Nutraceutical Excipients Market Size, Share Report, Analysis, Trends, Growth 2032

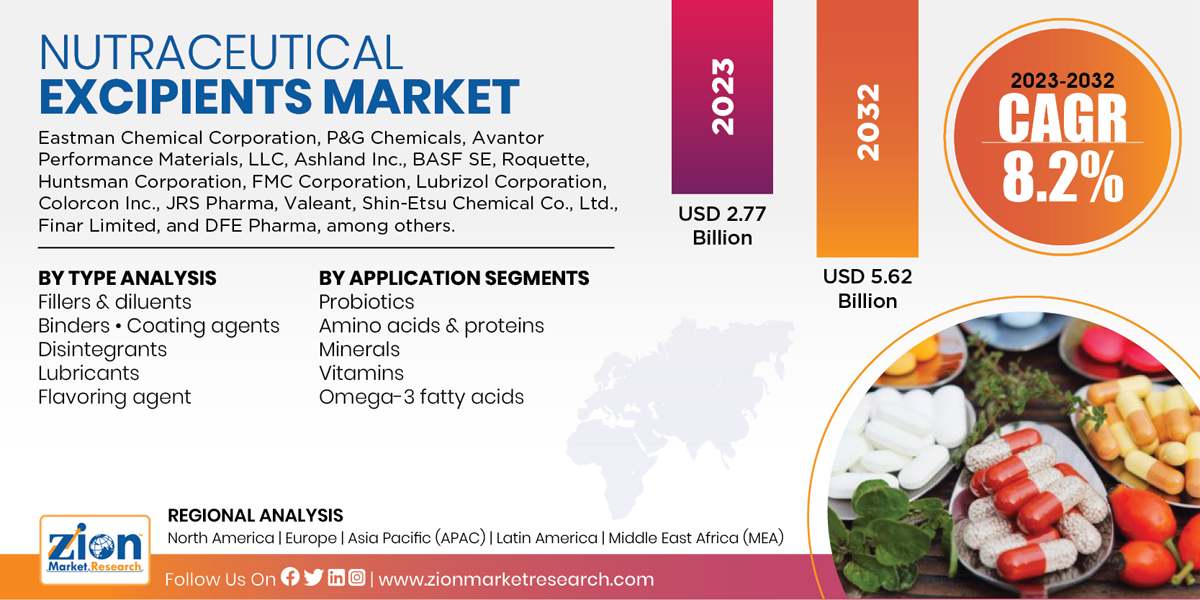

Nutraceutical Excipients Market By Type (Fillers & Diluents, Binders, Coating Agents, Disintegrants, Lubricants, and Flavoring Agents), by Application (Prebiotics, Probiotics, Amino Acids & Proteins, Minerals, Vitamins, and Omega-3 Fatty Acids), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

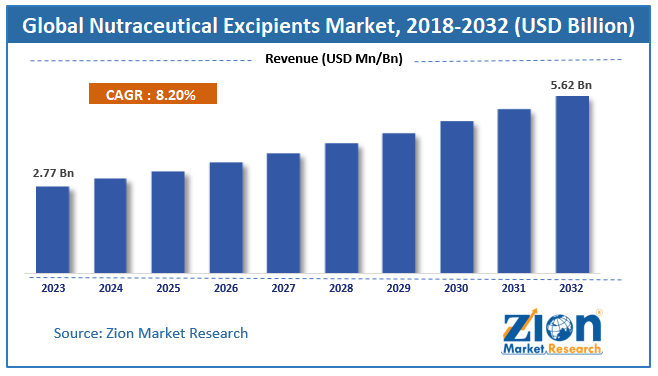

| USD 2.77 Billion | USD 5.62 Billion | 8.2% | 2023 |

Nutraceutical Excipients Industry Perspective:

The global Nutraceutical Excipients market size accrued earnings worth approximately USD 2.77 Billion in 2023 and is predicted to gain revenue of about USD 5.62 Billion by 2032, is set to record a CAGR of nearly 8.2% over the period from 2024 to 2032.

Request Free Sample

Request Free Sample

Key Insights

- As per the analysis shared by our research analyst, the nutraceutical excipients market is anticipated to grow at a CAGR of 8.2% during the forecast period.

- The global nutraceutical excipients market was estimated to be worth approximately USD 2.77 billion in 2023 and is projected to reach a value of USD 5.62 billion by 2032.

- The growth of the nutraceutical excipients market is being driven by increasing demand for dietary supplements, functional foods, and fortified beverages that promote health and wellness.

- Based on the type, the fillers & diluents segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the probiotics segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Nutraceutical Excipients Market Overview

Nutraceutical excipients market is rapidly growing on account of demand from several regions of the world. Nutraceutical refers to a material used standard nutrient or pharma grade nutrient. They are most commonly used as pharmaceutical formulations and food additives which are granted by the U.S. FDA under food and cosmetic act. The nutraceutical excipients are bioactive compounds, which are used to improve the bioavailability of nutraceuticals. Excipients most commonly provide functionality in medical dosage forms and help in improving the drugs functionality in the body of a recipient.

Nutraceutical Excipients Market Growth Dynamics

Increased consumer awareness about health & fitness coupled with the nutraceuticals being added in the pharmaceuticals & food products and supplement industry and rise in disposable income in emerging countries are the factors expected to boost the growth of nutraceutical excipients market in the forecast years. In addition, increase in the occurrence of lifestyle-related diseases such as diabetes, cardiac diseases, and blood pressure has aided in fueling the growth of the market. However, the amount of nutrients consumed by population is less than required due to a hectic lifestyle and rising health care expenditure. Less intake of nutrition is due to the consumer’s busy lifestyle and high cost of healthcare. Furthermore, increasing advancements in technology for the development of nutraceuticals result in providing significant opportunities to various pharmaceutical sectors. Several factors can hamper the growth of the market such as declining R&D investment and research related to nutraceuticals excipients.

Nutraceutical products are unstable to alkaline pH, oxygen, heat and light, and high humidity. Nutraceuticals excipients such as coating agents, flavoring agents, disintegrants, lubricants, binders, fillers, and diluents help to control the unstable nature of nutraceutical products. It also has variable particle size distribution, poor flow, and poor bulk density. Nutraceutical excipients are used as a binder in a tablet which helps to stabilize active ingredients in the formulation. Nutraceutical excipients are used in different form of supplements ex. capsules, liquid syrups, powders, and tablets.

To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the nutraceutical excipients market has also been included. The study encompasses a market attractiveness analysis, wherein type and application segments are benchmarked based on their market size, growth rate, and general attractiveness.

Recent Development

- In June 2024, Tate & Lyle announced the proposed acquisition of CP Kelco for approximately $1.8 billion. The deal, which was agreed upon to strengthen natural-gum and texture solutions (pectin and specialty-gums) used across foods and nutraceuticals, is expected to accelerate Tate & Lyle's growth strategy, create a leader in "mouthfeel," and significantly enhance its solutions for healthier, tastier, and more sustainable food and drink.

- In May 2023, Roquette launched PEARLITOL® ProTec. The excipient, a plant-based co-processed blend of mannitol and maize starch, is specifically designed to protect and stabilize moisture-sensitive active ingredients like probiotics. This innovation unlocks longer shelf life, improves consistency, and enables new, consumer-friendly dosage formats for probiotic supplements.

- In April 2021, Ingredion completed the acquisition of KaTech. This targeted acquisition, which brought in the German company's advanced texture and stabilization solutions expertise, significantly expanded Ingredion's specialty-ingredient portfolio and broadened its overall capabilities in food and supplement systems.

- In February 2021, IFF completed its merger with DuPont’s Nutrition & Biosciences unit. This merger created a much larger, combined ingredients group with an enhanced financial profile and complementary portfolios, specifically expanding IFF's excipient and formulation capabilities to better serve the nutraceuticals, food & beverage, and health & wellness markets.

Nutraceutical Excipients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nutraceutical Excipients Market |

| Market Size in 2023 | USD 2.77 Billion |

| Market Forecast in 2032 | USD 5.62 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 202 |

| Key Companies Covered | Eastman Chemical Corporation, P&G Chemicals, Avantor Performance Materials, LLC, Ashland Inc., BASF SE, Roquette, Huntsman Corporation, FMC Corporation, Lubrizol Corporation, Colorcon Inc., JRS Pharma, Valeant, Shin-Etsu Chemical Co., Ltd., Finar Limited, and DFE Pharma, among others. |

| Segments Covered | By Types, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nutraceutical Excipients Market Segmentation Analysis

The study provides a decisive view of the nutraceutical excipients market by segmenting the market based on type, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. Nutraceuticals excipients such as coating agents, flavoring agents, disintegrants, lubricants, binders, fillers, and diluents help to control the unstable nature of nutraceutical products. The nutraceutical excipients market is segmented into categories by their application, namely probiotics, prebiotics, proteins & amino acids, vitamins, minerals, omega-3 fatty acids.

North America accounted for a significant market share and is expected to grow in light of the redevelopment activities and changing trends in health care. Asia Pacific is expected to be the fastest growing market owing to rising nutritional and healthcare development activities in the region, especially in countries like India and China. The enormous population in the region is also expected to be a major factor for the growth of the market.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, and Rest of World with its further division into major countries including the U.S., Germany, France, UK, China, Japan, India, and Brazil.

The key players operating in this industry are

- Eastman Chemical Corporation

- P&G Chemicals

- Avantor Performance Materials, LLC

- Ashland Inc.

- BASF SE

- Roquette

- Huntsman Corporation

- FMC Corporation

- Lubrizol Corporation

- Colorcon Inc.

- JRS Pharma

- Valeant

- Shin-Etsu Chemical Co., Ltd.

- Finar Limited

- and DFE Pharma, among others.

The detailed description of players includes parameters such as company overview, financial overview, business strategies and recent developments of the company.

This report segments the global nutraceutical excipients market as follows:

By Type Analysis

- Fillers & diluents

- Binders

- Coating agents

- Disintegrants

- Lubricants

- Flavoring agent

By Application Segments

- Probiotics

- Amino acids & proteins

- Minerals

- Vitamins

- Omega-3 fatty acids

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed