Textile Chemicals Market Size, Share, Demand, Growth, Forecast 2034

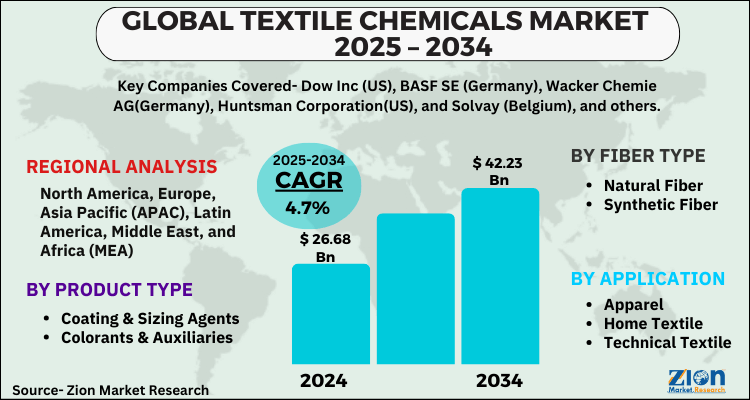

Textile Chemicals Market By Fiber Type (Natural Fiber, Synthetic Fiber), By Product Type (Coating & Sizing Agents, Colorants & Auxiliaries, Finishing Agents, Surfactants, Desizing Agents, Bleaching Agents, Others), By Application (Apparel, Home Textile, Technical Textile, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

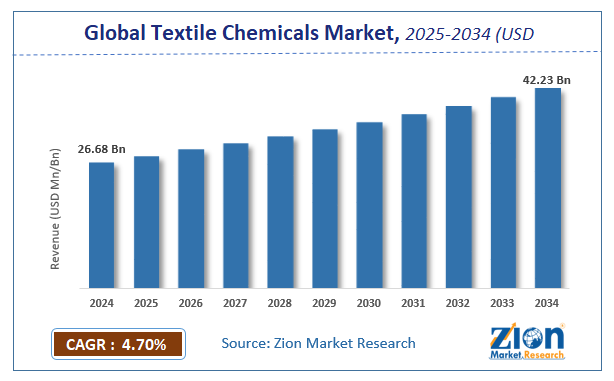

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.68 Billion | USD 42.23 Billion | 4.7% | 2024 |

Textile Chemicals Industry Perspective:

The global textile chemicals market was worth around USD 26.68 Billion in 2024 and is estimated to grow to about USD 42.23 Billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.7% between 2025 and 2034. The report analyzes the textile chemicals market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the textile chemicals market.

Textile Chemicals Market: Overview

Textile chemicals are a wide variety of chemicals used in the manufacturing and processing of textiles. These are inclusive of solvents, dyes, detergents, impregnation agents, coatings, etc. On an estimate, over 8000 synthetic chemicals are used in apparel manufacturing and range from a wide source of application from dyeing to washing of textiles.

The use of these chemicals has been questioned in recent times due to their increasingly harmful impact on human health and the environment. However, this did not change the course of demand for textile chemicals until very recently when governments across the world introduced stringent regulations to govern the use of chemicals in multiple industries including textile industries.

The textile chemicals market is majorly driven by rising demand from the apparel industry the and increasing popularity of technical textiles. A major challenge for the textile chemicals market growth will be the volatility of the world economy resulting in uncertainty for textile chemical companies across the world.

extile chemicals fall under the specialty class of chemicals, which consists of chemicals and intermediates. These intermediates are used in various stages of textile processing, such as preparation, dying, printing, and finishing. Textile chemicals are majorly used to enhance the impact of desired properties and the color of the fabric during the manufacturing process.

Increasing usage of textile chemicals in the apparel sector is one of the major factors that have augmented the growth of the global textile chemicals market. The textile chemicals are largely used in the apparel industry to enhance the color quality of the cloth. Apparels are among the most exported products in the world. The apparel industry is also one of the fastest growing industries across the globe. The developing countries are increasingly investing in the international textile market and apparels market. China, India, and Turkey are some of the major sellers of the textile chemicals market. Moreover, the key players are contributing toward major developments, such as product launch, mergers, and research and development centers, to fuel the growth of this market.

Additionally, governments are also supporting this market growth by opening various chemical factories, which, in turn, will further boost this market. Home furnishing is another leading market segment. Products like bed sheets, towels, curtains, and rugs are majorly made using textile chemicals to improve their quality. Moreover, the shifting focus toward soft furnishing is going to boost the fabric softener market in the furnishing application. However, it is the stringent environmental regulations regarding the disposal of textile effluents that are acting as a restraining factor for this market. Nevertheless, increasing demand for technical textiles is expected to provide ample growth opportunities to the key players of the global textile chemicals market.

Key Insights

- As per the analysis shared by our research analyst, the global textile chemicals market is estimated to grow annually at a CAGR of around 4.7% over the forecast period (2025-2034).

- Regarding revenue, the global textile chemicals market size was valued at around USD 26.68 Billion in 2024 and is projected to reach USD 42.23 Billion by 2034.

- The textile chemicals market is projected to grow at a significant rate due to increasing demand for functional textiles, rising fashion industry expansion, and innovations in eco-friendly textile processing.

- Based on Fiber Type, the Natural Fiber segment is expected to lead the global market.

- On the basis of Product Type, the Coating & Sizing Agents segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Apparel segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Textile Chemicals Market: Growth Drivers

Increasing demand for technical textile

Advancements in technology have vastly changed the textile industry in recent years and this trend is expected to be more prominent over the forecast period. Integration of advanced technology for textile manufacturing has increased as Industry 4.0 trend is picking up pace. Demand for technical textiles has substantially increased over the past few years as these textiles offer improved characteristics than regular textiles.

The use of technical textiles in healthcare and automotive industry verticals is anticipated to be a significant driver for the overall textile chemicals market. As technical textile offers better mechanical resistance, thermal resistance, radiation resistance, etc., their scope of application is increasing and subsequently driving the demand for textile chemicals. Textile chemicals are crucial to the manufacturing process of technical textiles and hence are anticipated to see a hike in consumption.

Textile Chemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Textile Chemicals Market |

| Market Size in 2024 | USD 26.68 Billion |

| Market Forecast in 2034 | USD 42.23 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 150 |

| Key Companies Covered | Dow Inc (US), BASF SE (Germany), Wacker Chemie AG(Germany), Huntsman Corporation(US), and Solvay (Belgium), and others. |

| Segments Covered | By Fiber Type, By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Textile Chemicals Market: Restraints

Adverse Impact on Environment and Human Health

Textile chemicals comprise chemicals that are potentially harmful to the environment and human health in a multitude of ways. For instance, dyes that do not bond to textile material can enter water streams and contaminate them in a very unsanitary manner. High production of wastewater by textile industries is one of the key sources of wastewater. Strict government mandates to regulate the use of harmful chemicals in the textile industry are expected to constrain textile chemical sales potential.

Textile Chemicals Market: Opportunities

Increasing Preference for Sustainable Products

Sustainability has been a major market trend in the wake of climate emergency that has engulfed the world. Like many other industries, the textile industry is also focusing on making its products and offerings eco-friendlier and sustainable, this is expected to provide highly lucrative opportunities to textile chemicals manufacturers. With a lot of untapped market potential in sustainable textile chemistry, we expect to see highly lucrative opportunities for multiple key players over the forecast period.

Textile Chemicals Market: Challenges

Rising Volatility Due to Cyclic Changes in Textile Chemicals Industry

The textile industry is largely subject to economic changes in the global landscape and this is a major challenge that makes it difficult for textile chemicals companies to establish a solid strategy to keep their business unscathed from volatile market situations. Fluctuations in raw material pricing and changing availability of textile chemicals are major challenges that textile chemicals manufacturers face.

Global Textile Chemicals Market: Segmentation

The global textile chemicals market is segregated based on fiber type, product type, application, and region.

By Product Type, the market is divided into coating & sizing agents, colorants & auxiliaries, finishing agents, surfactants, desizing agents, bleaching agents, and others. The colorant & auxiliaries have emerged as the most prominent product type in recent times and are a major contributor to overall market value. Increasing textile production and the rising importance of colorants and auxiliaries is expected to make this segment more prominent through 2028

By Application, the textile chemicals market is segmented into apparel, home textile, technical textile, and others. The rising production of apparel across the world to meet increasing demand from a growing population is what makes the apparel segment a highly lucrative one. Changing consumer trends, rising fashion awareness, increasing disposable income, etc., are some major factors that influence demand for apparel over the forecast.

Recent Developments

- In November 2021 – Cosmo Specialty Chemicals announced the launch of new eco-friendly finishing agents in India. The new agents are non-toxic and eco-friendly and are specifically designed for use in the textile industry.

- In October 2020 – Seven leading textile companies came together and announced the formation of a new initiative that will be focused on sustainability trend that is gaining impetus on a global scale. The collaborative effort is named Sustainable Chemistry for the Textile Industry (SCTI) and is backed by key giants like Archroma, CHT Group, Huntsman, Kyung-In Synthetic Corporation (KISCO), Pulcra Chemicals, Rudolf Group, and Tanatex Chemicals

Competitive Landscape

Some of the main competitors dominating the global textile chemicals market include - Dow, Inc. (US), BASF SE (Germany), Wacker Chemie AG(Germany), Huntsman Corporation(US), and Solvay (Belgium).

Regional Landscape

Asia Pacific region leads the global textile chemicals market in terms of revenue and volume share and is anticipated to maintain a dominant stance throughout the forecast period. Increasing industrialization is expected to be the major factor propelling market potential in this region. Emerging economies like India and China are expected to be the most important markets for textile chemicals companies in the Asia Pacific region.

The market for textile chemicals in North America is expected to account for a prominent market share over the forecast period and major revenue is expected to be driven by demand from the United States. Increasing exports of textiles from the United States and a highly lucrative consumer base are expected to majorly drive demand in the nation.

Textile Chemicals Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the textile chemicals market on a global and regional basis.

The global Textile Chemicals market is dominated by players like:

- Dow, Inc. (US)

- BASF SE (Germany)

- Wacker Chemie AG(Germany)

- Huntsman Corporation(US)

- Solvay (Belgium).

Global textile chemicals market is segmented as follows:

By Fiber Type

- Natural Fiber

- Synthetic Fiber

By Product Type

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Bleaching Agents

- Others

By Application

- Apparel

- Home Textile

- Technical Textile

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed