraded protein purification & isolation technologies in North America.

The Asia Pacific regional market is expected to expand the fastest during the forecast period. Initiatives launched by developing-country governments like China and India to strengthen healthcare facilities are expected to stimulate the market demand in the region. Additionally, these countries contribute funds to developing novel protein purification & isolation procedures. As a result, Japan, India, and China are the dominant countries in the Asia Pacific, providing enormous chances for the market's main players to grow and keep up with trends to deliver profitable outcomes.

Recent Developments

- October 2021 - Purolite, a resin-based chromatography separation company, introduced two next-generation chromatographic resins. The first protein is Praesto Jetted A50 HipH. It is a 50m homogeneous agarose bead-based alkaline stable resin. It is intended to deal with the purification of antibodies or even other pH-sensitive Fc-containing proteins.

- April 2021 - Thermo Fisher Scientific introduced the KingFisher Apex Purification System. It is a large sample purification apparatus designed for scientists that need to automate the separation of DNA, proteins, and cells from a variety of sample types. The KingFisher Apex purifying system allows users to isolate proteins and cells while also customizing methods.

Protein Purification & Isolation Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the protein purification & isolation market on a global and regional basis.

The global protein purification & isolation market is dominated by players like:

- Thermo Fischer Scientific Inc

- GE Healthcare Life Sciences

- Merck KGaA

- Qiagen N.V.

- Sigma-Aldrich Corporation

- Bio-Rad Laboratories Inc.

- Promega Corporation

- Abcam

- Roche Applied Science

- Agilent Technologies

The global protein purification & isolation market is segmented as follows:

By Product

- Instruments

- Consumables

By Technology

- Ultrafiltration Precipitation

- Chromatography

- Electrophoresis

- Western Blotting

- Others

By Application

- Drug Screening

- Biomarker Discovery

- Protein-protein Interaction Studies

- Diagnostics

By End-Use

- Academic & Research Institutes

- Hospitals

- Pharmaceutical & Biotechnological Companies

- and CROs

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Protein purification and isolation are processes used to extract a specific protein from a complex mixture, such as cells or tissues. These techniques separate the target protein based on its unique properties—like size, charge, or binding affinity—for research, pharmaceutical, or industrial use.

The global protein purification & isolation market is expected to grow due to increasing demand for biopharmaceuticals, advancements in proteomics research, rising focus on personalized medicine, and growing investments in drug discovery and development.

According to a study, the global protein purification & isolation market size was worth around USD 8.97 Billion in 2024 and is expected to reach USD 24.92 Billion by 2034.

The global protein purification & isolation market is expected to grow at a CAGR of 10.9% during the forecast period.

North America is expected to dominate the protein purification & isolation market over the forecast period.

Leading players in the global protein purification & isolation market include Thermo Fischer Scientific Inc, GE Healthcare Life Sciences, Merck KGaA, Qiagen N.V., Sigma-Aldrich Corporation, Bio-Rad Laboratories Inc., Promega Corporation, Abcam, Roche Applied Science, Agilent Technologies, among others.

The report explores crucial aspects of the protein purification & isolation market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Protein Purification IsolationIndustry PerspectiveProtein Purification Isolation OverviewKey InsightsProtein Purification Isolation Growth DriversProtein Purification Isolation RestraintsProtein Purification Isolation OpportunitiesProtein Purification Isolation ChallengesProtein Purification Isolation SegmentationProtein Purification Isolation Report ScopeProtein Purification Isolation Regional LandscapeRecent DevelopmentsProtein Purification Isolation Competitive AnalysisThe global protein purification isolation market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed