Pharmaceutical Continuous Manufacturing Market Size, Growth, Analysis, 2034

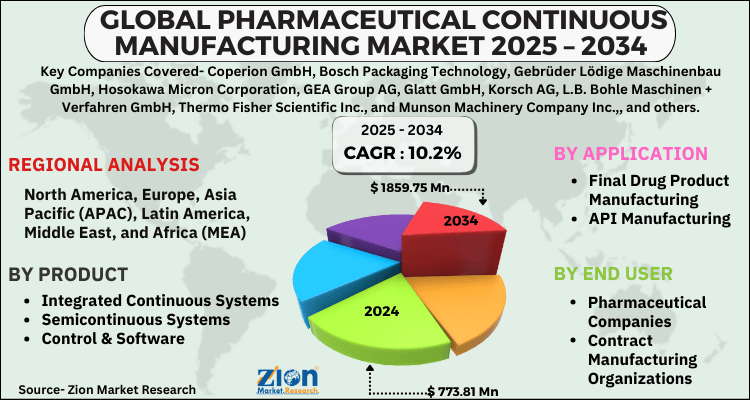

Pharmaceutical Continuous Manufacturing Market By Product (Integrated Continuous Systems, Semicontinuous Systems, and Control & Software), By Application (Final Drug Product Manufacturing and API Manufacturing), By End User (Pharmaceutical Companies, Contract Manufacturing Organizations, and Others), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

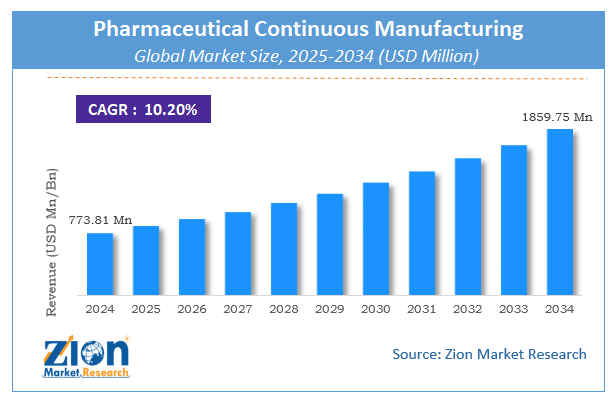

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 773.81 Million | USD 1859.75 Million | 10.2% | 2024 |

Pharmaceutical Continuous Manufacturing Industry Perspective:

The global pharmaceutical continuous manufacturing market size was worth around USD 773.81 Million in 2024 and is predicted to grow to around USD 1859.75 Million by 2034 with a compound annual growth rate (CAGR) of roughly 10.2% between 2025 and 2034. The report examines the drivers, constraints, and challenges in the pharmaceutical continuous manufacturing market, as well as their impact on demand throughout the forecast period. The report also looks at new prospects in the pharmaceutical continuous manufacturing market.

Pharmaceutical Continuous Manufacturing Market: Overview

Active pharmaceutical substances are manufactured in small, closed units using pharmaceutical continuous manufacturing technology, which makes use of automation. As a result, it needs fewer manual interventions. In a continuous process, production stages that would normally be carried out in a batch process are merged. All of this contributes to the continuous exploitation of industrial capacity. As a result, output variations are reduced, yields are improved, and operating & equipment expenses are reduced. Because of these benefits, the approach is gaining popularity steadily.

Key Insights

- As per the analysis shared by our research analyst, the global pharmaceutical continuous manufacturing market is estimated to grow annually at a CAGR of around 10.2% over the forecast period (2025-2034).

- Regarding revenue, the global pharmaceutical continuous manufacturing market size was valued at around USD 773.81 Million in 2024 and is projected to reach USD 1859.75 Million by 2034.

- The pharmaceutical continuous manufacturing market is projected to grow at a significant rate due to efficiency improvements and regulatory support for streamlined drug production.

- Based on Product, the Integrated Continuous Systems segment is expected to lead the global market.

- On the basis of Application, the Final Drug Product Manufacturing segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Pharmaceutical Companies segment is projected to swipe the largest market share.

- Based on region, North America & Europe is predicted to dominate the global market during the forecast period.

Pharmaceutical Continuous Manufacturing Market: Growth Drivers

Advancements in technology and improved process quality may benefit the market growth.

Continuous manufacturing refers to the production of a pharmaceutical product in a single continuous process. The entire procedure takes place in one location, from beginning to end, with no wait times. This helps to lower the manufacturing costs, mostly during the long process run. Further, technological advances aid in minimizing the manufacturing time from weeks to days. The advancement in the process also ensures low human errors that aid in quality improvement. Furthermore, continuous manufacturing is a more agile approach that facilitates production scalability. Scaling up, for example, just entails continuing to run the continuous production process for a longer period.

In other words, continuous production makes matching supply to demand much easier than batch manufacturing. Continuous manufacturing also enables tracing and tracking more versatile; for example, instead of a batch being specified by the equipment used in its production, a drug's batch amount might be determined by factors such as time or quantity made. This allows for lower batch sizes, resulting in less waste when flaws are discovered in a batch.

Pharmaceutical Continuous Manufacturing Market: Restraints

High process costs associated with continuous pharmaceutical manufacturing may hinder the market growth.

Continuous pharmaceutical manufacturing promises increases productivity at a given time, however, to maintain the continuous process high cost is needed to be invested. Continuous pharmaceutical production is a complex process that needs to maintain many parameters at certain points thus most of the continuous process runs on automation which adds more cost to the overall process.

Additionally, as the nature of the process is continuous there is low scope remaining for changing products. Moreover, since a single defect might halt the entire manufacturing process, high receptivity to malfunctions is required. All these factors may hinder the global pharmaceutical continuous manufacturing market growth over the forecast period.

Pharmaceutical Continuous Manufacturing Market: Opportunities

Increasing investments in process automation in pharmaceutical sectors are expected to offer better growth opportunities to the market.

As the demand for new drugs is rising, manufacturers are shifting their mode of process to increase productivity. Continuous production has several advantages, including increased efficiency (productivity, economy), which is enabled by the interconnection of unit operations such as refining, chemical reactions, and crystallization. Improved product quality and safety, which is enabled by continuous automated monitoring of processes. This aid to reduce environmental impact by reducing waste through a high rate of reaction efficiency and space savings due to the compact size of the equipment sets. All these factors support the adoption of automated production systems in the pharma sector. Besides, many major pharmaceutical manufacturers are expanding their API business in emerging countries which will further support the market expansion during the forecast period.

Pharmaceutical Continuous Manufacturing Market: Challenges

Low adoption of continuous automation process in small and mid-level pharmaceutical companies pose a major challenge for market growth.

The major hindrance to implementing a continuous automation system in a production unit is its cost and complex mechanism. Due to its multiple sensors and operating compartments, a skilled workforce is also required which makes it more tedious to operate. However, such advanced production unit having huge price tag is difficult to set for small-scale manufacturers, which hinders market growth to some extent.

Moreover, the number of small-scale drug manufacturers is increasing around the world, in that context the limitations to adopting continuous manufacturing systems by these emerging small-scale manufacturers may limit the market expansion.

Pharmaceutical Continuous Manufacturing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Continuous Manufacturing Market |

| Market Size in 2024 | USD 773.81 Million |

| Market Forecast in 2034 | USD 1859.75 Million |

| Growth Rate | CAGR of 10.2% |

| Number of Pages | 180 |

| Key Companies Covered | Coperion GmbH, Bosch Packaging Technology, Gebrüder Lödige Maschinenbau GmbH, Hosokawa Micron Corporation, GEA Group AG, Glatt GmbH, Korsch AG, L.B. Bohle Maschinen + Verfahren GmbH, Thermo Fisher Scientific Inc., and Munson Machinery Company Inc.,, and others. |

| Segments Covered | By Product, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Continuous Manufacturing Market: Segmentation

The global pharmaceutical continuous manufacturing market is categorized based on product, application, end-user, and region.

By product, the market is bifurcated into semicontinuous systems, integrated continuous systems, and control & software.

By application, segment of the market includes API manufacturing and final drug product manufacturing.

The end-user, segment of the market is segregated as contract manufacturing organizations, pharmaceutical companies, and others.

Recent Developments

- September 2021, Thermo Fisher will invest USD 82.5 million to increase production capacity at its biologic drug substance manufacturing facility in St. Louis. The investment will increase the company's entire manufacturing capacity two-fold, serving both short- and long-term COVID-19 requirements.

- September 2021, The Johnson & Johnson manufacturing facility in Ringaskiddy, Ireland, endures to expand. The firm has plans to increase the manufacturing capacity with the completion of a USD 354 million. This investment brings the total amount invested in the biologics production plant to USD 176 million.

Pharmaceutical Continuous Manufacturing Market: Regional Landscape

Europe to lead the global market over the forecast period.

The global pharmaceutical continuous manufacturing market is largely dominated by Europe. Key factors such as the existence of several contract manufacturing organizations, as well as strong demand for innovative technologies from pharmaceutical corporations, have fueled the industry in the region. The United Kingdom and Germany are driving Europe's growth. In 2021, the region holds over 35 percent of the share also in terms of growth, the market in the region is predicted to outperform others, with a CAGR of 9.6% during the forecast period.

This is due to the early availability of modern technologies and the increased number of technology suppliers around the area. In terms of market share, Asia Pacific lags behind Europe. The region accounted for around 34 percent of the worldwide pharmaceutical continuous production market in 2021. India and China, which are home to several contract manufacturers, have fueled the market growth in Asia Pacific.

Pharmaceutical Continuous Manufacturing Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the pharmaceutical continuous manufacturing market on a global and regional basis.

Major players operating in the global pharmaceutical continuous manufacturing market include;

- Coperion GmbH

- Bosch Packaging Technology

- Gebrüder Lödige Maschinenbau GmbH

- Hosokawa Micron Corporation

- GEA Group AG

- Glatt GmbH

- Korsch AG

- L.B. Bohle Maschinen + Verfahren GmbH

- Thermo Fisher Scientific Inc.

- and Munson Machinery Company, Inc.

The global pharmaceutical continuous manufacturing market is segmented as follows:

By Product

- Integrated Continuous Systems

- Semicontinuous Systems

- Control & Software

By Application

- Final Drug Product Manufacturing

- API Manufacturing

By End User

- Pharmaceutical Companies

- Contract Manufacturing Organizations

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global pharmaceutical continuous manufacturing market is expected to grow due to increasing demand for cost-effective drug production, rising adoption of automation in pharmaceuticals, and regulatory support for continuous manufacturing processes.

According to a study, the global pharmaceutical continuous manufacturing market size was worth around USD 773.81 Million in 2024 and is expected to reach USD 1859.75 Million by 2034.

The global pharmaceutical continuous manufacturing market is expected to grow at a CAGR of 10.2% during the forecast period.

North America & Europe is expected to dominate the pharmaceutical continuous manufacturing market over the forecast period.

Leading players in the global pharmaceutical continuous manufacturing market include Coperion GmbH, Bosch Packaging Technology, Gebrüder Lödige Maschinenbau GmbH, Hosokawa Micron Corporation, GEA Group AG, Glatt GmbH, Korsch AG, L.B. Bohle Maschinen + Verfahren GmbH, Thermo Fisher Scientific Inc., and Munson Machinery Company Inc.,, among others.

The report explores crucial aspects of the pharmaceutical continuous manufacturing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed