Packaging Bins Market Size, Growth, Global Trends, Forecast 2034

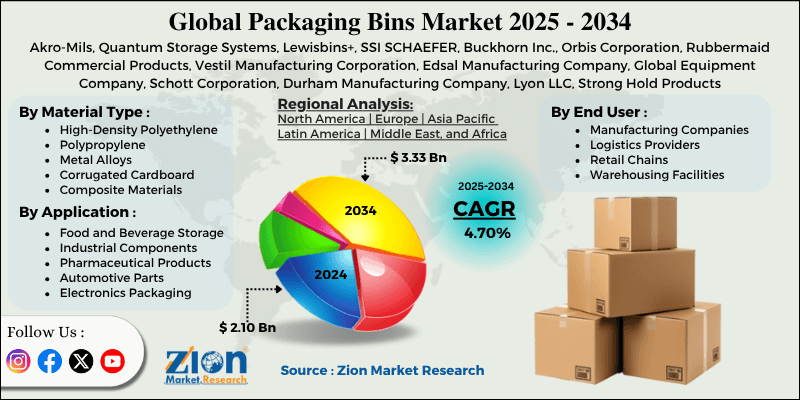

Packaging Bins Market By Application (Food and Beverage Storage, Industrial Components, Pharmaceutical Products, Automotive Parts, Electronics Packaging, Agricultural Products), By Material Type (High-Density Polyethylene, Polypropylene, Metal Alloys, Corrugated Cardboard, Composite Materials, Biodegradable Plastics), By End-User (Manufacturing Companies, Logistics Providers, Retail Chains, Warehousing Facilities, Distribution Centers, Food Processors), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

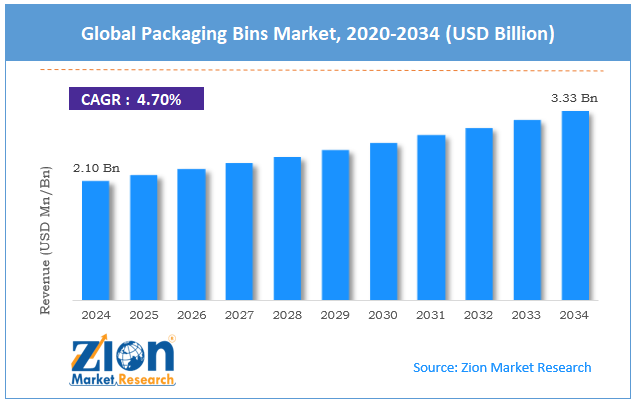

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.10 Billion | USD 3.33 Billion | 4.70% | 2024 |

Packaging Bins Industry Perspective:

The global packaging bins market size was worth approximately USD 2.10 billion in 2024 and is projected to grow to around USD 3.33 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global packaging bins market is estimated to grow annually at a CAGR of around 4.70% over the forecast period (2025-2034).

- In terms of revenue, the global packaging bins market size was valued at approximately USD 2.10 billion in 2024 and is projected to reach USD 3.33 billion by 2034.

- The packaging bins market is projected to grow significantly due to the expansion of e-commerce activities and the rise of automated warehouse management initiatives.

- Based on application, the food and beverage storage segment is expected to lead the market, while the electronics packaging segment is anticipated to experience significant growth.

- Based on material type, the high-density polyethylene segment is the dominating segment, while the biodegradable plastics segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the manufacturing companies segment is expected to lead the market compared to the food processors segment.

- Based on region, North America is projected to dominate the global packaging bins market during the estimated period, followed by Europe.

Packaging Bins Market: Overview

Packaging bins are standardized storage containers used in industrial logistics to organize, protect, and transport products efficiently across different sectors. They are designed to save space, safeguard contents, and enable smooth handling throughout the supply chain, with development based on load requirements, material durability, and workflow efficiency. Modern bins incorporate advanced polymers, modular designs, and automation-compatible features, ensuring strength, sustainability, and operational efficiency.

To guarantee reliability and safety, manufacturers conduct rigorous testing, verify load capacities, and follow standardized dimensions that are suitable for both manual and automated systems. Industry standards also shape design to improve workplace safety, ergonomics, and usability, with clear capacity markings that protect workers and optimize operational efficiency. By combining durability, compliance, and efficiency, packaging bins have become essential tools that streamline logistics and strengthen supply chain management across diverse industrial applications.

The growing emphasis on supply chain optimization is expected to drive substantial growth in the packaging bins market throughout the forecast period.

Packaging Bins Market Dynamics

Growth Drivers

Expanding e-commerce and warehouse automation trends

The packaging bins market is growing quickly due to the rise of e-commerce and warehouse automation, which require efficient storage and handling systems. Modern logistics relies on standardized bins that work in conjunction with automated sorting, picking, and storage operations to efficiently handle high volumes of orders. Companies and warehouses now need bins with consistent dimensions, strong durability, and compatibility with robotic handling systems, ensuring speed and efficiency in order fulfillment. Many facilities are investing in solutions that improve space use, reduce handling time, and connect with warehouse management software using barcodes and RFID technology.

Features like modular stacking, ergonomic designs, and automation-ready footprints are boosting productivity and safety. With the growth of omnichannel retail and direct-to-consumer models, demand has risen for versatile bins that can store a wide variety of products. As global supply chains evolve, packaging bins have become a core part of logistics operations, playing a vital role in supporting inventory management, customer satisfaction, and sustained market growth.

How is growth in manufacturing efficiency and lean production systems propelling the packaging bins market growth?

The packaging bins market is also benefiting from changes in manufacturing, where lean production, just-in-time systems, and continuous improvement programs are becoming standard. Bins now play a key role in ensuring smooth material flow, accurate inventory control, and waste reduction, while also supporting quality checks and workflow flexibility. Manufacturers, suppliers, and contractors are adopting standardized bins that fit seamlessly into production processes and meet quality standards. Corporate efficiency programs have increased the demand for custom bin designs tailored to specific operations, while workplace safety rules encourage bins that reduce strain, improve accessibility, and follow ergonomic guidelines.

Companies focused on productivity, safety, and quality are turning to bins with innovative features, including smart tracking and technology integration for better inventory management. With the rise of Industry 4.0 and smart manufacturing, bins are evolving into more than just storage tools; they are becoming part of digital transformation strategies. This makes them essential to both improving efficiency and enabling advanced manufacturing practices worldwide.

Restraints

Raw material price volatility and supply chain disruption restrictions

One of the biggest restraints in the packaging bins industry is the unpredictable cost of raw materials like petroleum-based polymers, recycled plastics, and metals. Prices often fluctuate due to global market trends, energy costs, and supply chain disruptions, making it hard for manufacturers to manage expenses and keep competitive pricing. To cope, companies are exploring diversified sourcing, stronger supplier relationships, and flexible pricing models.

However, the issue remains especially challenging for manufacturers using specialty or eco-friendly materials, which are more expensive than traditional ones. Additionally, global trade policies and complex supply networks add uncertainty to operations, further raising risks. This instability limits planning and creates pressure across the value chain. Unless the industry builds more resilient sourcing and pricing systems, raw material volatility will continue to be a key challenge to market growth in the coming years.

Opportunities

How are sustainable material innovation and circular economy principles creating opportunities in the packaging bins market?

Sustainability is creating strong opportunities in the packaging bins market, with companies increasingly focusing on recycled materials, bio-based plastics, and designs aligned with circular economy principles. Many are introducing bins that are recyclable, reusable, and supported by end-of-life recovery programs, reducing environmental impact without compromising durability. At the same time, smart technologies such as IoT-enabled sensors, condition monitoring, and inventory tracking are being built into bins, improving visibility and asset management across supply chains. Customization is also gaining traction, with manufacturers offering tailored solutions that include specific colors, accessories, and application-focused designs to meet the unique needs of various industries.

Ergonomic improvements and safety features are being prioritized to help workers handle bins more efficiently and safely. Together, these innovations not only support corporate sustainability goals but also make bins smarter and more valuable in digital-first operations. By focusing on eco-friendly materials, advanced features, and customer-specific solutions, packaging bin makers are creating competitive advantages and driving new growth opportunities in the market.

Challenges

How are standardization complexity and compatibility requirements limiting the growth of the packaging bins market?

Despite growth, the packaging bins market faces hurdles from inconsistent global standards and compatibility issues. Bin dimensions and design requirements vary widely across industries and regions, making it hard for manufacturers to create universal products that fit all automated systems and workflows. This lack of harmonization complicates integration, slows down adoption, and sometimes forces companies to invest in customized bins, which raises costs and limits flexibility. As automation in logistics continues to expand, the problem of compatibility becomes even more pressing. Differences in expertise among logistics professionals can also lead to poor bin selection or inefficient implementation, further reducing effectiveness.

To overcome these challenges, the industry needs better coordination, standardized frameworks, and broader education on the bin system usage. Establishing global dimensional standards and compatibility guidelines would simplify integration, lower costs, and improve trust among end-users. Addressing these challenges will be crucial for ensuring smoother growth, protecting buyers, and maintaining product reliability across the global packaging bins industry.

Packaging Bins Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaging Bins Market |

| Market Size in 2024 | USD 2.10 Billion |

| Market Forecast in 2034 | USD 3.33 Billion |

| Growth Rate | CAGR of 4.70% |

| Number of Pages | 213 |

| Key Companies Covered | Akro-Mils, Quantum Storage Systems, Lewisbins+, SSI SCHAEFER, Buckhorn Inc., Orbis Corporation, Rubbermaid Commercial Products, Vestil Manufacturing Corporation, Edsal Manufacturing Company, Global Equipment Company, Schott Corporation, Durham Manufacturing Company, Lyon LLC, Strong Hold Products, Penco Products Inc., and others. |

| Segments Covered | By Application, By Material Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaging Bins Market: Segmentation

The global packaging bins market is segmented based on application, material type, end-user, and region.

Based on application, the global packaging bins industry is divided into food and beverage storage, industrial components, pharmaceutical products, automotive parts, electronics packaging, and agricultural products. Food and beverage storage leads the market due to strict hygiene requirements, regulatory compliance needs, and the continuous growth in food processing and distribution operations that require specialized storage solutions.

Based on material type, the global packaging bins market is classified into high-density polyethylene, polypropylene, metal alloys, corrugated cardboard, composite materials, and biodegradable plastics. High-density polyethylene is expected to lead the market during the forecast period due to its excellent durability, chemical resistance, and cost-effectiveness across various industrial applications and environmental conditions.

Based on end-user, the global market is segmented into manufacturing companies, logistics providers, retail chains, warehousing facilities, distribution centers, and food processors. Manufacturing companies hold the largest market share due to their extensive storage needs, large-scale operations, and continuous investment in operational efficiency and lean manufacturing systems.

Packaging Bins Market: Regional Analysis

What factors are contributing to North America's dominance in the global packaging bins market?

North America continues to lead the global packaging bins market because of its advanced manufacturing base, highly developed logistics networks, and widespread use of automation across various industries. Around half of global bin innovation and automation-related integration comes from this region, with the United States contributing the most due to its large-scale manufacturing and focus on efficiency and supply chain optimization. Companies in North America demand high-quality bins that are durable, standardized, and compatible with automated systems, ensuring strong returns on investment.

The region’s edge also comes from strong research and development, extensive logistics expertise, and well-established industrial standards, which give businesses confidence in adopting new bin systems. Market growth is further supported by efforts to manage labor costs, improve productivity, and apply lean manufacturing and Six Sigma principles for better material handling.

North American firms are also leading the way in innovation, introducing bins made from advanced materials, featuring smart technology, and incorporating sustainable designs. Recently, there has been greater emphasis on environmental responsibility, circular economy practices, and safety. The integration of Internet of Things (IoT) systems, predictive maintenance, and digital supply chain platforms is making bin-based inventory management more intelligent and efficient.

Europe is expected to show strong growth.

Europe is showing rapid growth in the packaging bins market as industries adopt Industry 4.0 technologies, strict sustainability rules, and modern logistics solutions. Bin systems are becoming standard in key sectors such as automotive, pharmaceuticals, and food processing, where they improve efficiency, compliance, and quality control. The European Union’s strict workplace safety regulations and environmental policies create uniform requirements across member nations, helping businesses adopt sustainable and consistent practices. This has encouraged adoption not just in large factories but also among small and medium-sized enterprises, specialized producers, and emerging technology sectors.

Sustainability rules and support for circular economy programs are pushing demand for eco-friendly, recyclable, and carbon-neutral bins that meet corporate social responsibility goals. Governments and industry associations are also promoting advanced manufacturing practices, which are raising awareness of efficient storage and handling solutions. Suppliers in Europe are expanding product lines for healthcare, electronics, renewable energy, and automotive sectors, while partnerships with global manufacturers are helping local companies access advanced materials and automation systems.

Recent Market Developments:

- In March 2025, the International Material Handling Society introduced new smart bin certification standards for industrial applications, establishing comprehensive guidelines for IoT integration, durability testing, and automation compatibility across international manufacturing markets.

Packaging Bins Market: Competitive Analysis

The leading players in the global packaging bins market are:

- Akro-Mils

- Quantum Storage Systems

- Lewisbins+

- SSI SCHAEFER

- Buckhorn Inc.

- Orbis Corporation

- Rubbermaid Commercial Products

- Vestil Manufacturing Corporation

- Edsal Manufacturing Company

- Global Equipment Company

- Schott Corporation

- Durham Manufacturing Company

- Lyon LLC

- Strong Hold Products

- Penco Products Inc.

The global packaging bins market is segmented as follows:

By Application

- Food and Beverage Storage

- Industrial Components

- Pharmaceutical Products

- Automotive Parts

- Electronics Packaging

- Agricultural Products

By Material Type

- High-Density Polyethylene

- Polypropylene

- Metal Alloys

- Corrugated Cardboard

- Composite Materials

- Biodegradable Plastics

By End User

- Manufacturing Companies

- Logistics Providers

- Retail Chains

- Warehousing Facilities

- Distribution Centers

- Food Processors

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Packaging bins are specialized storage containers and systems designed to organize, contain, and transport various products and materials while providing efficient space utilization, protection, and handling convenience for industrial and commercial applications.

The global packaging bins market is projected to grow due to increasing e-commerce activities, rising warehouse automation, and growing emphasis on supply chain efficiency and lean manufacturing practices.

According to a study, the global packaging bins market size was worth around USD 2.10 billion in 2024 and is predicted to grow to around USD 3.33 billion by 2034.

The CAGR value of the packaging bins market is expected to be around 4.70% during 2025-2034.

North America is expected to lead the global packaging bins market during the forecast period.

The major players profiled in the global packaging bins market include Akro-Mils, Quantum Storage Systems, Lewisbins+, SSI SCHAEFER, Buckhorn Inc., Orbis Corporation, Rubbermaid Commercial Products, Vestil Manufacturing Corporation, Edsal Manufacturing Company, Global Equipment Company, Schott Corporation, Durham Manufacturing Company, Lyon LLC, Strong Hold Products, and Penco Products Inc.

The report examines key aspects of the packaging bins market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Macroeconomic factors such as manufacturing sector growth, logistics industry expansion, raw material price fluctuations, and automation technology investments will significantly influence the packaging bins market growth through demand patterns, technology adoption, and market expansion across different industrial sectors.

The growth of the packaging bins market is influenced by regulatory standards, including workplace safety requirements, load capacity specifications, material safety guidelines, and environmental compliance regulations. Environmental factors, including sustainability mandates, recycling programs, and circular economy initiatives, also shape market expansion by driving innovation in eco-friendly materials, promoting reusable designs, and meeting corporate demand for environmentally responsible storage solutions.

The growth of the packaging bins market is impacted by regulatory and quality factors such as load capacity standards, workplace safety regulations, material durability requirements, and dimensional accuracy specifications, promoting safe and effective industrial storage solutions.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed