Powder Metallurgy Market Size, Share, Trends, Growth 2034

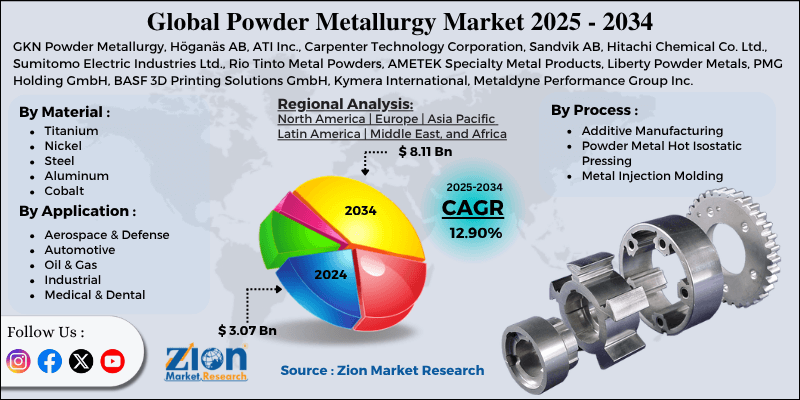

Powder Metallurgy Market By Material (Titanium, Nickel, Steel, Aluminum, Cobalt, and Others), By Process (Additive Manufacturing, Powder Metal Hot Isostatic Pressing, Metal Injection Molding), By Application (Aerospace & Defense, Automotive, Oil & Gas, Industrial, Medical & Dental), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

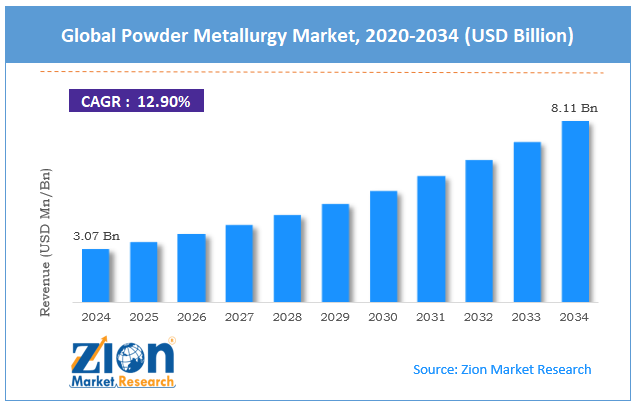

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.07 Billion | USD 8.11 Billion | 12.90% | 2024 |

Powder Metallurgy Industry Perspective:

The global powder metallurgy market size was worth around USD 3.07 billion in 2024 and is predicted to grow to around USD 8.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.90% between 2025 and 2034.

Powder Metallurgy Market: Overview

Powder metallurgy is a state-of-the-art manufacturing technique that produces metal components by compressing metal powders into a preferred shape and sintering them at high temperatures. This method enables precise control over material composition, reduces waste, and facilitates the production of complex geometries using conventional metalworking techniques.

The global powder metallurgy market is projected to grow substantially over the coming year, driven by the growth in 3D printing, surging aerospace applications, and advancements in material efficiency and sustainability. The rise in metal additive manufacturing solutions is changing the powder metallurgy process. Fine metal powders, such as aluminum, titanium, and stainless steel, are widely used in 3D printing for the production of end-use components and prototypes.

Moreover, aerospace companies rely on powder metallurgy to produce lightweight and high-performance parts that can withstand harsh weather conditions. Airbus and Boeing are increasing investment in PM-based components for weight reduction and fuel efficiency.

In addition, powder metallurgy produces significantly less waste than conventional machining, thereby increasing its appeal to companies seeking to achieve sustainability goals. Near-net shape production decreases scrap, post-processing, and energy consumption. This aligns with the global trend towards reducing carbon footprints and promoting green manufacturing.

Nevertheless, the global market is limited by a narrower range of materials compared to traditional processes and safety concerns. Despite improvements, powder metallurgy remains limited in its application to high-melting or high-strength point alloys, which restricts its use in specific industrial sectors. The process is also less suitable for huge components.

Additionally, fine metal powders are often reactive, flammable, and toxic, particularly in the case of magnesium, aluminum, and titanium. This increases safety issues for workers, fire risk, and storage, necessitating strict safety regulations and resulting in higher operational costs.

Yet, the global powder metallurgy industry is expected to experience notable growth due to opportunities arising from the expansion of electric vehicle (EV) production and customization in 3D-printed metal components.

As EV producers scale up production, there is a growing demand for thermally conductive, lightweight, and magnetically active materials, all of which can be produced through powder metallurgy.

In addition, the demand for tools, customized implants, and aerospace parts made by 3D printing creates opportunities for specialized powders such as titanium, Inconel, and stainless steel, which are deeply rooted in the global market.

Key Insights:

- As per the analysis shared by our research analyst, the global powder metallurgy market is estimated to grow annually at a CAGR of around 12.90% over the forecast period (2025-2034)

- In terms of revenue, the global powder metallurgy market size was valued at around USD 3.07 billion in 2024 and is projected to reach USD 8.11 billion by 2034.

- The powder metallurgy market is projected to grow significantly due to increasing demand from the automotive industry, advancements in powder production, defense investments, and government support.

- Based on material, the steel segment is expected to lead the market, while the titanium segment is expected to grow considerably.

- Based on process, the metal injection molding segment is the dominating segment, while the additive manufacturing segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the automotive segment is expected to lead the market compared to the aerospace & defense segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Powder Metallurgy Market: Growth Drivers

Developments in powder production techniques boost market growth

Constant advancements in powder production, like plasma rotating electrode processes, water atomization, and gas atomization, have improved the consistency, quality, and affordability of metal powders. These developments make PM more appealing to industries that were earlier dependent on conventional forging or casting.

Developed sintering techniques, such as microwave sintering and HIP (hot isostatic pressing), are extending the scope of materials that can be processed, offering excellent mechanical properties and densification. These developments enable powder metallurgy to enter high-end markets, like surgical robotics and jet engines, without compromising on quality.

Waste reduction and sustainability in manufacturing considerably fuel the market growth

One of the key benefits of powder metallurgy is its sustainability. The near-net production process decreases raw material wastage by 95% compared to subtractive techniques, lowers CO2 emissions, and conserves energy.

As global industries strive to meet ESG benchmarks, PM is gaining significant prominence, thereby influencing the growth of the worldwide powder metallurgy market.

Recently, BASF announced its initiative to develop recyclable powder-based metal-polymer composites, aiming for environmentally friendly services. This supports corporate net-zero goals and the growing demand for circular manufacturing models in various sectors.

Powder Metallurgy Market: Restraints

Restricted application scope in high-stress components adversely impacts market progress

Despite improvements, powder metallurgy parts often encounter mechanical limitations under extreme stress. Powder metallurgy components typically exhibit a certain degree of porosity, which reduces their ductility, fatigue resistance, and tensile strength compared to forged metals and fully dense wrought materials. This restricts their adoption in critical applications, such as heavy-duty automotive transmissions, oil drilling equipment, and aerospace engine components.

Recent advancements in additive manufacturing and hot isostatic pressing have aided in reducing porosity; however, these processes are costly and have not yet been widely adopted in mass manufacturing.

Powder Metallurgy Market: Opportunities

Integration into the hydrogen economy and renewable energy positively impacts market growth

The shift towards renewable energy is offering opportunities for PM, mainly in solar power systems, hydrogen fuel cell technology, and wind turbines. The need for high-strength, thermally conductive materials and corrosion resistance in extreme environments increases PM as an appealing solution. This fuels the demand for PM, impacting the global powder metallurgy industry.

In 2025, Johnson Matthey announced that it would increase production of powder-based platinum alloy membranes and nickel for hydrogen electrolyzers, following a five-year supply contract with a Scandinavian energy consortium.

Powder Metallurgy Market: Challenges

Supply chain susceptibility to perilous raw materials restricts the growth of the market

The powder metallurgy sector relies on a steady supply of fine and high-quality metal powders, such as cobalt, titanium, copper, and nickel. Nonetheless, these materials are susceptible to geopolitical risks, price volatility, and export restrictions, especially for high-value and rare powders. This unpredictability stresses procurement tactics and demotivates OEMs from scaling up powder metallurgy adoption, particularly in high-stakes sectors such as defense, aerospace, and medical implants.

Powder Metallurgy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Powder Metallurgy Market |

| Market Size in 2024 | USD 3.07 Billion |

| Market Forecast in 2034 | USD 8.11 Billion |

| Growth Rate | CAGR of 12.90% |

| Number of Pages | 211 |

| Key Companies Covered | GKN Powder Metallurgy, Höganäs AB, ATI Inc., Carpenter Technology Corporation, Sandvik AB, Hitachi Chemical Co. Ltd., Sumitomo Electric Industries Ltd., Rio Tinto Metal Powders, AMETEK Specialty Metal Products, Liberty Powder Metals, PMG Holding GmbH, BASF 3D Printing Solutions GmbH, Kymera International, Metaldyne Performance Group Inc., QuesTek Innovations LLC, and others. |

| Segments Covered | By Material, By Process, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Powder Metallurgy Market: Segmentation

The global powder metallurgy market is segmented based on material, process, application, and region.

Based on material, the global powder metallurgy industry is divided into titanium, nickel, steel, aluminum, cobalt, and others. The steel segment holds a remarkable market share due to its mechanical strength, affordability, and versatility across various industries. Steel powders, including alloyed and stainless steels, are widely used in the manufacture of structural parts for industrial machinery, consumer goods, and the automotive industry. Its ability to be sintered and compressed into complicated shapes with stable performance has increased its dominance.

Based on process, the global powder metallurgy market is segmented into additive manufacturing, powder metal hot isostatic pressing, and metal injection molding. The metal injection molding segment is currently leading the market due to its ability to produce high-strength, complex, and precision parts in large volumes at comparatively low prices. MIM is widely used in the electronics, industrial, medical, and automotive sectors, primarily for intricate and small parts, such as firearm components, mobile device connectors, and surgical tools.

Based on application, the global market is segmented as aerospace & defense, automotive, oil & gas, industrial, and medical & dental. The automotive segment led the worldwide market in the previous year and is expected to continue its leadership. PM is widely used for producing bushings, gears, camshaft sprockets, transmission parts, and structural components in automobiles. Its high material utilization, cost efficiency, and ability to deliver high volumes with equal consistency increase its suitability for the automotive sector. With the growing sales of EVs that are dependent on magnetic and lightweight PM parts, the segment continues to lead.

Powder Metallurgy Market: Regional Analysis

- Asia Pacific to witness significant growth over the forecast period

The Asia Pacific held a dominant share of the global powder metallurgy market, backed by a massive automotive manufacturing base, rapid industrialization, and infrastructural growth, as well as a progressing consumer goods and electronics industry.

Asia Pacific is a leader in vehicle production, with China manufacturing over 27 million units in 2023. Powder metallurgy is widely used in the manufacture of engine parts, gears, and structural components for both electric vehicles (EVs) and internal combustion engines (ICEs).

The region's emphasis on high-volume and cost-effective manufacturing increases the suitability of PM for the automotive industry. With the rising adoption of electric vehicles (EVs), the demand for precision and lightweight components is driving the demand for PM.

Additionally, economies such as Indonesia, Vietnam, and India are rapidly industrializing with strong government support. Programs like China's Industrial Upgrade Plan and Make in India are driving investments in energy systems, tools, and machinery. PM supports the effective mass production of long-lasting components for industries.

With the expansion of powder metallurgy, the demand for cost-efficient and reliable PM increases. The Asia Pacific is the leading producer of electronics, with South Korea, China, and Japan leading the way in exports. PM aids this sector by providing high-performance and miniaturized components, such as heat sinks, magnetic materials, and casings.

North America is anticipated to grow considerably as the second-largest region in the powder metallurgy industry, driven by the strong defense and aerospace industries, its pioneering role in additive manufacturing, and the growing demand for dental and medical applications.

North America, particularly the United States, is a leading center for aerospace and defense producers, including Lockheed Martin, Boeing, and Raytheon. Powder metallurgy plays a vital role in manufacturing complex, lightweight, and high-strength components for space systems, missiles, and jet engines.

The United States is a leader in metal additive manufacturing, with applications in the industrial, medical, and aerospace sectors. Industrial adoption and government R&D support continue to drive modernization in the region.

Additionally, the region boasts the most advanced and largest healthcare markets worldwide. PM plays a key role in the manufacture of surgical tools, producing implants and dental prosthetics using powders of cobalt-chrome, titanium, and stainless steel.

Powder Metallurgy Market: Competitive Analysis

The leading players in the global powder metallurgy market are:

- GKN Powder Metallurgy

- Höganäs AB

- ATI Inc.

- Carpenter Technology Corporation

- Sandvik AB

- Hitachi Chemical Co. Ltd.

- Sumitomo Electric Industries Ltd.

- Rio Tinto Metal Powders

- AMETEK Specialty Metal Products

- Liberty Powder Metals

- PMG Holding GmbH

- BASF 3D Printing Solutions GmbH

- Kymera International

- Metaldyne Performance Group Inc.

- QuesTek Innovations LLC

Powder Metallurgy Market: Key Market Trends

Surging demand for high-performance and lightweight alloys:

Industries are increasingly utilizing powder metallurgy to manufacture parts from heat-resistant and lightweight materials, including aluminum, titanium, and cobalt alloys. These are vital in aerospace, electric vehicles, and biomedical implants, where the strength-to-weight ratio is paramount. This trend obeys sustainability by decreasing emissions and material waste.

Growth of metal injection molding in electronics and medical:

Metal injection is gaining prominence in electronics and medical devices for producing intricate, small, and high-volume components, such as surgical tools, smartphone components, and dental brackets. Its dimensional precision and cost-efficiency are the best for miniaturized designs. Continued miniaturization in consumer electronics is projected to propel the adoption of MIM.

The global powder metallurgy market is segmented as follows:

By Material

- Titanium

- Nickel

- Steel

- Aluminum

- Cobalt

- Others

By Process

- Additive Manufacturing

- Powder Metal Hot Isostatic Pressing

- Metal Injection Molding

By Application

- Aerospace & Defense

- Automotive

- Oil & Gas

- Industrial

- Medical & Dental

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Powder metallurgy is a modern manufacturing technique that produces metal components by compressing metal powders into a preferred shape and sintering them at high temperatures. This method enables precise control over material composition, reduces waste, and facilitates the production of complex geometries using conventional metalworking techniques.

The global powder metallurgy market is projected to grow due to advancements in 3D printing, increased material efficiency and sustainability, and high demand from the consumer electronics sector.

According to study, the global powder metallurgy market size was worth around USD 3.07 billion in 2024 and is predicted to grow to around USD 8.11 billion by 2034.

The CAGR value of the powder metallurgy market is expected to be around 12.90% during 2025-2034.

Asia Pacific is expected to lead the global powder metallurgy market during the forecast period.

The key players profiled in the global powder metallurgy market include GKN Powder Metallurgy, Höganäs AB, ATI Inc., Carpenter Technology Corporation, Sandvik AB, Hitachi Chemical Co., Ltd., Sumitomo Electric Industries, Ltd., Rio Tinto Metal Powders, AMETEK Specialty Metal Products, Liberty Powder Metals, PMG Holding GmbH, BASF 3D Printing Solutions GmbH, Kymera International, Metaldyne Performance Group Inc., and QuesTek Innovations LLC.

The report examines key aspects of the powder metallurgy market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed