Wearable Payment Device Market Size, Share Report, Analysis, Trends, Growth 2032

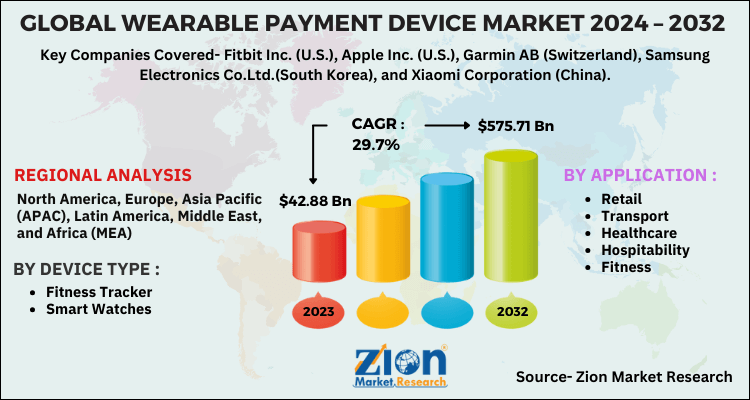

Wearable Payment Device Market By Device Type (Fitness Tracker and Smart Watches), By Application (Retail, Transport, Healthcare, Hospitability, and Fitness), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

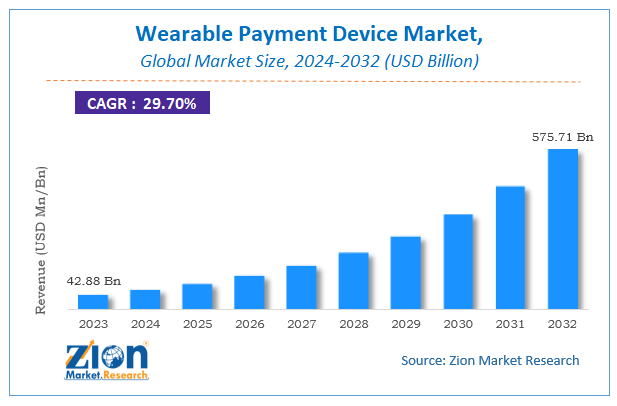

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.88 Billion | USD 575.71 Billion | 29.7% | 2023 |

Wearable Payment Device Market Insights

According to Zion Market Research, the global Wearable Payment Device Market was worth USD 42.88 Billion in 2023. The market is forecast to reach USD 575.71 Billion by 2032, growing at a compound annual growth rate (CAGR) of 29.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Wearable Payment Device Market industry over the next decade.

Wearable Payment Device Market: Overview

The report offers a valuation and analysis of the Wearable Payment Device market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Wearable Payment Device Market: Synopsis

Wearable payment equipment also termed wearables are attached to body parts such as hands for making any type of payment. Some of the most common kinds of wearable payment equipment are smartwatches and fitness trackers. The equipment makes utilization of services such as Apple Pay as well as Samsung Pay for connecting the wearable equipment with the customer's bank account. Citing an instance, in March 2021, Axis Bank introduced India’s first contactless wearable payment equipment named ‘Wear N Pay’ that will help customers in making more convenient on-the-go business transactions. Reportedly, the bank had entered into a partnership with Tappy Technologies for designing & developing this device.

Wearable Payment Device Market: Growth Drivers

The growing trend for cashless payments as well as the necessity of secured financial transactions will drive the growth of the wearable payment equipment market over 2024-2032. Apart from this, large-scale use of smart technologies along with humungous web penetration will steer industry trends. In addition to this, the massive use of smartphones and preference for online payments will create lucrative demand for wearable payment devices over the forthcoming years. The thriving IoT sector as well as the need to provide a seamless shopping experience to end-users will prompt the market space over the years to come.

Furthermore, the low costs of NFC system/tool deployment have given impetus to the wearable payment device market. Additionally, the rise in the spread of the COVID-19 pandemic across the globe will further enhance the need for cashless transactions, thereby resulting in the growing popularity of wearable payment devices. However, a low battery lifecycle and huge costs will create hurdles in the path of industry growth over the forecast timeframe. Nonetheless, rapid digitization of banking operations as well as automation of functions in various financial institutions will not only offset the hindrances but will boost the size of the wearable payment device market in the near future.

Wearable Payment Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wearable Payment Device Market |

| Market Size in 2023 | USD 42.88 Billion |

| Market Forecast in 2032 | USD 575.71 Billion |

| Growth Rate | CAGR of 29.7% |

| Number of Pages | 150 |

| Key Companies Covered | Fitbit Inc. (U.S.), Apple Inc. (U.S.), Garmin AB (Switzerland), Samsung Electronics Co.Ltd.(South Korea), and Xiaomi Corporation (China). |

| Segments Covered | By Application, By Device Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wearable Payment Device Market: Regional Landscape

North America To Occupy Major Share Of Global Wearable Payment Device Market By 2032

The growth of the wearable payment device industry in North America over the assessment period is owing to the presence of giant smart wearable equipment manufacturers in the region. The rise in use of the smart wearable devices by fitness enthusiasts will culminate in the growth of regional market size over the forecast timeframe.

Wearable Payment Device Market: Competitive Landscape

Key participants profiled in the study include

- Fitbit Inc. (U.S.)

- Apple Inc. (U.S.)

- Garmin AB (Switzerland)

- Samsung Electronics Co. Ltd.(South Korea)

- Xiaomi Corporation (China)

The global Wearable Payment Device Market is segmented as follows:

By Application:

- Retail

- Transport

- Healthcare

- Hospitability

- Fitness

By Device Type:

- Fitness Tracker

- Smart Watches

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Growing trend for cashless payments as well as necessity of secured financial transactions will drive the growth of wearable payment equipment market over 2024-2032. Apart from this, large-scale use of smart technologies along with humungous web penetration will steer industry trends. In addition to this, massive use of smartphones and preference of online payments will create lucrative demand for wearable payment devices over the forthcoming years. Thriving IoT sector as well as need to provide seamless shopping experience to end-users will prompt the market space over the years to come.

Furthermore, low costs of NFC system/tool deployment have given impetus to wearable payment device market. Additionally, rise in the spread of COVID 19 pandemic across the globe will further enhance the need for cashless transactions, thereby resulting in growing popularity of wearable payment devices. However, low battery lifecycle and huge costs will create hurdles in the path of industry growth over forecast timeframe. Nonetheless, rapid digitization of banking operations as well as automation of functions in various financial institutions will not only offset the hindrances but will boost the size of wearable payment device market in the near future.

global Wearable Payment Device Market was worth USD 42.88 Billion in 2023. The market is forecast to reach USD 575.71 Billion by 2032, growing at a compound annual growth rate (CAGR) of 29.7% during the forecast period 2024-2032

Which region will make notable contributions towards overall Wearable Payment Device Market revenue?

North America is likely to make noteworthy contributions towards overall market revenue during 2024-2032. The growth of the industry in the sub-continent over the estimated timespan is attributed to presence of giant smart wearable equipment manufacturers in the region. Rise in use of the smart wearable devices by fitness enthusiasts will culminate into growth of regional market size over the forecast timeframe.

The key players profiled in the report include are Fitbit Inc. (U.S.), Apple Inc. (U.S.) Garmin AB (Switzerland), Samsung Electronics Co., Ltd., (South Korea), and Xiaomi Corporation (China).

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed