Organic Yeast Market Size, Share, Trend & Forecast Report 2034

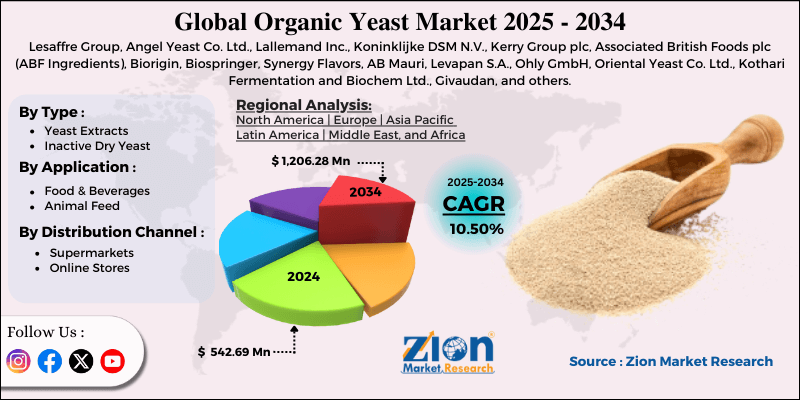

Organic Yeast Market By Type (Yeast Extracts, Inactive Dry Yeast), By Application (Food & Beverages, Animal Feed), By Distribution Channel (Supermarkets, Online Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

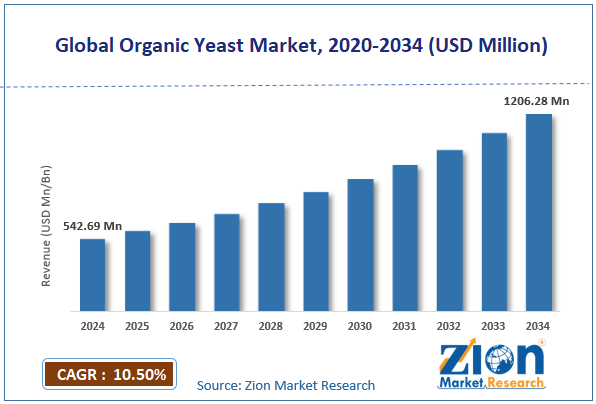

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 542.69 Million | USD 1206.28 Million | 10.5% | 2024 |

Organic Yeast Industry Perspective:

The global organic yeast market size was worth around USD 542.69 million in 2024 and is predicted to grow to around USD 1206.28 million by 2034, with a compound annual growth rate (CAGR) of roughly 10.50% between 2025 and 2034.

Organic Yeast Market: Overview

Organic yeast is a natural microorganism refined without synthetic chemicals, GMOs, or pesticides, increasing its suitability for sustainable and clean-label food production. It is commonly used in brewing, baking, nutritional supplements, and animal feed because of its rich vitamins, proteins, bioactive compounds, and mineral content. The global organic yeast market is projected to witness substantial growth driven by the growing health and wellness awareness, growth of the bakery and confectionery industry, and rise in plant-based and vegan diets. Growing awareness of immunity and nutrition has amplified the demand for organic yeast, which is high in amino acids, protein, minerals, and vitamins. This trend is mainly strong in fortified and dietary supplements.

Moreover, bakery products remain the leading end-use segment for the year. With higher food consumption and growing urbanization, the demand for organic yeast in the bakery continues to grow, especially in North America and Europe. Organic nutritional yeast serves as a dairy-free cheese substitute and a protein-rich supplement for vegan diets. The expansion in vegan production across the globe is remarkably driving the adoption of organic yeast in functional foods.

Although drivers exist, the global market is challenged by factors such as the low availability of raw materials, storage challenges, and a short shelf life. Organic-certified raw materials for yeast cultivation, such as molasses, are often unavailable in sufficient quantities, which restricts large-scale production. Also, organic yeast products usually have shorter shelf lives and need controlled storage settings, increasing the complexity of distribution.

Even so, the global organic yeast industry is well-positioned due to advancements in nutritional yeast, the rising nutraceutical & supplement industries, and applications in clean-label beverages. The development of fortified and flavored nutritional yeast for use in vegan cheese options, condiments, and snacks can help grow a larger consumer base. With the worldwide nutraceuticals industry projected to reach USD 600 billion by 2030, organic yeast as a vitamin- and protein-rich supplement has wider growth prospects. Additionally, organic yeast can be integrated into plant-based beverages, health drinks, and craft beer, satisfying consumers who prefer natural fermentation agents.

Key Insights:

- As per the analysis shared by our research analyst, the global organic yeast market is estimated to grow annually at a CAGR of around 10.50% over the forecast period (2025-2034)

- In terms of revenue, the global organic yeast market size was valued at around USD 542.69 million in 2024 and is projected to reach USD 1206.28 million by 2034.

- The organic yeast market is projected to grow significantly owing to growing demand in animal feed applications, increasing consumer preferences for organic bakery products, and supportive government certification and regulations for organic products.

- Based on type, the yeast extracts segment is expected to lead the market, while the inactive dry yeast segment is expected to grow considerably.

- Based on application, the food & beverages segment is the dominating segment, while the animal feed segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the supermarkets segment is expected to lead the market compared to the online stores segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Organic Yeast Market: Growth Drivers

How is functional nutrition driving the global organic yeast market growth?

Nutritional yeast settles at the intersection of function and flavor, offering B-vitamin fortification, savory notes, and protein contribution for snacks, soups, and dairy alternatives. Immune-support elements from yeast have maintained the demand since 2020-2022, now stabilizing in regular wellness items. Organic certification offers more trust for clean-eaters, parents, and label-checkers.

The worldwide functional foods and minerals/vitamins domain continues to post-steady mid-single-digit growth; within that, gut-health and immune platforms have been strong. Nutritional yeast retail sales have accelerated since transitioning from specialty to mainstream, with several brands experiencing a double-digit unit increase from 2021 to 2023. Organic variants register premiums of ~10–25%, based on the retailer and the pack size, enhancing category value mix.

How is the global organic yeast market propelled by the organic livestock, aquaculture, and antibiotic-reduction strategies?

Aquaculture systems and organic livestock systems primarily utilize yeast-based elements to enhance feed efficiency, gut health, and pathogen pressure mitigation, in accordance with regulations on ionophores and antibiotics. As organic meat, eggs, and dairy retain a loyal consumer base, compliant feed inputs grow in competition.

Global organic farmland has increased steadily, and organic animal product lines at retail have shown strong demand despite price inflation, backing upstream demand for certified feed additives, propelling the organic yeast market.

Organic Yeast Market: Restraints

How are shelf-life concerns and supply chain disturbances negatively impacting the organic yeast market progress?

Organic yeast has a shorter life than several other dried food ingredients, especially in liquid and active dry yeast forms. Maintaining cold-chain logistics for brewing yeasts or assuring stability for nutritional yeast powders contributes to logistical costs.

Transportation delays, be it from geopolitical stresses or port congestion, may result in reduced viability or spoilage, notably affecting consumer satisfaction. Many European breweries reported a scarcity of organic brewing yeast strains due to late imports from certified suppliers in Asia. These disturbances compelled some breweries to revert to traditional yeast provisionally, underscoring the brittleness of the supply chain for organic-certified strains.

Organic Yeast Market: Opportunities

Surging demand in organic beverages creates promising avenues for industry growth

The fermented beverage and craft brewing market primarily focuses on organic integrity. Worldwide organic beer sales exceeded USD 10 billion in 2023, backed by consumer demand for 'better-for-you' alcoholic options. In the meantime, kombucha, with a 15+% CAGR, continues to fuel the adoption of organic yeast.

The U.S. kombucha producers and European breweries, such as Neumarkter Lammsbräu in Germany, have introduced fresh organic-certified product lines. This elevated demand for organic brewing yeast, particularly in dry and ready-to-inoculate liquid forms, is driving the growth of the organic yeast industry.

Organic Yeast Market: Challenges

Certification and regulatory burdens limit the market development

Organic certification is time-consuming and costly. Compliance with the USDA's SOE rule (2024) and European Union Regulation 2018/848 contributes to administrative overhead. Small suppliers face higher obstacles to entry, which restricts industry diversity.

Many Asian exporters of yeast experienced shipment interruptions to the United States because of incomplete SOE documentation, underscoring how strict compliance is hampering supply chains.

Organic Yeast Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Organic Yeast Market |

| Market Size in 2024 | USD 542.69 Million |

| Market Forecast in 2034 | USD 1,206.28 Million |

| Growth Rate | CAGR of 10.50% |

| Number of Pages | 214 |

| Key Companies Covered | Lesaffre Group, Angel Yeast Co. Ltd., Lallemand Inc., Koninklijke DSM N.V., Kerry Group plc, Associated British Foods plc (ABF Ingredients), Biorigin, Biospringer, Synergy Flavors, AB Mauri, Levapan S.A., Ohly GmbH, Oriental Yeast Co. Ltd., Kothari Fermentation and Biochem Ltd., Givaudan, and others. |

| Segments Covered | By Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Organic Yeast Market: Segmentation

The global organic yeast market is segmented based on type, application, distribution channel, and region.

Based on type, the global organic yeast industry is divided into yeast extracts and inactive dry yeast. The yeast extracts segment registered a leading market share owing to extensive use in smacks, sauces, bakery, and ready-to-eat meals. They serve as a natural flavor enhancer, offering umami taste without chemical enhancers or artificial additives. With the growing consumer preference for organic-certified, clean-label, and natural ingredients, manufacturers are primarily dependent on yeast extracts. Their role in enhancing flavors in savory foods and plant-based meat alternatives has elevated their prominence in the industry.

Based on application, the global organic yeast market is segmented into food & beverages and animal feed. The food & beverages segment holds a larger market share due to its broader use in confectionery, savory snacks, bakery, and drinks. Organic yeast is valued as a natural fermentation agent, nutritional booster, and flavor enhancer, increasing its significance in health-focused and clean-label foods. With the rising demand for organic bakery items, functional drinks, and plant-based alternatives, the segmental dominance fuels the market.

Based on the distribution channel, the global market is segmented into supermarkets and online stores. The supermarkets and hypermarkets segment captures the maximum market share owing to consumer trust and their broad accessibility. These outlets offer a wider range of organic food products, comprising bakery ingredients, nutritional yeast, and supplements. Shoppers prefer buying from supermarkets due to the ability to check certifications, compare brands, and ensure the authenticity of organic labels. The rising presence of organic sections in retail chains in Europe and North America reinforces their prominence in the segment.

Organic Yeast Market: Regional Analysis

What gives Europe a competitive edge in the global Organic Yeast Market?

Europe is likely to sustain its leadership in the organic yeast market due to the strong organic food consumption, established regulatory architecture, and rise in the confectionery and bakery market. Europe holds one of the biggest organic food industries worldwide, estimated at more than $60 billion in 2023, accounting for approximately half of the global organic sales. Economies like Italy, France, and Germany are forerunners in beverage consumption and organic bakery, directly amplifying organic yeast demand.

With consumers prioritizing chemical-free and clean-label foods, the region continues to be a core hub for organic ingredient adoption. The European Union holds strict regulations under the EU Organic Certification and the Farm to Fork Strategy, promising stringent quality standards for the production of organic yeast. These policies motivate food manufacturers to integrate certified organic ingredients, including yeast, into their products. These regulations improve consumer trust, driving broader acceptance of organic yeast in beverages and foods.

Also, the region is a leading global consumer of bakery products, with the bakery industry anticipated at $230+ billion in 2023. Organic yeast plays a vital role in cakes, breads, and pastries, thereby increasing its significance in the region's bakery supply chain. With consumers moving to healthy and sustainable food options, the demand for organic yeast continues to expand rapidly.

North America continues to secure the second-highest share in the organic yeast industry owing to the expanding organic food sector, rise of vegan diets and nutritional supplements, and growth of retail and online distribution. North America holds the leading market for organic food, estimated at more than $63 billion in 2023, with the United States alone accounting for approximately 90% of the regional portion. Consumer preference for clean-label, non-GMO, and chemical-free products fuels organic yeast demand. This robust organic food infrastructure ranks the region as a leading contributor to the worldwide industry growth.

Also, the United States nutraceutical industry exceeded $120 billion in 2023, with substantial demand for plant-based vitamins, proteins, and fortified foods. Nutritional yeast, mainly organic-certified, is a popular choice among health-conscious and vegan consumers. This trend makes North America a key growth center for organic yeast in functional foods and dietary supplements.

North America boasts a robust retail landscape, featuring supermarket giants such as Whole Foods, Kroger, and Walmart, alongside a growing e-commerce platform like Amazon. Organic yeast products are widely available both online and offline, offering consumers easy access. The blend of digital sales and strong distribution underscores the region's industry dominance.

Organic Yeast Market: Competitive Analysis

The leading players in the global organic yeast market are:

- Lesaffre Group

- Angel Yeast Co. Ltd.

- Lallemand Inc.

- Koninklijke DSM N.V.

- Kerry Group plc

- Associated British Foods plc (ABF Ingredients)

- Biorigin

- Biospringer

- Synergy Flavors

- AB Mauri

- Levapan S.A.

- Ohly GmbH

- Oriental Yeast Co. Ltd.

- Kothari Fermentation and Biochem Ltd.

- Givaudan

Organic Yeast Market: Key Market Trends

Expansion of functional and clean-label foods:

Consumers are demanding clean-label products free from preservatives, artificial additives, and GMOs. Organic yeast suits this demand as a nutritional booster and natural fermentation agent in snacks, bakery, and beverages. The trend toward functional and fortified foods drives its inclusion in health-oriented product lines.

Growing innovation in yeast-based ingredients:

Manufacturers are actively investing in R&D to develop fortified, flavored, and specialty organic yeast extracts for use in nutraceutical and food industries. Advancements like functional yeast blends and vitamin-enriched yeast are gaining prominence in health-conscious regions. This emphasis on value-added formulations is transforming the future of the organic yeast industry.

The global organic yeast market is segmented as follows:

By Type

- Yeast Extracts

- Inactive Dry Yeast

By Application

- Food & Beverages

- Animal Feed

By Distribution Channel

- Supermarkets

- Online Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Organic yeast is a natural microorganism refined without synthetic chemicals, GMOs, or pesticides, increasing its suitability for sustainable and clean-label food production. It is commonly used in brewing, baking, nutritional supplements, and animal feed because of its rich vitamins, proteins, bioactive compounds, and mineral content.

The global organic yeast market is projected to grow due to rising demand for natural and clean-label food products, expansion of the organic food industry, and increasing health awareness and functional food consumption.

According to study, the global organic yeast market size was worth around USD 542.69 million in 2024 and is predicted to grow to around USD 1206.28 million by 2034.

The CAGR value of the organic yeast market is expected to be around 10.50% during 2025-2034.

North America is expected to lead the global organic yeast market during the forecast period.

Technological advancements in fermentation optimization, strain development, and substrate utilization are improving organic yeast yields, cost efficiency, and stability. Innovations like advanced drying techniques and precision fermentation also enhance product quality, extending applications in beverages, bakery, animal feed, and nutrition.

Tighter sustainability-focused farming policies and organic certification rules are increasing compliance costs but boosting supply and trust for organic yeast.

The key players profiled in the global organic yeast market include Lesaffre Group, Angel Yeast Co., Ltd., Lallemand Inc., Koninklijke DSM N.V., Kerry Group plc, Associated British Foods plc (ABF Ingredients), Biorigin, Biospringer, Synergy Flavors, AB Mauri, Levapan S.A., Ohly GmbH, Oriental Yeast Co., Ltd., Kothari Fermentation and Biochem Ltd., and Givaudan.

Stakeholders should invest in supply chain resilience, R&D, and product diversification to tap into beverage, bakery, and nutrition segments. Strengthening certifications, partnerships, and transparency will help reduce costs, build trust, and maintain competitiveness.

The report examines key aspects of the organic yeast market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed