Pipe Coating Market Size, Share, Trends, Growth and Forecast 2025 - 2034

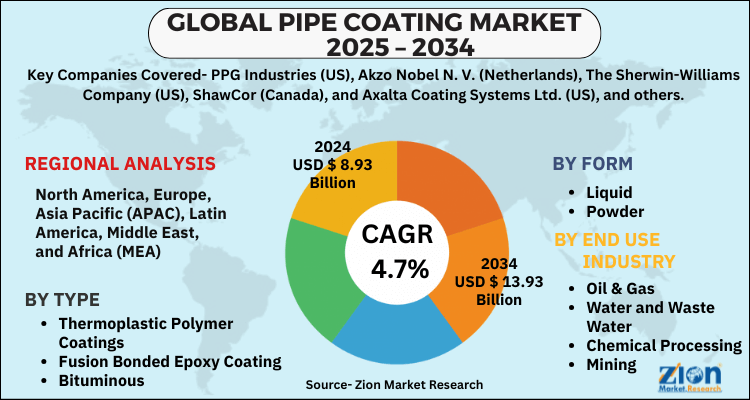

Pipe Coating Market By Type (Thermoplastic Polymer Coatings, Fusion Bonded Epoxy Coating, Bituminous, Concrete, Others.). By Form (Liquid, Powder). By End-Use Industry (Oil & Gas, Water and Waste Water, Chemical Processing, Mining, Agriculture, Others). and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.93 Billion | USD 13.93 Billion | 4.7% | 2024 |

Pipe Coating Market: Industry Perspective

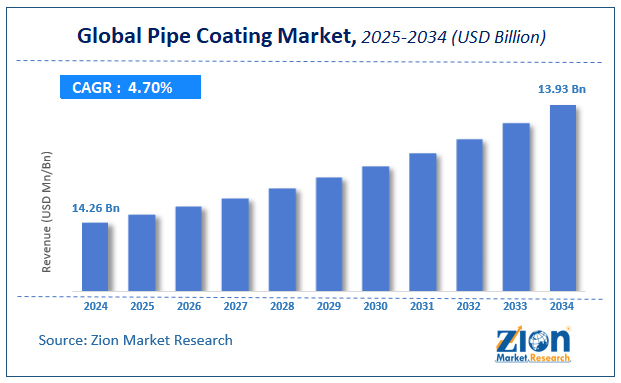

The global pipe coating market size was worth around USD 8.93 Billion in 2024 and is predicted to grow to around USD 13.93 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.7% between 2025 and 2034. The report analyzes the global pipe coating market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pipe coating industry.

Pipe Coating Market: Overview

Pipe coating is a method of protecting a pipe from corrosion and abrasion by coating it with protective materials. Pipe coatings are necessary to protect a pipe from harmful environmental elements such as moisture, ultraviolet rays, acid, carbon dioxide, hydrogen disulfide, and others, which can directly affect the pipe's performance, reliability, durability, and flow. One of the major factors driving the growth of the pipe coating market in the forecast period is the rising demand for sewage treatment around the world.

In addition, people become more interested in pipe coating because of various benefits such as improved flow, reduced abrasion, and increased wear resistance, which will drive the market in the coming years. The market is influenced positively by the high adoption of pipe coating in the oil and gas industry for transportation of heavy oil, crude oil, and petroleum products.

Moreover, rapid industrialization, increased investment, and the implementation of strict government regulations for environmental and health safety (EHS), an increase in demand for the product in various industrial applications will drive market expansion in the following years. The increase in the popularity of mobile coating technology provides profitable opportunities for market players. The growth of the pipe coating market is aided by regionally strict government regulations for the environment and health safety (EHS). The need for higher shelf life and smooth transportation of oils and acids is also contributing to the growth of the market.

Key Insights

- As per the analysis shared by our research analyst, the global pipe coating market is estimated to grow annually at a CAGR of around 4.7% over the forecast period (2025-2034).

- Regarding revenue, the global pipe coating market size was valued at around USD 8.93 Billion in 2024 and is projected to reach USD 13.93 Billion by 2034.

- The pipe coating market is projected to grow at a significant rate due to increasing investments in oil & gas infrastructure and demand for corrosion-resistant coatings.

- Based on Type, the Thermoplastic Polymer Coatings segment is expected to lead the global market.

- On the basis of Form, the Liquid segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-Use Industry, the Oil & Gas segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Pipe Coating Market: Driver

Increased activity in the oil and gas and infrastructure industries

Oil and gas demand is expected to rise in the near future. Because of the high depletion of energy and higher technological advancements, the demand for oil and gas is increasing. As a result, the pipeline market is expected to be driven by the oil and gas industry, which will help the pipe coatings market grow. Emerging economies are also expected to grow their markets. As APAC and South America's emerging economies become more involved in manufacturing, the region's infrastructure is being upgraded to facilitate trade. As a result, the pipeline market's growth is a major driver of the pipe coatings market. Furthermore, the pipeline market is being driven by the demand for gas, which is fueling the growth of the pipe coatings market.

Pipe Coating Market: Restraint

Pipe coatings with a high content of volatile organic compounds (VOCs)

The various solvent-based coatings currently used in pipes contain a high amount of volatile organic compounds (VOCs). The presence of VOCs and HAPS (Hazardous Air Pollutant Sources) in the coatings endangers the environment. High levels of VOC released into the atmosphere are hazardous to human health, pollute the environment, and contribute to the greenhouse effect. Adopting low-solvent or non-solvent coatings frequently necessitates a significant financial investment in new equipment, increased surface preparation requirements for better wetting and flow, and more technical experience and training in the application. End users must pay extra at first to compensate for the higher costs compared to traditional solvent-based systems. Due to the implementation of strict VOC emission regulations, the use of solvent-based coatings is expected to grow slowly in the future.

Pipe Coating Market: Opportunities

Mobile coating technology

Coating services are provided at the project site using mobile coating technology, also known as innovative portable coating technology. It improves project streamlining, reducing transportation and handling costs as well as the time it takes to finish the coating. This technique is required for pipe coatings and linings for exterior anti-corrosion, mechanical protection, thermal insulation, and buoyancy control. This technology can lower the cost of repairing transportation and handling damages while also allowing pipeline builders to work more efficiently. A mobile coating facility is simple to set up and has the same production capacity as a fixed plant. Companies can hire local technicians and train them to produce the same output as a fixed plant without sacrificing productivity, quality, or cost-effectiveness in this type of facility. As a result of the introduction of these techniques, the supply of pipe coating will increase. Other factors that contribute to promising opportunities include rising investments. Developing countries, in particular, will increase their market investments. All of these growth factors will boost the market's supply rates.

Pipe Coating Market: Challenges

Weather conditions that are unfavorable and terrain that is difficult

Significant pipelines constructed in rocky terrain, mountains, steep slopes, rivers, and roads with wet, frozen, or silty/clay trench materials create new obstacles for coatings providers, particularly during inclement weather. Pipelines are installed in many remote areas during extremely cold weather. These areas have less developed infrastructure and provide less support for the pipeline's operation. Furthermore, pipeline integrity is a concern as new and larger diameter pipelines are built in remote areas with harsh terrains and climates. The pipeline integrity effort is focused on corrosion protection. Mechanical protection, on the other hand, must be addressed in order to ensure the corrosion protection's integrity. Sand bedding and padding, mechanical bedding and padding, rock shield materials, and extra-thick anti-corrosion coatings are all common mechanical protection methods used around the world. These methods, however, have limitations. Sand bedding and padding, for example, is not suitable for use with frozen materials or in extremely cold temperatures. For steep slopes, river and road crossings, it becomes impractical to use. These factors pose a challenge to pipeline coaters and, as a result, the market's growth.

Pipe Coating Market: Segmentation

The global private hospital market is segregated based on Type, Form, and End-Use Industry.

By Type, the market is classified into Thermoplastic Polymer Coatings, Fusion Bonded Epoxy Coating, Bituminous, Concrete, and Others. The most common type of pipe coating is thermoplastic polymer coating. When compared to the other types of pipe coatings, thermoplastic polymer coatings were the most valuable segment in 2020. The high demand for thermoplastic polymer coatings can be attributed to their superior properties and wide range of applications in a variety of industries. During the forecast period, the market for thermoplastic polymer coatings is expected to grow significantly.

By End-Use Industry, the market is classified into Oil & Gas, Water and Waste Water, Chemical Processing, Mining, Agriculture, Others. The largest end-use industry for pipe coatings is oil and gas. Exploration and production have begun to increase around the world as oil and gas prices have recovered. The segment's growth will be fueled by a significant increase in oil and gas offshore exploration and production activities. Pipes are used in offshore and onshore petroleum production and refineries in the oil and gas industry. Damage to pipelines occurs without corrosion protection, resulting in equipment failure and lost production time. With the oil and gas industry's recovery prices, exploration and production have begun to rise around the world, propelling the market forward. Moreover, properties such as superior corrosion resistance, abrasion resistance, and chemical resistance are expected to drive demand for these coatings, contributing to the growth. The considerable expansion of the pipe coatings market in all regions may be ascribed to increased usage of pipe coatings in municipal water supply, oil and gas, industrial, and chemical processing, among other end-use sectors.

Pipe Coating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pipe Coating Market |

| Market Size in 2024 | USD 8.93 Billion |

| Market Forecast in 2034 | USD 13.93 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 160 |

| Key Companies Covered | PPG Industries (US), Akzo Nobel N. V. (Netherlands), The Sherwin-Williams Company (US), ShawCor (Canada), and Axalta Coating Systems Ltd. (US), and others. |

| Segments Covered | By Type, By Form, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Development:

- In 2020, AkzoNobel has completed the acquisition of 100 percent of the shares of Mauvilac Industries Limited, a leading paints and coatings company in Mauritius, Regional Landscape.

- In 2021, Arkema acquired Poliplas, a pioneer in the development of hybrid-technology sealants and adhesives. The acquisition strengthens its position in the fast-growing Brazilian construction adhesives market.

Pipe Coating Market: Regional Landscape

Over the forecast period, North America is expected to be the leading region in the global pipe coatings industry. Pipe coatings are being used more frequently by various end-use businesses in countries in this region, such as the United States, Canada, and Mexico. The local pipe coatings industry is being driven by the increased demand for pipelines in end-use industries such as oil and gas, water and wastewater treatment, chemical processing, and others. The United States is expected to be the region's fastest-growing country. Furthermore, the regional market will be driven by an increase in natural gas production from shale formations, as well as major markets for process pipe coating due to the region's high production of petroleum and other liquids.

Over the forecast period, Asia-Pacific is expected to grow rapidly. The market will expand due to rising demand for pipeline infrastructure from the oil and gas, chemical, mining, water and wastewater, agriculture, and construction industries. The construction sector in Asia-Pacific has been experiencing strong growth in countries such as India, Indonesia, China, Vietnam, and Singapore, resulting in increased demand for construction pipes in the region. Furthermore, gas projects are likely to be developed in Indonesia and Malaysia, resulting in an increase in pipeline projects in those countries. Malaysia had the largest share of the total gas resources to be developed. In addition, water treatment facilities have been expanding in the region as a result of a number of factors, including tightening environmental regulations, a growing scarcity of freshwater, and rising industrial water demand. With all of these market trends, the demand for pipes from these industries has been increasing, which is expected to drive the demand for pipe coatings in the region.

Pipe Coating Market: Competitive Landscape

Some of the main competitors dominating the Pipe Coating Market include:

- PPG Industries (US)

- Akzo Nobel N. V. (Netherlands)

- The Sherwin-Williams Company (US)

- ShawCor (Canada)

- Axalta Coating Systems Ltd. (US)

Pipe Coating Market is segmented as follows:

By Type

- Thermoplastic Polymer Coatings

- Fusion Bonded Epoxy Coating

- Bituminous

- Concrete

- Others

By Form

- Liquid

- Powder

By End Use Industry

- Oil & Gas

- Water and Waste Water

- Chemical Processing

- Mining

- Agriculture

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global pipe coating market is expected to grow due to increasing demand for corrosion-resistant coatings in oil & gas, water infrastructure, and industrial applications.

According to a study, the global pipe coating market size was worth around USD 8.93 Billion in 2024 and is expected to reach USD 13.93 Billion by 2034.

The global pipe coating market is expected to grow at a CAGR of 4.7% during the forecast period.

North America is expected to dominate the pipe coating market over the forecast period.

Leading players in the global pipe coating market include PPG Industries (US), Akzo Nobel N. V. (Netherlands), The Sherwin-Williams Company (US), ShawCor (Canada), and Axalta Coating Systems Ltd. (US), among others.

The report explores crucial aspects of the pipe coating market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed