Human Microbiome Market Size, Share, Trends, Growth 2032

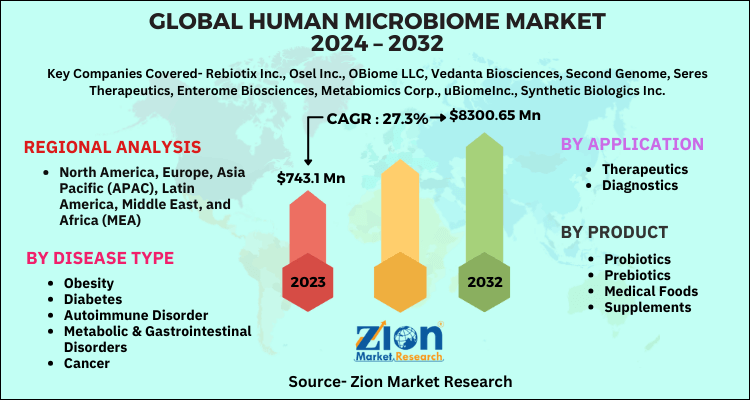

Human Microbiome Market By Product (Probiotics, Prebiotics, Medical Foods, and Supplements), By Application (Therapeutics And Diagnostics) And By Disease Type (Obesity, Diabetes, Autoimmune Disorder, Metabolic & Gastrointestinal Disorders, and Cancer): Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

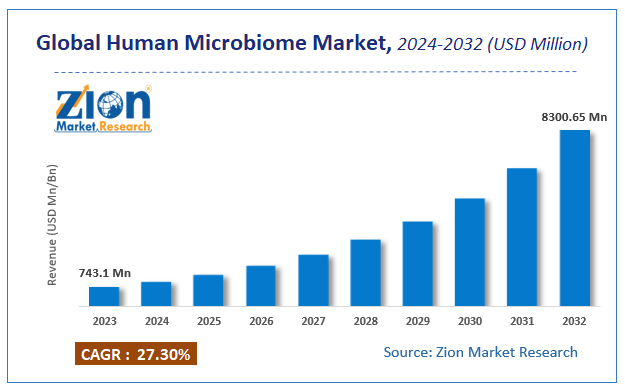

| USD 743.1 Million | USD 8300.65 Million | 27.3% | 2023 |

Human Microbiome Market Insights

Zion Market Research has published a report on the global Human Microbiome Market, estimating its value at USD 743.1 Million in 2023, with projections indicating that it will reach USD 8300.65 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 27.3% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Human Microbiome Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Request Free Sample

Request Free Sample

Global Human Microbiome Market: Outlook

Human microbiome consists of viruses, archaea, eukaryotes, and bacteria residing inside as well as outside of human body at various sites. Furthermore, human microbiome is referred as genomic content of microorganisms that inhabits a particular location in human body system such as skin, gastrointestinal tract, mammary gland, respiratory tract, mucosa, and urogenital tract. Moreover, these microbes affect human physiology contributing towards improvement as well as impairment of both immune & metabolic activities during good health & disorders. Rapid development of sequence and analytical methods are increasing our ability in understanding human microbiome working and its constituents. Moreover, human microbiota comprises of 10 to 100 trillion symbiotic microbial tissue cells that are harbored by each individual and human microbiome comprises of genes of these microbial tissue cells harbor.

For the record, studies of diverse human microbiome commenced with Antonie Van Leewenhoek. Reportedly, he in 1680s compared his own fecal with his oral microbiota and found huge differences in microbes of both. Moreover, he also found profound differences between samples of two habitats taken from large number of population. Moreover, in modern times, not only these differences are measured by using various techniques, but some strong powerful methods such as molecular techniques are developed in understanding the differences existing between two habitats as well as gain insights into how one can impact transformation from one state to other state.

The human microbiome is the full array of the microbiota (microorganisms) that reside in or on the human body. Specifically, these are the collection of the genomes of microbes that contribute to the metagenome, i.e., a genetic portrait of humans.

Human Microbiome Market: Growth Factors

According to the CDC, in 2015-16, over 93.3 million adults in the U.S. were obese. The human microbiome helps the body to improve the digestion system due to which the metabolic activities increases. These help the obese people to control the weight & initiate their weight loss. The rapid awareness about the use of human microbiome to treat diseases like diabetes, autoimmune disorders, obesity, etc. is fueling the growth of the global human microbiome market. Also, increased research in this field, use of human microbiome for drug development, and need of early diagnosis of various diseases are expected to drive the growth of the global human microbiome market.

Breakthroughs in sequencing techniques & understanding of microbiome are projected to provide insights into microbiota and thereupon decide on personalized medicine treatment for each individual based on the extracted microbiota information. This is predicted to create new growth opportunities for human microbiome market in near future. Furthermore, microbiome ventures are launched across globe with an aim of knowing roles played by symbionts as well as their impact on health of human beings, thereby driving industry trends. Understanding human microbiome helps in garnering information about presence of cancer tissues as well as identifying inflammatory bowel disease causing viruses and allergy causing microbes.

Furthermore, human microbiome plays a key role in development & maintenance of human body. Moreover, these microorganisms hold a key to development of immune system & hosts nutrition, homeostasis maintenance, and colonization resistance as well as immune regulation in young children and neonates. Major role played by microbiome in human health development will prompt growth of human microbiome market over the forecasting timeframe. Furthermore, human microbiome is a major source of genetic diversity, disease modifier, a key immunity component, and functional entity influencing body metabolism and modulating medicine interactions.

Moreover, examination of human microbiome has been highly influenced due to breakthroughs taking place in genome technologies. Additionally, developments witnessed in biotechnology domain and particularly in genome field have helped researchers to delve deep into human microbiome studies and gain comprehensive understanding about its findings.

Human Microbiome Market Segment Analysis

Human microbiome market is segmented on the basis of product, application, and disease type. All the segments of Microbiome Market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the product, the human microbiome market is further segmented into prebiotics, probiotics, medical foods, supplements, & others. Probiotics segment is anticipated to dominate the product segment of the human microbiome market. The growth in awareness about the beneficial properties of prebiotics is expected to fuel the growth of the prebiotics segment.

Based on application, the human microbiome market is further segmented into therapeutics application & diagnostics application. The increase in research yielding new applications and usage of the human microbiome is expected to fuel the growth of the therapeutic market.

The disease type segment is further segmented into obesity, diabetes, an autoimmune disorder, metabolic & gastrointestinal disorders, cancer & other diseases. Metabolic & gastrointestinal diseases segment is expected to dominate the market in the forecast period due to rise in awareness about the use of human microbiome in the treatment of metabolic & gastrointestinal diseases.

Human Microbiome Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Human Microbiome Market |

| Market Size in 2023 | USD 743.1 Million |

| Market Forecast in 2032 | USD 8300.65 Million |

| Growth Rate | CAGR of 27.3% |

| Number of Pages | 157 |

| Key Companies Covered | Rebiotix Inc., Osel Inc., OBiome LLC, Vedanta Biosciences, Second Genome, Seres Therapeutics, Enterome Biosciences, Metabiomics Corp., uBiomeInc., Synthetic Biologics Inc |

| Segments Covered | By Product, By Disease Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Human Microbiome Market Regional Analysis

North America is anticipated to dominate the human microbiome market in the forecast period due to the increase in the number of ongoing clinical trials, increase in the prevalence of a disease such as diabetes & cancer, and early adoption of recently developed technologies. The Asia Pacific is expected to show the highest growth rate in the forecast period due to rapid awareness about the benefits of the human microbiome & rapid development & innovations in the research. Also, increase in a number of initiatives that aims to optimize the method for studying the effect of the gut microbiome on human health through the various protocols and procedures is anticipated to fuel the growth of Asia Pacific market.

Human Microbiome Market: Competitive Insights

- Rebiotix Inc.

- Osel Inc.

- OBiome LLC

- Vedanta Biosciences

- Second Genome

- Seres Therapeutics

- Enterome Biosciences

- Metabiomics Corp.

- uBiomeInc.

- Synthetic Biologics Inc

The global Human Microbiome Market is segmented as follows:

By Product

- Probiotics

- Prebiotics

- Medical Foods

- Supplements

By Disease Type

- Obesity

- Diabetes

- Autoimmune Disorder

- Metabolic & Gastrointestinal Disorders

- Cancer

By Application

- Therapeutics

- Diagnostics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Breakthroughs in sequencing techniques & understanding of microbiome are projected to provide insights into microbiota and thereupon decide on personalized medicine treatment for each individual based on the extracted microbiota information. This is predicted to create new growth opportunities for human microbiome market in near future. Furthermore, microbiome ventures are launched across globe with an aim of knowing roles played by symbionts as well as their impact on health of human beings, thereby driving industry trends. Understanding human microbiome helps in garnering information about presence of cancer tissues as well as identifying inflammatory bowel disease causing viruses and allergy causing microbes.

Zion Market Research has published a report on the global Human Microbiome Market, estimating its value at USD 743.1 Million in 2023, with projections indicating that it will reach USD 8300.65 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 27.3% over the forecast period 2024-2032.

North America will contribute lucratively towards the global market earnings over the projected timeline. The regional market surge is subject to amplicon-based surveys carried on human microbial communities and microbial genome sequencing & whole-genome shotgun metagenomic sequencing activities in various reputed biotech firms based in the U.S. In addition to this, presence of giant biotech players in the countries such as Canada and the U.S. will contribute lucratively towards regional market size. Growing focus on human microbiome drug development and launching of new kinds of antibiotics for treating disease after studying human microbiome in the U.S. labs will steer growth of human microbiome market in sub-continent.

The key market participants include Rebiotix, Inc., Osel, Inc., OBiome LLC, Vedanta Biosciences, Second Genome, Seres Therapeutics, Enterome Biosciences, Metabiomics Corp., uBiome, Inc., and Synthetic Biologics, Inc.

Product (Probiotics, Prebiotics, Medical Foods, And Supplements), By Application (Therapeutics And Diagnostics) And By Disease Type (Obesity, Diabetes, Autoimmune Disorder, Metabolic & Gastrointestinal Disorders, And Cancer)

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed