Industrial Waste Management Market Size, Share, Trends, And Growth Report 2032

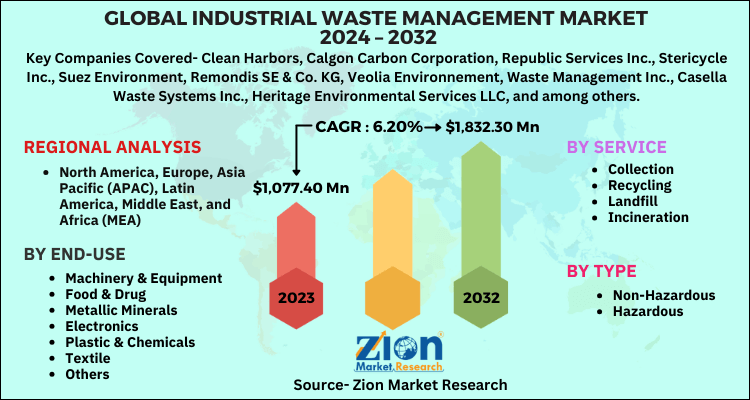

Industrial Waste Management Market By Service (Collection, Recycling, Landfill, And Incineration), By Type (Non-Hazardous And Hazardous), By End-User (Machinery & Equipment, Food & Drug, Metallic Minerals, Electronics, Plastic & Chemicals, Textile, And Others), And By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,077.40 Million | USD 1,832.30 Million | 6.20% | 2023 |

Industrial Waste Management Market: Size

The global industrial waste management market size was worth around USD 1,077.40 million in 2023 and is predicted to grow to around USD 1,832.30 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.20% between 2024 and 2032.

The report covers forecasts and analyses for the industrial waste management market on a global and regional level. The study provides historic data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Million).

Industrial Waste Management Market: Overview

Industrial waste refers to the solid, liquid, and gaseous emissions, residual and unwanted wastes from an industrial operation. Industrial wastes account for around 50% share of the overall waste generated globally. Strategic investors from both, outside the industry as well as those within, including waste management are still in the process to understand which ones will prove economically viable, particularly at scale, and which will be best suited to particular situations.

Factors such as stringent regulations and increasing focus on energy and resource recovery are expected to fuel the growth of the market over the forecast years. In 2007, China’s MEP (Ministry of Environmental Protection) and the Ministry of Commerce announced that enterprises with serious environmental violations would be subjected to an export ban for one to three years. The two government bodies are expected to set up a database to collect information about exporters with poor environmental compliance records

Another regulation, EU policy on waste management, has set out some principles for the proper management of industrial waste. Those responsible for the generation of waste, and consequent adverse effects on the environment should be required to pay the costs of avoiding or alleviating those adverse consequences.

In spite of rising awareness regarding the usage of recycled products, practices such as the ineffective inspection, monitoring, and regulations for industrial waste in developing nations are anticipated to propel the growth of the industrial waste market over the forecast years. In developing countries, hazardous waste management systems lack a systematic approach to administer waste management programs; inability to effectively collect and manage wastes as well as to reduce the negative impacts of those activities. Also, there are inadequacies in the implementation of regulations associated with hazardous waste management due to fragmented responsibilities among government departments and local authorities.

Rising trend for the Increase in the purchase of recyclable products around the globe is expected to bolster the growth of industrial waste management market in the forecast timeline. Green consumers (consumers who are environment conscious) have been shown to be willing to pay a higher price for environmentally friendly products, which is a huge opportunity for companies as well as governments looking to make eco-friendly policy changes. Thus, the increasing numbers of consumers who prefer and are willing to buy eco-friendly products are creating an opportunity for businesses that are using eco-friendly or environmentally friendly as a component of their value proposition.

Industrial Waste Management Market: Growth Factors

The industrial waste management market is poised for significant growth in the coming years, driven by a growing emphasis on energy and resource recovery worldwide. This heightened focus on harnessing the potential of waste materials is expected to be a key factor propelling the market forward in the forecast timeline.

As we look ahead to the future, it becomes increasingly evident that the demand for water, food, and energy on a global scale is set to experience continuous and substantial growth. However, this growth is juxtaposed with a concerning decline in the reserves of non-renewable elements such as phosphorus, copper, and zinc.

This pressing issue underscores the urgent need for increased investments in resource recovery and reuse within the realms of food, waste, and sanitation. By prioritizing these sectors, we can effectively address the challenges posed by diminishing reserves and pave the way for a more sustainable future. In addition to the commendable goal of minimizing food waste throughout the entire food chain, resource recovery presents a remarkable opportunity to extract value from resources that may initially appear to be discarded.

Industrial Waste Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Waste Management Market Research Report |

| Market Size in 2023 | USD 1,077.40 million |

| Market Forecast in 2032 | USD 1,832.30 million |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 110 |

| Key Companies Covered | Clean Harbors, Calgon Carbon Corporation, Republic Services Inc., Stericycle Inc., Suez Environment, Remondis SE & Co. KG, Veolia Environnement, Waste Management Inc., Casella Waste Systems Inc., Heritage Environmental Services LLC, and among others. |

| Segments Covered | By Service, By Type, By End-User, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Waste Management Market: Segmentation

The study provides a decisive view of the industrial waste management market by segmenting the market based on service, type, end user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of service, industrial waste management market is segmented into collection, recycling, landfill, and incineration. Recycling is a resource recovery practice that refers to the collection and reuse of waste materials. Recycling operations depend profoundly on production and consumption. Recycled waste is waste material reprocessed in a production process that diverts it from the waste stream, except reuse as fuel. Incineration is a disposal method in which solid organic wastes are subjected to combustion so as to convert them into residue and gaseous products. This method is useful for disposal of both municipal solid waste and solid residue from wastewater treatment

On the basis of type, the industrial waste management market is segmented into non-hazardous and hazardous. Toxic and hazardous waste are materials that can cause serious health problems if disposal is not handled correctly. Primarily, the high-volume of industrial hazardous waste is generated by industries such as chemical, petrochemical, etc. Small - and medium-sized industries that generate hazardous waste include hospital and health-care centers, electroplating and metal finishing shops, etc.

By regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Industrial Waste Management Market: Competitive Space

The key players operating in the industrial waste management market are

- Clean Harbors

- Calgon Carbon Corporation

- Republic Services Inc.

- Stericycle Inc.

- Suez Environment

- Remondis SE & Co. KG

- Veolia Environnement

- Waste Management Inc.

- Casella Waste Systems Inc.

- Heritage Environmental Services LLC

The global industrial waste management market has been segmented as follows:

By Service Segment Analysis

- Collection

- Recycling

- Landfill

- Incineration

By Type Segment Analysis

- Non-Hazardous

- Hazardous

By End-User Segment Analysis

- Machinery & Equipment

- Food & Drug

- Metallic Minerals

- Electronics

- Plastic & Chemicals

- Textile

- Others

Global Industrial Waste Management Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The term "industrial waste management" refers to the handling, treatment, disposal, and regulation of waste that is generated by industrial activities in a responsible and methodical manner.

Increasing focus on energy and resource recovery around the globe is one of the major factors that are expected to fuel the growth of the industrial waste management market in the forecast timeline.

According to study, the Industrial Waste Management Market size was worth around USD 1,077.40 million in 2023 and is predicted to grow to around USD 1,832.30 million by 2032, growing at a CAGR of around 6.20% during 2024-2032.

The key players operating in the industrial waste management market are Clean Harbors, Calgon Carbon Corporation, Republic Services Inc., Stericycle Inc., Suez Environment, Remondis SE & Co. KG, Veolia Environnement, Waste Management Inc., Casella Waste Systems Inc., Heritage Environmental Services LLC, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed