Lubricants Market Size, Share Report, Analysis, Trends, Growth 2032

Lubricants Market Size Analysis By Base Oil (Greases, Mineral Oil, Synthetic Oil, Bio-Based Oil), By Product (Engine Oil, Hydraulic Fluid, Metalworking Fluid, Gear Oil, Compressor Oil, Grease, Turbine Oil, Others), By End-Use Industry (Transportation, Industrial), by Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

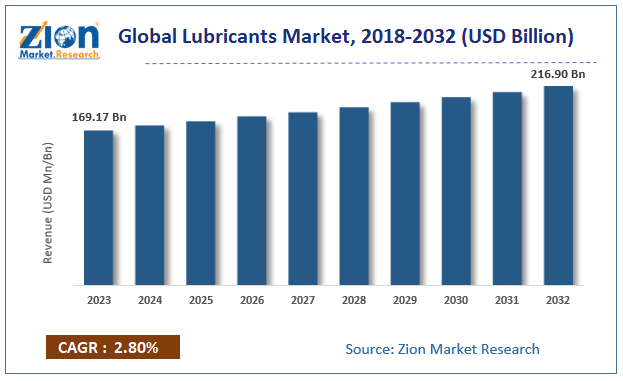

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 169.17 Billion | USD 216.90 Billion | 2.8% | 2023 |

Lubricants Market: Overview

The global Lubricants market size accrued earnings worth approximately USD 169.17 Billion in 2023 and is predicted to gain revenue of about USD 216.90 Billion by 2032, is set to record a CAGR of nearly 2.8% over the period from 2024 to 2032.

This is attributed to the growing demand for automotive oils and greases due to the growing trade of vehicles and spare parts. Lubricants are an essential part of rapidly expanding industries. They are used between two relatively moving machinery parts to reduce friction and wear & tear. They can be either petroleum-based or water-based and are essential for proper machinery functioning. Lubricants also decrease operational downtime and eventually increase overall productivity. Lubricants are extensively used in processing industries and automobile parts, especially brakes and engines, which need lubrication for continuous smooth functioning.

Lubricants Market Outlook

Lubricants are used to reduce wear and friction between surfaces in contact that are in relative motion. Based upon the nature of lubricant they are also used to eliminate wear debris and heat, to seal, protect and transmit power along with acting as a supply additive into the contact. A lubricant is in semisolid, gaseous, solid or liquid forms. Many lubricants consist of additive in the range of 5 to 30% to enhance their performance.

The marine industry is expected to register significant growth owing to increasing leisure boat production to cater to enhanced tourism. Leisure boat includes cabin cruisers, propulsion systems, personal watercraft, jet boats, drive power boats, pontoon boats, sailboats, fishing boats, towboats, and runabouts. There is a growing demand of these boats worldwide in the past decade that has induced lubricants consumption in the industry. Recreational boating is anticipated to have a positive outlook along with new avenues in a sailboat, outboard, stern drive, and inboard. Lubricants market will witness substantial gains in coming years owing to the bulging tourism industry globally.

Lubricants Market Growth Analysis

Automotive production will depict an exponential growth scenario in emerging countries as compared to developed economies during the forecast period. The growth can be attributed to stabilizing economic conditions and rising urbanization in the corresponding regions. Vehicles fleet will flourish by a modest CAGR owing to higher adoption and production rate of passenger cars. Further, to comply with regional safety rules & regulations, producers are increasingly making use of lubricants in their vehicle variants. Lubricants are even utilized to provide better fuel efficiency to high-powered engines. European regulations restricting vehicle emissions has induced owners to maintain their cars by periodically lubricating their engines and various parts.

This report offers a comprehensive analysis of the global lubricants market along with, market trends, drivers, and restraints of the lubricants market. This report includes a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, the secondary and primary research teams of industry experts.

The study provides a decisive view of the lubricants market by segmenting the market based on product, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. Based on the product, the segmentation of the lubricants market is Greases, Bio-based, Synthetic, and Mineral oil. Based on application, the segmentation of the lubricants market is Industrial, Automotive, Marine, and Aerospace.

Lubricants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lubricants Market |

| Market Size in 2023 | USD 169.17 Billion |

| Market Forecast in 2032 | USD 216.90 Billion |

| Growth Rate | CAGR of 2.8% |

| Number of Pages | 214 |

| Key Companies Covered | Shell PLC. (U.K.), BP p.l.c. (U.K.), FUCHS (Germany), Petroliam Nasional Berhad (Patrons) (Malaysia), Lubrita Europe B.V (Europe), Liberty Lubricants (U.S.), China Petrochemical corporation (China), TotalEnergies (France), ExxonMobil Corporation (U.S.), Phillips 66 company (U.S.), Indian Oil Corporation Ltd. (India), Idemitsu Kosan Co.,Ltd. (Japan), Chevron Corporation (U.S.), JX Nippon Oil & Gas Exploration Corporation (Japan), KLÜBER LUBRICATION INDIA Pvt. Ltd. (India), Mineral Oil Corporation (India), Valvoline (U.S.), ENEOS Holdings, Inc, (Japan). |

| Segments Covered | By Base Oil, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lubricants Market Segmentation Analysis

Based on product, lubricants market is classified as greases, bio-based, synthetic and mineral oil. Greases are anticipated to register significant gains over the forecast timeframe owing to its wide applications in mining, unconventional energy, and chemicals sector and will strengthen its demand in industrial engines, hydraulics, centrifuges, bearings and compressors in future. Various applications involving the use of lubricants are industrial, automotive, marine and aerospace. Industrial machinery will account for major share of the market, as there is increasing adoption of this machinery in power generation, manufacturing and agricultural sectors.

Lubricants Market Regional Analysis

The Asia Pacific will witness substantial growth over the forecast timeframe subject to rising demand from metal forming, plastics, mining, and machining industry majorly in India and China. India lubricants market is anticipated to register gains of above 11% in revenue generation due to strong lubricant consumption in manufacturing and automotive industries. Increasing concerns over carbon dioxide emission and fuel economy will stimulate Europe lubricants market till 2032. Germany contributes over 10% in regions volume share and will witness the growth of above 8% in revenue generation till 2032. Increasing construction sector, capital, and consumer goods will complement regional industry outlook during the forecast period.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Each region has been further segmented into countries such as the U.S., Canada, Mexico, UK, France, Germany, Italy, Poland, Russia, China, India, Japan, India, Korea, Indonesia, Malaysia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait, and Oman.

The report covers a detailed competitive outlook including the market share and company profiles of the key participants operating in the global lubricants market such as

- Shell PLC. (U.K.)

- BP p.l.c. (U.K.)

- FUCHS (Germany)

- Petroliam Nasional Berhad (Patrons) (Malaysia)

- Lubrita Europe B.V (Europe)

- Liberty Lubricants (U.S.)

- China Petrochemical corporation (China)

- TotalEnergies (France)

- ExxonMobil Corporation (U.S.)

- Phillips 66 company (U.S.)

- Indian Oil Corporation Ltd. (India)

- Idemitsu Kosan Co.,Ltd. (Japan)

- Chevron Corporation (U.S.)

- JX Nippon Oil & Gas Exploration Corporation (Japan)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (India)

- Mineral Oil Corporation (India)

- Valvoline (U.S.)

- ENEOS Holdings Inc(Japan)

The report segments the global Lubricants market as follows:

By Base Oil

- Greases

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product

- Engine Oil

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Compressor Oil

- Grease

- Turbine Oil

- Others

By End-Use Industry

- Transportation

- Industrial

By Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed