Industrial Control Systems Market Size, Share, Growth Report 2032

Industrial Control Systems Market By Solution (Encryption, Security And Vulnerability Management, Security Configuration Management, Intrusion Detection System/Intrusion Prevention System, Antimalware/Antivirus, Firewall, Distributed Denial Of Service Mitigation, Security Information And Event Management, And Identity And Access Management), By Service (Consulting And Integration, Managed Security, Incident Response, Support And Maintenance, And Training And Development), By Security Type (Network, Endpoint, Vertical, And Database), Vertical (Power, Energy And Utilities, Transportation Systems, Manufacturing, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

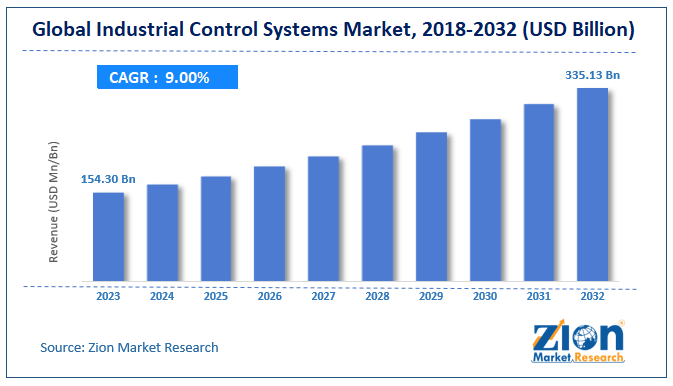

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 154.30 Billion | USD 335.13 Billion | 9.00% | 2023 |

Industrial Control Systems Industry Perspective:

The global industrial control systems market size was worth around USD 154.30 billion in 2023 and is predicted to grow to around USD 335.13 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.00% between 2024 and 2032. The report covers a forecast and an analysis of the industrial control systems market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Key Insights

- As per the analysis shared by our research analyst, the industrial control systems market is anticipated to grow at a CAGR of 9.00% during the forecast period (2024-2032).

- The global industrial control systems market was estimated to be worth approximately USD 154.30 billion in 2023 and is projected to reach a value of USD 335.1 billion by 2032.

- The growth of the industrial control systems market is being driven by [content].

- Based on the solution, the encryption segment is growing at a high rate and is projected to dominate the market.

- On the basis of service, the consulting and integration services segment is projected to swipe the largest market share.

- In terms of security type, the network security segment is expected to dominate the market.

- Based on the vertical, the power segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Industrial Control Systems Market: Overview

Industrial control systems target cybercriminals by primarily monitoring the industrial processes and critical infrastructures that distribute water, transport, manufacturing, power, and other vital services. Rapidly changing business prototypes, rising cost pressures and regulatory requirements propel the necessity for the convergence of information and operational technologies. IIoT enables extraordinary levels of real-time connectivity, control, and visibility through principal operations along with simultaneously increasing cybersecurity risk. Traditional security layers are not adequate to guard against these increasing cyber threats to OT (Operational Technology) and IT systems. To tackle these situations, industrial control system plans are specially designed with operational and asset requirements to shield the vital business processes.

The study includes drivers and restraints for the industrial control systems market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the industrial control systems market on a global level.

The report provides a transparent outlook of the industrial control systems market. We have included a detailed competitive scenario and portfolio of leading vendors operative in the industrial control systems market. To understand the competitive landscape in the industrial control systems market, an analysis of Porter’s Five Forces model has also been included. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their general attractiveness, market size, and their growth rate.

The report provides company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, product, and regional expansion of major participants involved in the market on a regional basis.

Industrial Control Systems Market: Growth Drivers

Rising cyber threats related to critical infrastructure is expected to be the key factor driving the industrial control systems market in the upcoming years. The increasing investments made by organizations in Industry 4.0 paired with increasing infrastructure development activities among the industrial environment is predicted to shape the industrial control systems market globally in the future. Furthermore, the implication of regulatory compliance by various governments across the globe for the security of critical infrastructure is also estimated to support the industrial control systems market in the in years to come. However, the lack of awareness about industrial control system security might limit the industrial control systems market in the years ahead.

Industrial Control Systems Market: Segmentation

The study provides a crucial view of the industrial control systems market by segmenting it based on the solution, service, security type, vertical, and region. The segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on a solution, the global industrial control systems market is fragmented into encryption, security and vulnerability management, security configuration management, intrusion detection system/intrusion prevention system, antimalware/antivirus, firewall, distributed denial of service mitigation, security information, and event management, and identity and access management.

By service, the market is divided into consulting and integration services, managed security services, incident response services, support and maintenance services, and training and development services. Network security, endpoint security, vertical security, and database security form the security type segment of the market.

By vertical, the global industrial control systems market is divided into power, energy and utilities, transportation systems, manufacturing, and others.

Industrial Control Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Control Systems Market Research Report |

| Market Size in 2023 | USD 154.30 Billion |

| Market Forecast in 2032 | USD 335.13 Billion |

| Growth Rate | CAGR of 9.00% |

| Number of Pages | 110 |

| Key Companies Covered | ABB, Check Point Software Technologies, Sophos, Schneider Electric, Positive Technologies, NozomiNetworks, Baker Hughes, GE Company, Cyberark Cisco, Honeywell, FireEye, McAfee, Bayshore Networks, Symantec, Kaspersky Lab, Belden, Airbus, BAE Systems, and Rockwell Automation, among others. |

| Segments Covered | By Solution, By Service, By Security Type, By Vertical, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Control Systems Market: Regional Analysis

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Europe, Latin America, and the Asia Pacific with its further bifurcation into major countries including the U.S., France, UK, Germany, China, India, Japan, and Brazil.

In 2023, North America and Europe currently held the majority share in the industrial control systems market globally. This was due to the high technology adoption rate, the presence of key solution providers, and the rising use of cloud-based SCADA system. The cloud-based SCADA software is a supreme platform for IIoT gateway. The Asia Pacific region is predicted to be the most lucrative for the industrial control systems market in the forthcoming years.

Industrial Control Systems Market: Competitive Analysis

The competitive profiling of key players of industrial control systems market includes company and financial overview, business strategies adopted by them, their recent developments and product offered by them which can help in assessing competition in the market. Some key players of the industrial control systems market are:

- ABB

- Check Point Software Technologies

- Sophos

- Schneider Electric

- Positive Technologies

- NozomiNetworks

- Baker Hughes

- GE Company

- Cyberark Cisco

- Honeywell

- FireEye

- McAfee

- Bayshore Networks

- Symantec

- Kaspersky Lab

- Belden

- Airbus

- BAE Systems

- Rockwell Automation

- Among others

This report segment the global industrial control systems market into:

Global Industrial Control Systems market: Solution Segment Analysis

- Encryption

- Security and Vulnerability Management

- security Configuration Management

- Intrusion Detection System/Intrusion Prevention System

- Antimalware/Antivirus

- Firewall

- Distributed Denial of Service Mitigation

- Security Information and Event Management

- Identity and Access Management

Global Industrial Control Systems market: Service Analysis

- Consulting and Integration Services

- Managed Security Services

- Incident Response Services

- Support and Maintenance Services

- Training and Development Services

Global Industrial Control Systems Market: Security Type Analysis

- Network Security

- Endpoint Security

- Vertical Security

- Database Security

Global Industrial Control Systems market: Vertical Analysis

- Power

- Energy and Utilities

- Transportation Systems

- Manufacturing

- Others

Global Industrial Control Systems Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial control systems target cybercriminals by primarily monitoring the industrial processes and critical infrastructures that distribute water, transport, manufacturing, power, and other vital services.

According to study, the global Industrial Control Systems market size was worth around USD 154.30 billion in 2023 and is predicted to grow to around USD 335.13 billion by 2032.

The CAGR value of Industrial Control Systems market is expected to be around 9.00% during 2024-2032.

Asia Pacific has been leading the global Industrial Control Systems market and is anticipated to continue on the dominant position in the years to come.

The global Industrial Control Systems market is led by players like ABB, Check Point Software Technologies, Sophos, Schneider Electric, Positive Technologies, NozomiNetworks, Baker Hughes, GE Company, Cyberark Cisco, Honeywell, FireEye, McAfee, Bayshore Networks, Symantec, Kaspersky Lab, Belden, Airbus, BAE Systems, Rockwell Automation, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed