Global Financial Fraud Detection Software Market Size, Share, Growth Analysis Report - Forecast 2034

Financial Fraud Detection Software Market By Component (Software, Services), By Deployment Mode (On-premise, Cloud), By Application (Payment Fraud, Insurance Fraud, Identity Theft, Money Laundering, Others), By End-user (BFSI, E-commerce, Retail, Healthcare, Government, Others), By Organization Size (Large Enterprises, SMEs), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

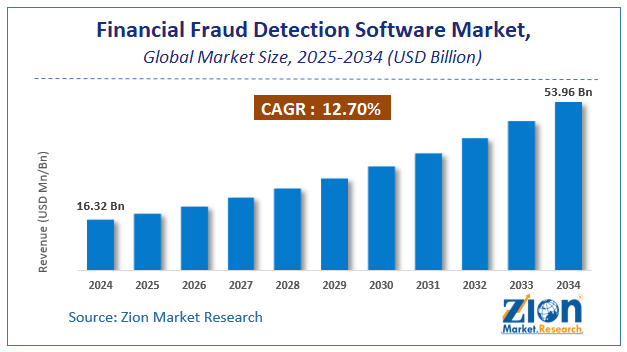

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.32 Billion | USD 53.96 Billion | 12.7% | 2024 |

Financial Fraud Detection Software Market: Industry Perspective

The global financial fraud detection software market size was worth around USD 16.32 Billion in 2024 and is predicted to grow to around USD 53.96 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.7% between 2025 and 2034. The report analyzes the global financial fraud detection software market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the financial fraud detection software industry.

Financial Fraud Detection Software Market: Overview

Financial fraud detection software and programs that assist in identifying, detecting, and preventing any finance-related malpractices or fraudulent activities that may be occurring in various types of financial institutions. The tools leverage the benefits of advanced technologies and analytical algorithms to scan through large volumes of data in real-time and quickly to detect any transaction that deviates from normal patterns and could be an indicator of fraud. The industry is growing at an exceptional rate as the world moves toward digitizing every aspect of financial transactions that occur at the business or personal level. The software programs make use of different types of solutions like authentication solutions, fraud analytics, risk and compliance solutions governance, and solutions that monitor transactions across the consumer group of the financial unit using the software. These programs are essential in detecting any abnormal payment patterns and transactions and are useful in avoiding irreparable damage to the entity using the software.

Key Insights

- As per the analysis shared by our research analyst, the global financial fraud detection software market is estimated to grow annually at a CAGR of around 12.7% over the forecast period (2025-2034).

- Regarding revenue, the global financial fraud detection software market size was valued at around USD 16.32 Billion in 2024 and is projected to reach USD 53.96 Billion by 2034.

- The financial fraud detection software market is projected to grow at a significant rate due to Rising cyber threats and regulatory requirements for fraud prevention drive adoption. Growth in digital payments and fintech also supports demand.

- Based on Component, the Software segment is expected to lead the global market.

- On the basis of Deployment Mode, the On-premise segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Payment Fraud segment is projected to swipe the largest market share.

- By End-user, the BFSI segment is expected to dominate the global market.

- In terms of Organization Size, the Large Enterprises segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Financial Fraud Detection Software Market: Growth Drivers

Growing incidences of financial fraud to propel market growth

The global financial fraud detection software market is projected to grow owing to the growing associated incidences across the globe. Such incidents are occurring more frequently in recent times as compared to the last decade and they can be observed across transaction groups including personal transactions, business-related, and government unit-related. The banking sector along with other units that deal in different types of monetary transactions has become highly prone to cyber-attacks and financial fraud. Factors like rapid digitization, lack of security awareness amongst consumers, insider threats, rising complexity, and economic instability are the leading causes of the increase in digital cyber-crimes including financial fraud. In addition to this, the rising rate of digital payment systems makes consumers more vulnerable to becoming victims to financial fraudsters causing a greater need to have fraud-detecting software programs in place.

Financial Fraud Detection Software Market: Restraints

Integration challenges to restrict the market growth

One of the key growth restrictions that exist in the global financial fraud detection software industry is the complex integration challenges faced by market players in terms of aligning new systems along with already existing technologies in place. Integrating fraud detection software programs can be challenging and time-consuming. Furthermore, it required high initial investment along with expenses associated with the employment of skilled professionals that can optimize the use of advanced technology. Additionally, companies are required to spend on training existing employees for them to become comfortable with using new and complex systems for maximum optimization.

Financial Fraud Detection Software Market: Opportunities

Higher demand for end-user verticals to provide growth opportunities

Given the benefits of using financial fraud detection software programs, the demand for such systems has increased multifold in the last couple of years. Earlier, the main target consumer group for product providers were banking and financial institutes. However, in recent times, corporates and smaller businesses have incorporated such tools to detect any fraudulent activities in everyday business transactions. Moreover, the growing e-commerce sector is expected to open more doors for growth as it is one of the hotspots in terms of financial fraud.

Financial Fraud Detection Software Market: Challenges

Growing incidents of false positive rates to act as a challenge

False positive rates are incidents in which the program concludes legitimate transactions as fraudulent activities. The growing rate of such incidents is a major challenge for global industry players to tackle. False positive rates can occur due to multiple human or mechanical errors like the input of wrong data, along with lack of context and integration, and several other times of human error in understanding. Software programs are also highly prone to collapse under certain situations.

Financial Fraud Detection Software Market: Segmentation Analysis

The global financial fraud detection software market is segmented based on Component, Deployment Mode, Application, End-user, Organization Size, and region.

Based on Component, the global financial fraud detection software market is divided into Software, Services.

On the basis of Deployment Mode, the global financial fraud detection software market is bifurcated into On-premise, Cloud.

By Application, the global financial fraud detection software market is split into Payment Fraud, Insurance Fraud, Identity Theft, Money Laundering, Others.

In terms of End-user, the global financial fraud detection software market is categorized into BFSI, E-commerce, Retail, Healthcare, Government, Others.

By Organization Size, the global Financial Fraud Detection Software market is divided into Large Enterprises, SMEs.

Financial Fraud Detection Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Financial Fraud Detection Software Market |

| Market Size in 2024 | USD 16.32 Billion |

| Market Forecast in 2034 | USD 53.96 Billion |

| Growth Rate | CAGR of 12.7% |

| Number of Pages | PagesNO |

| Key Companies Covered | Feedzai, FICO, Oracle, ThreatMetrix, SAS, SAP, Fiserv, IBM, Experian, Bottomline Technologies, Software AG, Simility, NICE Actimize, Featurespace, BAE Systems, Socure, and Forter, to name a few., and others. |

| Segments Covered | By Component, By Deployment Mode, By Application, By End-user, By Organization Size, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Financial Fraud Detection Software Market: Regional Analysis

North America to emerge as the largest market

The global financial fraud detection software market is expected to register the highest growth in North America since it currently holds the most significant segment of the global market share. Factors like the presence of key industry players along with a high product awareness rate and growing adoption of advanced systems to improve digital safety aspects are leading reasons for high regional CAGR. The US is home to one of the most advanced banking systems that work with updated IT infrastructure and banking technologies.

The growing number of fraudulent transactions including identity theft and credit or debit card fraud has led to the government deploying various stringent regulatory measures to ensure consumer safety. Growth in Asia-Pacific is expected to be driven by the rising number of players along with the growing use of digital payment methods necessitating better safety processes in place.

Recent Developments:

- In January 2023, the Reserve Bank of India (RBI), the country's national bank, issued a green signal to 6 entities for testing fintech products that can effectively manage financial fraud. The move came under India’s sandbox scheme, which deals with the live testing of products and services. The 6 entities include Creditwatch and HSBC bank

- In March 2022, ACI Worldwide, a leading provider of real-time payment software programs and services, launched Fraud Scoring Services. It is the first-of-its-kind fraud scoring platform that uses advanced machine learning abilities and can be used by financial units of all sizes

- In June 2022, eFraud Services announced the launch of a new financial fraud detection software called eFraud Converter which is Ai-driven and a software-as-a-service (SaaS) solution

Financial Fraud Detection Software Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the financial fraud detection software market on a global and regional basis.

The global financial fraud detection software market is dominated by players like:

- Feedzai

- FICO

- Oracle

- ThreatMetrix

- SAS

- SAP

- Fiserv

- IBM

- Experian

- Bottomline Technologies

- Software AG

- Simility

- NICE Actimize

- Featurespace

- BAE Systems

- Socure

- and Forter

- to name a few.

The global financial fraud detection software market is segmented as follows;

By Component

- Software

- Services

By Deployment Mode

- On-premise

- Cloud

By Application

- Payment Fraud

- Insurance Fraud

- Identity Theft

- Money Laundering

- Others

By End-user

- BFSI

- E-commerce

- Retail

- Healthcare

- Government

- Others

By Organization Size

- Large Enterprises

- SMEs

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Financial fraud detection software and programs that assist in identifying, detecting, and preventing any finance-related malpractices or fraudulent activities that may be occurring in various types of financial institutions.

The global financial fraud detection software market is expected to grow due to Rising cyber threats and regulatory requirements for fraud prevention drive adoption. Growth in digital payments and fintech also supports demand.

According to a study, the global financial fraud detection software market size was worth around USD 16.32 Billion in 2024 and is expected to reach USD 53.96 Billion by 2034.

The global financial fraud detection software market is expected to grow at a CAGR of 12.7% during the forecast period.

North America is expected to dominate the financial fraud detection software market over the forecast period.

Leading players in the global financial fraud detection software market include Feedzai, FICO, Oracle, ThreatMetrix, SAS, SAP, Fiserv, IBM, Experian, Bottomline Technologies, Software AG, Simility, NICE Actimize, Featurespace, BAE Systems, Socure, and Forter, to name a few., among others.

The report explores crucial aspects of the financial fraud detection software market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed