Pesticides Packaging Market Size, Share, Trends, Growth & Forecast 2034

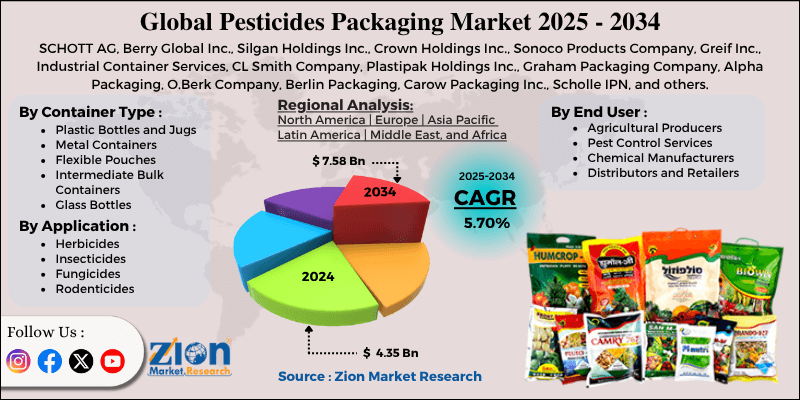

Pesticides Packaging Market By Application (Herbicides, Insecticides, Fungicides, Rodenticides, Plant Growth Regulators, Soil Fumigants), By Container Type (Plastic Bottles and Jugs, Metal Containers, Flexible Pouches, Intermediate Bulk Containers, Glass Bottles, Composite Containers), By End-User (Agricultural Producers, Pest Control Services, Chemical Manufacturers, Distributors and Retailers, Government Agencies, Research Institutions), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034.

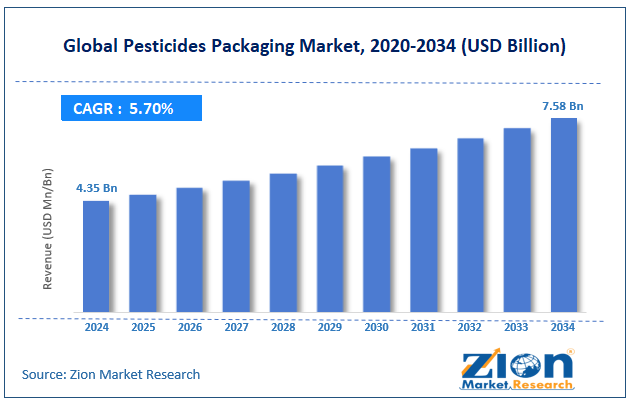

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.35 Billion | USD 7.28 Billion | 5.70% | 2024 |

Pesticides Packaging Industry Perspective:

The global pesticides packaging market size was worth approximately USD 4.35 billion in 2024 and is projected to grow to around USD 7.58 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global pesticides packaging market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034).

- In terms of revenue, the global pesticides packaging market size was valued at approximately USD 4.35 billion in 2024 and is projected to reach USD 7.58 billion by 2034.

- The pesticide packaging market is projected to grow significantly due to the expansion of global agricultural activities and the rise of sustainable crop protection initiatives.

- Based on application, the herbicides segment is expected to lead the market, while the plant growth regulators segment is anticipated to experience significant growth.

- Based on container type, the plastic bottles and jugs segment is the dominating segment, while the flexible pouches segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the agricultural producers segment is expected to lead the market compared to the research institutions segment.

- Based on region, North America is projected to dominate the global pesticides packaging market during the estimated period, followed by the Asia Pacific.

Pesticides Packaging Market: Overview

Pesticide packaging is a specialized part of the chemical packaging industry, created to safely store, transport, and dispense agricultural chemicals while ensuring effectiveness and user safety. These solutions are designed to resist chemical interactions, prevent contamination, and maintain stability during storage and distribution. Manufacturing requires knowledge of chemical compatibility, regulations, and safety protocols to ensure a safe and compliant work environment. Modern production uses chemical-resistant materials, barrier coatings, and tamper-evident closures to protect product integrity and meet strict safety and environmental standards. Packaging formats range from small consumer bottles to industrial bulk containers, including HDPE bottles, steel drums, flexible bulk containers, and specialized dispensing systems.

To ensure compliance, manufacturers conduct chemical compatibility tests, perform safety checks, and apply standardized labeling to facilitate proper handling throughout the supply chain. Regulatory frameworks guide packaging design to meet hazardous material requirements and provide clear safety instructions, protecting users and the environment while supporting both professional and agricultural applications.The increasing global food production demands are expected to drive substantial growth in the pesticide packaging market throughout the forecast period.

Pesticides Packaging Market Dynamics

Growth Drivers

How is the increase in global food security needs and agricultural productivity demands propelling the pesticides packaging market growth?

The pesticide packaging market is experiencing strong growth as worldwide agricultural production intensifies to meet the growing population’s needs and food security challenges. Farmers in many countries are adopting advanced crop protection methods that need reliable packaging for chemical storage and longer shelf life. Modern agricultural users prefer packaging with clear labeling, tamper-proof security, and precise measurement features that support safety and compliance. Manufacturers are introducing innovative container designs that improve product stability, minimize waste, and offer user-friendly handling. New safety features like child-resistant caps, spill-prevention systems, and ergonomic designs are boosting adoption and regulatory approval.

In addition, precision farming and integrated pest management have created a higher demand for specialized packaging that enables targeted use and reduces environmental impact. This makes pesticide packaging an important part of crop protection, user safety, and environmental care, driving steady market growth.

Specialty chemical formulations and precision agriculture

The global pesticides packaging market is expanding rapidly with the development of advanced chemical formulations, biological pesticides, and precision application technologies. Packaging must adapt to different product properties, viscosities, and storage needs while maintaining stability and effectiveness. Companies in specialty formulations, biotechnology, and precision agriculture require customized packaging that protects active ingredients and ensures accurate delivery.

Sustainability goals and pest management programs are also pushing demand for formats that reduce chemical use and improve efficiency. These advancements not only improve product performance but also allow differentiation through technology-integrated packaging and precision delivery. With the advancement of agricultural technology and the growing adoption of sustainable farming practices, pesticide packaging remains essential for supporting both product efficacy and environmental responsibility across diverse agricultural applications.

Restraints

How are regulatory compliance complexity and hazardous material handling restrictions restraining the pesticides packaging market growth?

A major challenge confronting the pesticide packaging industry is the varying safety regulations, environmental standards, and hazardous material handling requirements across global markets. Packaging must comply with chemical safety standards, transport protocols, and environmental guidelines, creating complex compliance demands. Studies show that 40–55% of development costs are tied to regulatory testing and certifications, increasing timelines and barriers to entry.

To address this, companies must invest in testing facilities, compliance experts, and documentation systems. Challenges also include launching packaging for new chemical types or entering several international markets with different rules. The lack of uniform global standards and evolving environmental requirements adds further cost and operational difficulties.

Opportunities

How is sustainable packaging development and smart technology integration creating opportunities in the pesticide packaging market?

The pesticides packaging market is advancing through innovations in environmentally responsible materials, recyclable container designs, and smart packaging technologies. Companies are developing biodegradable parts and refillable systems that reduce environmental impact without compromising safety. Technology-led innovations, such as RFID tags, tamper-proof seals, and integrated measuring systems, are gaining popularity as they improve tracking and application accuracy. Connected packaging is also gaining popularity, featuring digital safety information, GPS tracking, and QR codes that facilitate inventory management and user education. These smart and sustainable solutions are attracting professional farmers and large-scale agricultural operations. By focusing on green materials and digital tools, the industry is enhancing its value proposition while strengthening its competitive edge.

Challenges

Environmental concerns and waste management requirements

The pesticides packaging industry faces significant hurdles due to increasing environmental regulations and waste disposal requirements that affect packaging design, materials selection, and end-of-life management. Many regions are enforcing tougher regulations on container waste, pushing manufacturers to create cost-effective packaging that balances safety with sustainability. This raises expenses for producers and farmers. Limited recycling infrastructure and inconsistent waste systems add to the problem, especially for materials needing special handling. Varying environmental rules across regions also affect adoption rates.

To overcome these hurdles, the industry needs stronger recycling systems, standardized disposal practices, and wider environmental education. Building sustainability frameworks and waste reduction programs will lower costs, protect ecosystems, and ensure responsible market growth.

Pesticides Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pesticides Packaging Market |

| Market Size in 2024 | USD 4.35 Billion |

| Market Forecast in 2034 | USD 7.58 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 212 |

| Key Companies Covered | SCHOTT AG, Berry Global Inc., Silgan Holdings Inc., Crown Holdings Inc., Sonoco Products Company, Greif Inc., Industrial Container Services, CL Smith Company, Plastipak Holdings Inc., Graham Packaging Company, Alpha Packaging, O.Berk Company, Berlin Packaging, Carow Packaging Inc., Scholle IPN, and others. |

| Segments Covered | By Application, By Container Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pesticides Packaging Market: Segmentation

The global pesticides packaging market is segmented based on application, container type, end-user, and region.

Based on application, the global pesticides packaging industry is divided into herbicides, insecticides, fungicides, rodenticides, plant growth regulators, and soil fumigants. Herbicides lead the market due to extensive agricultural usage, widespread crop protection applications, and continuous development of new formulations that require specialized packaging solutions for stability and safety.

Based on container type, the global pesticides packaging market is segmented into plastic bottles and jugs, metal containers, flexible pouches, intermediate bulk containers, glass bottles, and composite containers. Plastic bottles and jugs are expected to lead the market during the forecast period due to their chemical compatibility, cost-effectiveness, and versatile design options across various pesticide formulations and application methods.

Based on end-user, the global market is classified into agricultural producers, pest control services, chemical manufacturers, distributors and retailers, government agencies, and research institutions. Agricultural producers hold the largest market share due to their direct packaging needs for crop protection chemicals, large-scale purchasing volumes, and continuous investment in agricultural productivity and food security initiatives.

Pesticides Packaging Market: Regional Analysis

What factors are contributing to North America's dominance in the global pesticides packaging market?

North America leads the global pesticides packaging market due to its advanced farming systems, strict regulatory environment, and strong chemical manufacturing base. Around 45% of global innovation in pesticide packaging comes from this region, with the United States contributing the most because of its large-scale agriculture and environmental protection measures. Farmers and agricultural professionals in this region prefer high-performance packaging that ensures product stability, precise application, and complete safety compliance. These requirements are supported by robust manufacturing capabilities, state-of-the-art research facilities, and a comprehensive network of chemical specialists and packaging engineers.

Established safety standards and regulatory frameworks build trust in packaged pesticides, making adoption widespread. Growth is further supported by factors like large-scale farming operations, integrated pest management, and precision agriculture, all of which demand advanced packaging solutions. North American companies are also leaders in innovation, developing barrier coatings, smart packaging systems, and eco-friendly materials. Recently, manufacturers have shown greater commitment to sustainability, circular economy practices, and digital tools like supply chain tracking, making chemical use safer and more efficient.

Asia Pacific is expected to show strong growth.

The Asia Pacific pesticides packaging market is expanding quickly as farming systems modernize, food security challenges increase, and agricultural practices become more advanced. Packaging adoption is rising in both large commercial farms and smallholder operations, as well as in government-led crop protection programs. Farmers and cooperatives value packaging for its ability to improve product safety, ensure accurate application, and meet compliance requirements. Regional governments are encouraging modern farming methods and safe chemical use through agricultural development policies, which support long-term growth.

Economic development initiatives allow farmers to access packaging that meets global safety requirements. Retailers are also expanding offerings of packaged pesticides for conventional, specialty, and organic farming. Leading regional agricultural companies are forming partnerships with international packaging firms to adopt advanced containers and improve chemical management systems. With government backing, rising professionalism, and stronger safety awareness, the Asia Pacific is positioned as one of the fastest-growing markets worldwide. Growing investments in agricultural infrastructure are further accelerating adoption. Rising export opportunities are also increasing demand for compliant and durable pesticide packaging.

Recent Market Developments:

- In September 2025, Corteva Agriscience announced it is exploring a corporate split between its seed and pesticide businesses, aiming to create independent units that can focus on growth, innovation, and regulatory compliance in agricultural packaging and crop protection markets.

Pesticides Packaging Market: Competitive Analysis

The leading players in the global pesticides packaging market are:

- SCHOTT AG

- Berry Global Inc.

- Silgan Holdings Inc.

- Crown Holdings Inc.

- Sonoco Products Company

- Greif Inc.

- Industrial Container Services

- CL Smith Company

- Plastipak Holdings Inc.

- Graham Packaging Company

- Alpha Packaging

- O.Berk Company

- Berlin Packaging

- Carow Packaging Inc.

- Scholle IPN

The global pesticides packaging market is segmented as follows:

By Application

- Herbicides

- Insecticides

- Fungicides

- Rodenticides

- Plant Growth Regulators

- Soil Fumigants

By Container Type

- Plastic Bottles and Jugs

- Metal Containers

- Flexible Pouches

- Intermediate Bulk Containers

- Glass Bottles

- Composite Containers

By End User

- Agricultural Producers

- Pest Control Services

- Chemical Manufacturers

- Distributors and Retailers

- Government Agencies

- Research Institutions

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pesticides packaging consists of specialized containers and systems designed to safely store, transport, and dispense agricultural chemicals while maintaining product integrity, ensuring user safety, and meeting regulatory compliance requirements for hazardous material handling.

The global pesticides packaging market is projected to grow due to increasing agricultural production needs, rising adoption of integrated pest management practices, and growing emphasis on safe chemical handling and environmental protection.

According to a study, the global pesticides packaging market size was worth around USD 4.35 billion in 2024 and is predicted to grow to around USD 7.58 billion by 2034.

The CAGR value of the pesticides packaging market is expected to be around 5.70% during 2025-2034.

North America is expected to lead the global pesticides packaging market during the forecast period.

The major players profiled in the global pesticides packaging market include SCHOTT AG, Berry Global Inc., Silgan Holdings Inc., Crown Holdings Inc., Sonoco Products Company, Greif Inc., Industrial Container Services, CL Smith Company, Plastipak Holdings Inc., Graham Packaging Company, Alpha Packaging, O.Berk Company, Berlin Packaging, Carow Packaging Inc., and Scholle IPN.

The report examines key aspects of the pesticides packaging market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

The emerging trends and innovations impacting the pesticides packaging market include sustainable packaging, biodegradable materials, smart packaging with RFID/QR codes, tamper-proof systems, precision dispensing, and circular economy practices, driven by food safety, regulatory compliance, and sustainable farming initiatives.

The technological advancement influencing the pesticides packaging market includes smart tracking (RFID, GPS), bio-based plastics, multilayer HDPE, child-resistant closures, and connected packaging with digital instructions, improving safety, compliance, sustainability, and supply chain efficiency.

The stages in the value chain of the global pesticides packaging market include raw material supply, design and development, manufacturing, compliance testing, distribution, end use by farmers and agencies, and post-use recycling or waste management aligned with circular economy principles.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed