Marine Engine Market Size, Share, Trends, Growth 2032

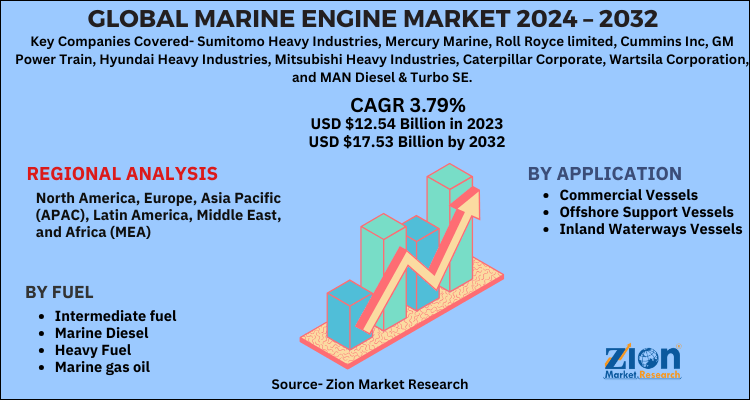

Marine Engine Market By Fuel (Intermediate Fuel, Marine Diesel, Heavy Fuel, Marine Gas Oil) By Application (Commercial Vessels, Offshore Support Vessels, And Inland Waterways Vessels Applications): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

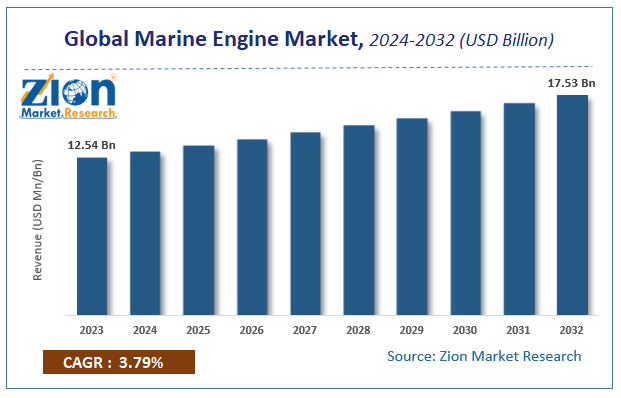

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.54 Billion | USD 17.53 Billion | 3.79% | 2023 |

Marine Engine Market Insights

Zion Market Research has published a report on the global Marine Engine Market, estimating its value at USD 12.54 Billion in 2023, with projections indicating that it will reach USD 17.53 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 3.79% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Marine Engine Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Marine Engine Market Overview

Maritime transport is taken into account to be the backbone of international trade. Consistent with data published by the International Chamber of Shipping (UK), approximately 90% of the worldwide volume of merchandise trade is administered via sea, as this channel is cheaper than rail and road transport. Countries in the Asia Pacific became the leading providers of manufactured goods. Thus, the demand for container ships is significantly high in this region, due to a rise in the export of products.

Most shipbuilding companies, including manufacturers of propulsion systems and engines, are located in the Asia Pacific. Thus, the demand for maritime transport services and therefore the growth of the shipping industry in the Asia Pacific have contributed to the increasing demand for marine engines.

Global Marine Engine Market: Growth Factors

The major boosting factors for the development of the marine engine market are the advanced development of inland waterways vessels, the emergence of new technologies, and the high requirement for commercial vessels. Huge capital constraints and huge demands for R&D activities can be limiting factors for the development of the marine engine market.

The global marine engine market provides new growth avenues due to the rising requirement for hybrid fuel engines. The rise in the requirement for low-priced engines will also elevate the growth of the marine engine market.

Marine Engine Market: Segment Analysis Preview

The marine engine market is divided based on applications and fuels. Based on fuel, the global marine engine market is categorized into marine diesel, intermediate fuel, marine gas oil, and heavy fuel. The heavy fuel market section has the biggest share of the marine engine market owing to huge requirements all over the world. Increasing the requirement for a fiscally viable engine paired with an increment in seaborne trade will boost the development of the marine engine market.

Based on application, the commercial segment is estimated to account for the largest size of the marine engines market in 2020. This growth is attributed to the increasing international freight trade and cargo movement aided by the installation of advanced electrical devices because of the aging infrastructure.

Marine Engine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Engine Market |

| Market Size in 2023 | USD 12.54 Billion |

| Market Forecast in 2032 | USD 17.53 Billion |

| Growth Rate | CAGR of 3.79% |

| Number of Pages | 178 |

| Key Companies Covered | Sumitomo Heavy Industries, Mercury Marine, Roll Royce limited, Cummins Inc, GM Power Train, Hyundai Heavy Industries, Mitsubishi Heavy Industries, Caterpillar Corporate, Wartsila Corporation, and MAN Diesel & Turbo SE. |

| Segments Covered | By Fuel, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Marine Engine Market: Regional Analysis Preview

The Asia Pacific was the largest and most attractive area for the marine engine market. An extra factor adding to the development of the marine engine market will be an increment in maritime trade in South East Asia deployed by China and other emerging nations in the region including Indonesia. Owing to the high ship-developing activity in the Asia Pacific area, it has become an active spot for the marine engine market.

Key Market Players & Competitive Landscape

Some of the major companies comprised in the global marine engine market are

- Sumitomo Heavy Industries

- Mercury Marine

- Roll Royce limited

- Cummins Inc

- GM Power Train

- Hyundai Heavy Industries

- Mitsubishi Heavy Industries

- Caterpillar Corporate

- Wartsila Corporation

- MAN Diesel & Turbo SE.

The global Marine Engine market is segmented as follows:

By Fuel

- Intermediate fuel

- Marine Diesel

- Heavy Fuel

- Marine gas oil

By Applications

- Commercial Vessels

- Offshore Support Vessels

- Inland Waterways Vessels

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed