Mobile Positioning System Market Size, Share, Trends, Growth and Forecast 2032

Mobile Positioning System Market: By Application (Mapping And Surviving, Live Tracking Of Objects, Vehicles, And Other), and By Region: Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends And Forecast, 2024-2032

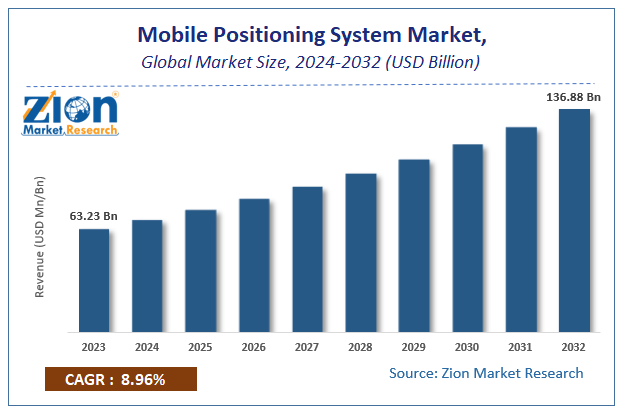

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 63.23 Billion | USD 136.88 Billion | 8.96% | 2023 |

Mobile Positioning System Market Insights

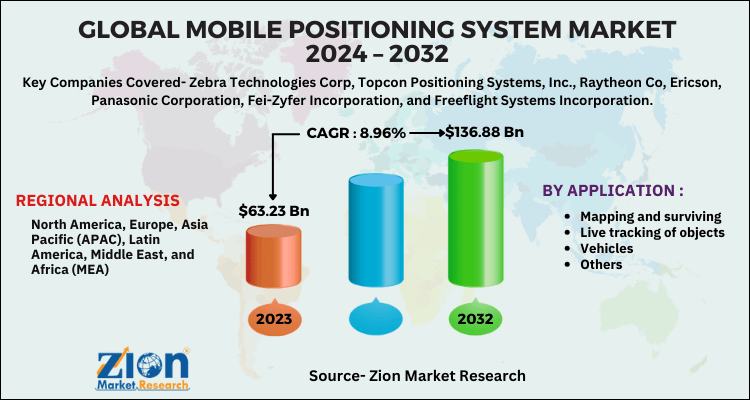

Zion Market Research has published a report on the global Mobile Positioning System Market, estimating its value at USD 63.23 Billion in 2023, with projections indicating that it will reach USD 136.88 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 8.96% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Mobile Positioning System Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Mobile Positioning System Market: Overview

The global marketplace for mobile positioning systems is predicted to witness exponential growth over the approaching years due to the growing demand for top security across the world concerning an alarming rise in terrorist and other criminal activities. The rapidly growing need for efficient transportation is additionally another primary factor that's expected to drive the marketplace for mobile positioning systems over the upcoming years. The event and growing acceptance of the latest technology is additionally expected to magnify the adoption of the mobile positioning system. However, the expansion of the market is predicted to be challenged by the high cost of deployment of mobile positioning systems.

Over the coming years, players are expected to take up partnerships and mergers and acquisitions as their key strategy for business development. Citing an instance, in February 2018, reports stated that the government of India will make the Global Positioning System mandatory in mobile devices. Sources cite that the decision is aimed at enabling the state authorities to equip the mobile devices with panic buttons for helping women in distress. The strategic move is likely to boost the expansion of the mobile positioning system market size in India and across the world.

COVID-19 Impact Analysis

Currently, the demand for mobile positioning systems is on the increase during the COVID-19 pandemic. However, this requirement is probably going to be hindered thanks to reductions within the budgets of electronics companies due to partial lockdowns imposed worldwide. The lockdowns have caused severe losses to the worldwide industry players and placed restrictions on public gatherings at international events, theaters, concerts, and music festivals, which is hindering the market growth. Furthermore, the market is indicating a big recovery rate, mainly attributed to the remote working policies adopted by many industry players to stop the spread of COVID-19 at workplaces. The industry is, however, expected to face challenges within the future due to the consequences of COVID-19.

Mobile Positioning System Market: Growth Factors

Massive security requirements across the world alongside the acceptance of recent vehicle transport systems in developed economies are anticipated to drive mobile positioning system market value within the years ahead. Aside from this, government initiative for public safety with an increase in incidences of terrorist & criminal activities is predicted to propel the demand for the mobile positioning system market within the years ahead.

Mobile Positioning System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Positioning System Market |

| Market Size in 2023 | USD 63.23 Billion |

| Market Forecast in 2032 | USD 136.88 Billion |

| Growth Rate | CAGR of 8.96% |

| Number of Pages | 150 |

| Key Companies Covered | Zebra Technologies Corp, Topcon Positioning Systems, Inc., Raytheon Co, Ericson, Panasonic Corporation, Fei-Zyfer Incorporation, and Freeflight Systems Incorporation |

| Segments Covered | By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Positioning System Market: Segment Analysis

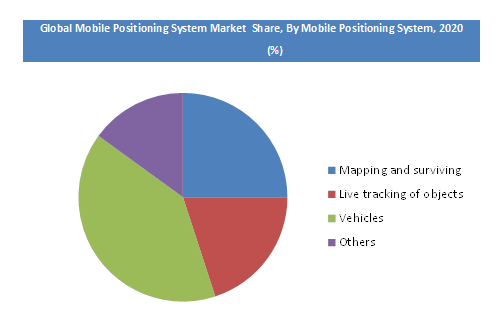

The applications of mobile positioning systems include mapping and surviving, live tracking of objects, security, and vehicles among others. The massive scale deployment of the mobile positioning system in vehicles is anticipated to bode well for the expansion of the market. Vehicle navigation technology has been inseparably linked to the present transportation systems, thus making it the leading application segment.

Mobile Positioning System Market: Regional Segment Analysis Preview

Regionally, North America has been leading the worldwide mobile positioning system market and is anticipated to continue on the dominant position within the years to return. The massive penetration of smart mobile equipment like smartphones and smart wearable devices alongside the acceptance of the latest technologies by market players across the region is that the main factor behind the dominance of the North American mobile positioning system market. The high number of market players being headquartered in North America is another significant factor that's supporting the expansion of this regional mobile positioning system market.

Mobile Positioning System Market: Competitive Landscape

The key companies operating in the Mobile Positioning System market include-

- Zebra Technologies Corp

- Topcon Positioning Systems

- Raytheon Co

- Ericson

- Panasonic Corporation

- Fei-Zyfer Incorporation

- Freeflight Systems Incorporation

The global Mobile Positioning System Market is segmented as follows:

By Application

- Mapping and surviving

- Live tracking of objects

- Vehicles

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mobile Positioning System Market market size valued at US$ 63.23 Billion in 2023

Mobile Positioning System Market market size valued at US$ 63.23 Billion in 2023, set to reach US$ 136.88 Billion by 2032 ,CAGR of about 8.96% from 2024 to 2032.

Some of the key factors driving the global Mobile Positioning System Market growth are Rapid urbanization, a rise in the number of international airports, and the predominant use of mobile positioning systems in object tracking, vehicles, and mapping & surviving will open new vistas of growth for mobile positioning system market.

North America region held a substantial share of the Mobile Positioning System Market in 2032.

The key companies operating in the Mobile Positioning System market include Zebra Technologies Corp, Topcon Positioning Systems, Inc., Raytheon Co, Ericson, Panasonic Corporation, Fei-Zyfer Incorporation, and Freeflight Systems Incorporation are some of the key vendors of mobile positioning system across the world.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed