Global Nickel Acetate Tetrahydrate Market Size, Share, Growth Analysis Report - Forecast 2034

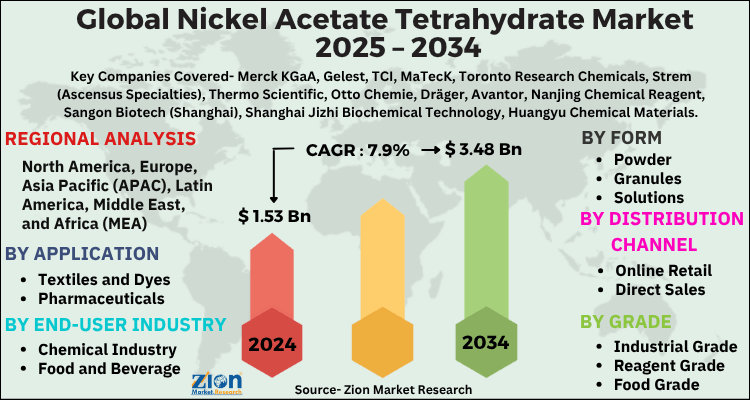

Nickel Acetate Tetrahydrate Market By Application (Textiles and Dyes, Pharmaceuticals, Catalysts in Chemical Reactions, Electroplating, Food Additives), By End-User Industry (Chemical Industry, Food and Beverage, Pharmaceuticals, Agriculture, Textile Industry), By Form (Powder, Granules, Solutions), By Distribution Channel (Online Retail, Direct Sales, Distributors, Specialty Chemical Suppliers), By Grade (Industrial Grade, Reagent Grade, Food Grade), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.53 Billion | USD 3.48 Billion | 7.9% | 2024 |

Nickel Acetate Tetrahydrate Market Size:

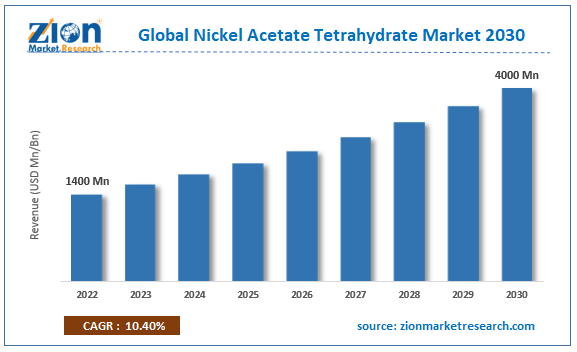

The global nickel acetate tetrahydrate market size was worth around USD 1.53 Billion in 2024 and is predicted to grow to around USD 3.48 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.9% between 2025 and 2034. The report analyzes the global nickel acetate tetrahydrate market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the nickel acetate tetrahydrate industry.

Nickel Acetate Tetrahydrate Market: Overview

Nickel Acetate Tetrahydrate, with the chemical formula Ni (CH3COO)2 · 4H2O and CAS number 373-02-4, is a crystalline compound widely used in various industrial applications. This chemical is a hydrated form of nickel acetate, characterized by its green crystalline structure. Its molecular structure consists of nickel ions coordinated with acetate (CH3COO-) groups and four water molecules. In industrial settings, Nickel Acetate Tetrahydrate is frequently employed as a catalyst in chemical processes, particularly in the production of certain types of polyesters and vinyl acetate. Its catalytic properties make it valuable in reactions involving esterification and transesterification. Additionally, it serves as a precursor in the synthesis of diverse nickel-containing materials, including catalysts and magnetic nanomaterials. The compound's distinctive green coloration is a result of its nickel content, and its solubility in water enhances its utility in various aqueous-phase reactions. While Nickel Acetate Tetrahydrate offers valuable applications in the chemical industry, it is essential to handle it with care, considering the toxicity of nickel compounds. Users must adhere to proper safety protocols and regulatory guidelines to ensure its responsible and safe utilization in industrial processes.

Key Insights

- As per the analysis shared by our research analyst, the global nickel acetate tetrahydrate market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2025-2034).

- Regarding revenue, the global nickel acetate tetrahydrate market size was valued at around USD 1.53 Billion in 2024 and is projected to reach USD 3.48 Billion by 2034.

- The nickel acetate tetrahydrate market is projected to grow at a significant rate due to increasing demand in electroplating, as a catalyst in various chemical processes, and in the growing battery manufacturing industry.

- Based on Application, the Textiles and Dyes segment is expected to lead the global market.

- On the basis of End-User Industry, the Chemical Industry segment is growing at a high rate and will continue to dominate the global market.

- Based on the Form, the Powder segment is projected to swipe the largest market share.

- By Distribution Channel, the Online Retail segment is expected to dominate the global market.

- In terms of Grade, the Industrial Grade segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Nickel Acetate Tetrahydrate Market: Growth Drivers

Snowballing demand in electroplating applications is propelling growth of the nickel acetate tetrahydrate market

A significant driver for the global nickel acetate tetrahydrate market is its increasing demand in electroplating applications. Nickel acetate tetrahydrate serves as a crucial component in electroplating processes, especially in the deposition of nickel coatings on various surfaces. This application is vital in industries such as electronics, automotive, and aerospace, where a thin, uniform, and corrosion-resistant layer of nickel is desirable. The growing manufacturing activities in these sectors, driven by increasing consumer demands for electronic devices and durable automotive components, contribute substantially to the rising demand for nickel acetate tetrahydrate.

Furthermore, the compound's role as a catalyst in chemical reactions is another key driver. Nickel acetate tetrahydrate is utilized as a catalyst in diverse chemical processes, particularly in the synthesis of polymers and other organic compounds. As industries continue to explore sustainable and efficient chemical synthesis methods, the catalytic properties of nickel acetate tetrahydrate become increasingly relevant. This has led to its adoption in various industrial applications, driving the overall growth of the global nickel acetate tetrahydrate market. The compound's versatility in catalyzing reactions across different sectors positions it as a valuable driver in the evolving landscape of industrial chemistry.

Nickel Acetate Tetrahydrate Market: Restraints

Potential health and environmental concerns associated with the use and production of nickel compounds may hinder market growth.

A notable restraint in the global nickel acetate tetrahydrate industry is the potential health and environmental concerns associated with the use and production of nickel compounds. Nickel is known to be a skin sensitizer, and exposure to nickel compounds, including nickel acetate tetrahydrate, can lead to allergic reactions in some electronics. Occupational exposure in industries utilizing nickel acetate tetrahydrate, such as electroplating or catalyst manufacturing, may pose health risks to workers. Additionally, the disposal of waste containing nickel compounds requires careful consideration to prevent environmental contamination. Regulatory authorities worldwide are increasingly stringent about nickel exposure limits and environmental standards, necessitating industry adherence to safety protocols and waste management practices.

Moreover, the fluctuating prices of nickel in the global market can pose economic challenges for stakeholders in the nickel acetate tetrahydrate industry. The market is susceptible to volatility in nickel prices influenced by factors such as global demand, geopolitical events, and mining activities. Unpredictable price fluctuations can impact production costs, supply chain stability, and the overall profitability of companies involved in nickel acetate tetrahydrate manufacturing. As a result, market players need to navigate these economic uncertainties, implement effective risk management strategies, and maintain flexibility in their operations to mitigate the impact of nickel price volatility on the global market for nickel acetate tetrahydrate.

Nickel Acetate Tetrahydrate Market: Opportunities

Potential to cater to the growing trend of digital and mobile-first lifestyles to provide growth opportunities

An opportunity of significance in the global nickel acetate tetrahydrate industry lies in the increasing adoption of renewable energy technologies, specifically in the realm of batteries. Nickel plays a crucial role in the composition of certain advanced battery technologies, including nickel-cadmium (Ni-Cd) and nickel-metal hydride (Ni-MH) batteries. As the demand for energy storage solutions rises, driven by the growth of electric vehicles and renewable energy projects, the utilization of nickel acetate tetrahydrate in battery manufacturing presents a substantial growth opportunity. Nickel-based batteries are valued for their energy density, durability, and potential for cost-effectiveness, positioning nickel acetate tetrahydrate as a key component in the development of advanced energy storage systems.

Furthermore, the expanding electronics industry, driven by the proliferation of smartphones, laptops, and other consumer electronic devices, presents another avenue for growth. Nickel acetate tetrahydrate is employed in the electroplating of nickel onto electronic components, providing corrosion resistance and enhancing conductivity. With the continuous evolution of electronic devices and the increasing demand for high-performance coatings, the use of nickel acetate tetrahydrate in the electronics sector is anticipated to surge. This represents a strategic opportunity for market players to align their production capacities and capabilities with the growing needs of the electronics industry, fostering innovation and collaboration to capitalize on this expanding market segment.

Additionally, the ongoing emphasis on sustainable practices and environmentally friendly technologies opens doors for the application of nickel acetate tetrahydrate in green chemistry initiatives. The compound's catalytic properties make it valuable in eco-friendly chemical processes, aligning with the global push for sustainable manufacturing practices. As industries strive to reduce their environmental footprint, the adoption of nickel acetate tetrahydrate in green chemistry applications represents a forward-looking opportunity for industry players to contribute to environmentally conscious practices and position themselves favorably in the evolving landscape of sustainable chemical manufacturing.

Nickel Acetate Tetrahydrate Market: Challenges

Potential impact of supply chain disruptions stemming from the geopolitical landscape and mining activities to challenge market growth

A significant challenge in the global nickel acetate tetrahydrate market is the potential impact of supply chain disruptions stemming from the geopolitical landscape and mining activities. Nickel, a key component in the production of nickel acetate tetrahydrate, is subject to market uncertainties influenced by geopolitical tensions, trade policies, and mining regulations. Disruptions in the supply chain, such as export restrictions or changes in mining practices, can directly affect the availability and cost of nickel, impacting the production and pricing dynamics of nickel acetate tetrahydrate. Market participants need to navigate these challenges by implementing robust supply chain strategies, diversifying sources, and staying attuned to geopolitical developments to ensure a stable and secure supply of raw materials.

Moreover, stringent environmental regulations and heightened awareness of nickel's potential health impacts present an ongoing challenge for the nickel acetate tetrahydrate industry. Regulatory bodies worldwide are imposing stricter standards on nickel exposure limits and environmental discharge, necessitating adherence to stringent safety and waste management protocols. Meeting these regulatory requirements adds complexity to manufacturing processes and can increase operational costs. As sustainability becomes a paramount concern, companies operating in the nickel acetate tetrahydrate market need to proactively invest in eco-friendly practices, research alternative manufacturing methods, and ensure compliance with evolving environmental standards to overcome this persistent challenge.

Nickel Acetate Tetrahydrate Market: Segmentation

The global nickel acetate tetrahydrate market is segmented based on Application, End-User Industry, Form, Distribution Channel, Grade, and region.

Based on Application, the global nickel acetate tetrahydrate market is divided into Textiles and Dyes, Pharmaceuticals, Catalysts in Chemical Reactions, Electroplating, Food Additives.

On the basis of End-User Industry, the global nickel acetate tetrahydrate market is bifurcated into Chemical Industry, Food and Beverage, Pharmaceuticals, Agriculture, Textile Industry.

By Form, the global nickel acetate tetrahydrate market is split into Powder, Granules, Solutions.

In terms of Distribution Channel, the global nickel acetate tetrahydrate market is categorized into Online Retail, Direct Sales, Distributors, Specialty Chemical Suppliers.

By Grade, the global Nickel Acetate Tetrahydrate market is divided into Industrial Grade, Reagent Grade, Food Grade.

Nickel Acetate Tetrahydrate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nickel Acetate Tetrahydrate Market |

| Market Size in 2024 | USD 1.53 Billion |

| Market Forecast in 2034 | USD 3.48 Billion |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | 209 |

| Key Companies Covered | Merck KGaA, Gelest, TCI, MaTecK, Toronto Research Chemicals, Strem (Ascensus Specialties), Thermo Scientific, Otto Chemie, Dräger, Avantor, Nanjing Chemical Reagent, Sangon Biotech (Shanghai), Shanghai Jizhi Biochemical Technology, Huangyu Chemical Materials, and others. |

| Segments Covered | By Application, By End-User Industry, By Form, By Distribution Channel, By Grade, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nickel Acetate Tetrahydrate Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is anticipated to emerge as the leading region in the global nickel acetate tetrahydrate market during the forecast period. The region's dominance is attributed to the robust growth of key end-use industries such as electronics, automotive, and battery manufacturing. Countries like China, Japan, and South Korea are at the forefront of these industries, driving substantial demand for nickel acetate tetrahydrate. The burgeoning electronics sector, coupled with the increasing adoption of electric vehicles in the region, particularly in China, propels the demand for nickel-based batteries, creating a significant market opportunity for nickel acetate tetrahydrate manufacturers.

Additionally, Asia Pacific's role as a major manufacturing hub further amplifies the demand for nickel acetate tetrahydrate in electroplating applications.

The South Korean government has actively fostered the electroplating industry through initiatives such as funding R&D for innovative technologies, providing tax incentives for environmental investments by electroplating firms, and promoting industry-academia collaborations to advance electroplating solutions. These programs underscore a comprehensive approach aimed at supporting technological advancements, environmental sustainability, and innovation within the electroplating sector.

With the region being a global manufacturing powerhouse, the need for high-quality coatings on electronic components and automotive parts enhances the importance of nickel acetate tetrahydrate in surface treatment processes. As economic activities continue to surge and technological advancements drive industry trends, Asia Pacific is poised to play a pivotal role in steering the growth of the nickel acetate tetrahydrate market, making it a focal point for industry stakeholders and investors alike.

Key Developments

2023: Jiangsu Huatai New Materials Co., Ltd. launched a new high-purity nickel acetate tetrahydrate product specifically designed for use in battery applications.

2023: Umicore, a Belgian materials technology company, partnered with Shenzhen Huahang Electronic Co., Ltd., a Chinese battery manufacturer, to develop new nickel acetate tetrahydrate-based battery materials.

2022: Zhejiang Huachi New Material Co., Ltd. acquired Shaoxing Dongzheng Fine Chemical Co., Ltd., a Chinese nickel salt manufacturing company. This acquisition is expected to expand Huachi's production capacity and market share in the global nickel acetate tetrahydrate industry.

2022: Tokyo Chemical Industry Co., Ltd., a Japanese chemical company, partnered with Ningbo Fenghuo Chemical Co., Ltd., a Chinese nickel salt producer, to establish a joint venture for the production of nickel acetate tetrahydrate.

2022: Hunan Xiangtan Nonferrous Metal Co., Ltd. developed a new nickel acetate tetrahydrate production process that reduces energy consumption and environmental impact.

Nickel Acetate Tetrahydrate Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the nickel acetate tetrahydrate market on a global and regional basis.

The global nickel acetate tetrahydrate market is dominated by players like:

- Merck KGaA

- Gelest

- TCI

- MaTecK

- Toronto Research Chemicals

- Strem (Ascensus Specialties)

- Thermo Scientific

- Otto Chemie

- Dräger

- Avantor

- Nanjing Chemical Reagent

- Sangon Biotech (Shanghai)

- Shanghai Jizhi Biochemical Technology

- Huangyu Chemical Materials

The global nickel acetate tetrahydrate market is segmented as follows;

By Application

- Textiles and Dyes

- Pharmaceuticals

- Catalysts in Chemical Reactions

- Electroplating

- Food Additives

By End-User Industry

- Chemical Industry

- Food and Beverage

- Pharmaceuticals

- Agriculture

- Textile Industry

By Form

- Powder

- Granules

- Solutions

By Distribution Channel

- Online Retail

- Direct Sales

- Distributors

- Specialty Chemical Suppliers

By Grade

- Industrial Grade

- Reagent Grade

- Food Grade

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Nickel Acetate Tetrahydrate is a green, crystalline compound with the formula Ni(CH₃COO)₂·4H₂O. It is commonly used in electroplating, dyeing, and as a catalyst in chemical reactions. The compound provides a source of nickel ions and is valued for its solubility in water and stability in various industrial applications.

The global nickel acetate tetrahydrate market is expected to grow due to rising demand in electroplating and catalysis, growth in battery production, increasing applications in ceramics and textiles, and expansion of the electronics industry.

According to a study, the global nickel acetate tetrahydrate market size was worth around USD 1.53 Billion in 2024 and is expected to reach USD 3.48 Billion by 2034.

The global nickel acetate tetrahydrate market is expected to grow at a CAGR of 7.9% during the forecast period.

Asia-Pacific is expected to dominate the nickel acetate tetrahydrate market over the forecast period.

Leading players in the global nickel acetate tetrahydrate market include Merck KGaA, Gelest, TCI, MaTecK, Toronto Research Chemicals, Strem (Ascensus Specialties), Thermo Scientific, Otto Chemie, Dräger, Avantor, Nanjing Chemical Reagent, Sangon Biotech (Shanghai), Shanghai Jizhi Biochemical Technology, Huangyu Chemical Materials, among others.

The report explores crucial aspects of the nickel acetate tetrahydrate market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed