Mobile Gaming Market Size, Share Report, Analysis, Trends, Growth 2032

Mobile Gaming Market by Platform (Android, iOS and Others) by Device (Smartphones and Tablets): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

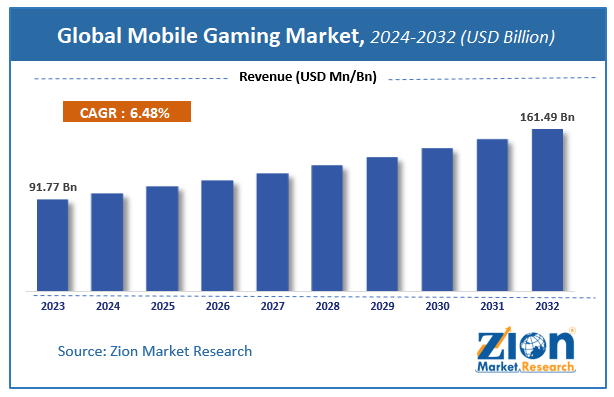

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 91.77 Billion | USD 161.49 Billion | 6.48% | 2023 |

Mobile Gaming Market Insights

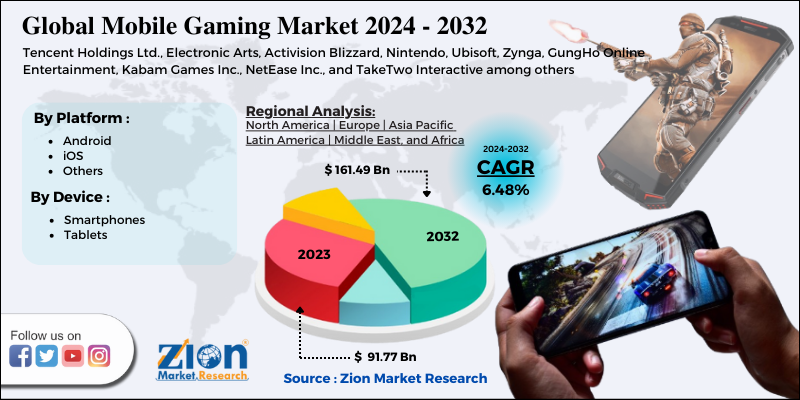

Zion Market Research has published a report on the global Mobile Gaming Market, estimating its value at USD 91.77 Billion in 2023, with projections indicating that it will reach USD 161.49 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.48% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Mobile Gaming Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Mobile Gaming Market: Overview

Mobile games are basically video games that are played on smartphones, feature phones, smartwatches, tablets, computers or any other portable media players. Infrared, Bluetooth, Wi-Fi, and 3G are a few of the networking features available on today's mobile phones, especially smartphones, that enable mobile gaming online. Wireless multiplayer games with two or more players are made possible by these technologies. These days mobile games are usually downloaded through an app store or a mobile operator's portal, but also at times are pre-installed in handheld devices by the OEM or the mobile operator when purchased.

The proliferation of smartphones and technological advancements clubbed with the increasing adoption of latest technologies for developing games are some major factors driving the market for mobile gaming industry. Free-to-play is becoming a popular pricing model within the market that allows users to sample a game before committing to it in terms of money and time spent. In-game purchases and ads are also becoming a popular trend and source of revenue for mobile gaming companies. 2023 was a good year for mobile game media buy as it witnessed rapid growth.

Mobile Gaming Market: Growth Factors

Owing to a shift of gamers away from consoles and pre-installed computer games and towards games on smartphones and tablets, the mobile games market is expected to develop significantly over the forecast period. Mobile games are likely to become more prominent at the expense of gaming on computers due to their growing popularity.

New trends in mobile gaming, such as AR/VR enabled mobile games, location-based games, blockchain-based game and cloud gaming are also expected to fuel the demand for mobile games. Customers are particularly drawn to the benefits offered by smart games on the cloud.

Governments around the globe are also supporting the gaming industry by establishing funds, which is also anticipated to develop space for mobile games. For example, the German government in 2019 allocated EUR 50 million for the creation of a games fund.

Mobile Gaming Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Gaming Market |

| Market Size in 2023 | USD 91.77 Billion |

| Market Forecast in 2032 | USD 161.49 Billion |

| Growth Rate | CAGR of 6.48% |

| Number of Pages | 140 |

| Key Companies Covered | Tencent Holdings Ltd., Electronic Arts, Activision Blizzard, Nintendo, Ubisoft, Zynga, GungHo Online Entertainment, Kabam Games Inc., NetEase Inc., and TakeTwo Interactive among others. |

| Segments Covered | By Platform, By Device and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Gaming Market: Segmentation

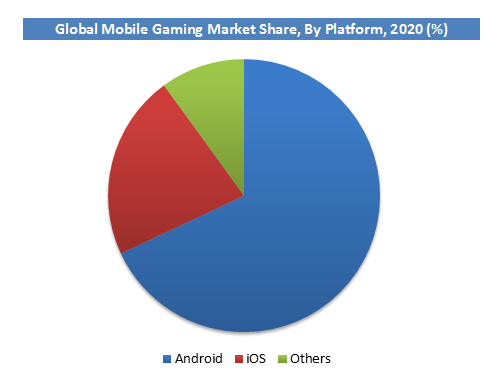

Platform Segment Analysis Preview

Android segment held a share of around 68% in 2023. This is attributable to the growing popularity and user base of android phones. The demand for android phones is expected to increase rapidly in the coming years, thereby stimulating growth for mobile gaming.

Device Segment Analysis Preview

Smartphone segment will grow at a CAGR of over 10.9 % from 2024 to 2032. Smartphone gaming has been increasingly popular around the world, and this trend is expected to continue throughout the projected future. The demand for smartphones in mobile gaming will continue to grow in the future due to their lower cost and easy mobility compared to other devices such as tablets. Integration of AR and VR technologies in smartphones is also expected to augment growth by enhancing the smartphone gaming experience.

Regional Analysis Preview

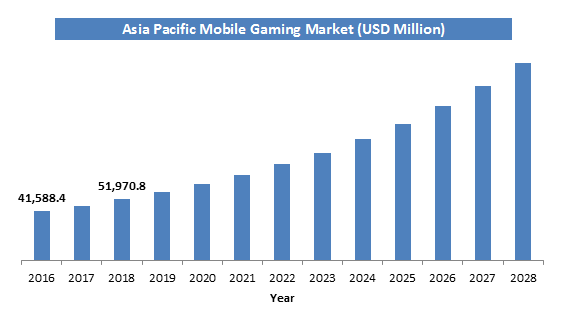

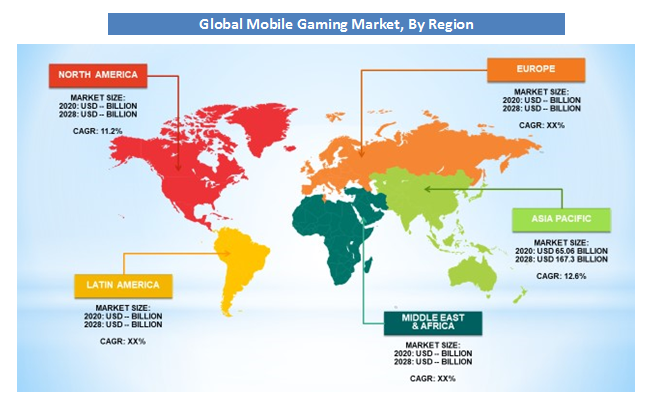

The Asia Pacific region held a share of around 39% in 2023. Asia Pacific is expected to witness the highest growth primarily owing to the rapid increase of smartphone users in regions such as China, causing an increase in mobile gaming. South Korea is leading the way behind China with a high penetration of mobile games in an already rapidly growing gaming industry. In 2023 itself, revenues from mobile gaming increased by 23.1% in South Korea. India is also one of the fastest-growing smartphone markets, with smartphone sales predicted to nearly double by 2022. Presence of key players such as Tencent Holdings Ltd. is also expected to augment growth in this region.

The North America region is projected to grow at a CAGR of around 11.2% over the forecast period. Smartphone penetration, content localization and fast internet bandwidth are expected to facilitate growth in this region. To grab the attention and imagination of gamers all around the world, the mobile gaming business in the region is constantly growing in step with latest technologies such as augmented reality and virtual reality.

Mobile Gaming Market: Competitive Landscape

Some of key players in automated sortation system market are

- Tencent Holdings Ltd.

- Electronic Arts

- Activision Blizzard

- Nintendo

- Ubisoft

- Zynga

- GungHo Online Entertainment

- Kabam Games Inc.

- NetEase Inc.

- TakeTwo Interactive

- among others.

To remain competitive, key players are developing new technology and coming up with new launches. More companies are entering the market seeing a potential for growth. Some of the market leaders are acquiring their way into mobile gaming. Tencent, for example, has purchased Glu Mobile, Netmarble, Pocket Gems, and Supercell in part or in whole to gain a foothold in the global mobile gaming market.

The global mobile gaming market is segmented as follows:

By Platform

- Android

- iOS

- Others

By Device

- Smartphones

- Tablets

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global mobile gaming market was valued at USD 91.77 Billion in 2023.

The global mobile gaming market is expected to reach USD 161.49 Billion by 2032, growing at a CAGR of 6.48% between 2024 to 2032.

Some of the key factors driving the global mobile gaming market growth are proliferation of smartphones and technological advancements clubbed with the increasing adoption of latest technologies such as AR and VR.

Asia Pacific region held a substantial share of the mobile gaming market in 2023. This is attributable to the proliferation of smartphones and presence of key players such as Tencent Holdings Ltd. and Nintendo among others. North America region is projected to grow at a significant rate owing to the rising demand for mobile games in the region.

Some of the major companies operating in the mobile gaming market are Tencent Holdings Ltd., Electronic Arts, Activision Blizzard, Nintendo, Ubisoft, Zynga, GungHo Online Entertainment, Kabam Games Inc., NetEase Inc., and TakeTwo Interactive among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed