Global PTZ Camera Market Size, Share, Growth Analysis Report - Forecast 2034

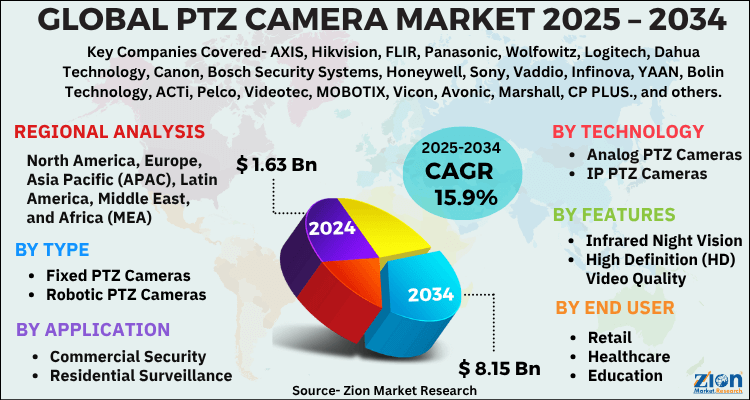

PTZ Camera Market By Type (Fixed PTZ Cameras, Robotic PTZ Cameras, Virtual PTZ Cameras), By Application (Commercial Security, Residential Surveillance, Traffic Monitoring, Industrial Surveillance, Military and Defense), By Technology (Analog PTZ Cameras, IP PTZ Cameras, Wireless PTZ Cameras), By Features (Infrared Night Vision, High Definition (HD) Video Quality, 360-Degree Rotation Capability, Smart Tracking Technology, Remote Control Functionality), By End User (Retail, Healthcare, Education, Transportation and Logistics, Hospitality), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

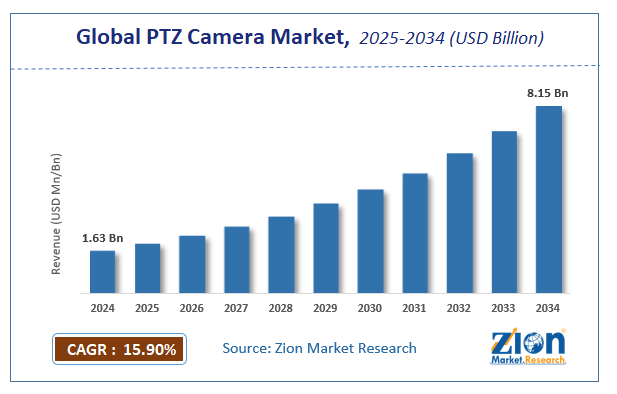

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.63 Billion | USD 8.15 Billion | 15.9% | 2024 |

PTZ Camera Market: Industry Perspective

The global PTZ camera market size was worth around USD 1.63 Billion in 2024 and is predicted to grow to around USD 8.15 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 15.9% between 2025 and 2034.

The report analyzes the global PTZ camera market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the PTZ camera industry.

PTZ Camera Market: Overview

A pan-tilt-zoom (PTZ) camera is a scanning and recording device mounted to a surface but the camera lens is capable of moving in multiple directions including swiveling right to left, zooming in and out of space, and tilting up and down. These devices are typically used to scan wide areas and are equipped to manage a 180 to 360-degree viewing angle. PTZ cameras can be mostly found in spaces that require constant monitoring as responsible personnel can control the camera remotely and view transmitted information on screens installed in a safe and private facility.

These cameras are considered, by many, as the most versatile cameras currently available especially for security purposes. Furthermore, depending on the model and software of the PTZ camera, they can be triggered to follow motion-dependent activity or follow a pre-set schedule for recording and transmitting captured images and video. In most cases, PTZ cameras are part of a larger surveillance infrastructure and are used to take detailed shots of specific areas. The growing demand in the PTZ camera industry is expected to continue during the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global PTZ camera market is estimated to grow annually at a CAGR of around 15.9% over the forecast period (2025-2034).

- Regarding revenue, the global PTZ camera market size was valued at around USD 1.63 Billion in 2024 and is projected to reach USD 8.15 Billion by 2034.

- The PTZ camera market is projected to grow at a significant rate due to rising demand for enhanced security and surveillance across diverse sectors, rapid technological advancements including AI-powered analytics and higher resolutions, and the growing adoption of remote monitoring and live streaming solutions.

- Based on Type, the Fixed PTZ Cameras segment is expected to lead the global market.

- On the basis of Application, the Commercial Security segment is growing at a high rate and will continue to dominate the global market.

- Based on the Technology, the Analog PTZ Cameras segment is projected to swipe the largest market share.

- By Features, the Infrared Night Vision segment is expected to dominate the global market.

- In terms of End User, the Retail segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

PTZ Camera Market: Growth Drivers

Growing sports and live entertainment industry to directly impact market demand

The global PTZ camera market is projected to grow owing to the increasing investments in the sports and entertainment industry across the globe. In recent times, several nations have invested higher resources in encouraging sports tourism as a means to boost their respective regional economies. The growing number of people actively following sports and entertainment events or personalities plays a crucial role in putting a country or region on the global map. In order to attract more people toward the thriving industry, building a supporting infrastructure is the primary concern resulting in higher investments in world-class and state-of-the-art stadiums or venues that can host thousands of people at once.

These facilities are equipped with PTZ cameras at multiple checkpoints including parking lots, entry and exit points, and other corners or areas of the large facility. Since PTZ cameras are extremely versatile and can be controlled remotely to zoom in or zoom out, they have proven to enhance security-related aspects of large crowd gatherings. As the number of venue infrastructure development projects grows, the demand for powerful PTZ cameras will continue to rise. In June 2023, the Saudi Arabian government was reported to hold multiple discussions with construction companies that can contribute to the country's Stadiums Development Program. In February 2023, Saudi Arabia announced that it would be hosting the 33rd Asian Football Federation Congress to be held in 2027. More investments are expected to construct new stadiums while renovating existing ones.

Growing national security threats to create scope for efficient surveillance-facilitating devices

A pan-tilt-zoom camera offers excellent assistance in surveying surrounding areas as it can focus on people, objects, and products with detailed video or images. They are one of the best and most-suited recording devices currently available in the market for surveillance purposes. The recent and ongoing war between Russia-Ukraine and Iraq-Hamas along with other terrorism-related incidents has resulted in countries upgrading surveillance systems for national security reasons. PTZ cameras are deployed on crosswalks and other spaces that are generally accessed by many people to track and avoid any unwanted incident thus impacting the demand in the global market.

PTZ Camera Market: Restraints

Technical challenges in terms of field of view may restrict market growth

Pan-tilt-zoom cameras have a large field of view and although the devices can move along 3 axes, they can simultaneously pan, tilt, or zoom. This lack of features can lead to significant gaps in coverage since the camera cannot record areas where the lens is not pointed. This leads to a dangerous possibility of an incident occurring in a particular area when the camera is turned in another direction. Intruders may remain undetected if they succeed in avoiding the camera’s field of view. Manufacturers of PTZ cameras are continuously working toward working on these drawbacks such as the launch of automatic motion detection and panning capabilities, however, the cost of advanced cameras is too high, further creating growth barriers.

PTZ Camera Market: Opportunities

Market players offering advanced and new camera features may lead to a higher consumption rate

The global PTZ camera industry players are expected to encounter new expansion avenues due to the latest advancements made in terms of PTZ camera features and capabilities. In October 2023, Canon India announced the launch of a new range of remote PTZ cameras including outdoor CR-X300 and CR-X500 remote PTZ cameras and CR-N100 remote PTZ cameras. They are equipped with 4K video capturing technology and can be used in several settings such as theme parks, animal observatories, sports broadcasting, and others. In June 2023, i-PRO Co. Ltd., a global leader providing professional security solutions for public safety and surveillance, launched Rapid PTZ. It is a high-speed PTZ camera with 4K resolution and infrared (IR) illumination.

The camera range is the smallest in its category and is equipped with a large range of resolution options along with artificial intelligence (AI) capabilities. In October 2022, Panasonic took a similar leap in terms of PTZ technology when it launched the AW-UE160W/K camera range. It is the industry’s first Society of Motion Picture and Television Engineers (SMPTE ST2110) compatible PTZ camera and is expected to help reduce the burden on shooting units thus catering to the evolving needs of the broadcasting industry and the entertainment industries.

PTZ Camera Market: Challenges

Reducing latency period and tough competition from alternate solutions to challenge market growth rate

The PTZ camera market growth rate will be limited since most PTZ cameras have significant latency periods. It is the time lag between an operator issuing a command and the camera acting on it. However, market players are working on ensuring more precise and smooth control which can be challenging to achieve. Additionally, there are multiple other options available for recording and capturing videos and images such as rotating cameras, network cameras, and others. These units also enjoy significant market share leading to industry fragmentation.

PTZ Camera Market: Segmentation

The global PTZ camera market is segmented based on application, type, and region.

Based on application, the global market segments are commercial centers, public spaces, government offices, housing & residential units, large-scale venues, and others. In 2022, the highest growth was observed in the large-scale venues segment. The wide application of pan-tilt-zoom cameras in sports and entertainment stadiums, auditoriums, and other spaces meant for large numbers of people to visit at once is the primary reason for higher segmental growth. PTZ cameras are helpful in monitoring large crowds as they offer greater flexibility and remote monitoring. Premium grade PZ cameras can cost as high as USD 10,000 or even higher.

Based on type, the PTZ cameras industry divisions are full HD PTZ cameras, HD PTZ cameras, SHD PTZ cameras, and UHD PTZ cameras. In 2022, the demand for high-definition (HD) PTZ cameras and full HD cameras was higher since they are suited for wider applications while offering cost-efficiency. The growing number of new HD and full HD PTZ cameras will help the market expand further. Certain camera brands can capture up to 1080p at 60 fps.

By Technology, the global PTZ camera market is split into Analog PTZ Cameras, IP PTZ Cameras, Wireless PTZ Cameras.

In terms of Features, the global PTZ camera market is categorized into Infrared Night Vision, High Definition (HD) Video Quality, 360-Degree Rotation Capability, Smart Tracking Technology, Remote Control Functionality.

By End User, the global PTZ Camera market is divided into Retail, Healthcare, Education, Transportation and Logistics, Hospitality.

PTZ Camera Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | PTZ Camera Market |

| Market Size in 2024 | USD 1.63 Billion |

| Market Forecast in 2034 | USD 8.15 Billion |

| Growth Rate | CAGR of 15.9% |

| Number of Pages | PagesNO |

| Key Companies Covered | AXIS, Hikvision, FLIR, Panasonic, Wolfowitz, Logitech, Dahua Technology, Canon, Bosch Security Systems, Honeywell, Sony, Vaddio, Infinova, YAAN, Bolin Technology, ACTi, Pelco, Videotec, MOBOTIX, Vicon, Avonic, Marshall, CP PLUS., and others. |

| Segments Covered | By Type, By Application, By Technology, By Features, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

PTZ Camera Market: Regional Analysis

North America to continue its dominance streak during the forecast period

The global PTZ camera market is projected to witness the highest growth in North America. The US and Canada regions are the leading revenue generators due to the extensive application of advanced and superior-grade pan-tilt-zoom cameras across end-user verticals. These devices are widely used by the national security forces to prevent potential threats against national security. As per research reports, the US uses at least one surveillance-facilitating camera for every 4.6 citizens.

Furthermore, the growing number of sports and entertainment events in the US region with each event hosting more than a few thousand people is a leading consumer segment for the regional market. The US is currently hosting the Eras Tour by popular singer Taylor Swift. As per official status, the average number of people per show was 72,460.

Europe is projected to register a significant growth rate driven by the growing number of PTZ camera manufacturers. In April 2023, Canon Europe launched a new downloadable driver for its PTZ cameras focusing on the education industry as 4k video streaming and conferencing using CR-X300, CR-N500, and CR-N300 will become seamless.

PTZ Camera Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the PTZ camera market on a global and regional basis.

The global PTZ camera market is dominated by players like:

- AXIS

- Hikvision

- FLIR

- Panasonic

- Wolfowitz

- Logitech

- Dahua Technology

- Canon

- Bosch Security Systems

- Honeywell

- Sony

- Vaddio

- Infinova

- YAAN

- Bolin Technology

- ACTi

- Pelco

- Videotec

- MOBOTIX

- Vicon

- Avonic

- Marshall

- CP PLUS.

The global PTZ camera market is segmented as follows;

By Type

- Fixed PTZ Cameras

- Robotic PTZ Cameras

- Virtual PTZ Cameras

By Application

- Commercial Security

- Residential Surveillance

- Traffic Monitoring

- Industrial Surveillance

- Military and Defense

By Technology

- Analog PTZ Cameras

- IP PTZ Cameras

- Wireless PTZ Cameras

By Features

- Infrared Night Vision

- High Definition (HD) Video Quality

- 360-Degree Rotation Capability

- Smart Tracking Technology

- Remote Control Functionality

By End User

- Retail

- Healthcare

- Education

- Transportation and Logistics

- Hospitality

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global PTZ camera market is expected to grow due to increasing security concerns, technological advancements such as AI integration, the rise of smart city initiatives, and the growing demand for high-definition surveillance systems across various sectors.

According to a study, the global PTZ camera market size was worth around USD 1.63 Billion in 2024 and is expected to reach USD 8.15 Billion by 2034.

The global PTZ camera market is expected to grow at a CAGR of 15.9% during the forecast period.

North America is expected to dominate the PTZ camera market over the forecast period.

Leading players in the global PTZ camera market include AXIS, Hikvision, FLIR, Panasonic, Wolfowitz, Logitech, Dahua Technology, Canon, Bosch Security Systems, Honeywell, Sony, Vaddio, Infinova, YAAN, Bolin Technology, ACTi, Pelco, Videotec, MOBOTIX, Vicon, Avonic, Marshall, CP PLUS., among others.

The report explores crucial aspects of the PTZ camera market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed