Active Pharmaceutical Ingredients (API) Market Size, Share, Value and Forecast 2032

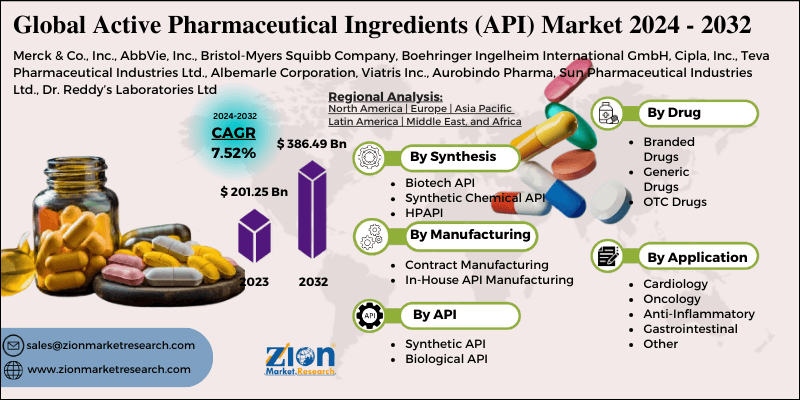

Active Pharmaceutical Ingredients (API) Market By API Synthesis Segment Analysis (Biotech API, Synthetic Chemical API, HPAPI), By Type of Manufacturing Segment Analysis (Contract Manufacturing, In-House API Manufacturing), By Type of API Segment Analysis (Synthetic API, Biological API), By Drug Type Segment Analysis (Branded Drugs, Generic Drugs, OTC Drugs), By Therapeutic Application Segment Analysis (Cardiology, Oncology, Anti-Inflammatory, Gastrointestinal, Other) : Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

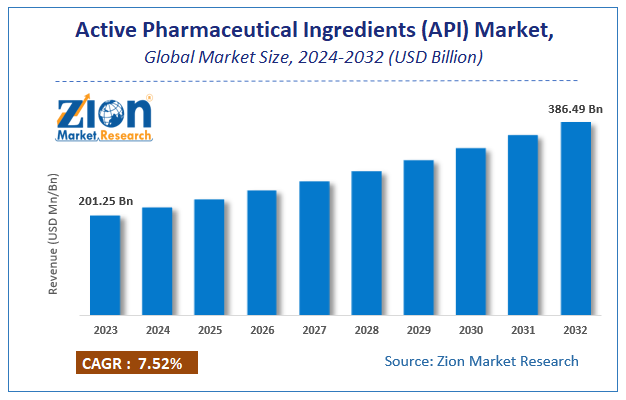

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 201.25 Billion | USD 386.49 Billion | 7.52% | 2023 |

Active Pharmaceutical Ingredients (API) Market Insights

Zion Market Research has published a report on the global Active Pharmaceutical Ingredients (API) Market, estimating its value at USD 201.25 Billion in 2023, with projections indicating that it will reach USD 386.49 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.52% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Active Pharmaceutical Ingredients (API) Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Active Pharmaceutical Ingredient (API) Market Overview

Active Pharmaceutical Ingredient (API) means the active ingredient which is contained in every medicine. For example, an active ingredient to relieve pain is included in a painkiller. A small amount of the active ingredient has an effect, so only a tiny part of the active ingredient is contained in medicine. Due to the advancements in active pharmaceutical ingredient manufacturing and the increasing prevalence of chronic diseases, such as cardiovascular diseases and cancer obesity, osteoporosis, and pulmonary diseases, it has proved favorable market conditions in the active pharmaceutical ingredients market.

Holding a largely geriatric population and growing concerns of increasing chronic disorders have proved to be beneficial for the market growth. Increasing healthcare importance and infected incidences has caused measurable growth under active pharmaceutical ingredients market. Owing to the rising drug research and development activities for manufacturing, the rising importance of generics have together enhanced the market size for the active pharmaceutical ingredients market. The unfavorable drug price control policies across various nations and high manufacturing costs are expected to weaken the growth of the market.

Active Pharmaceutical Ingredients (API) Market: Growth Factors

Some of the factors driving the growth of active pharmaceutical ingredients market is the increasing prevalence of chronic disorders care and support, older population, high investment in the department of research and development, increased spending on the healthcare, growing incidence of COVID-19 cases, and the inevitable technological advancements. In the recent past, the incidence of chronic diseases such as diabetes, coronary artery disease, chronic obstructive pulmonary disease (COPD), asthma, hepatitis, arthritis, and cancer has increased significantly in major regions across the globe. This can be attributed to the rising geriatric population across the globe, changing lifestyles, and dietary changes as a result of rapid urbanization.

The market for API is driven by a number of factors, such as increasing prevalence of chronic diseases, technological advancements in the API manufacturing, and growing incidences of age-related diseases. Furthermore, patent expiration of major drugs that increased generic drug sales, government initiatives flourishing the market growth. However, stringent regulatory requirement and decline in global economics may curb the worldwide active pharmaceutical ingredient market. Hence, there is an impulsive need for the active pharmaceutical ingredients (API) in the pandemic-stricken world of today. The anticipated growth in the market is promising for the forecasted period.

Active Pharmaceutical Ingredients (API) Market: Segment Analysis

On the basis of type of drug, the active pharmaceutical ingredients market is segmented into branded drugs, general drugs and over-the-counter drugs. As per latest study, branded drugs segment is dominating the active pharmaceutical ingredients market because of high cost of the drugs which will increase the APIs and manufacturing cost of the APIs.

Due to the rising cost of healthcare, governments and investors are pushing for increasing generics consumption over branded drugs, thus driving the growth of generic APIs market, in the predicted period. Additionally, several major pharmaceutical companies are also focusing on generic drugs along with branded drugs due to valid reasons like eroding product pipeline and patent expirations.

The synthetic API segment holds a dominance due to the higher availability of raw materials and easier protocols for the synthesis of these molecules. Many synthetic molecules are also anticipated to go off-patent in the coming years, which indirectly caters to the growth. The biotech segment is expected to expand over the forecast period, driven by factors such as increasing demand for biopharmaceuticals and higher efficiency of these molecules. Furthermore, the growth of the biotech segment can be attributed to high investments in the biotechnology sectors. This allows the innovation of new molecules that aid in the treatment of diseases, such as cancer.

On the basis of therapeutic application, the market is bifurcated into Cardiology, Oncology, Anti-Inflammatory, Gastrointestinal, Others. The cardiology diseases segment accounts to be the largely beneficial, attributed to the increasing prevalence of target diseases worldwide. Various organizations such as the World Heart Federation, the World Stroke Organization are working toward increasing awareness about cardiology diseases.

Many government initiatives programs are aimed at improving awareness related to cholesterol-related diseases. Increasing awareness about cardiology diseases and high prevalence are anticipated to drive the segment over the forecast period, thus driving demand for APIs for cardiology drugs. Although, oncology is expected to be the fastest-growing application segment with due consideration to factors such as changing lifestyles and the growing prevalence of cancer.

Active Pharmaceutical Ingredients (API) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Active Pharmaceutical Ingredients (API) Market |

| Market Size in 2023 | USD 201.25 Billion |

| Market Forecast in 2032 | USD 386.49 Billion |

| Growth Rate | CAGR of 7.52% |

| Number of Pages | 120 |

| Key Companies Covered | Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla, Inc., Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd. |

| Segments Covered | By Synthesis, By Manufacturing, By API, By Drug, By Therapeutic Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

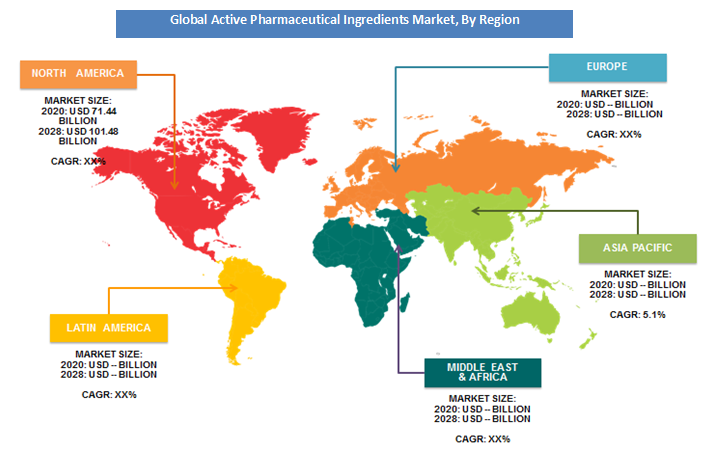

Active Pharmaceutical Ingredients (API) Market: Regional Analysis

Geographically, the active pharmaceutical ingredients market is segmented into North America, Europe, Asia, and Rest of the World. In recent times, North America accounted for the largest share of the active pharmaceutical ingredients market, followed by Europe and the Asia Pacific. The reason for North America’s dominance in the global market is attributed to the rising incidence of preventable chronic diseases, increasing government focus on generic drugs, rising demand for specialty drugs, and technological advancements in the manufacturing processes of APIs.

During the forecasted period, Asia Pacific is anticipated to have an accelerated growth. The presence of economies like China and India among the Asia Pacific, which the world relies on for low-cost API production, is a benefit for the region. The market is expected to rise due to rising healthcare expenditure in the region.

Active Pharmaceutical Ingredients (API) Market Players & Competitive Landscape

Some of the leading players in the market are

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation, Viatris Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

The global home Active pharmaceutical ingredients market is segmented as follows:

By Synthesis Segment Analysis:

- Biotech API

- Synthetic Chemical API

- HPAPI

By Manufacturing Type Segments:

- Contract Manufacturing

- In-House API Manufacturing

By API Type Segments:

- Synthetic API

- Biological API

By Drug Type Segments:

- Branded Drugs

- Generic Drugs

- OTC Drugs

By Therapeutic Application Segments:

- Cardiology

- Oncology

- Anti-Inflammatory

- Gastrointestinal

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Active Pharmaceutical Ingredients (API) Market, estimating its value at USD 201.25 Billion in 2023, with projections indicating that it will reach USD 386.49 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 7.52% over the forecast period 2024-2032.

Some of the factors driving the growth of active pharmaceutical ingredients market is the increasing prevalence of chronic disorders care and support, older population, high investment in the department of research and development, increased spending on the healthcare, growing incidence of COVID-19 cases, and the inevitable technological advancements. In the recent past, the incidence of chronic diseases such as diabetes, coronary artery disease, chronic obstructive pulmonary disease (COPD), asthma, hepatitis, arthritis, and cancer has increased significantly in major regions across the globe. This can be attributed to the rising geriatric population across the globe, changing lifestyles, and dietary changes as a result of rapid urbanization.

Geographically, the active pharmaceutical ingredients market is segmented into North America, Europe, Asia, and Rest of the World. In recent times, North America accounted for the largest share of the active pharmaceutical ingredients market, followed by Europe and the Asia Pacific. The reason for North America’s dominance in the global market is attributed to the rising incidence of preventable chronic diseases, increasing government focus on generic drugs, rising demand for specialty drugs, and technological advancements in the manufacturing processes of APIs.

Some of the leading players in the market are Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla, Inc., Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed