Fleet Management Systems Market Size, Share, Trends, Growth and Forecast 2032

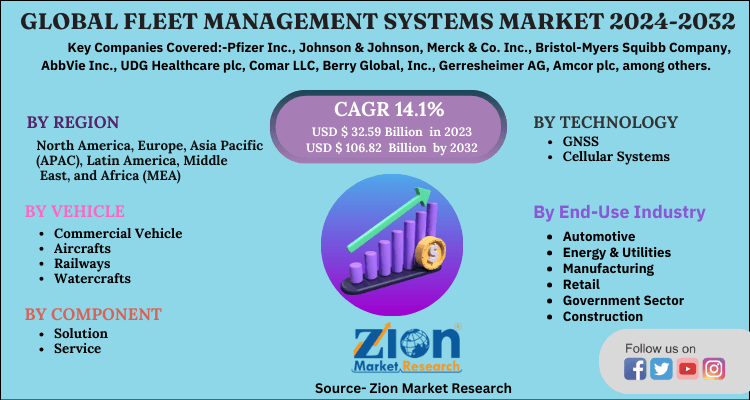

Fleet Management Systems Market - By Vehicle (Commercial Vehicle, Aircrafts, Railways, And Watercrafts), By Component (Solution And Service), By Technology (GNSS And Cellular Systems), And By End-Use Industry (Automotive, Energy & Utilities, Manufacturing, Retail, Government Sector, and Construction): Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024-2032

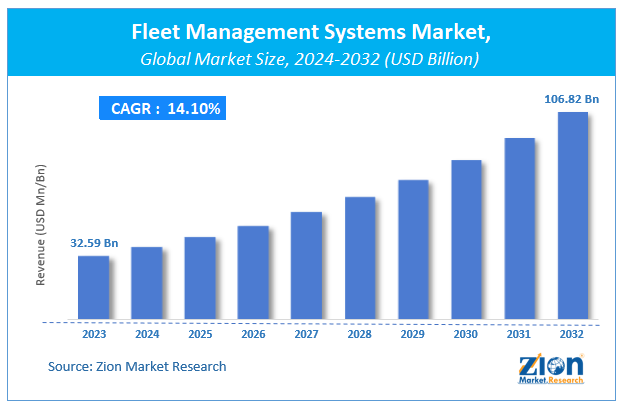

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.59 Billion | USD 106.82 Billion | 14.1% | 2023 |

Fleet Management Systems Market Insights

Zion Market Research has published a report on the global Fleet Management Systems Market, estimating its value at USD 32.59 Billion in 2023, with projections indicating that it will reach USD 106.82 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 14.1% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Fleet Management Systems Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

The report offers assessment and analysis of the Fleet Management Systems Market on a global and regional level. The study offers a comprehensive assessment of the market competition, constraints, revenue estimates, opportunities, evolving trends, and industry-validated data. The report provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Fleet Management Systems Market: Outlook

Fleet management system includes managing of ship, aviation equipment, commercial motor vehicles, rail cars, private vehicles, and non-powered vehicle systems. In addition to this, fleet management comprises of array of functionalities including vehicle maintenance, supply chain management, financing, licensing & compliance, vehicle leasing, accident management & vehicle telematics, speed management, fuel management, driver management, and health & safety management. Moreover, fleet management systems helps firms in transportation industry to minimize risks related to vehicle investment, enhance productivity, reduce transport & staff expenses, and improve efficiency.

Fleet management is a managerial approach that benefits various companies to coordinate and organize vehicle transit to improve their efficiency, curtail transport costs, and comply with government norms and regulations. Fleet management systems are widely used for vehicle tracking and mechanical operations. Various vendors of fleet management systems offer telematics, such as GLONASS, GPS, and GALILEO. These systems providers are focusing on integrating with artificial intelligence (AI) to curtail autonomous vehicle accidents.

Fleet management systems help construction organizations to track the location of heavy machines during transit. In 2016, the global construction output was USD 8.8 trillion in comparison to USD 7.9 trillion in 2012. In 2018, the global construction organizations turnover is estimated to grow by almost 3.2% in comparison to 2.4% in 2017. Thus, it is expected that the construction industry’s growth will fuel the fleet management systems market during the estimated timeframe. Growing number of cyber-attacks might limit the fleet management systems market in the future. However, increasing use of artificial intelligence (AI) in various sectors might open new avenues for the fleet management systems market in the upcoming years.

Fleet Management Systems Market: Growth Drivers

Surge in acceptance of wireless technology, rise in global trade, and necessity of improving operational efficiency in fleet management activities will steer growth of fleet management systems market. Escalating need of enhancing fleet efficacy and massive use of vehicle telematics by fleet operators will proliferate size of fleet management systems industry. In addition to this, increase in acceptance of cloud computing & analytics, reduction in costs of hardware & IoT connectivity, necessity of improving operational proficiency, and favorable government mandates will spur fleet management systems industry growth. Many of fleet firms are adopting green initiatives for reducing ecological impact and improving fleet efficiency, thereby driving market trends.

Furthermore, introduction of new technology and entry of new firms in industry is projected to magnify expansion of fleet management systems market size. Growing requirement of fleet management systems in passenger & commercial vehicles are likely to produce new growth avenues for fleet management systems market.

Fleet Management Systems Market: Segmentation

The fleet management systems market is divided into vehicle, component, technology, and end-use industry. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the vehicle, the global fleet management systems market is segmented into the commercial vehicle, aircrafts, railways, and watercrafts. Commercial vehicles are projected to hold a significant market share during the forecast timeframe, due to the increasing demand for online car rental services. Moreover, increasing investments made by car rental service providers, such as Ola and Uber, in autonomous vehicles is likely to drive this market segment.

By end-use industry, this market includes automotive, energy and utilities, manufacturing, retail, government sector, construction, and others. The government sector is anticipated to grow substantially in the estimated time period, due to growing investments in technology for defense applications.

The Asia Pacific is likely to hold a considerable share of the global fleet management systems market in the upcoming years, due to technological advancements made in developing countries, such as China and India. Furthermore, giant automotive manufacturers, such as Volkswagen, Ford, etc., are planning to set up their manufacturing plants in China, India, and Taiwan. This, in turn, is anticipated to further fuel this regional market’s expansion.

Fleet Management Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fleet Management Systems Market |

| Market Size in 2023 | USD 32.59 Billion |

| Market Forecast in 2032 | USD 106.82 Billion |

| Growth Rate | CAGR of 14.1% |

| Number of Pages | 176 |

| Key Companies Covered | Pfizer Inc., Johnson & Johnson, Merck & Co. Inc., Bristol-Myers Squibb Company, AbbVie Inc., UDG Healthcare plc, Comar LLC, Berry Global, Inc., Gerresheimer AG, Amcor plc, among others |

| Segments Covered | By Material, By Product, By End-Users, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Insights

North America To Contribute Majorly Towards Overall Market Size By 2032

Growth of fleet management systems market in North America over forecast timespan is subject to use of connected systems as well as connected vehicle tools for addressing concerns pertaining to vehicle tracking. Surge in online banking & payment solution firms in region along with launching of new payment services for vehicle fleets will steer growth of fleet management systems market in North America. Rise in presence of firms such as The Boeing Company, Airbus SE, and Bombardier Inc. will create lucrative avenues for fleet management systems industry in North America over forecasting timeline.

Competitive Landscape

Certain players operating in the global fleet management systems market are TomTom N.V., Navico, MiTAC International Corporation, AT&T Inc., Fleetmatics Group PLC, IBM Corporation, Freeway Fleet Systems, I.D. Systems, Telogis, Cisco Systems, Inc., ABB, and Honeywell International Inc., among others.

Key players profiled in report and influencing growth of fleet management systems industry are -

- Cisco Systems

- ABB Ltd.

- TomTom N.V.

- Telogis

- Navico

- MiTAC International Corporation

- AT&T Inc.

- Fleetmatics Group PLC

- IBM Corporation

- Freeway Fleet Systems

- I.D. Systems

- Honeywell International Inc.

The global Fleet Management Systems Market is segmented as follows:

By Vehicle

- Commercial Vehicle

- Aircrafts

- Railways

- Watercrafts

By Component

- Solution

- Service

By Technology

- GNSS

- Cellular Systems

By End-Use Industry

- Automotive

- Energy & Utilities

- Manufacturing

- Retail

- Government Sector

- Construction

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed