Global Ophthalmic Drugs Market Size, Share, Growth Analysis Report - Forecast 2034

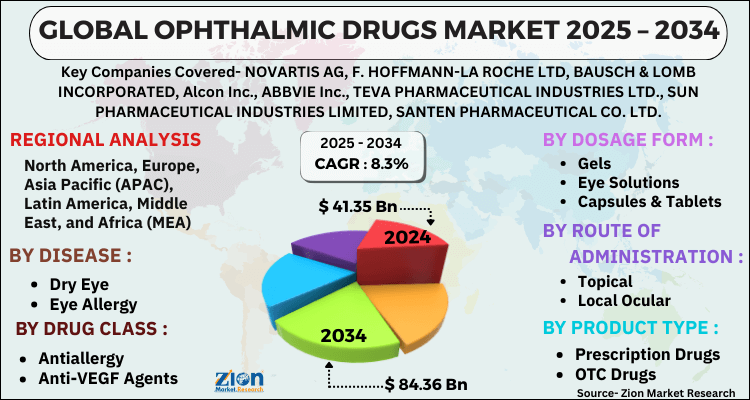

Ophthalmic Drugs Market By Disease (Dry Eye, Eye Allergy, Glaucoma, Eye Infection, Retinal Disorders, and Others), By Drug Class (Antiallergy, Anti-VEGF Agents, Anti-inflammatory, Antiglaucoma, and Others), Dosage Form (Gels, Eye Solutions, Capsules & Tablets, Eye Drops, and Ointments), Route Of Administration (Topical, Local Ocular, and Systemic), Product Type (Prescription Drugs and OTC Drugs), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

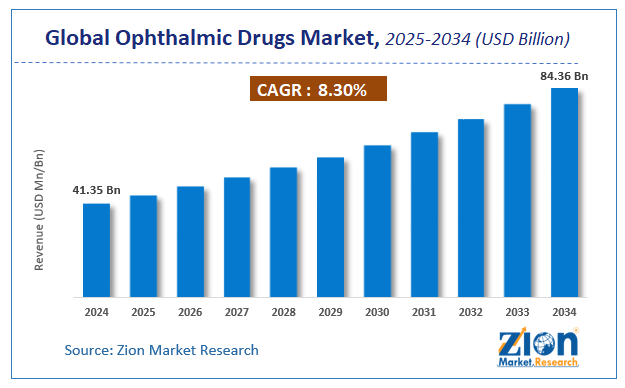

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 41.35 Billion | USD 84.36 Billion | 8.3% | 2024 |

Ophthalmic Drugs Market: Industry Perspective

The global ophthalmic drugs market size was worth around USD 41.35 Billion in 2024 and is predicted to grow to around USD 84.36 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.3% between 2025 and 2034.

The report analyzes the global ophthalmic drugs market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ophthalmic drugs industry.

Ophthalmic Drugs Market: Overview

There are many different types of eye disorders and diseases. Preventable blindness and visual impairment are caused by refractive errors, glaucoma, and cataracts. Some of the most prevalent causes of eye disorders are smoking, genetics, chemical irritants, vitamin inadequacy, allergies, and infection. Ophthalmic drugs are a diverse group of medications, each of which serves a distinct role in ophthalmic therapy or operation.

Ophthalmology deals with the diagnosis, treatment, and prevention of diseases which are associated with the visual system. Most of the eye-related disorders occur over a long period of time and at initial phase are usually asymptomatic or cause a slight decrease in the vision. However, over time this becomes quite distinct. Ophthalmologic disorders cannot be cured completely; however, the treatment aims at managing the disease indication to reduce the severity or slow its progression. Ophthalmologists provide around 85% of their procedure-based services to the seniors. Cataract surgery is the most frequent surgical procedure which is performed in many countries.

Key Insights

- As per the analysis shared by our research analyst, the global ophthalmic drugs market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2025-2034).

- Regarding revenue, the global ophthalmic drugs market size was valued at around USD 41.35 Billion in 2024 and is projected to reach USD 84.36 Billion by 2034.

- The ophthalmic drugs market is projected to grow at a significant rate due to increasing prevalence of eye diseases, aging population, and advancements in drug delivery systems.

- Based on Disease, the Dry Eye segment is expected to lead the global market.

- On the basis of Drug Class, the Antiallergy segment is growing at a high rate and will continue to dominate the global market.

- Based on the Dosage Form, the Gels segment is projected to swipe the largest market share.

- By Route Of Administration, the Topical segment is expected to dominate the global market.

- In terms of Product Type, the Prescription Drugs segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Ophthalmic Drugs Market: Growth Drivers

Growing prevalence of eye-related disorders is fueling the market growth

The global need for ophthalmic drugs is growing as the frequency of eye diseases rises. Eye diseases have already surfaced as possible dangers to people's visual experience in many developed and developing countries. Diabetes treatment has been introduced as the prevalence of diabetes has increased in many nations as it leads to diabetic retinopathy. Because of the difficulties in detecting glaucoma early and the requirement for long-term treatment, glaucoma has been on the healthcare agenda for millennia. In 2021, according to the WHO, over 2.2 billion individuals have blindness or visual impairment, with at least 1 billion of those having a vision impairment that can be avoided. The 1 billion population consists of those with severe or limited vision impairment due to trachoma, diabetic retinopathy, corneal opacities, glaucoma, cataract, and unresolved refractive error, as well as those with imminent vision impairment due to unspecified presbyopia. The growing geriatric population is exacerbating the prevalence of ocular disorders, with uncorrected refractive errors and cataracts being the leading causes of visual impairment. The majority of persons with visual problems are above the age of 50. All such factors are fostering the market growth.

Factors driving the ophthalmic drugs market are the increasing focus of the market players in the emerging economies to tap the unmet medical needs, increasing number of co-development agreements among leading players to make novel biological drugs which have less treatment duration, high proportion of visually challenged population, and generic manufacturers trying to strengthen their distribution networks for cost-effective drugs in developing regions. Moreover, rising prevalence of intraocular eye disorders, age-related macular degeneration, glaucoma, diabetic retinopathy, etc., in the elderly population is also boosting the global ophthalmic drugs market growth. Several organizations globally are increasing allocations on investments in research and development to come up with more effective novel biological agents. However, some of the factors like longer approval timelines required for ophthalmic drugs and loss of patent protection for drugs can hinder the market growth for ophthalmic drugs.

Ophthalmic Drugs Market: Restraints

Side effects associated with the ophthalmic drugs to restrain the market growth

Ophthalmic medications have their own set of side effects. Some of the common side effects that have a tendency to have a severe expression include eye itching, red eyes, eye inflammation, and skin rash. Further, some drugs may also have infrequent side effects for the user which include eye irritation and blurred vision. Some of the patients also experience some rare side effects with the use of the ophthalmic drug that consists of increased intraocular pressure, inflammation of the cornea (keratitis), sensitivity to light & redness of the eye, conjunctival hemorrhage, and many more. All such side effects related to ophthalmic drugs may limit the growth of the market.

Ophthalmic Drugs Market: Opportunities

Increasing approvals of the therapeutics to boost the market growth during the forecast period.

The number of innovative treatments approved by the FDA is increasing. As a result, there is a huge requirement for advanced ophthalmology drugs. The most recent ophthalmic medication trend is to achieve enough drug concentrations at the targeted area of the eye while eliminating adverse effects. The global ophthalmic drugs market is expected to benefit from the growing investment by the market players for pipeline expansion, as well as increased approvals for the introduction of therapeutic drugs thereby driving the growth of the market during the forecast period.

Ophthalmic Drugs Market: Challenges

Issues related to ocular drug delivery to act as a challenge for market growth

One of the most attractive and difficult issues faced by pharmaceutical researchers is ocular drug delivery. Obtaining and maintaining a therapeutic dose at the site of action for an extended period of time is one of the fundamental challenges of ocular medication. The barriers that protect the eye make ocular medication distribution difficult. The active pharmacological substance's bioavailability is sometimes the most difficult barrier to overcome. Traditional ocular dose forms, such as eye drops, are no longer effective in the fight against ocular diseases. In addition to this, to maintain an effective medication level, the drug product must be administered on a regular basis. This, however, can result in toxicity & overdose which are two issues that need to be addressed, patient compliance suffers as a result of the added inconvenience, dealing with a high-priced active pharmaceutical ingredient, may lead to the high cost of the drug. All these factors may act as major challenges for market growth.

Ophthalmic Drugs Market: Segmentation Analysis

The global ophthalmic drugs market is segmented based on Disease, Drug Class, Dosage Form, Route Of Administration, Product Type, and region.

Based on Disease, the global ophthalmic drugs market is divided into Dry Eye, Eye Allergy, Glaucoma, Eye Infection, Retinal Disorders, and Others.

On the basis of Drug Class, the global ophthalmic drugs market is bifurcated into Antiallergy, Anti-VEGF Agents, Anti-inflammatory, Antiglaucoma, and Others.

By Dosage Form, the global ophthalmic drugs market is split into Gels, Eye Solutions, Capsules & Tablets, Eye Drops, and Ointments.

In terms of Route Of Administration, the global ophthalmic drugs market is categorized into Topical, Local Ocular, and Systemic.

By Product Type, the global Ophthalmic Drugs market is divided into Prescription Drugs and OTC Drugs.

Ophthalmic Drugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ophthalmic Drugs Market |

| Market Size in 2024 | USD 41.35 Billion |

| Market Forecast in 2034 | USD 84.36 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 180 |

| Key Companies Covered | NOVARTIS AG, F. HOFFMANN-LA ROCHE LTD, BAUSCH & LOMB INCORPORATED, Alcon Inc., ABBVIE Inc., TEVA PHARMACEUTICAL INDUSTRIES LTD., SUN PHARMACEUTICAL INDUSTRIES LIMITED, SANTEN PHARMACEUTICAL CO. LTD, REGENERON PHARMACEUTICALS INC., PFIZER INC, and others. |

| Segments Covered | By Disease, By Drug Class, By Dosage Form, By Route Of Administration, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In March 2021, Alcon revealed an agreement with Novartis to acquire exclusive marketing rights to Simbrinza (brinzolamide/brimonidine tartrate ophthalmic solution) 1 percent /0.2 percent in the United States.

- In March 2022, Novartis received approval for Beovu® from the European Commission for adults with Diabetic macular edema. Year one results from the Phase III KESTREL and KITE studies, which compared Beovu (brolucizumab) 6 mg to aflibercept 2 mg in Diabetic macular edema patients, were used to get approval.

Ophthalmic Drugs Market: Regional Landscape

North America to rule the market during the forecast period.

North America is predicted to dominate the global ophthalmic drugs market during the forecast period, accounting for major revenue, owing to the high consumer awareness and availability of superior healthcare infrastructure and availability of superior healthcare infrastructure. Furthermore, the presence of prominent competitors in this region, such as Alcon and Pfizer, Inc., is projected to boost the market growth. Over the projection period, Asia Pacific is expected to be the fastest-growing region in the market. In Asia Pacific, the rising consumer awareness and increased prevalence of ocular diseases are projected to fuel market expansion. Local businesses are launching strategic endeavors to develop and market innovative patient care solutions. As a result, market growth is likely to accelerate.

Ophthalmic Drugs Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the ophthalmic drugs market on a global and regional basis.

The global ophthalmic drugs market is dominated by players like:

- NOVARTIS AG

- F. HOFFMANN-LA ROCHE LTD

- BAUSCH & LOMB INCORPORATED

- Alcon Inc.

- ABBVIE Inc.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- SUN PHARMACEUTICAL INDUSTRIES LIMITED

- SANTEN PHARMACEUTICAL CO. LTD

- REGENERON PHARMACEUTICALS INC.

- PFIZER INC

The global ophthalmic drugs market is segmented as follows;

By Disease

- Dry Eye

- Eye Allergy

- Glaucoma

- Eye Infection

- Retinal Disorders

- and Others

By Drug Class

- Antiallergy

- Anti-VEGF Agents

- Anti-inflammatory

- Antiglaucoma

- and Others

By Dosage Form

- Gels

- Eye Solutions

- Capsules & Tablets

- Eye Drops

- and Ointments

By Route Of Administration

- Topical

- Local Ocular

- and Systemic

By Product Type

- Prescription Drugs

- OTC Drugs

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global ophthalmic drugs market is expected to grow due to rising prevalence of eye disorders, increasing geriatric population, and growing investments in novel ophthalmic treatment solutions.

According to a study, the global ophthalmic drugs market size was worth around USD 41.35 Billion in 2024 and is expected to reach USD 84.36 Billion by 2034.

The global ophthalmic drugs market is expected to grow at a CAGR of 8.3% during the forecast period.

North America is expected to dominate the ophthalmic drugs market over the forecast period.

Leading players in the global ophthalmic drugs market include NOVARTIS AG, F. HOFFMANN-LA ROCHE LTD, BAUSCH & LOMB INCORPORATED, Alcon Inc., ABBVIE Inc., TEVA PHARMACEUTICAL INDUSTRIES LTD., SUN PHARMACEUTICAL INDUSTRIES LIMITED, SANTEN PHARMACEUTICAL CO. LTD, REGENERON PHARMACEUTICALS INC., PFIZER INC, among others.

The report explores crucial aspects of the ophthalmic drugs market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed