Surgical Robots Market Growth, Size, Share, Trends, and Forecast 2032

Surgical Robots Market Analysis By Component (Surgical System, Accessories, and Service), By Brands (DA Vinci Surgical System, CyberKnife, Renaissance, ARTAS, ROSA, Others), By Application (Gynecological, Cardiovascular, Neurosurgery, Laparoscopy, Urology and Others) and by End-users (Hospitals and Ambulatory Surgical Centers): Global Industry Perspective, Comprehensive Analysis, and Forecast 2024-2032

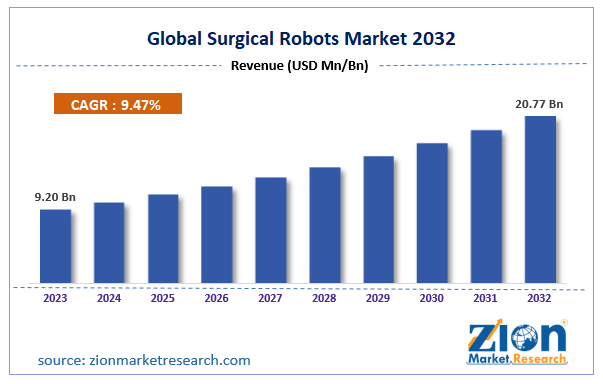

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.20 Billion | USD 20.77 Billion | 9.47% | 2023 |

Surgical Robots Industry Perspective:

The global surgical robots market size accrued earnings worth approximately USD 9.20 Billion in 2023 and is predicted to gain revenue of about USD 20.77 Billion by 2032, is set to record a CAGR of nearly 9.47% over the period from 2024 to 2032. The study includes drivers and restraints for the surgical robots market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the surgical robots market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the surgical robots market is anticipated to grow at a CAGR of 9.47% during the forecast period.

- The global surgical robots market was estimated to be worth approximately USD 9.20 billion in 2023 and is projected to reach a value of USD 20.77 billion by 2032.

- The growth of the surgical robots market is being driven by the increasing demand for minimally invasive procedures that offer greater precision, shorter recovery times, and reduced hospital stays.

- Based on the component, the surgical system segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the gynecological segment is projected to swipe the largest market share.

- In terms of end-user, the hospitals segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Surgical Robots Market Overview

In order to give the users of this report a comprehensive view of the surgical robots market, we have included a competitive landscape and an analysis of Porter’s Five Forces Model for the market. The study encompasses a market attractiveness analysis, wherein component segment, application and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

The use of surgical robots is a revolutionary step in the surgical arena. Since the last several decades, general surgery has been shifting toward minimally invasive methods that were typically executed though large, open incisions. The previous belief in the surgical domain that “big incision is required for a big surgery” no longer holds true. Surgical robots are used for robotic surgeries, which are also known as minimally invasive surgeries. In late 1990’s, the pioneer robot-based surgery was introduced in clinical practice, which made a significant impact related to conventional laparoscopic surgery on the modern surgical practice. The major benefit of robotic surgeries is their ability to overcome the challenges and limitations of conventional minimally invasive procedures. In 1992, the Integrated Surgical Systems introduced ROBODOC to the femur for hip replacement accurately with precise fitting. Furthermore, the Da Vinci Surgical System was introduced by Intuitive Surgical and AESOP by Computer Motion and the ZEUS robotic surgical system.

Healthcare providers are challenged with increasing patient numbers and growing complexities in surgical procedures. Thus, to reduce these operational challenges, majority of healthcare providers are embracing robotic process automation to overcome these challenges, offer enhanced efficiency, and contribute to the development of the healthcare sector. Moreover, the precision and flexibility offered by robotic surgeries and rising demand for non-invasive surgeries are prominently driving the market growth during the forecast time period.

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and component portfolio of various companies according to the regions.

Surgical Robots Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Surgical Robots Market |

| Market Size in 2023 | USD 9.20 Billion |

| Market Forecast in 2032 | USD 20.77 Billion |

| Growth Rate | CAGR of 9.47% |

| Number of Pages | 201 |

| Key Companies Covered | Auris Surgical Robotics, Inc. (Hansen Medical Inc.), KUKA AG, Stryker Corporation (MAKO Surgical Corp.), Smith & Nephew Plc. (Blue Belt Technologies, Inc.), Medtronic plc, Intuitive Surgical, Inc., Renishaw plc, Mazor Robotics, THINK Surgical Inc., and Zimmer Biomet Holdings Inc. |

| Segments Covered | By Component, By Application, By End-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Surgical Robots Market Segment Analysis

The study provides a decisive view of the surgical robots market by segmenting the market based on component, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024.

By component, the market is segmented into surgical system, accessories, and service. The accessories segment is anticipated to hold the largest market share, due to the recurrent sales of accessories for surgical robotic systems and the demand for highly effective and efficient components that are easily replaceable.

By application, the market is segmented into gynecological, cardiovascular, neurosurgery, laparoscopy, and urology. The urology segment is likely to grow at a significant CAGR in the global surgical robots market, owing to high adoption of robotic surgeries for urology surgical procedures and upsurge in the prostatectomy procedures worldwide.

By end-users the market is bifurcated into hospitals and ambulatory surgical centers.

Surgical Robots Market Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further fragmentation into major countries including the U.S., Rest of North America, U.K., Germany, France, Italy, Spain, Rest of Europe, China, Japan, India, Southeast Asia, Rest of Asia Pacific, Brazil, Rest of Latin America, GCC Countries, South Africa, and Rest of Middle East and Africa.

North America dominated the surgical robots market in 2023 and is estimated to continue its regional dominance over the forthcoming years. This is due to the high adoption of robotic surgeries, high awareness and acceptance rates among patients, and advanced healthcare infrastructure. Asia Pacific is anticipated to grow at a noteworthy CAGR by 2032. The increasing acceptance of robotic surgeries, growing government support, and a large patient pool are anticipated to drive the surgical robots market in Asia Pacific in the forecast timeframe.

This segmentation includes the demand for surgical robots market based on individual components and applications in all the regions and countries.

Some key players in the surgical robots market are Auris Surgical Robotics, Inc. (Hansen Medical Inc.), KUKA AG, Stryker Corporation (MAKO Surgical Corp.), Smith & Nephew Plc. (Blue Belt Technologies, Inc.), Medtronic plc, Intuitive Surgical, Inc., Renishawplc, Mazor Robotics, THINK Surgical Inc., and Zimmer Biomet Holdings Inc., among others.

This report also includes the detailed profiles of various end players, such as

- Auris Surgical Robotics, Inc. (Hansen Medical Inc.)

- KUKA AG

- Stryker Corporation (MAKO Surgical Corp.)

- Smith & Nephew Plc. (Blue Belt Technologies, Inc.)

- Medtronic plc

- Intuitive Surgical, Inc.

- Renishaw plc

- Mazor Robotics

- THINK Surgical Inc.

- and Zimmer Biomet Holdings Inc.

This report segments the global surgical robots market as follows:

Global Surgical Robots Market: Component Segment Analysis

- Surgical System

- Accessories

- Service

Global Surgical Robots Market: Application Segment Analysis

- Gynecological

- Cardiovascular

- Neurosurgery

- Laparoscopy

- Urology

- Others

Global Surgical Robots Market: End-user Segment Analysis

- Hospitals

- Ambulatory Surgical Centers

Global Surgical Robots Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed