Plasma Fractionation Market Size, Share, Trends, Growth 2032

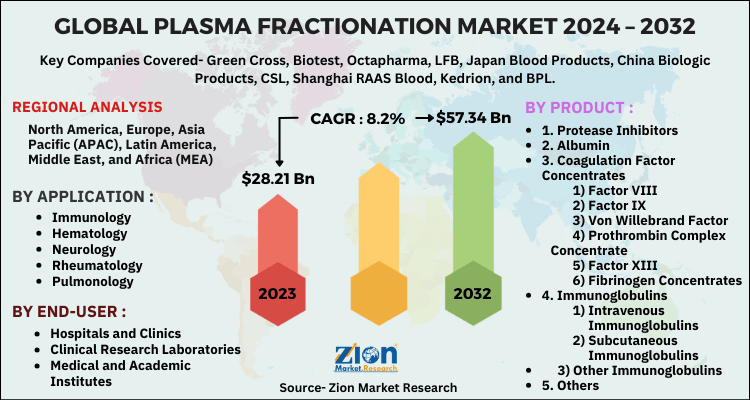

Plasma Fractionation Market By Product (Albumin, Protease Inhibitors, Coagulation Factor Concentrates, Immunoglobulins, and Others), By Application (Immunology, Hematology, Neurology, Rheumatology, Pulmonology, and Others), and By End-User (Hospitals & Clinics, Clinical Research Laboratories, Medical and Academic Institutes, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

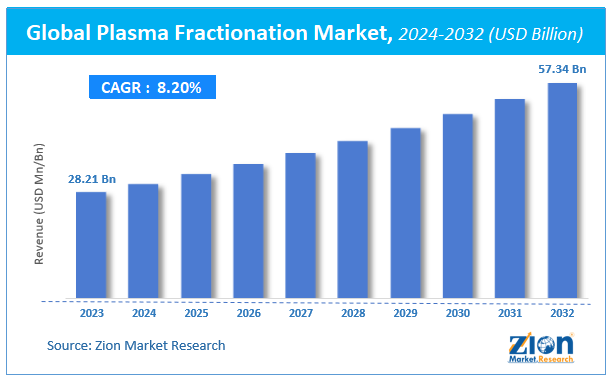

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 28.21 Billion | USD 57.34 Billion | 8.2% | 2023 |

Plasma Fractionation Industry Perspective:

The global plasma fractionation market size was worth around USD 28.21 billion in 2023 and is predicted to grow to around USD 57.34 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.2% between 2024 and 2032.

In order to give the users of this report a comprehensive view of the plasma fractionation market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Plasma Fractionation Market: Growth Factors

Plasma processing is a process to obtain pure components that can be further used for injection and transfusion. The Cohn process (also called cold ethanol fractionation) was developed by Edwin J. Cohn during World War II, which was a major breakthrough in the field of blood plasma fractionation. The preparation of plasma-derived products is an important and rising phenomenon in the human plasma biotechnological industry. Some important proteins extensively used in medical treatments are factor VIII, albumin, and Factor IX. Different methods used to extract plasma are based on cold ethanol fractionation of the human plasma, which breaks it down into its components, gel filtration, and chromatographic methods that offer higher purity and fractionation by polyethylene glycol or by salt.

The increased penetration of the global plasma fractionation market is largely due to the increased use of immunoglobulins and alpha-1-antitrypsin in areas of medicine and the consistent investments in medicine and R&D, which has resulted in cost-effective procedures. The global population has a significant proportion of aged people, who suffer from rare diseases that often require high plasma proteins. There are multiple centers to collect plasma that facilitates smooth treatment and also the subsequent development of the plasma fractionation market globally.

Additionally, the increasing patient life span due to better healthcare services, increasing health awareness, rising disposable income and reimbursement policies are also contributing to this market. However, the affordability of plasma products may be a major concern for the patients worldwide.

The report provides company market share analysis to give a broader overview of the key players in the plasma fractionation market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the plasma fractionation market on a global and regional basis.

Plasma Fractionation Market: Segmentation

The study provides a decisive view of the plasma fractionation market by segmenting it based on product, application, end-user, and region.

Based on product, the market is segmented into protease inhibitors, albumin, coagulation factor concentrates (factor IX, prothrombin complex concentrate, factor VIII, Von Willebrand factor, factor XIII, and fibrinogen concentrates), and immunoglobulins (subcutaneous immunoglobulin, intravenous immunoglobulin (IVIG), and other immunoglobulins), and others.

The application segment is divided into immunology, hematology, neurology, rheumatology, pulmonology, and others.

The end-user segment comprises clinical research laboratories, hospitals and clinics, medical and academic institutes, and others.

Plasma Fractionation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plasma Fractionation Market |

| Market Size in 2023 | USD 28.21 Billion |

| Market Forecast in 2032 | USD 57.34 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 110 |

| Key Companies Covered | Green Cross, Biotest, Octapharma, LFB, Japan Blood Products, China Biologic Products, CSL, Shanghai RAAS Blood, Kedrion, and BPL |

| Segments Covered | By product, By application, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plasma Fractionation Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America leads the extraction of plasma proteins and treatment of genetic and blood-related disorders, which makes it the global leader of the plasma fractionation market. The Asia Pacific region exhibits the highest potential to grow notably in the global plasma fractionation market in the years ahead. Increased disposable income, rising lifestyle-related disorders, growing healthcare expenditure, and escalating awareness about health disorders are driving the region’s plasma fractionation market. Additionally, the increasing aging population and cancer prevalence are further driving the plasma fractionation market in the Asia Pacific region.

Plasma Fractionation Market: Competitive players

The key players for plasma fractionation Market are:

- Green Cross

- Biotest

- Octapharma

- LFB

- Japan Blood Products

- China Biologic Products

- CSL

- Shanghai RAAS Blood

- Kedrion

- BPL

This report segments the global plasma fractionation market into:

Plasma Fractionation Market: By Product

- Protease Inhibitors

- Albumin

- Coagulation Factor Concentrates

- Factor VIII

- Factor IX

- Von Willebrand Factor

- Prothrombin Complex Concentrate

- Factor XIII

- Fibrinogen Concentrates

- Immunoglobulins

- Intravenous Immunoglobulins

- Subcutaneous Immunoglobulins

- Other Immunoglobulins

- Others

Plasma Fractionation Market: By Application

- Immunology

- Hematology

- Neurology

- Rheumatology

- Pulmonology

- Others

Plasma Fractionation Market: By End-User

- Hospitals and Clinics

- Clinical Research Laboratories

- Medical and Academic Institutes

- Others

Global Plasma Fractionation Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Plasma fractionation is a method that is employed to separate and purify the diverse components of blood plasma for medical and therapeutic purposes. Plasma is the liquid component of blood that persists after the removal of red and white blood cells, as well as platelets. Proteins, hormones, electrolytes, and waste products are present.

The demand for plasma-derived therapeutics is driven by the increasing prevalence of chronic diseases, including haemophilia, immune deficiencies, and liver diseases. The treatment of these conditions requires the production of essential products such as coagulation factors, immunoglobulins, and albumin through plasma fractionation.

The Global plasma fractionation market size was worth around USD 28.21 billion in 2023 and is predicted to grow to around USD 57.34 billion by 2032.

The Global plasma fractionation market a compound annual growth rate (CAGR) of roughly 8.2% between 2024 and 2032.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Some key players operating in the Global plasma fractionation market are Green Cross, Biotest, Octapharma, LFB, Japan Blood Products, China Biologic Products, CSL, Shanghai RAAS Blood, Kedrion, and BPL.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed