Global Confectionery Market Size, Share, Growth Analysis Report - Forecast 2034

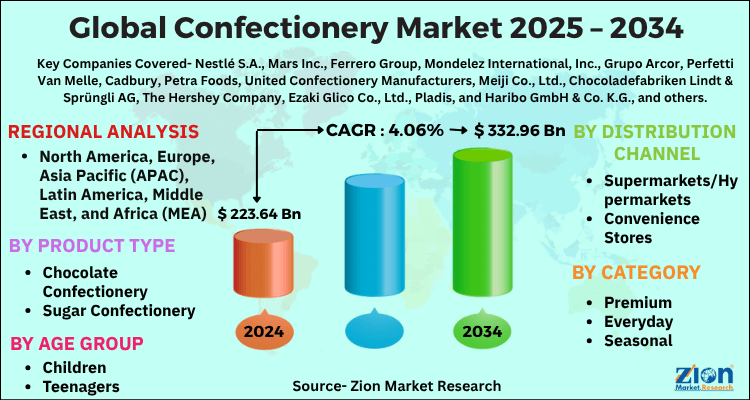

Confectionery Market By Product Type (Chocolate Confectionery, Sugar Confectionery, Gum), By Age Group (Children, Teenagers, Adults), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others), By Category (Premium, Everyday, Seasonal), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

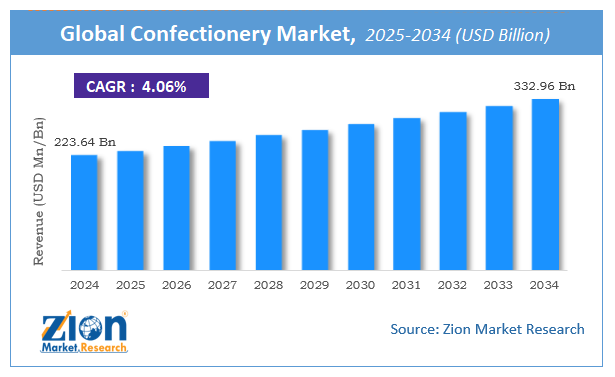

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 223.64 Billion | USD 332.96 Billion | 4.06% | 2024 |

Confectionery Market: Industry Perspective

The global confectionery market size was worth around USD 223.64 Billion in 2024 and is predicted to grow to around USD 332.96 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.06% between 2025 and 2034. The report analyzes the global confectionery market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the confectionery industry.

Confectionery Market: Overview

Foods high in sugar and carbs are referred to as confections. Chocolates, biscuits, bars, candies, mints, and other confections are among the items available. The behaviors, interests, and preferences of consumers are always changing. This has resulted in confectionary innovation, which is driving market expansion.

To fulfill evolving customer preferences, manufacturers are expanding their product variety by integrating tropical fruit, organic herbal fillings, functional ingredients, and nut-based & exotic tastes in product formulations. Furthermore, in recent years, the practice of giving confectionery products such as chocolates, cookies, bakery items, and others has aided market expansion. Confectionery items are heavily purchased, thus brands are continuously developing novel engaging strategies to attract consumer attention.

Key Insights

- As per the analysis shared by our research analyst, the global confectionery market is estimated to grow annually at a CAGR of around 4.06% over the forecast period (2025-2034).

- Regarding revenue, the global confectionery market size was valued at around USD 223.64 Billion in 2024 and is projected to reach USD 332.96 Billion by 2034.

- The confectionery market is projected to grow at a significant rate due to rising disposable incomes, demand for premium and sugar-free products, seasonal and gifting trends, and product innovations in flavor and packaging.

- Based on Product Type, the Chocolate Confectionery segment is expected to lead the global market.

- On the basis of Age Group, the Children segment is growing at a high rate and will continue to dominate the global market.

- Based on the Distribution Channel, the Supermarkets/Hypermarkets segment is projected to swipe the largest market share.

- By Category, the Premium segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

COVID-19 Impact:

The COVID-19 pandemic has had a significant impact on the confectionery industry. During FY 2020, the strict rules and lockdown had repercussions on the confectionery industry, causing differential impacts on the supply of raw materials such as food ingredients, agricultural produce, and intermediate food products. The impact also resulted in disruption in trade & logistics, demand-supply uncertainty, iffy consumer demand, and availability of workforce at the industrial scale. Further, the sales declines as a consequence of diminished gifting and impulse spending among customers throughout the world were one of the primary issues that affected the confectionery business during the shutdown.

Confectionery Market: Growth Drivers

Rise in demand for organic chocolate is boosting the growth of the market

Healthier snacking, coupled with simplicity and flavor, is a growing trend among buyers, and firms are responding with a big plan to cater to the increasing demand for healthier snacks. As a result, confectionery businesses are developing packaging that allows consumers to eat tiny quantities and save the remainder for later. Snack bars are also widely considered a healthy alternative to chocolate or confectionery, and they have a strong image as a treat owing to product variety in terms of varied nutrients, such as proteins.

For example, Mars Inc. launched "Goodness Knows," a new low-chocolate and low-calorie bar that is the first low-calorie bar in 20 years. Thus, all these factors coupled with the rise in the export of organic chocolates are fostering global confectionery market growth. In addition to this, the growing trend of gifting confectionery products, rise in the retail market, online distribution channels, rising disposable income, and hectic lifestyle are also some of the key factors that are propelling the market growth.

Confectionery Market: Restraints

Raw material price fluctuations can affect market growth

Sugar and cocoa are two fundamental raw ingredients used in the production of confectioneries all over the world. Cocoa and sugar prices have fluctuated in recent years due to rapid changes in production and demand in the worldwide marketplace. Unfavorable weather conditions, labor availability, stock ratios, crop diseases, and other economic issues all impact cocoa and sugar yields, interfering with the seamless functioning of need and supply in the confectionery industry. As a result, the average yearly price of raw materials ranges from low to high, resulting in excess or understock in the market for sugar and chocolate goods. As a result, raw material price changes are projected to impact overall demand in the future years.

Confectionery Market: Opportunities

Rise in sugar-free confectionery popularity in developed economies to fuel the market growth

Low-calorie items, including sugar-free confectionaries, are likely to drive the global confectionery market's modest rise throughout the forecast period. High sugar consumption is also a matter of concern across the world since it has been related to a variety of health issues. When it comes to sweets, many individuals opt for sugar-free products to avoid ingesting too much sugar. Artificial sweeteners and sugar alcohols are the most common sweeteners used in the production of sugar-free chocolate and gums.

For example, Hershey, the largest chocolate company in the United States, offers sugar-free versions of popular brands like Hershey’s and Reese's that employ polyglucitol and maltitol instead of sugar. Thus, the growing inclination of consumers towards a healthy lifestyle has led to the growing demand for sugar-free confectionery. Hence, sugar minimizing movement in the new products by the manufacturers may generate ample opportunities for market growth during the forecast period.

Confectionery Market: Challenges.

Traceability and need for flexibility in supply chain challenges the market expansion

The capacity to trace any foodstuff through all phases of the food chain is a critical component of both administration and information. Each stakeholder in the supply chain, from farmer and breeder to manufacturer, distributor, and retailer, must be able to trace goods movements back and forth. Each instance should take one stride forward and one step back. This should include the ability to identify the source of all dietary inputs in order to take remedial actions appropriately and safely. In addition to this, product lifecycles are smaller than they were previously.

There is a trend toward ongoing product innovation and package modifications to promote products. As the number of products changes rises, so does the number of portfolio changes. Inventory levels are low, and fast-moving consumer products are moving at a quicker rate than ever before. To manage this, flexibility in the supply chain is required which serves as a major challenge to the confectionery industry growth along with the traceability factor.

Confectionery Market: Segmentation

The global confectionery market is segmented as product type, price point, age group, distribution channel, and region.

Based on age group, the market is categorized into adults, children, and geriatric.

The price point segment of the market is divided into luxury, mid-range, and economy.

Based on product type, the market is bifurcated into hard-boiled sweets, mints, gums & jellies, chocolate, caramels & toffees, medicated confectionery, fine bakery wares, and others. The chocolate segment held the largest market share in 2022 and is further predicted to occupy a dominant status and simultaneously grow at a significant CAGR during the forecast period. The reason for the growth of this segment is that the highest per capita consumed confectionery product across the globe is chocolate, and hence it is widely consumed among all age groups, particularly among children so as to appease their taste buds. Besides, the surge in demand for premium, organic, and exotic flavors of chocolates be it white or dark, or milk-based chocolate among people further drive the growth of this segment.

Based on distribution channel, the market is bifurcated into supermarkets/hypermarkets, convenience stores, pharmaceutical & drug stores, food services, duty-free outlets, e-Commerce, and others. The supermarkets/hypermarkets segment held the largest market share in 2022 and is further predicted to occupy a significant market share during the forecast period. The main reason for the growth of this segment is the convenient access and wide variety of confectionery products based on the preference of consumers in supermarkets and hypermarkets. Besides, consumers can physically validate the quality and size of the products and can even taste them in some cases which increases credibility and further drives the growth of the segment.

Recent Developments

- In March 2022, Chewters Chocolates, a Canadian confectionery company, made a significant investment in cutting-edge product inspection technology to improve its packaging line competency to "world-class standards”.

- In March 2022, Pharmactive Biotech Products, located in Madrid, entered the gummies flavor market with Aged Black Garlic+ (ABG+), which they describe as a sweet,' social' taste that is odor-free and so perfect for functional gummies.

- In November 2022, Fazer, one of the oldest confectionery companies based in Finland, announced that they have collaborated with Aberdeen Group, in order to launch its extensive range of confectionery products in India. Fazer will leverage Aberdeen Group's vast network of retail outlets, e-commerce platforms, and airport stores for the launch of Frazer’s popular products.

- In May 2022, Moo Free, a dominant UK-based confectionery brand, announced the launch of its new chocolate bar range called ‘Jub-moo-lee Bar’ which is made from exquisite Hispaniola cocoa beans. This limited-edition line of chocolate is free from soya, gluten, and dairy and is made from superior cocoa that is certified by Rainforest Alliance farmers.

Confectionery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Confectionery Market |

| Market Size in 2024 | USD 223.64 Billion |

| Market Forecast in 2034 | USD 332.96 Billion |

| Growth Rate | CAGR of 4.06% |

| Number of Pages | 214 |

| Key Companies Covered | Nestlé S.A., Mars Inc., Ferrero Group, Mondelez International, Inc., Grupo Arcor, Perfetti Van Melle, Cadbury, Petra Foods, United Confectionery Manufacturers, Meiji Co., Ltd., Chocoladefabriken Lindt & Sprüngli AG, The Hershey Company, Ezaki Glico Co., Ltd., Pladis, and Haribo GmbH & Co. K.G., and others. |

| Segments Covered | By Product Type, By Age Group, By Distribution Channel, By Category, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Confectionery Market: Regional Landscape

Europe to account for the highest market share during the forecast period

In 2021, Europe accounted for the largest portion of the global confectionery market, with over 35 percent of the share. Due to their expanded taste preferences and permissive eating habits, people are increasingly seeking quality and premium chocolates over sugar confectionery goods. One of the primary causes that are becoming important motivators to eat confectioneries in their daily routine is the mix of work-life, health concerns, and individual wishes among consumers.

Consumers are requesting specialized and personalized chocolates in the market, such as "melt-in-the-mouth" feel chocolate, "quality-for-chocolate," and others, resulting in increased confectionery sales in the region. In several European nations, including Germany, Austria, and the United Kingdom it is the most popular snack. Asia Pacific is the world's second-largest and rapidly growing confectionery market, with enormous potential for chocolate product consumption. The rise of the regional market is mostly due to rapid urbanization, rising disposable income, a youthful & dynamic population, and the simple availability of confectioneries in consumer packs.

Confectionery Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the confectionery market on a global and regional basis.

Major players functioning in the global confectionery market include:

- Nestlé S.A.

- Mars Inc.

- Ferrero Group

- Mondelez International Inc.

- Grupo Arcor

- Perfetti Van Melle

- Cadbury

- Petra Foods

- United Confectionery Manufacturers

- Meiji Co. Ltd.

- Chocoladefabriken Lindt & Sprüngli AG

- The Hershey Company

- Ezaki Glico Co. Ltd.

- Pladis

- Haribo GmbH & Co. K.G.

Global confectionery market is segmented as follows:

By Age Group

- Children

- Adult

- Geriatric

By Product Type

- Hard-boiled Sweets

- Mints

- Gums & Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Pharmaceutical & Drug Stores

- Food Services

- Duty-free Outlets

- E-commerce

- Others

By Price Point

- Economy

- Mid-Range

- Luxury

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Confectionery is all those food items that have high sugar and carbohydrate content. They usually include jellies, fudge, candies, toffies, hard candy, pastilles, etc. Chocolate confectionery is widely popular in various countries across the globe as more and more children and increasingly inflicted towards it as they are sweeter and also because cocoa or chocolate is a crucial part of these confectioneries.

The global confectionery market is expected to grow due to rising disposable incomes, demand for premium and sugar-free products, seasonal and gifting trends, and product innovations in flavor and packaging.

According to a study, the global confectionery market size was worth around USD 223.64 Billion in 2024 and is expected to reach USD 332.96 Billion by 2034.

The global confectionery market is expected to grow at a CAGR of 4.06% during the forecast period.

North America is expected to dominate the confectionery market over the forecast period.

Major players functioning in the global confectionery market include Nestlé S.A., Mars Inc., Ferrero Group, Mondelez International, Inc., Grupo Arcor, Perfetti Van Melle, Cadbury, Petra Foods, United Confectionery Manufacturers, Meiji Co., Ltd., Chocoladefabriken Lindt & Sprüngli AG, The Hershey Company, Ezaki Glico Co., Ltd., Pladis, and Haribo GmbH & Co. K.G.

The report explores crucial aspects of the confectionery market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed