Insulin Market Size, Share, Growth Analysis, 2032

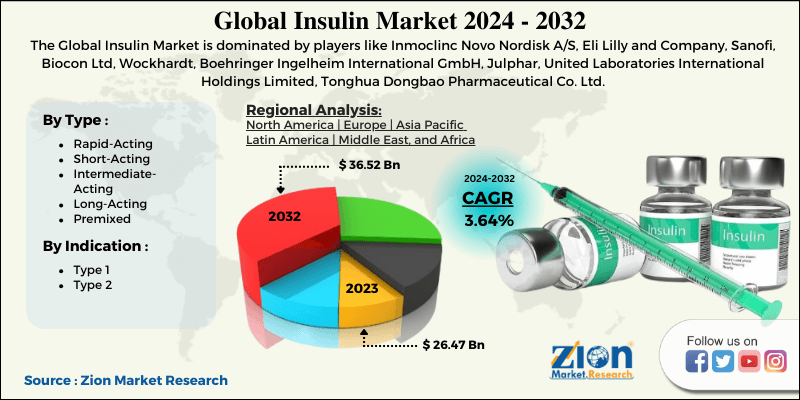

Insulin Market By Type (Rapid-Acting, Short-Acting, Intermediate-Acting, Long-Acting, and Premixed), By Indication (Type 1 and Type 2), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

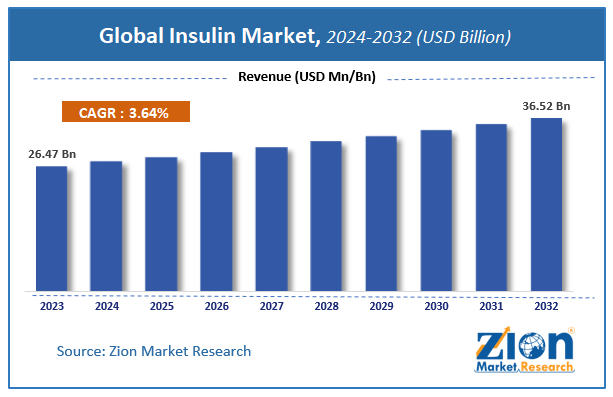

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.47 Billion | USD 36.52 Billion | 3.64% | 2023 |

Insulin Market Insights

Zion Market Research has published a report on the global Insulin Market, estimating its value at USD 26.47 Billion in 2023, with projections indicating that it will reach USD 36.52 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 3.64% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Insulin Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Insulin Market: Overview

Globally, more than 422 million people are suffering from type 1 and type 2 diabetes. Wherein, most of the insulin demand is coming from type 1 as they are needed to inject insulin on a daily basis to regulate the blood sugar level and avoid any further complications.

As of 2020, more than 10% of the diabetic population is affected byT1D and the number is expanding rapidly with each passing year. All age groups around found to be affected by the disease, but the prevalence is relatively higher among elderly people. In fact, people having T2D for more than 20 years have also emerged as the consumer of insulin regularly.

Over $760 billion was spent on diabetes management in 2023 across the globe and the number is expected to surpass 830 billion by 2032 on account of the rapidly growing prevalence of the disease. Wherein, the U.S. emerged as the largest country to spend more than$327 billion on diabetic care. The demand for insulin is likely to remain high in the developed countries of North America and Europe on account of its easy availability, controlled prices in Europe, coverage in insurance policies, and strong healthcare infrastructure among others. China, India, the U.S. and Brazil are the top four countries housing the largest diabetic population. For instance, China alone has more than 116 million people suffering from the disease, whereas the U.S. has over 34 million people. In fact, it is the sixth deadliest disease across the globe. Every year, it claims the lives of more than 1.8 million people.

The average price per unit across all types of insulin in America was $98.70 (£76.34). Other countries would have paid a fraction as much for the same insulins. American prices were found to be 27.7 times higher than units sold in Turkey and 6.3 times higher than those in Canada, 5.9 times higher than those in Japan and 8.9 times higher than those in the U.K.

COVID-19 Impact Analysis

The COVID-19 pandemic has impacted all sectors across the globe. However, it fails to leave any evident dent in the demand for insulin. The demand remained steady during the initial period and is likely to continue the same in the years to come. However, the pandemic has disrupted the supply chain of materials required for manufacturing insulin to some extent due to stringent lockdown restrictions across the globe. The lockdown has hampered the smoothness of raw material transport to the manufacturing facility, which, in turn, has created pressure on the available resources to meet the increasing demand for the products.

Most of the players based in the European and Asia Pacific region faced little difficulty in accessing the raw materials due to the ban on import and export activities to reduce the spread of infection. As a result, the manufacturers had to purchase the required material from the local providers at inflated prices

Insulin Market: Growth Factors

Globally more than 422 million people are living with diabetes across the globe. Every year, more than 1.6 million people die of the disease. Wherein, the prevalence of diagnosis and mortality is higher in the aging population. Mid and low-income countries are the worst affected, especially in Asia, Africa and Latin America. By 2040, the diabetic population is likely to double, which would further drive the demand for insulin. As of 2019, Latin had around 2.9 million people using insulin on a daily basis, which is likely to grow at an alarming rate in the years to come.

The global market is witnessing significant growth in the prevalence of diabetes on account of changing lifestyles, increasing obese and overweight populations, sedentary lifestyles, increased consumption of food containing a higher amount of carbohydrates and fat, and growing hereditary prevalence of type diabetes. Over 39%of the global adults are categorized as overweight. In 2016, more than 1.9 billion adults, 18 years and older, were overweight. Of these over 650 million were obese. Apart from this, a large number of people are consuming tobacco and smoking. The number is significantly high in China and India. It further increases the risk of developing diabetes.

Insulin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insulin Market |

| Market Size in 2023 | USD 26.47 Billion |

| Market Forecast in 2032 | USD 36.52 Billion |

| Growth Rate | CAGR of 3.64% |

| Number of Pages | 220 |

| Key Companies Covered | Novo Nordisk, Eli Lilly & Co., Sanofi, Biocon |

| Segments Covered | By Type, By Indication, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insulin Market: Segmentation Analysis

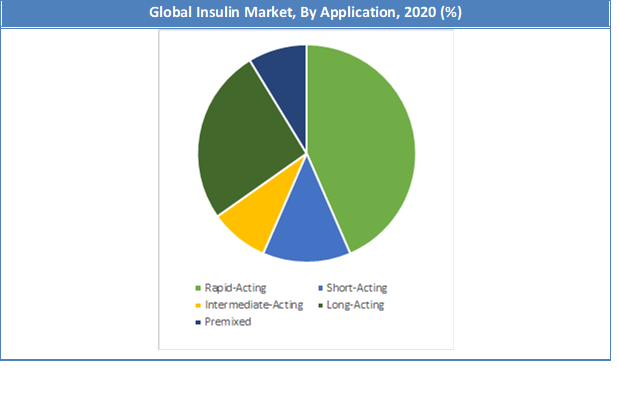

By Type Segment Analysis

On the basis of types, the global market is segmented into Rapid-Acting, Short-Acting, Intermediate-Acting, Long-Acting, and Premixed. Rapid-acting insulin starts working somewhere between 2.5 to 20 minutes after injection. Its action is at its greatest between one and three hours after injection and can last up to five hours. This type of insulin acts more quickly after a meal, similar to the body's natural insulin, reducing the risk of low blood glucose (blood glucose below 4 mmol/L).

Short-acting insulin takes longer to start working than rapid-acting insulin. It starts to reduce blood glucose levels within 30 minutes. Therefore, it is recommended to administer the dose within 30 minutes before eating. This type of insulin can last up to eight hours but shows maximum efficiency in the first 2-5 hours.

By Indication Segment Analysis

Based on Indication, the global market is segmented into type 1 and type 2. It is recommended for the patient having type 1 diabetes to inject insulin daily. They are often advised to take rapid insulin doses along with last-lasting insulin for better outcomes. Type 1 diabetes is always treated with insulin, which is injected with a pen, syringe or pump. The aim is to keep blood glucose levels as close to normal as possible. Over 64,000 Americans are diagnosed with T1D every year. As of 2020, over 1.6 million people in the U.S. are suffering from the disease.

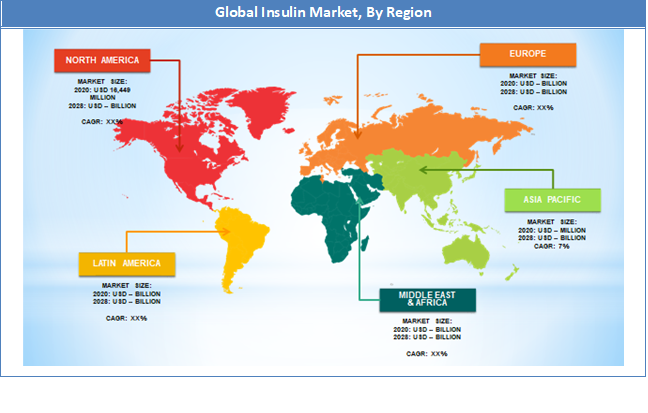

Insulin Market: Regional Analysis

The U.S. is projected to continue dominating the North American insulin market during the forecast period. Canada holds a significantly lower share of the market as compared to the U.S. As of 2019, the country spent $327 billion on diabetes care. Each year, over 64,000 Americans are diagnosed with T1D and more than 1.64 million people are living with the same disease in the country. In 2018, over 10.5% of the American population or 34.4 million had diabetes. Wherein, the prevalence is significantly higher in the elderly population having an age above 60 years. To be precise, over 14.3 million people 65 years and above are suffering from the disease.

Asia Pacific is housing over 60% of the global population, out of which, more than 35% reside in China and India. The prevalence of diabetes is significantly higher in low- and mid-income countries. China is housing the world's largest population suffering from diabetes. Currently, China and India have over 116 million and 77 million people suffering from diabetes, respectively. In addition to this, more than 50% of the global population having diabetes lives in the Asia Pacific region.

Insulin Market: Competitive Analysis

Some of the major players in the global Insulin market include:

- Novo Nordisk

- Eli Lilly & Co.

- Sanofi

- Biocon

The Insulin Market is segmented as follows:

By Type Segment Analysis

- Rapid-Acting

- Glulisine

- Lispro

- Aspart

- Short-Acting

- Intermediate-Acting

- Long-Acting

- Glargine

- Detemir

- Premixed

By Indication Segment Analysis

- Type 1

- Type 2

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Insulin market size was worth around USD 26.47 billion in 2023 and is expected to reach USD 36.52 billion by 2032.

The global Insulin market is expected to grow at a CAGR of 3.64% during the forecast period.

Insulin Market The global market is witnessing a significant growth in the prevalence of diabetes on account of changing lifestyle, increasing obese and overweight population, sedentary lifestyle, increased consumption of food containing higher amount of carbohydrates and fat, and growing hereditary prevalence of type diabetes.

North America is expected to dominate the Insulin market over the forecast period.

Some of the major companies operating in the Insulin Market are Novo Nordisk, Eli Lilly & Co., Sanofi, Biocon.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed