Global Acetic Acid Market Growth, Size, Share, Trends, and Forecast 2034

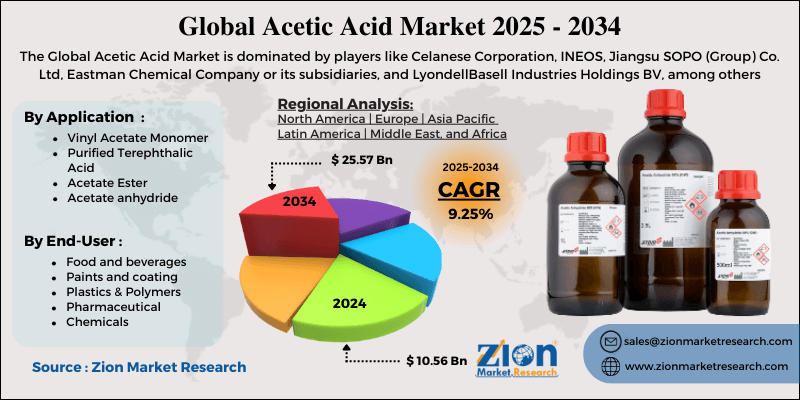

Acetic Acid Market Analysis By Application Type (Vinyl Acetate Monomer, Purified Terephthalic Acid, Acetate Esters, Acetate Anhydride), Based on End-User (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, Others), and By Region: Global Industry Perspective, Growth Dynamics, Comprehensive Analysis and Forecast, 2025-2034

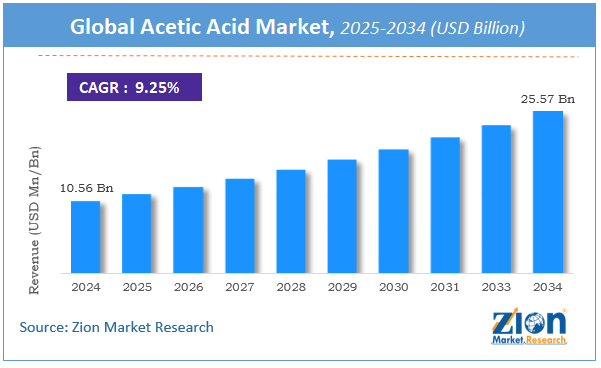

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.56 Billion | USD 25.57 Billion | 9.25% | 2024 |

Acetic Acid Market Size Analysis

The global acetic acid market size was estimated at USD 10.56 Billion in 2024 and is expected to reach USD 25.57 Billion by 2034, growing at a CAGR of 9.25% from 2025 to 2034.

Acetic Acid Market Overview

Acetic acid is a colourless liquid; it can be also called as ethanoic acid, that also projects to be the antecedent to the production of various chemicals which is being used in textile, rubber and plastic industries. Additionally, it acts as an intermediary for the formulation of various coatings, bridging elements, and greases that are widely used in the packaging, construction, and electronics. The rising demand for the acetic acid in the production of various products such as vinyl acetate monomers (VAM) and purified terephthalic acid are all driving factors to enhance the market size in the forecasted period.

The production of acetic acid has witnessed measurable growth owing to the varying end-use industry of acetic acid, as it can be used in manufacture for the purpose of resins for coatings, adhesives, paints, etc. Therefore, the global acetic acid market is expected to be booming. Owing to the reasons for its dynamic usage of acetic acid has also led to an increase in its demand over time in the global market. Many other factors such as population growth, changing markets and favourable government schemes stimulate the growth for the global acetic acid market.

Key Insights

- As per the analysis shared by our research analyst, the global Acetic Acid Market is estimated to grow annually at a CAGR of around 12.6% over the forecast period (2025-2034).

- Regarding revenue, the global Acetic Acid Market size was valued at around USD 10.56 Billion in 2024 and is projected to reach USD 25.57 Billion by 2034.

- The Acetic Acid Market is projected to grow at a significant rate due to Rising automation in logistics, manufacturing, and warehousing sectors fuels demand. E-commerce growth and electrification trends also support market expansion.

- Based on Vehicle Type, the Forklift segment is expected to lead the global market.

- On the basis of Drive Type, the Internal Combustion Engine segment is growing at a high rate and will continue to dominate the global market.

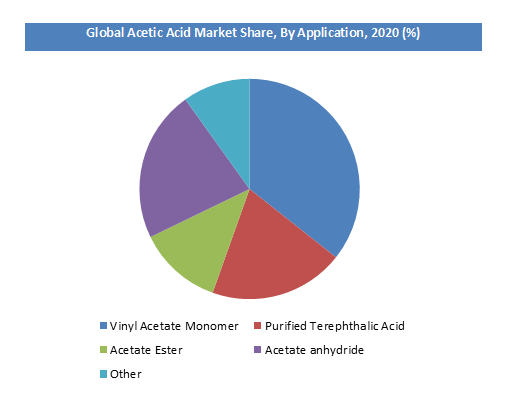

- Based on the Application, the Vinyl Acetate Monomer segment is projected to swipe the largest market share.

- By End User, the Food and beverages segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Growth Factors

Certain factors like increasing demand for purified terephthalic acid from the textile and packaging industry, rising use of ester solvents for the purposes of paints and coatings, the rising infrastructural investments for the projects across the world, the increasing development of new separation technologies to cause increase in the production efficiency of acetic acid, the very many application of acetic acid in home furnishing and in the production of textiles such as bed sheets and curtains are all the reasons for the increased demand in the global acetic acid market.

Despite this, increasing usage of acetic acid can be harmful for certain natural elements like animals, and plants, which can be a huge setback for the global acetic acid market in estimated period. Moreover, the difficulty in pricing policies of raw material can also be a limiting factor for the acetic acid market.

COVID-19 Impact Analysis

The global acetic acid market was negatively impacted by COVID-19 causing a sharp decline in the automotive industry, also due to the temporary lockdown of automotive manufacturing units and different other construction investment projects due to the increasing spread of the deadly virus scenario. Not to forget the decline in the consumption of coatings, adhesives and paints. Therefore, all the above-mentioned factors have created a negative impact on the demand for acetic acid.

Furthermore, the stoppages of work due to various government measures announced by the authorities across the world in order to break the cycle of the spread of the virus and precautionary measures such as quarantines impacted most of the end-user industries who use the acetic acid, such as textiles, food and beverage, and construction, thereby indirectly affecting the growth prospects of the acetic acid market.

Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Acetic Acid Market |

| Market Size in 2024 | USD 10.56 Billion |

| Market Forecast in 2034 | USD 25.57 Billion |

| Growth Rate | CAGR of 9.25% |

| Number of Pages | 221 |

| Key Companies Covered | Celanese Corporation, INEOS, Jiangsu SOPO (Group) Co. Ltd, Eastman Chemical Company or its subsidiaries, and LyondellBasell Industries Holdings BV, among others |

| Segments Covered | By Application Type, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020-2024 |

| Forecast Year | 2025-2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis By Application Type

On the basis of application type, the market can be divided into Vinyl Acetate Monomer, Purified Terephthalic Acid, Acetate Esters, Ethanol. Vinyl acetate monomer (VAM) was the largest application segment for the market accounting for more than 32% of global acetic acid consumption in 2023.The growth of VAM is driven by usage of VAM in sealants and adhesive industry. Ester solvent is the 2nd largest application area in term of consumption. However, PTA is projected to witness the fastest growth due to an increasing demand for polyester from the textile and packaging industries.

With the increasing demand for these applications across the world, it is anticipated to cause an increase in the total contribution to the segment’s growth by the end of the forecast period. Additionally, factors such as rapid urbanization & industrialization mainly in the Asia Pacific region has led to strong increase in the construction industry which will have an underlying impact on the overall acetic acid market demand during the forecasted period.

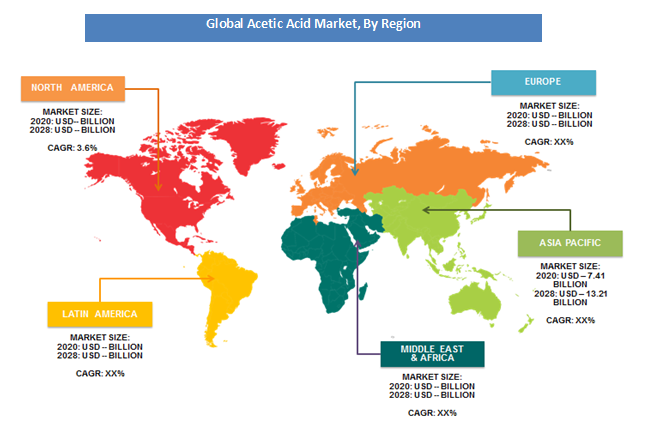

Regional Analysis

In regional segmentation, the global coronavirus vaccines market is bifurcated into six key regions, namely, Europe, North America, Latin America, Asia Pacific, the Middle East, and Africa. However, it was noted that Asia-Pacific is the largest consumer of acetic acid in the global acetic acid market. The Asia-Pacific market is predicted to be the largest market for the textile industry, citing reasons such as having a strong industrial base. All the more, India will also record significant growth in the global acetic acid market with reasons like increasing investments, growing population index, accumulative government schemes, and substantial growth in the demand from end-use industries. But North America and Europe are also the major markets for the production of acetic acid.

Key Market Players & Competitive Landscape

Some of the key important market players are

- Celanese Corporation

- INEOS

- Jiangsu SOPO (Group) Co. Ltd

- Eastman Chemical Company or its subsidiaries

- and LyondellBasell Industries Holdings BV, among others.

The global Acetic Acid market is segmented as follows:

By Application Type:

- Vinyl Acetate Monomer

- Purified Terephthalic Acid

- Acetate Ester

- Acetate anhydride

- Others

Based on End-User

- Food and beverages

- Paints and coating

- Plastics & Polymers

- Pharmaceutical

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global acetic acid market size was $ 10.56 Billion in 2024.

The global acetic acid market size is expected to reach USD 25.57 Billion by 2034, growing at a CAGR of 9.25% between 2025 and 2034.

Certain factors like increasing demand for purified terephthalic acid from the textile and packaging industry, rising use of ester solvents for paints and coatings, the rising infrastructural investments for projects across the world, the increasing development of new separation technologies cause an increase in the production efficiency of acetic acid, the very many applications of acetic acid in home furnishing and in the production of textiles such as bedsheets and curtains are all the reasons for the increased demand in the global acetic acid market.

Despite this, increasing usage of acetic acid can be harmful for certain natural elements like animals, and plants, which can be a huge setback for the global acetic acid market in the estimated period. Moreover, the difficulty in pricing raw materials policies can also be a limiting factor for the acetic acid market.

In regional segmentation, the global coronavirus vaccines market is bifurcated into six key regions, namely, Europe, North America, Latin America, Asia Pacific, the Middle East, and Africa. However, it was noted that Asia-Pacific is the largest consumer of acetic acid in the global acetic acid market. The Asia-Pacific market is predicted to be the largest market for the textile industry, citing reasons such as having a strong industrial base. All the more, India will also record significant growth in the global acetic acid market with reasons like increasing investments, growing population index, accumulative government schemes, substantial growth in the demand from end-use industries. But North America and Europe are also the major markets for the production of acetic acid.

Some of the key important market players are Celanese Corporation, INEOS, Jiangsu SOPO (Group) Co. Ltd, Eastman Chemical Company or its subsidiaries, and LyondellBasell Industries Holdings BV, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed