Global Optical Waveguide Market Size, Share, Growth Analysis Report - Forecast 2034

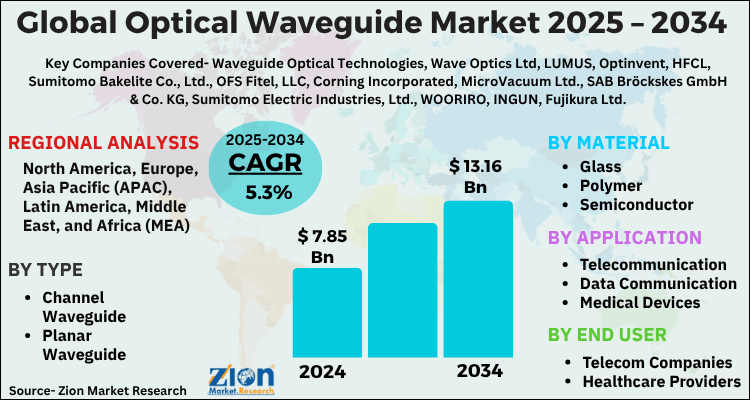

Optical Waveguide Market By Type (Channel Waveguide, Planar Waveguide), By Material (Glass, Polymer, Semiconductor, Silica), By Application (Telecommunication, Data Communication, Medical Devices, Sensors, Aerospace & Defense), By End-user (Telecom Companies, Healthcare Providers, Electronics Manufacturers, Research Institutions), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.85 Billion | USD 13.16 Billion | 5.3% | 2024 |

Optical Waveguide Market: Industry Perspective

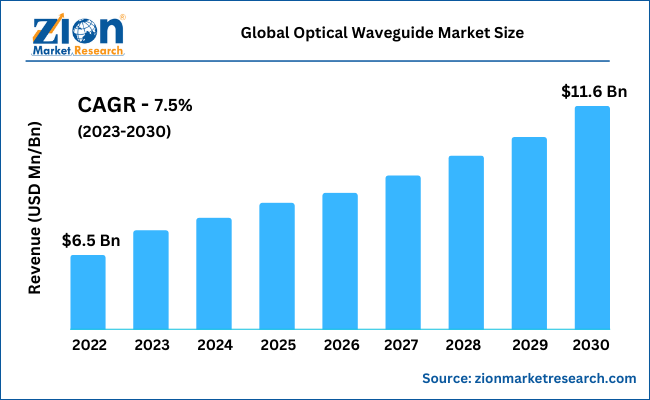

The global optical waveguide market size was worth around USD 7.85 Billion in 2024 and is predicted to grow to around USD 13.16 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.3% between 2025 and 2034. The report analyzes the global optical waveguide market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the optical waveguide industry.

Optical Waveguide Market: Overview

A waveguide is a device or material that can be used to direct waves along a predetermined route. Waveguides assist wave propagation from a source to another designated location while minimizing wave intensity loss. The wave is limited to a fixed dimensional route during this process, thereby preventing propagation in all directions. Waveguides are crucial components in much modern technology. They are used in the fiberoptic cables which deliver broadband internet, guide the microwaves within microwave ovens, and are also used in the complex scientific equipment found in the physical sciences and medicine.

Waveguides are not a single type of technology. There are many different wave types, e.g. optical, sonic or electromagnetic, which can be guided, and each type requires a completely different waveguide structure. Optical waveguides are among the most sophisticated waveguides available, and they are used to guide electromagnetic waves in the optical spectrum.

The most widely used optical waveguides are optical fibers, which are a frequent method of transmitting high-speed broadband. There are numerous types of optical waveguides. 2D dimensional waveguides such as strip and rectangle waveguides are prevalent, as are dielectric waveguides such as slab and planar waveguides. Regardless of geometry, optical waveguides direct light through a sequence of internal reflections. This can be accomplished by leveraging the refractive index of the surrounding materials, a sandwich material with a substantially higher dielectric index than the surrounding layers, or the photorefractive index of transparent materials.

Key Insights

- As per the analysis shared by our research analyst, the global optical waveguide market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2025-2034).

- Regarding revenue, the global optical waveguide market size was valued at around USD 7.85 Billion in 2024 and is projected to reach USD 13.16 Billion by 2034.

- The optical waveguide market is projected to grow at a significant rate due to rising demand for high-speed data transmission, use in telecommunication and photonics, and advancements in 5G infrastructure.

- Based on Type, the Channel Waveguide segment is expected to lead the global market.

- On the basis of Material, the Glass segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Telecommunication segment is projected to swipe the largest market share.

- By End-user, the Telecom Companies segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Optical Waveguide Market: Growth Drivers

Increasing demand for higher bandwidth drives the market growth

The market for optical waveguides will expand as demand for higher bandwidth and faster speeds increases. Because more people and businesses are using the internet for video calls, gaming, online shopping, and social media, there is an increase in demand for high bandwidth. To improve and speed up internet connections that can handle more bandwidth, fiber optic cable transmits data using light rather than electricity. For instance, 4K Ultra High Definition (UHD) TV requires three times as much data as standard HD TV or about 15–18 Mbps. It is predicted that 62% of connected flat panel TVs will be 4K by 2022.

This emphasis is on rising bandwidth demands and rising video consumption. Thus, increasing demand for higher bandwidth is expected to drive global optical waveguide market growth over the forecast period.

Optical Waveguide Market: Restraints

Complex design and fabrication process is expected to hamper the market

The complex design and fabrication process is the primary barrier to the expansion of the optical waveguide market. Optical waveguides demand skill in physics and engineering since they are built to meet specific specifications and rely mostly on a specific set of waveguide transmission protocols. Furthermore, optical waveguides are fragile, costly, and prone to transmission losses. Thus, this factor limits the market expansion.

Optical Waveguide Market: Opportunities

The growing consumer electronics industry provides a lucrative opportunity

The growing consumer electronics industry particularly in the developing nations including India, China, and others is expected to provide a lucrative opportunity for optical waveguide industry expansion over the forecast period. For instance, according to the second volume of the Vision document on Electronics Manufacturing in India, which was published by the Ministry of Electronics & Information Technology, the electronics manufacturing industry will increase from its current value of US$ 75 billion in 2020–21 to US$ 300 billion in 2025–26.

Mobile phones, IT hardware (laptops, tablets), consumer electronics (TV and audio), industrial electronics, auto electronics, electronic components, LED lighting, strategic electronics, printed circuit board assembly (PCBA), wearables and hearables, and telecom equipment are the main products that are anticipated to drive growth in India's electronics manufacturing. From its current level of US$ 30 billion, mobile manufacturing is predicted to reach US$ 100 billion in annual production growth or about 40% of the industry's growth. Thereby, propelling the market growth.

Optical Waveguide Market: Challenges

High cost poses a major challenge for the market growth

The increased installation cost of optical waveguides for data communication areas such as data centers is expected to obstruct optical waveguide market growth. Also, the sluggish introduction of several optical waveguide related technologies is projected to challenge the optical waveguide.

Optical Waveguide Market: Segmentation Analysis

The global optical waveguide market is segmented based on Type, Material, Application, End-user, and region.

Based on Type, the global optical waveguide market is divided into Channel Waveguide, Planar Waveguide.

On the basis of Material, the global optical waveguide market is bifurcated into Glass, Polymer, Semiconductor, Silica.

By Application, the global optical waveguide market is split into Telecommunication, Data Communication, Medical Devices, Sensors, Aerospace & Defense.

In terms of End-user, the global optical waveguide market is categorized into Telecom Companies, Healthcare Providers, Electronics Manufacturers, Research Institutions.

Optical Waveguide Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Optical Waveguide Market |

| Market Size in 2024 | USD 7.85 Billion |

| Market Forecast in 2034 | USD 13.16 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 219 |

| Key Companies Covered | Waveguide Optical Technologies, Wave Optics Ltd, LUMUS, Optinvent, HFCL, Sumitomo Bakelite Co., Ltd., OFS Fitel, LLC, Corning Incorporated, MicroVacuum Ltd., SAB Bröckskes GmbH & Co. KG, Sumitomo Electric Industries, Ltd., WOORIRO, INGUN, Fujikura Ltd., STL Tech, AFL, Digilens, Commscope, Cognifiber.com, Synopsys, Inc., and Waveguide Communications, Inc. among others., and others. |

| Segments Covered | By Type, By Material, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Optical Waveguide Market: Regional Analysis

North America is expected to capture the largest revenue share during the forecast period

North America is expected to dominate the global optical waveguide market during the forecast period. The regional growth is attributed to the nation's recent rapid expansion of fiber optic infrastructure. For instance, the results of the Fiber Broadband Association's 2022 Fiber Provider Survey indicate that US fiber-to-the-home (FTTH) deployments will likely break all previous records in years to come. FTTH networks passed 7.9 million more homes in the US in 2022, despite supply-chain and labor issues, according to the data.

The group claims that large government funding initiatives, like BEAD, RDOF, and ReConnect, among others, which are starting to have a direct impact, are accountable for the increase in FTTH deployments. For instance, the Broadband Equity, Access, and Deployment (BEAD) Program allocates USD 42.45 billion to increase high-speed internet access by funding infrastructure deployment, adoption, and planning programs in all 50 states, Washington, DC, Puerto Rico, the US Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands. Moreover, the increasing investment for high-speed internet in the country like the US is expected to fuel the growth of the market over the forecast period. For instance, in July 2022, the USDA invested around USD 401 million to provide access to high-speed internet for 31,000 rural residents and businesses in 11 states. Thus, these facts support the market expansion in the North American region.

The Asia Pacific is expected to grow at the highest CAGR during the forecast period. The regional growth is attributed to the growing consumer electronics industry along with increasing government initiatives and the rapid penetration of the internet in the region. For instance, the present Indian government has set out to develop the nation into a worldwide manufacturing hub under the larger concept of "Make in India" and the National Policy on Electronics 2019 (NPE 2019), with electronics manufacturing being one of the key objectives. There is a drive in policy to expand mobile phone manufacturing and assembly operations in the nation because mobile phones are currently among the most significant electronic products. A 1 billion mobile phone production target, including 600 million devices for exports, is anticipated under the NPE 2019 by 2025.

Recent Developments:

- In January 2023, TCL, a pioneer in display technology and affordable, premium smart experiences, launched TCL RayNeo X2 augmented reality (AR) smart glasses at CES 2023. The revolutionary glasses harness pioneering binocular full-color Micro-LED optical waveguide displays alongside an array of new interactive features to create unparalleled AR experiences for users.

- In December 2022, Lumenisity® Limited, a pioneer in next-generation hollow core fiber (HCF) technology, has been acquired by Microsoft. Global, enterprise, and large-scale businesses can benefit from rapid, reliable, and secure networking through Lumenisity's ground-breaking and industry-leading HCF product. With the acquisition, Microsoft will be better able to meet the stringent latency and security needs of its Cloud Platform and Services customers while also significantly optimizing its global cloud infrastructure. A wide range of businesses, including healthcare, financial services, manufacturing, retail, and government, can profit from the technology.

- In April 2022, Corning Incorporated announced the acquisition of Saint-Gobain's Shielding and Optics business unit, which includes the Saint-Gobain Sovis radiation shielding and optics company in Jouarre, France, and Hot Cell Services in Kent, Washington, United States. This acquisition broadens Corning's present radiation shielding business, creates new market prospects, and allows the company to manufacture and supply solutions for nuclear power, medical shielding, and optical components.

Optical Waveguide Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the optical waveguide market on a global and regional basis.

The global optical waveguide market is dominated by players like:

- Waveguide Optical Technologies

- Wave Optics Ltd

- LUMUS

- Optinvent

- HFCL

- Sumitomo Bakelite Co. Ltd.

- OFS Fitel LLC.

- Corning Incorporated

- MicroVacuum Ltd.

- SAB Bröckskes GmbH & Co. KG

- Sumitomo Electric Industries Ltd.

- WOORIRO

- INGUN

- Fujikura Ltd.

- STL Tech

- AFL

- Digilens

- Commscope

- Cognifiber.com

- Synopsys Inc.

- and Waveguide Communications Inc

- among others.

The global optical waveguide market is segmented as follows;

By Type

- Channel Waveguide

- Planar Waveguide

By Material

- Glass

- Polymer

- Semiconductor

- Silica

By Application

- Telecommunication

- Data Communication

- Medical Devices

- Sensors

- Aerospace & Defense

By End-user

- Telecom Companies

- Healthcare Providers

- Electronics Manufacturers

- Research Institutions

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

An optical waveguide is a physical structure that directs and transmits light waves from one point to another, typically using total internal reflection. It is commonly used in fiber optic cables, sensors, and integrated photonic circuits for high-speed data communication and signal transmission.

The global optical waveguide market is expected to grow due to rising demand for high-speed data transmission, use in telecommunication and photonics, and advancements in 5G infrastructure.

According to a study, the global optical waveguide market size was worth around USD 7.85 Billion in 2024 and is expected to reach USD 13.16 Billion by 2034.

The global optical waveguide market is expected to grow at a CAGR of 5.3% during the forecast period.

North America is expected to dominate the optical waveguide market over the forecast period.

Leading players in the global optical waveguide market include Waveguide Optical Technologies, Wave Optics Ltd, LUMUS, Optinvent, HFCL, Sumitomo Bakelite Co., Ltd., OFS Fitel, LLC, Corning Incorporated, MicroVacuum Ltd., SAB Bröckskes GmbH & Co. KG, Sumitomo Electric Industries, Ltd., WOORIRO, INGUN, Fujikura Ltd., STL Tech, AFL, Digilens, Commscope, Cognifiber.com, Synopsys, Inc., and Waveguide Communications, Inc. among others., among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed