Real-World Evidence Solutions Market Size, Share, Trends and Forecast, 2034

Real-World Evidence Solutions Market By Component (Dataset and Services), Therapeutic Area (Oncology, Cardiovascular, Neurology, Immunology, and Others), End-User (Healthcare Payers, Healthcare Providers, Pharmaceutical & Medical Devices Companies, and Other End Users), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

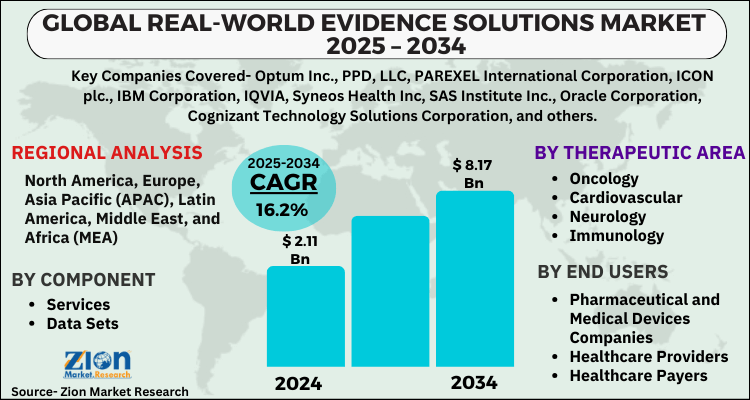

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.11 Billion | USD 8.17 Billion | 16.2% | 2024 |

Global Real-World Evidence Solutions Market Industry Perspective:

The global real-world evidence solutions market size was worth around USD 2.11 Billion in 2024 and is predicted to grow to around USD 8.17 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 16.2% between 2025 and 2034. The report analyzes the global real-world evidence solutions market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the real-world evidence solutions industry.

Real-World Evidence Solutions Market: Overview

When it comes to showing the efficacy of the therapy, real-world evidence (RWE) is a valuable resource. It aids in the comprehension of existing and possible novel treatment alternatives in terms of cost, safety, and efficacy. The real-world evidence solutions include services that help pharmaceutical, providers, payers, and healthcare firms manage their operations more efficiently while also speeding up the drug research and approval process.

The healthcare industry is constantly in a surge to improve efficiency and throughput by reducing costs and waste, thus automation of labor-intensive tasks can be a significant part of a strategy for performance enhancement. Healthcare providers are facing the challenges with increasing number of patients regarding managing inventory, optimizing scheduled time for appointments, supporting digitization of patient records, and performing billing and claims processing. In order to reduce these operational challenges, the maximum number of healthcare providers are embracing automation to decrease these problems and drive enhanced efficiency and growth of the healthcare sector.

Key Insights

- As per the analysis shared by our research analyst, the global real-world evidence solutions market is estimated to grow annually at a CAGR of around 16.2% over the forecast period (2025-2034).

- Regarding revenue, the global real-world evidence solutions market size was valued at around USD 2.11 Billion in 2024 and is projected to reach USD 8.17 Billion by 2034.

- The real-world evidence solutions market is projected to grow at a significant rate due to rising focus on personalized medicine, increasing demand for data-driven insights in healthcare decision-making, advancements in data analytics and AI, and the need for cost-effective solutions in drug development and regulatory processes.

- Based on Component, the Dataset segment is expected to lead the global market.

- On the basis of Therapeutic Area, the Oncology segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Healthcare Payers segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Real-World Evidence Solutions Market: Growth Drivers

Increase in backing from regulatory groups for the use of real-world evidence solutions to drive the market growth

A post-market active safety surveillance system through newer digital tools, such as the FDA Sentinel Initiative as well as traditional pharmacovigilance tools such as the vaccine adverse event reporting system, periodic safety update report, and periodic benefit-risk evaluation report, are used by regulators to supervise the safety of marketed products. RWE is currently being employed in pre-approved efficacy determinations, and it has the ability that could be used more widely in pediatric ailments, rare diseases, and oncology where randomized controlled clinical trials are unethical or impracticable to execute. Simultaneously, the value of RWE solutions is also being recognized by legislators. RWE is a multifaceted FDA program. Internal processes, stakeholder involvement, and demonstration projects are all part of the plan to include top leadership in the RWE review. These factors are combinedly leading to the global real-world evidence solutions market growth.

The rising geriatric population and the subsequent increase in the prevalence of chronic diseases will significantly drive the market during the forecast period. Geriatric population is majorly suffering from the chronic diseases but these elderly people are often excluded from clinical trials. The real world evidence can be significantly used to understand how the excluded individuals react to a drug. That will provide a much broader insight into the how a product will affect the heterogeneous patient population outside of the clinical trial setting. This broader insight will help in identification of populations with enhanced benefit/risk, minimization of the number of patients exposed to less efficacious therapy, and much more, which will significantly propel the growth of real world evidence solutions market over the forecast period

Real-World Evidence Solutions Market: Restraints

Lack of willingness to depend on real-world research to impede the market growth

Despite the fast adoption of RWE, certain stakeholders are still hesitant to depend on real-world research. Although payers have begun to embrace RWE, they prefer to base medication coverage decisions on randomized clinical trials (RCTs) rather than external observational data. The majority of RWD (real-world data) sources are not gathered for research reasons, implying that data quality is a problem. Businesses are also hesitant to use real-world evidence tactics since regulatory advice in this area is still in the works. Furthermore, for statistical validity, the approaches for correcting data discrepancies are not yet commonly acknowledged. Such difficulties are projected to stifle the market for RWE solutions.

Real-World Evidence Solutions Market: Opportunities

Increasing emphasis on end-to-end real-world evidence services is likely to drive the market during the forecast period.

The healthcare environment is always evolving. Globally, "value" is being scrutinized more closely as healthcare finance players look for innovative ways of coping with the excessive economic burden and low return on investment. Companies require a robust evidence lifecycle management capability to establish value. This has opened the door for an end-to-end strategy to leveraging knowledge assets, evidence, and life sciences organization's data, breaking down conventional silos and enabling insight-driven decision-making from research & development activities through product commercialization. Additionally, the increased need for full evidence services all across the lifecycle of a product is likely to give RWE vendors with an opportunity to boost their investments during the whole drug development cycle. All these factors are estimated to have numerous opportunities for the global real-world evidence solutions market growth during the forecast period.

Real-World Evidence Solutions Market: Challenges.

Inadequate data processing infrastructure and broadly acknowledged methodological standards may pose challenges for the market growth

A fundamental difficulty in this sector is the lack of globally acknowledged rules or principles for the reporting, analysis, conduct, and design of RWE. Because of this lack of agreement, RWE is frequently not regarded as sufficient quality to be included in the body of data used to compare the efficacy of various treatment choices. This limits the ability to generate information by lowering the possible value of the data generated. Furthermore, important players are hesitant to embrace RWE as a result of this. Also, the most significant barrier is a serious lack of interoperable and digitalized patient data, particularly in rural areas. All such factors may act as a challenge to market growth.

Real-World Evidence Solutions Market: Report Scope

Real-World Evidence Solutions Market: Segmentation

The global real-world evidence solutions market is divided based on component, therapeutic area, end-user, and region. Based on the component, the global market is characterized by services and datasets. By therapeutic area, the market is classified into neurology, cardiovascular, oncology, immunology, and others. The end-user segment consists of healthcare payers, healthcare providers, pharmaceutical & medical devices companies, and other end users.

Real-World Evidence Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Real-World Evidence Solutions Market |

| Market Size in 2024 | USD 2.11 Billion |

| Market Forecast in 2034 | USD 8.17 Billion |

| Growth Rate | CAGR of 16.2% |

| Number of Pages | 192 |

| Key Companies Covered | Optum Inc., PPD, LLC, PAREXEL International Corporation, ICON plc., IBM Corporation, IQVIA, Syneos Health Inc, SAS Institute Inc., Oracle Corporation, Cognizant Technology Solutions Corporation, and others. |

| Segments Covered | By Component, By Therapeutic Area, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In March 2021, Verantos and Amgen have announced a partnership to create advanced real-world evidence (RWE) initiative focusing on high-validity observational research. To get insight into unmet patient requirements, the companies collaborated on research on heart failure, nonalcoholic steatohepatitis, and hyperlipidemia.

- In August 2021, Syneos Health and Aetion formed an alliance to provide RWE solutions to headway drug development and commercialization. Syneos Health's unique data gathering and research tools will be combined with Aetion Evidence Platform® (AEP) to create evidence using real-world data and patient data curation.

Real-World Evidence Solutions Market: Regional Landscape

North America to lead the global market during the forecast period

North America is expected to hold the greatest portion of the global real-world evidence solutions market during the forecast period. The growth of the RWE solutions market in North America is being driven by factors such as the growing number of pharmaceutical companies implementing RWE for drug approval processes, a rising number of RWE service providers, an increasing number of payers employing RWD, and favorable regulatory system. During the projected period, however, the Asia Pacific market is expected to expand at the fastest CAGR. Asia Pacific RWE solutions market is being driven by the growing elderly population, rising need for enhanced healthcare services, the rising prevalence of chronic diseases, and increased government initiatives for the acceptance of RWE research.

Real-World Evidence Solutions Market: Competitive Landscape

- Optum, Inc.

- PPD

- LLC

- PAREXEL International Corporation

- ICON plc.

- IBM Corporation

- IQVIA

- Syneos Health, Inc

- SAS Institute Inc.

- Oracle Corporation

- Cognizant Technology Solutions Corporation

are some of the major players operating in the global real-world evidence solutions market.

Global Real-World Evidence Solutions Market is segmented as follows:

GLobal Real-World Evidence Solutions Market By Component

- Services

- Data Sets

By Therapeutic area

- Oncology

- Cardiovascular

- Neurology

- Immunology

- Others

By End Users

- Pharmaceutical and Medical Devices Companies

- Healthcare Providers

- Healthcare Payers

- Other End Users

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global real-world evidence solutions market is expected to grow due to increasing need for data-driven healthcare decision-making, the growing adoption of value-based care, and the rising demand for evidence to support drug development and regulatory approvals.

According to a study, the global real-world evidence solutions market size was worth around USD 2.11 Billion in 2024 and is expected to reach USD 8.17 Billion by 2034.

The global real-world evidence solutions market is expected to grow at a CAGR of 16.2% during the forecast period.

North America is expected to dominate the real-world evidence solutions market over the forecast period.

Leading players in the global real-world evidence solutions market include Optum Inc., PPD, LLC, PAREXEL International Corporation, ICON plc., IBM Corporation, IQVIA, Syneos Health Inc, SAS Institute Inc., Oracle Corporation, Cognizant Technology Solutions Corporation, among others.

The report explores crucial aspects of the real-world evidence solutions market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed