IoT in Banking & Financial Services Market Size, Share, Growth Report 2032

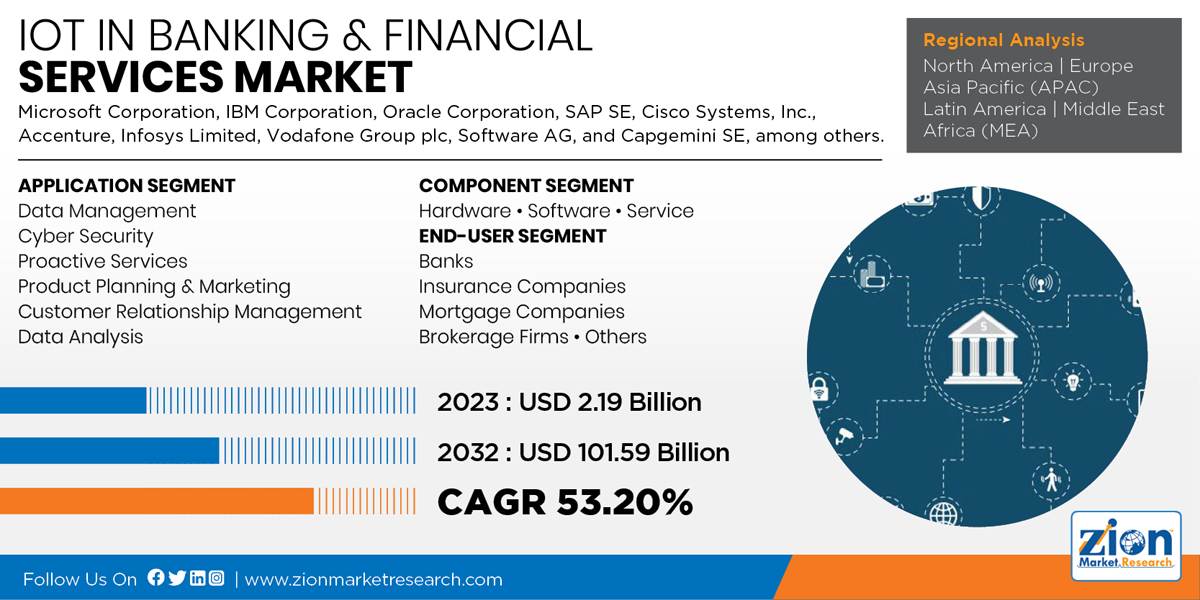

IoT in Banking & Financial Services Market By Application (Data Management, Cybersecurity, Proactive Services, Product Planning & Marketing, Customer Relationship Management, And Data Analysis) By Component (Hardware, Software, And Service), And By End-User (Banks, Insurance Companies, Mortgage Companies, Brokerage Firms, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

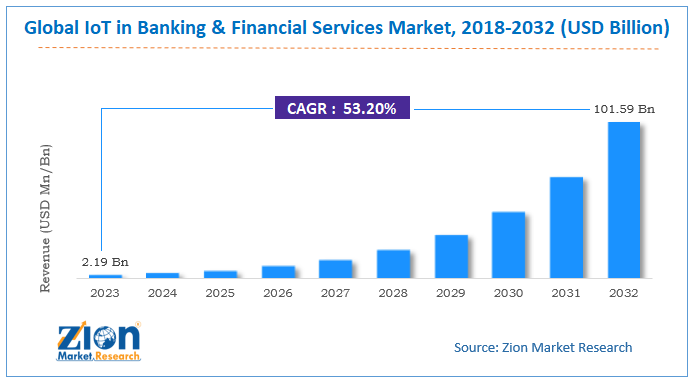

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.19 Billion | USD 101.59 Billion | 53.20% | 2023 |

The global IoT in banking & financial services market size was worth around USD 2.19 billion in 2023 and is predicted to grow to around USD 101.59 billion by 2032 with a compound annual growth rate (CAGR) of roughly 53.20% between 2024 and 2032.

The report analyzes and forecasts the IoT in banking & financial services market on a global and regional level. The study offers historical data from 2018 to 2022 along with forecast from 2024 to 2032 based on revenue (USD Billion).

Global IoT in Banking & Financial Services Market: Overview

IoT is the interconnection of distinguished embedded computing devices within the existing infrastructure. IoT provides an advanced connectivity of various systems, devices, and services that is not only restricted to machine-to-machine (M2M) communications but also covers various domains, protocols, and applications. In financial services, the interconnection of these devices is likely to guide their business in automating various processes.

Assessment of IoT in banking & financial services market dynamics gives a brief thought about the drivers and restraints for the IoT in banking & financial services market along with the impact they have on the demand over the years to come. Additionally, the report also includes the study of opportunities available in the IoT in banking & financial services market on a global level.

Digitalization in the banking sector is likely to fuel the IoT in banking & financial services market during the forecast timeframe. In 2015, the Singaporean financial sector invested nearly USD 225 million to establish innovation labs and infrastructure for fintech services. However, increasing cyber-attack scan might hinder this market’s growth. The use of banking with voice assistance is anticipated to present an opportunity to drive this market in the future. Amazon, Google, and Apple have offered their platforms and services to the U.S. Bank for voice assistance banking.

The report gives a transparent view of the IoT in banking & financial services market. We have included a detailed competitive scenario and portfolio of leading vendors operative in the IoT in banking & financial services market. To understand the competitive landscape in the IoT in banking & financial services market, an analysis of Porter’s Five Forces model for the IoT in banking & financial services market has also been included. The study encompasses a market attractiveness analysis, wherein application, component, end-user, and regional segments are benchmarked based on their market size, growth rate, and general attractiveness.

Global IoT in Banking & Financial Services Market: Segmentation

The study provides a crucial view of the IoT in banking & financial services by segmenting the market based on application, component, end-user, and region. All the segments of IoT in banking & financial services market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on application, the IoT in banking & financial services market is divided into data management, cybersecurity, proactive services, product planning and marketing, customer relationship management, and data analysis. The data management segment is anticipated to grow at a considerable rate during the estimated timeframe, due to the increasing adoption of online banking facilities in developing economies, such as China and India. Hardware, software, and service comprise the component segment of this market.

Based on component segment the IoT in banking & financial services market is divided into Hardware, software, and service.

By end-user, this market includes banks, insurance companies, mortgage companies, brokerage firms, and others.

Global IoT in Banking & Financial Services Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT in Banking & Financial Services Market |

| Market Size in 2023 | USD 2.19 Billion |

| Market Forecast in 2032 | USD 101.59 Billion |

| Growth Rate | CAGR of 53.20% |

| Number of Pages | 148 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Cisco Systems, Inc., Accenture, Infosys Limited, Vodafone Group plc, Software AG, and Capgemini SE, among others. |

| Segments Covered | By Application, By Component, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global IoT in Banking & Financial Services Market: Regional Analysis

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America and Europe for the IoT in banking & financial services market with their further bifurcation into the U.S., Canada, Mexico, UK, France, Spain, Germany, Switzerland, China, Japan, India, South Korea, Australia, Brazil, Argentina, UAE, Saudi Arabia, and South Africa.

North America is projected to hold a significant share in the global IoT in banking & financial services market during the forecast time period. North America is the most technologically advanced region; it was a pioneer in adopting IoT in banking sector. Furthermore, rising investments in IoT in the U.S. are expected to propel this regional market. The Asia Pacific is anticipated to grow at a considerable rate in the estimated timeframe, due to the growing investments made related to the usage of technology in the banking sector.

Global IoT in Banking & Financial Services Market: Competitive Analysis

The competitive profiling of noticeable players of the IoT in banking & financial services market includes company and financial overview, business strategies adopted by them, their recent developments and product offered by them which can help in assessing competition in the market. Noticeable players included in this report:

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems

- Inc.

- Accenture

- Infosys Limited

- Vodafone Group plc

- Software AG

- Capgemini SE

- Among others

This report segments the global IoT banking & financial services market as follows:

Global IoT in Banking & Financial Services Market: Application Segment Analysis

- Data Management

- Cyber Security

- Proactive Services

- Product Planning & Marketing

- Customer Relationship Management

- Data Analysis

Global IoT in Banking & Financial Services Market: Component Segment Analysis

- Hardware

- Software

- Service

Global IoT in Banking & Financial Services Market: End-User Segment Analysis

- Banks

- Insurance Companies

- Mortgage Companies

- Brokerage Firms

- Others

Global IoT in Banking & Financial Services Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

IoT is the interconnection of distinguished embedded computing devices within the existing infrastructure.

According to study, the global IoT in Banking & Financial Services market size was worth around USD 2.19 billion in 2023 and is predicted to grow to around USD 101.59 billion by 2032.

The CAGR value of IoT in Banking & Financial Services market is expected to be around 53.20% during 2024-2032.

North America has been leading the global IoT in Banking & Financial Services market and is anticipated to continue on the dominant position in the years to come.

The global IoT in Banking & Financial Services market is led by players like Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Cisco Systems Inc., Accenture, Infosys Limited, Vodafone Group plc, Software AG, and Capgemini SE.

List of Contents

Global IoT in Banking Financial Services OverviewGlobal IoT in Banking Financial Services SegmentationGlobal IoT in Banking Financial Services Report Scope:Global IoT in Banking Financial Services Regional AnalysisGlobal IoT in Banking Financial Services CompetitiveAnalysisThis report segments the global IoT banking financial services market as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed