Diabetic Retinopathy Market Size, Share, Growth, Analysis, Forecast 2024-2032

Diabetic Retinopathy Market by Type (Non-Proliferative Diabetic Retinopathy and Proliferative Diabetic Retinopathy) and by Management (Vitrectomy, Anti-VEGF Therapy, Laser Surgery, and Intraocular Steroid Injection): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

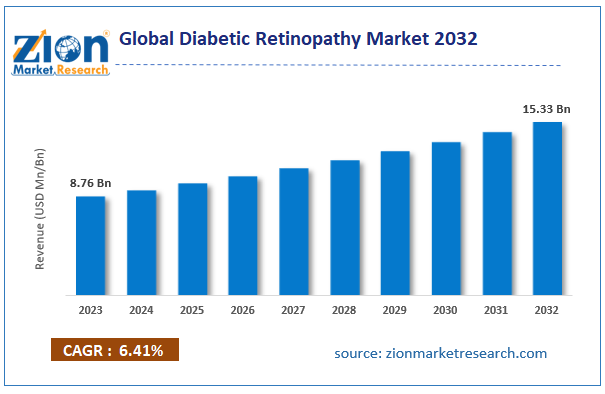

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.76 Billion | USD 15.33 Billion | 6.41% | 2023 |

Diabetic Retinopathy Industry Perspective:

The global diabetic retinopathy market size was worth around USD 8.76 billion in 2023 and is predicted to grow to around USD 15.33 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.41% between 2024 and 2032.

Key Insights

- As per the analysis shared by our research analyst, the diabetic retinopathy market is anticipated to grow at a CAGR of 6.41% during the forecast period.

- The global diabetic retinopathy market was estimated to be worth approximately USD 8.76 billion in 2023 and is projected to reach a value of USD 15.33 billion by 2032.

- The growth of the diabetic retinopathy market is being driven by increasing prevalence of diabetes worldwide and the rising risk of vision-related complications associated with the disease.

- Based on the type, the non-proliferative diabetic retinopathy segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the vitrectomy segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Diabetic Retinopathy Market Outlook

Diabetic retinopathy is an eye disease in which the retina is damaged due to diabetes-related complications. People who have been suffering from diabetes for more than 20 years are at an elevated risk of diabetic retinopathy. Diabetic retinopathy does not have early warning signs. The continued high blood sugar levels lead to the damage of retinal blood vessels. The retinal blood vessels may swell and trickle. In certain cases, unusual blood vessels develop on the retina. Diabetic retinopathy can develop in people with type 1 or 2 diabetes. High sugar blood levels for a prolonged period of time leads to obstruction of small vessels that supply blood to the retina. Diabetic retinopathy progresses in four stages: mild non-proliferative retinopathy, moderate non-proliferative retinopathy, severe non-proliferative retinopathy, and proliferative diabetic retinopathy (PDR). In mild nonproliferative retinopathy, tiny balloon-like swelling occurs in retinal blood vessels. In moderate nonproliferative retinopathy, the vessels supplying blood to retina swell and change. Furthermore, these blood vessels might not carry the required blood. In severe non-proliferative retinopathy, more blood vessels are blocked, leading to deprivation of blood supply to the retina. Proliferative diabetic retinopathy is an advanced stage, where fragile, new blood vessels grow inside the retina and in the vitreous gel.

The severity of diabetic retinopathy can be minimized by taking constant eye check-ups, controlling blood sugar and blood pressure levels, and taking note of vision problems as and when they occur. Diagnosis of diabetic retinopathy is conducted through eye examinations, such as visual acuity test, pupil dilation, ophthalmoscopy, Fundus Fluorescein angiography (FFA), and Optical coherence tomography (OCT), among others. The eye care professionals examine the retina for initial symptoms of diabetic retinopathy.

Diabetic Retinopathy Market Growth Analysis

Growing baby boomer generation worldwide and rising occurrences of diabetes due to a sedentary lifestyle and an unhealthy diet are major factors driving the growth of the global diabetic retinopathy market. Furthermore, delayed diagnosis of diabetes, refusal for treatment, rising occurrences of vision loss due to diabetes, increasing healthcare expenditure, development of innovative treatments, and increasing research and development activities will further propel market growth. Various government and non-government organizations are trying to increase awareness regarding diabetic retinopathy and rapid advancements in the technology are acting as growth opportunities for the market players in the diabetic retinopathy market. However, lack of skilled ophthalmologists, non-availability of insurance facilities, and substandard primary infrastructure in developing regions might restrict the growth of the global diabetic retinopathy market.

The study includes drivers and restraints for the diabetic retinopathy market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the diabetic retinopathy market on a global and regional level.

In order to give the users of this report a comprehensive view of the diabetic retinopathy market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the Type segment is benchmarked based on its market size, growth rate, and general attractiveness.

The report provides a company market share analysis in order to give a broader overview of the key players in the diabetic retinopathy market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new type launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the diabetic retinopathy market on a global and regional basis.

Diabetic Retinopathy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diabetic Retinopathy Market |

| Market Size in 2023 | USD 8.76 Billion |

| Market Forecast in 2032 | USD 15.33 Billion |

| Growth Rate | CAGR of 6.41% |

| Number of Pages | 210 |

| Key Companies Covered | Regeneron Pharmaceuticals, Novartis, Allergan, Genentech, Bayer AG, Aerpio Pharmaceuticals, BCN Peptides, Ampio Pharmaceuticals, ThromboGenics, Alimera Sciences, Kowa Company, and others. |

| Segments Covered | By Type, By Management, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diabetic Retinopathy Market Segmentation Analysis

The study provides a decisive view of the diabetic retinopathy market by segmenting the market based on type, management, and region. The segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. Based on the type, the diabetic retinopathy market has been segmented into non-proliferative diabetic retinopathy and proliferative diabetic retinopathy. Non-proliferative diabetic retinopathy segment holds the majority market share, due to the rising number of diabetic retinopathy patients and increasing awareness. The management segment includes vitrectomy, anti-VEGF therapy, laser surgery, and intraocular steroid injection. Anti-VEGF therapy segment holds the majority share of the management segment, due to its multiple benefits when compared to other therapies.

Region Analysis Preview

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further bifurcation into major countries including the U.S., Canada, Germany, France, UK, China, Japan, India, and Brazil. This segmentation includes the demand for diabetic retinopathy based on individual segments and types in all regions and countries.

North America is projected to be the leading region in the forecast timeframe. The increasing prevalence of diabetic retinopathy and growing espousal of an unhealthy diet are driving the market growth in this region. Europe is projected to be the second-largest market. The major growth factors include an increasing number of diabetic patients, rapid technological advancements, and increasing healthcare spending. The Asia Pacific is projected to propagate at a speedy rate in the forecast timeframe. Increasing geriatric population, growing diabetic population, and multiple governmental and non-governmental efforts will boost the market growth in this region. The Latin American market will develop at a significant rate in the forecast timeframe. The Middle Eastern and African countries are expected to experience moderate growth in the near future.

Diabetic Retinopathy Market: Competitive Analysis

The global diabetic retinopathy market is led by players like:

- Regeneron Pharmaceuticals

- Novartis

- Allergan

- Genentech

- Bayer AG

- Aerpio Pharmaceuticals

- BCN Peptides

- Ampio Pharmaceuticals

- ThromboGenics

- Alimera Sciences

- Kowa Company

This report segments the global diabetic retinopathy market as follows:

Global Diabetic Retinopathy Market: By Type

- Non-Proliferative Diabetic Retinopathy

- Proliferative Diabetic Retinopathy

Global Diabetic Retinopathy Market: By Management

- Vitrectomy

- Anti-VEGF Therapy

- Laser Surgery

- Intraocular Steroid Injection

Global Diabetic Retinopathy Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Diabetic retinopathy is a complication that affects the eyes of diabetic people. Incessant elevated blood sugar due to diabetes is linked with impairment of small blood vessels present in the retina. Diabetic retinopathy can induce retinal blood vessels to hemorrhage or cause fluid leakage.

According to the report, the global diabetic retinopathy market size was worth around USD 8.76 billion in 2023 and is expected to reach around USD 15.33 billion by 2032.

The global diabetic retinopathy market is expected to grow at a CAGR of 6.41% during the forecast period.

North America is expected to dominate the diabetic retinopathy market over the forecast period.

The global diabetic retinopathy market is dominated by players like Regeneron Pharmaceuticals, Novartis, Allergan, Genentech, Bayer AG, Aerpio Pharmaceuticals, BCN Peptides, Ampio Pharmaceuticals, ThromboGenics, Alimera Sciences, and Kowa Company, among others.

The diabetic retinopathy market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed