Corrosion Resistant Resin Market Value, Share, Global Trends Report, 2032

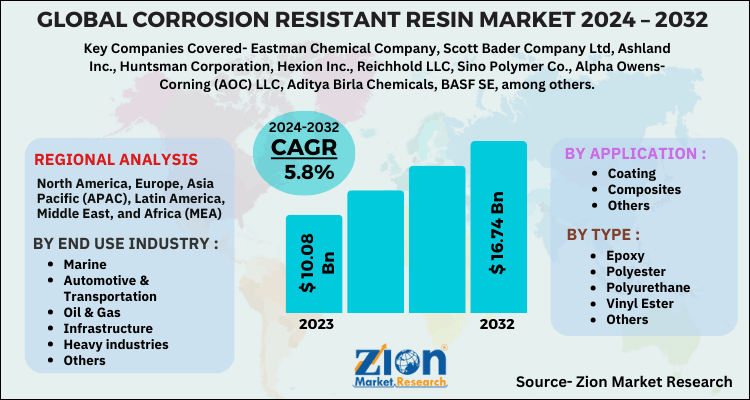

Corrosion Resistant Resin Market By Type (Epoxy, Polyester, Polyurethane, Vinyl Ester, and Others), By Application (Coating, Composites, and Others), By End Use Industry (Marine, Automotive & Transportation, Oil & Gas, Infrastructure, Heavy industries, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.08 Billion | USD 16.74 Billion | 5.8% | 2023 |

Corrosion Resistant Resin Market Insights

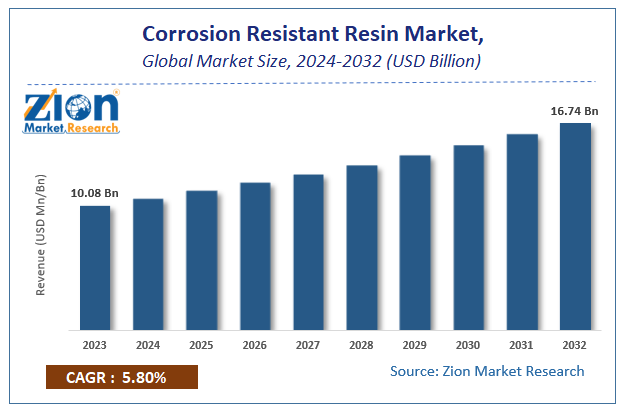

According to a report from Zion Market Research, the global Corrosion Resistant Resin Market was valued at USD 10.08 Billion in 2023 and is projected to hit USD 16.74 Billion by 2032, with a compound annual growth rate (CAGR) of 5.8% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Corrosion Resistant Resin Market industry over the next decade.

Corrosion Resistant Resin Market: Overview

Corrosion resistance is the ability to prevent environmental deterioration from happening due to chemical or electro-chemical reactions. Resins are used for long-term resistance to chemical attack or at a place where operating is at elevated temperatures. Epoxy coating is mainly used for the protection of marine engineering as organic coatings are good options for metal protection. Polyester and vinyl resin are mainly used for manufacturing tanks, vessels, pipes which contain fuel, acid, foodstuffs, and other materials that can corrode metal.

COVID-19 Impact Analysis

The outbreak of COVID-19 is unprecedented and has significantly impacted the global economy. Supply chain disruptions will likely continue which will affect the availability of equipment and parts and then eventually impact projects. There has been a downward slope in usage and demand for various assets like transportation, due to the lockdown.

Corrosion Resistant Resin Market: Growth Factors

Infrastructure is crucial for economic growth. Investments in infrastructure across transport, water, energy, and communication help stimulate long-term growth. This is creating opportunities for corrosion resistant resin manufacturers globally. Increasing environmental protection awareness conventionally used metals such as aluminum and carbon steel are being replaced by composites due to reasons like cost effectiveness and low maintenance.

This is estimated to encourage the demand in this sector. The food and beverage industry is also contributing in the demand for corrosion resistant resin to enhance production safety and quality.

Corrosion Resistant Resin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Corrosion Resistant Resin Market |

| Market Size in 2023 | USD 10.08 Billion |

| Market Forecast in 2032 | USD 16.74 Billion |

| Growth Rate | CAGR of 5.8% |

| Number of Pages | 185 |

| Key Companies Covered | Eastman Chemical Company, Scott Bader Company Ltd, Ashland Inc., Huntsman Corporation, Hexion Inc., Reichhold LLC, Sino Polymer Co., Alpha Owens-Corning (AOC) LLC, Aditya Birla Chemicals, BASF SE, among others. |

| Segments Covered | By Type, By Application, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Corrosion Resistant Resin Market: Segmentation Analysis

By Type Segment Analysis

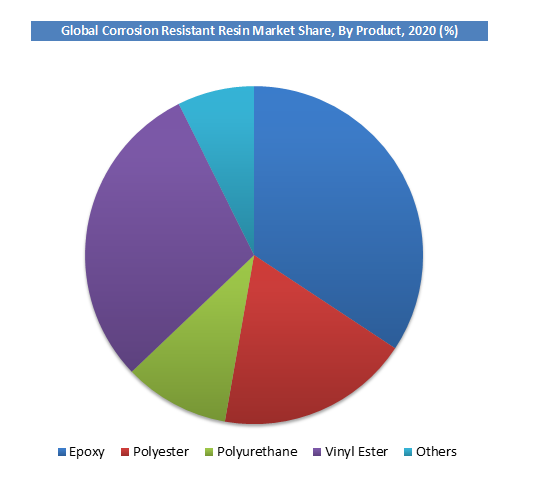

The epoxy resin segment held a share of over 27.2% in 2023 and is expected to grow due to its corrosion resistance property. It is easy to apply and also reasonable in cost. These resins are commonly used to protect against erosion in the production of tanks, industrial scrubbers, equipment and other purposes. Polyester, polyurethane, vinyl ester, and others form the type segment.

By End-Use Industry Segment Analysis

The oil & gas segment is projected to grow at a CAGR of around 7.8% from 2024 to 2032. Corrosion-resistant resins are widely used in this segment as coatings and composites as they possess great corrosion resistant properties. Marine, automotive & transportation, infrastructure, heavy industries, and others form the end-use industry segment.

Corrosion Resistant Resin Market: Regional Analysis

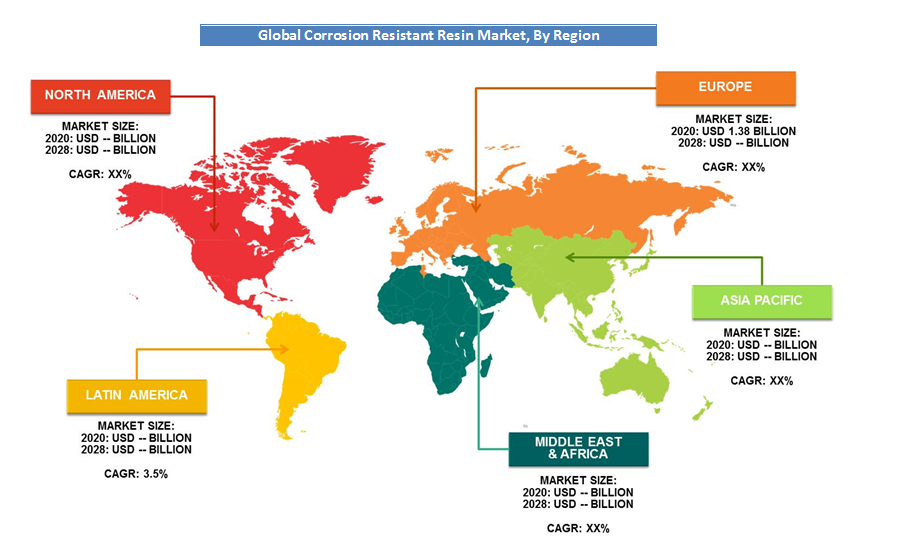

Asia Pacific held the largest market share exceeding 33.9% in 2023. Rapid industrialization, demand for modern infrastructure, and GDP growth in this region are some of the reasons contributing to this share. The Indian construction industry is creating a highly conducive environment for this market. Increasing investment in infrastructure in emerging economies in China and India is expected to boost the market over the coming years.

Middle East & Africa is projected to grow at a CAGR of around 2.4%. This is due to a huge scope for growth in the oil & gas industry. North America and Europe are in a saturation state and hence growing at a moderate pace for the corrosion resistant resin market. Countries in these regions have an established infrastructure for commercial, public, and transport sectors, which is stirring the growth.

Corrosion Resistant Resin Market: Competitive Analysis

Some of the major players in the global Corrosion Resistant Resin market include:

- Eastman Chemical Company

- Scott Bader Company Ltd

- Ashland Inc.

- Huntsman Corporation

- Hexion Inc.

- Reichhold LLC

- Sino Polymer Co.

- Alpha Owens-Corning (AOC) LLC

- Aditya Birla Chemicals

- BASF SE

The global corrosion resistant resin market is segmented as follows:

By Type

- Epoxy

- Polyester

- Polyurethane

- Vinyl Ester

- Others

By Application

- Coating

- Composites

- Others

By End Use Industry

- Marine

- Automotive & Transportation

- Oil & Gas

- Infrastructure

- Heavy industries

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the Global Corrosion Resistant Resin market size was worth around USD 10.08 billion in 2023 and is expected to reach USD 16.74 billion by 2032.

The Global Corrosion Resistant Resin market is expected to grow at a CAGR of 5.8% during the forecast period.

Some of the key factors driving the Global corrosion resistant resin market growth are rising demand for modern technology, environmental protection awareness, and increasing demand in F&B sector for maintaining the quality and safety.

Asia Pacific is expected to dominate the Corrosion Resistant Resin market over the forecast period.

Some of the key players in Corrosion Resistant Resin Market(CRR) are Eastman Chemical Company, Scott Bader Company Ltd, Ashland Inc., Huntsman Corporation, Hexion Inc., Reichhold LLC, Sino Polymer Co., Alpha Owens-Corning (AOC) LLC, Aditya Birla Chemicals, and BASF SE, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed