India Ethyl Acetate Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

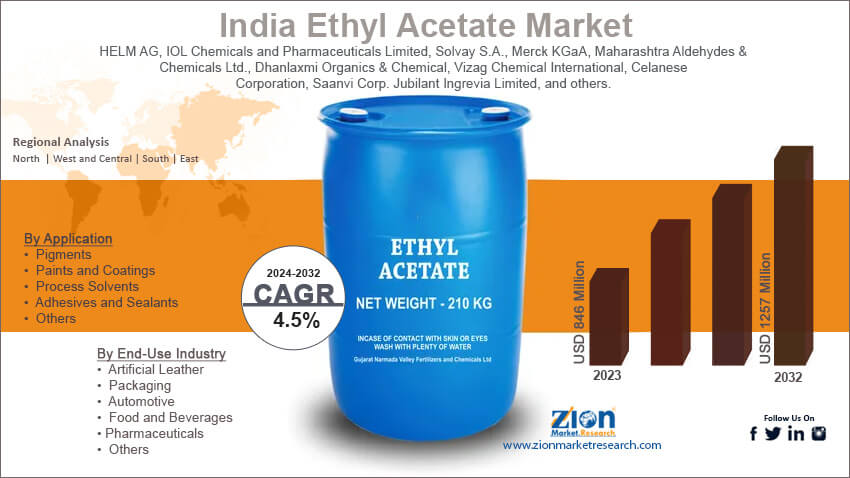

India Ethyl Acetate Market By Application (Pigments, Paints and Coatings, Process Solvents, Adhesives & Sealants, and Others), By End-Use Industry (Artificial Leather, Packaging, Automotive, Food & Beverages, Pharmaceuticals, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

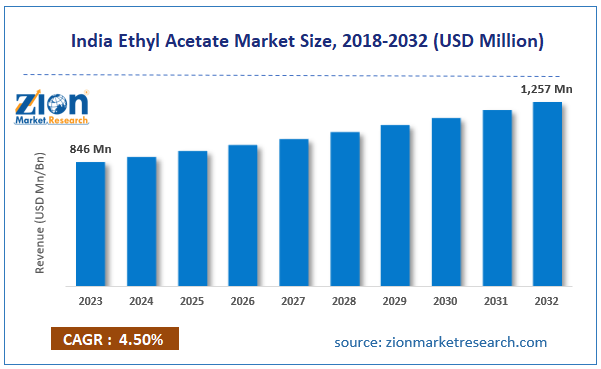

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 846 Million | USD 1257 Million | 4.5% | 2023 |

India Ethyl Acetate Industry Perspective:

India ethyl acetate market size was worth around USD 846 million in 2023 and is predicted to grow to around USD 1257 million by 2032 with a compound annual growth rate (CAGR) of roughly 4.5% between 2024 and 2032.

India Ethyl Acetate Market: Overview

Paints, lacquers, dry cleaning, nitrocellulose, stains, and fats are all solvents that can be used with ethyl acetate. When synthetic silk and leather are being produced, as well as when photographic films and plates are being prepared, it is discharged. Artificial fruit flavorings and essences, acetic acid, dyes, linoleum, "plastic" wood, pharmaceuticals, drug intermediates, and perfumes & aromas are among the products that are released during production. Nail polish remover, base coats, and other manicure products contain ethyl acetate as a solvent. Wines do include ethyl acetate.

Key Insights

- As per the analysis shared by our research analyst, India's ethyl acetate market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2024-2032).

- In terms of revenue, the India ethyl acetate market size was valued at around USD 846 million in 2023 and is projected to reach USD 1257 million by 2032.

- The rising pharmaceutical sector is expected to propel India ethyl acetate market growth over the projected period.

- Based on the application, the adhesives segment is expected to dominate the market during the forecast period.

- Based on its end-use industry, the pharmaceutical segment is expected to hold a significant market share over the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Ethyl Acetate Market: Growth Drivers

Rising demand from the food processing industry drives market growth

In many food processing applications, ethyl acetate is used due to its excellent solvent properties and pleasant, fruity aroma. A well-liked flavoring chemical in the food industry, ethyl acetate has a pleasant, fruity aroma that is reminiscent of pears and bananas. This flavoring is one of the artificial ones that one may find in candies, baked goods, and beverages. Utilizing ethyl acetate as a solvent, many compounds are also extracted from natural sources. When extracting flavorings, essential oils, and aromatic compounds from plants and other raw materials, for instance, it can be used. Additionally, this aids in processing when making food. It works with several types of food ingredients to make emulsifiers and stabilizers.

India Ethyl Acetate Market: Restraints

Lack of technological advancements impedes market growth

One of the main obstacles to the expansion of India ethyl acetate market is the lack of technical advancement in the country. India still produces ethyl acetate through traditional manufacturing techniques, which might result in expensive production costs and constrained output. The product's quality could not be as high as it could be due to the absence of cutting-edge technologies. Energy economy and process sustainability are not prioritized in the traditional industrial methods utilized in India to produce ethyl acetate. This may have detrimental effects on the environment in addition to increasing production costs.

India Ethyl Acetate Market: Opportunities

Significant application in the adhesive sector offers an attractive opportunity for market growth

Ethyl acetate is widely used in the adhesive industry in India, mostly as a solvent for various synthetic polymer types. It is used to dissolve the polymers and improve their flow properties to produce a strong and durable binding. Ethyl acetate is used to make a range of adhesives used in the packaging industry. Among other synthetic polymers, it serves as a solvent for polyester, polypropylene, and polyethylene. In March 2022, TCPL Packaging Limited quadrupled the capacity of its flexible packaging factory, which has started commercial manufacturing in India. To enhance offset capacity, the business installed a new printing line at the Goa site. Ethyl acetate is used to make a variety of adhesives utilized in the Indian automotive industry. Many synthetic polymers, including epoxy and polyurethane, use it as a solvent. When placed between various materials, such as rubber, plastic, and metal, these adhesives offer a robust and long-lasting bind. Thus, the significant uses of ethyl acetate in the adhesives sector offer a potential opportunity for India's ethyl acetate industry over the projected period.

India Ethyl Acetate Market: Challenges

Strict environmental regulation poses a major challenge to market expansion

The ethyl acetate market may face difficulties from the emergence of more affordable or ecologically friendly solvent alternatives. If other solvents work better or are less expensive, industries may switch to them. Additionally, foreign manufacturers, especially those with lower manufacturing costs, pose a threat to Indian makers of ethyl acetate, potentially reducing their share of the domestic market. Therefore, the presence of alternatives is expected to pose a major challenge to India's ethyl acetate market.

India Ethyl Acetate Market: Segmentation

India's ethyl acetate industry is segmented based on application, end-use industry, and region.

Based on the application, India ethyl acetate market is bifurcated into pigments, paints and coatings, process solvents, adhesives & sealants, and others. The adhesives segment is expected to dominate the market during the forecast period. India's adhesives market is growing thanks to the country's progress in the furniture, automotive, building, and packaging industries. When creating adhesives, especially those used in packaging, shoes, and other industrial uses, ethyl acetate is an essential solvent. Because of ethyl acetate's superior solvency qualities and quick evaporation rate, solvent-based adhesives are still in high demand in India. The ethyl acetate market's revenue growth is greatly aided by this tendency. Furthermore, India's increasing infrastructural development and urbanization have raised the demand for adhesives in the building industry, which in turn has increased the demand for ethyl acetate.

Based on the end-use industry, India ethyl acetate industry is segmented into artificial leather, packaging, automotive, food & beverages, pharmaceuticals, and others. The pharmaceutical segment is expected to hold a significant market share over the forecast period. Pharmaceuticals are made using ethyl acetate as a solvent, especially for formulating medications. It is used in the extraction, purification, and crystallization of active pharmaceutical ingredients (APIs). Ethyl acetate is used as an intermediary in the pharmaceutical industry to synthesize a variety of medicines. It is useful in the production process because of its capacity to dissolve a variety of compounds. India is one of the world's top producers of generic medications, and the country's pharmaceutical sector is growing quickly. The need for solvents like ethyl acetate, which are crucial to the production of drugs, is increased by this expansion.

India Ethyl Acetate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Ethyl Acetate Market |

| Market Size in 2023 | 846 Mn |

| Market Forecast in 2032 | 1257 Mn |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 215 |

| Key Companies Covered | HELM AG, IOL Chemicals and Pharmaceuticals Limited, Solvay S.A., Merck KGaA, Maharashtra Aldehydes & Chemicals Ltd., Dhanlaxmi Organics & Chemical, Vizag Chemical International, Celanese Corporation, Saanvi Corp. Jubilant Ingrevia Limited, and others. |

| Segments Covered | By Application, By End-Use Industry, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Ethyl Acetate Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead India ethyl acetate market over the forecast period. The demand for ethyl acetate is largely driven by the pharmaceutical industry's rapid growth in North India, which is being caused by the opening of new manufacturing facilities and the expansion of old ones. The pharmaceutical industry in the area boosts ethyl acetate usage by supporting exports in addition to meeting domestic needs. Furthermore, there is a growing need for paints, coatings, and adhesives due to North India's continued infrastructural development and urbanization. This in turn fuels the need for ethyl acetate in these products as a solvent. Therefore driving the market in the area.

India Ethyl Acetate Market: Competitive Analysis

India's ethyl acetate market is dominated by players like:

- HELM AG

- IOL Chemicals and Pharmaceuticals Limited

- Solvay S.A.

- Merck KGaA

- Maharashtra Aldehydes & Chemicals Ltd.

- Dhanlaxmi Organics & Chemical

- Vizag Chemical International

- Celanese Corporation

- Saanvi Corp. Jubilant Ingrevia Limited.

India's ethyl acetate market is segmented as follows:

By Application

- Pigments

- Paints and Coatings

- Process Solvents

- Adhesives and Sealants

- Others

By End-Use Industry

- Artificial Leather

- Packaging

- Automotive

- Food and Beverages

- Pharmaceuticals

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Paints, lacquers, dry cleaning, nitrocellulose, stains, and fats are all solvents that can be used with ethyl acetate. When synthetic silk and leather are being produced, as well as when photographic films and plates are being prepared, it is discharged. Artificial fruit flavorings and essences, acetic acid, dyes, linoleum, "plastic" wood, pharmaceuticals, drug intermediates, and perfumes and aromas are among the products that are released during production. Nail polish remover, base coats, and other manicure products contain ethyl acetate as a solvent. Wines do include ethyl acetate.

In India, the pharmaceutical industry is one of the main consumers of ethyl acetate. Active pharmaceutical ingredients (APIs) are extracted from plants using ethyl acetate, which is employed as a solvent in medication manufacturing operations. As the Indian pharmaceutical sector grows, there will likely be a greater need for ethyl acetate as a solvent. India is a major manufacturer of generic pharmaceuticals.

According to the report, India's ethyl acetate market size was worth around USD 846 million in 2023 and is predicted to grow to around USD 1257 million by 2032.

India's ethyl acetate market is expected to grow at a CAGR of 4.5% during the forecast period.

India's ethyl acetate market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising pharmaceutical sector.

India's ethyl acetate market is dominated by players like HELM AG, IOL Chemicals and Pharmaceuticals Limited, Solvay S.A., Merck KGaA, Maharashtra Aldehydes & Chemicals Ltd., Dhanlaxmi Organics & Chemical, Vizag Chemical International, Celanese Corporation, Saanvi Corp. and Jubilant Ingrevia Limited among others.

India's ethyl acetate market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed