Mobile Point of Sale (mPOS) Market Size, Share, Trends and Analysis 2032

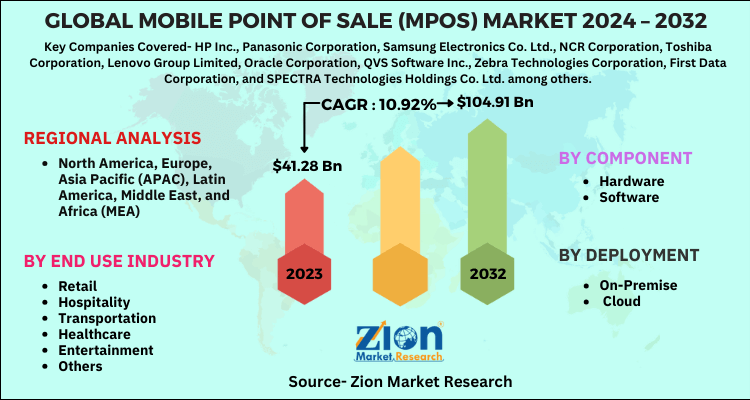

Mobile Point of Sale (mPOS) Market By Component (Hardware and Software), By Deployment (On-Premise and Cloud) by End Use Industry (Retail, Hospitality, Transportation, Healthcare, Entertainment and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

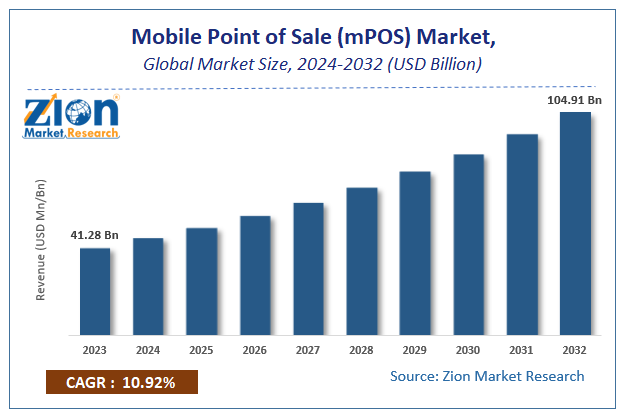

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 41.28 Billion | USD 104.91 Billion | 10.92% | 2023 |

Mobile Point of Sale (mPOS) Market Insights

According to Zion Market Research, the global Mobile Point of Sale (mPOS) Market was worth USD 41.28 Billion in 2023. The market is forecast to reach USD 104.91 Billion by 2032, growing at a compound annual growth rate (CAGR) of 10.92% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Mobile Point of Sale (mPOS) Market industry over the next decade.

Mobile Point of Sale (mPOS) Market: Overview

A tablet, smartphone, or dedicated wireless computer that performs the functions of an electronic point-of-sale terminal (POS terminal) or a cash register wirelessly is known as an mPOS (mobile point-of-sale). Businesses that need to make purchases on the go benefit from mPOS. Consumer adoption of mobile point-of-sale devices has been driven by rising demand for contactless and cashless payments, along with the need for inventory monitoring, customer and employee management, and in-store sales and online unification.

In addition, the growing usage of smartphones has boosted the demand for portable POS systems, resulting in market growth. Over the years, the demand for mPOS devices that enable transactions across sectors such as lodging, shopping, banking, and transportation has grown across businesses of all sizes.

Nationwide lockdowns were implemented in various countries across the globe, to fight the spread of the COVID-19 pandemic. This resulted in reduced demand for new POS devices or their services, as most of the industries like retail, hospitality, entertainment, etc, were physically shut. However, since it does not require the use of a common terminal, demand for mobile POS (mPOS) systems increased relatively. The pandemic had a negative effect on the global tourism industry along with the industries like retail, sports, and restaurants, which were key consumers for POS vendors, suffering a decline as these activities came to a halt in 2020.

Mobile Point of Sale (mPOS) Market: Growth Factors

Over the last few years, the rise in financial frauds has influenced government bodies across the world to protect and safeguard payment transactions. The market for secure payment systems has grown as consumers demand stable and safe digital transactions. As a result, these regulatory authorities have had a positive effect on the implementation of POS terminals in their respective regions. The global mobility trend is one of the factors due to which the market for mPOS devices is gaining popularity. Since the adoption of cashless transactional technology, POS has seen an increase in usage rates.

The potential development of terminals and face-to-face outlets is likely to be influenced by the growth of e-commerce and the merging of brick-and-mortar and online retailing activities. With big e-commerce sites now offering cash on delivery, a boom in the use of handheld POS terminals has been observed.

Mobile Point of Sale (mPOS) Market: Segment Analysis Preview

This is attributable to the technological advancements that have taken place in the domain of cloud computing. These advancements have resulted in the increased use of POS devices that are based on Software-as-a-Service (SaaS) platforms. The said software combines the functionalities of screen terminals and barcode scanners and in addition, provides features of backup and data restoration. The mobile POS platforms are specially designed to perform the functionalities related to the industry market operations. For example, management of gift and credit cards, internet orders, kitchen boards, menu displays, floor plans, and raw material inventory is all aspects of restaurant POS applications.

This growth can be attributed to the fact that small retailers using new payment options would drive the segment growth. Disney Stores, Target, Home Depot, and several other retailers have reported chain-wide adoption of mPOS solutions in their operational activities. In addition, the penetration of retail-oriented products is expected to increase because of the use of mobile wallet technologies. Technology adoption in various industries, like healthcare, hospitality, and entertainment along with the advent of wireless networking is expected to boost business growth. The need to accelerate the checkout process and avoid line bursting is expected to propel the mPOS devices industry forward.

Mobile Point of Sale (mPOS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Point of Sale (mPOS) Market |

| Market Size in 2023 | USD 41.28 Billion |

| Market Forecast in 2032 | USD 104.91 Billion |

| Growth Rate | CAGR of 10.92% |

| Number of Pages | 110 |

| Key Companies Covered | HP Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., NCR Corporation, Toshiba Corporation, Lenovo Group Limited, Oracle Corporation, QVS Software Inc., Zebra Technologies Corporation, First Data Corporation, and SPECTRA Technologies Holdings Co. Ltd. among others |

| Segments Covered | By Component, By Deployment, By End Use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Point of Sale (mPOS) Market: Regional Analysis Preview

This share is attributable to the adoption of mobile POS devices across various industries particularly entertainment, healthcare, and retail. The USA holds a major share in the North American mobile POS devices market. For many years now, various types of mobile POS devices have been used in stores and outlets in the country, which has boosted the need to update existing technologies with new ones.

This surge can be attributed to an increase in the adoption of digital payment technology in the Asia Pacific that has generated a pool of opportunities for the mPOS market in countries like India, China, and Japan. Furthermore, government policies to promote a cashless economy are driving up demand for mPOS devices in this region. The booming tablet market and smartphone markets in Asia-Pacific, particularly in China and India, are expected to benefit the region's mPOS devices industry during the forecast period.

Mobile Point of Sale (mPOS) Market: Key Players & Competitive Landscape

Some of the key players in the mobile POS devices market are

- HP Inc

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- NCR Corporation

- Toshiba Corporation

- Lenovo Group Limited

- Oracle Corporation

- QVS Software Inc

- Zebra Technologies Corporation

- First Data Corporation

- SPECTRA Technologies Holdings Co. Ltd

The global mobile point of sale (mPOS) devices market is segmented as follows:

By Component

- Hardware

- Software

By Deployment

- On-Premise

- Cloud

By End Use Industry

- Retail

- Hospitality

- Transportation

- Healthcare

- Entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Mobile Point of Sale (mPOS) Market was worth USD 41.28 Billion in 2023. The market is forecast to reach USD 104.91 Billion by 2032.

According to Zion Market Research, the global Mobile Point of Sale (mPOS) Market a compound annual growth rate (CAGR) of 10.92% during the forecast period 2024-2032.

Some of the key factors driving the global mobile point of sale (mPOS) devices market growth are rising demand for cashless and contactless payments, as well as the need for employee and customer management, inventory monitoring, and online and in-store sale unification.

This is due to an increase in the adoption of digital payment technology in Asia Pacific has generated a pool of mPOS opportunities in countries like China, Japan, and India, over the forecast period. Furthermore, government policies to promote a cashless economy are driving up demand for mPOS devices in this region. The booming smart phone and tablet market in Asia-Pacific, particularly in China and India is also driving the growth.

Some of the major companies operating in the mobile point of sale (mPOS) devices market are Samsung Electronics Co. Ltd., HP Inc., Panasonic Corporation, NCR Corporation, Lenovo Group Limited, Toshiba Corporation, QVS Software Inc., Oracle Corporation, Zebra Technologies Corporation, SPECTRA Technologies Holdings Co. Ltd. and First Data Corporation among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed