IDI Contact Technology Market Size, Share, Trends, Growth & Forecast 2034

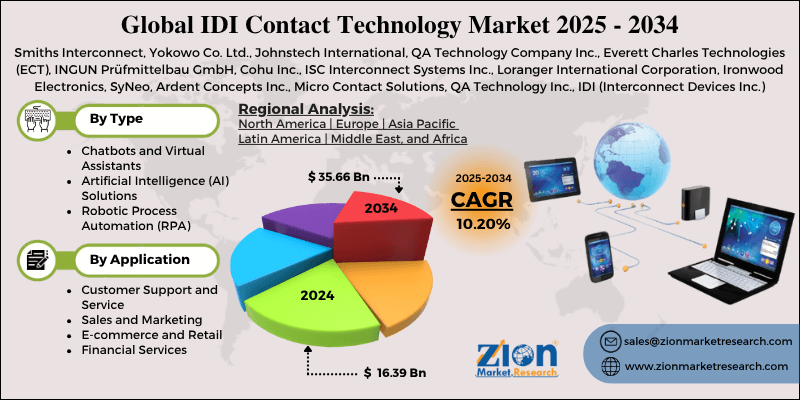

IDI Contact Technology Market By Type (Chatbots and Virtual Assistants, Artificial Intelligence [AI] Solutions, Robotic Process Automation [RPA], and Others), By Application (Customer Support and Service, Sales and Marketing, E-commerce and Retail, Financial Services, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

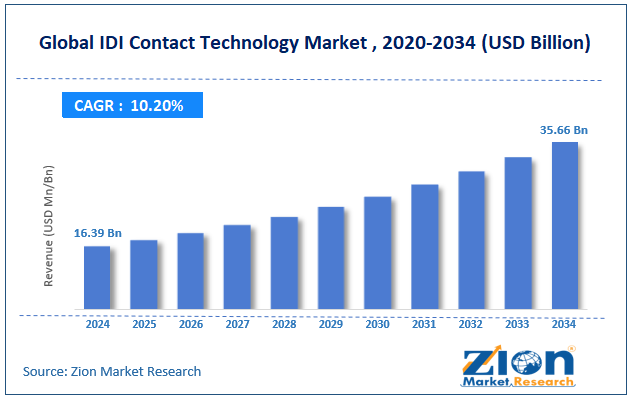

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.39 Billion | USD 35.66 Billion | 10.20% | 2024 |

IDI Contact Technology Industry Perspective:

The global IDI contact technology market size was worth around USD 16.39 billion in 2024 and is predicted to grow to around USD 35.66 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global IDI contact technology market is estimated to grow annually at a CAGR of around 10.20% over the forecast period (2025-2034)

- In terms of revenue, the global IDI contact technology market size was valued at around USD 16.39 billion in 2024 and is projected to reach USD 35.66 billion by 2034.

- The IDI contact technology market is projected to grow significantly due to the expansion of 5G and IoT infrastructure, the growing miniaturization of electronic components, and technological advancements in probe and contact designs.

- Based on type, the Artificial Intelligence (AI) solutions segment is expected to lead the market, while the Robotic Process Automation (RPA) segment is expected to grow considerably.

- Based on application, the customer support and service segment is the dominating segment, while the financial services segment is projected to witness sizeable revenue over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

IDI Contact Technology Market: Overview

IDI (Interconnect Devices, Inc.) contact technology is an advanced spring-loaded and precision interconnect solution that establishes reliable electrical connections in electronic testing, connector systems, and semiconductor packaging. These contacts promise continual performance under high-cycle operations and harsh environments, increasing their significance in diverse industries. The global IDI contact technology market is projected to witness substantial growth, driven by the increasing adoption in automotive electronics, the development of 5G infrastructure, and the miniaturization of electronic devices. The move towards autonomous and electric vehicles has elevated the complexity of automotive electronics. IDI contact systems are used in ECUs, sensors, and battery testing, assuring reliable connections under extreme conditions. This rising integration of electronics in automobiles is creating continuous demand for strong interconnect solutions.

Moreover, as 5G networks roll out worldwide, the need for high-frequency test interfaces and connectors grows. IDI contact solutions support millimeter-wave frequencies and promise low-loss signal transmission, increasing their significance in 5G component validation and network equipment production. The worldwide trend towards more powerful and smaller devices in wearables, smartphones, and medical equipment necessitates efficient and compact interconnects. IDI's micro-scale contacts allow high-density and space-saving circuit designs, fueling their broader use in compact electronics.

Although drivers exist, the global market is challenged by factors like complex integration in miniaturized circuits and limited standardization in applications. The growing miniaturization of circuits offers challenges in integrating contact solutions while maintaining optimal performance. Precision alignment and assembly raise design cost and complexity, hampering the adoption in compact systems. Variability in test socket designs, equipment standards, and connector interfaces limits interoperability. The lack of universal standardization obscures product compatibility and slows mass adoption in different industries.

Even so, the global IDI contact technology industry is well-positioned due to the growth of the EV ecosystem and rising use in medical electronics. With the worldwide EV production anticipated to surpass 40 million units every year by 2030, opportunities grow in charging infrastructure, battery management systems, and ECU testing, where IDI contact technologies promise performance consistency.

Additionally, the precision and miniaturization of wearable and medical diagnostic devices create opportunities for low-profile and biocompatible IDI contacts. Their low resistance and reliability make them suitable for high-precision healthcare electronics.

IDI Contact Technology Market Dynamics

Growth Drivers

How do 5G, edge computing, and telecom infrastructure demands propel the IDI contact technology market?

The speedy deployment of 5G networks, edge computing, and small cells infrastructure is raising the demand for IDI contacts that maintain tight impedance, low signal loss, and minimal VSWR at mmWave frequencies. Advanced materials, specialized plating, and precise contact geometries are vital to promise signal integrity under repeated mating periods.

Investments by telecom operators in low-latency edge and network diversification applications are fueling the adoption of field-serviceable and modular contact systems. Suppliers like Amphenol RF and Rosenberger have secured contracts for 5G small-cell deployments, indicating the growth of the IDI contact technology market.

How are medical devices and implantable/diagnostic reliability requirements fueling the IDI contact technology market?

Medical electronics need contacts that are biocompatible, capable of long-term operation, and corrosion-resistant in diagnostic, implantable, and modular surgical instruments. Regulatory compliance with FDA and ISO standards has propelled suppliers to develop gold-equivalent finishes, redundant contact designs, and hermetic sealing for enhanced reliability. The medical devices industry continues to grow, with global spending exceeding USD 520 billion in 2024, driving the demand for specialized IDI contacts. Low failure, high reliability, and long service life remain critical selection criteria for medical OEMs.

Restraints

Technological obsolescence and short product cycles unfavorably impact the market progress

Speedy advancements in automotive, electronics, and telecom technologies need IDI contact suppliers to innovate continuously. Short product lifecycles of 12-18 months in consumer electronics require frequent redesigns, high-speed signaling, high-voltage applications, and miniaturization. Suppliers that fail to adapt risk losing industry share to more innovative competitors. This fuels elevated R&D, production costs, and prototyping. Companies like TE Connectivity and Kyocera are actively investing in rapid prototyping, simulation, and modular designs to stay competitive.

Opportunities

How does the adoption of industrial automation and robotics create promising avenues for the growth of the IDI contact technology industry?

Global investments in AVGs, robotics, and IIoT devices are creating demand for high-MTBF and durable IDI contacts that can tolerate extreme industrial environments. Industrial automation spending reached USD 80 billion worldwide in 2024, underscoring growth prospects for ruggedized connectors. Contacts with self-cleaning geometrics, alignment-tolerant designs, and fretting-resistant coatings are progressively needed. Hot-swappable modules and predictive maintenance drive the demand for reliable industrial connectors. Suppliers investing in strong solutions are gaining strategic benefits in automated production lines and smart factories globally, fueling the growth of the IDI contact technology industry.

Challenges

Geopolitical risks and supply chain disruptions limit the industry's growth

IDI contact manufacturing relies on global supply chains for plastics, metals, and precision machinery, leaving it vulnerable to shipping delays, regional conflicts, and trade restrictions. In 2024, semiconductor scarcities and port congestion caused shipment delays of 6-8 weeks in significant markets. These disturbances raise inventory costs and force manufacturers to adopt regional production strategies and dual-sourcing. Supply disturbances may delay OEM production and impact revenue streams. Recent investments in localized production facilities in North America and the Asia Pacific demonstrate the market's emphasis on mitigating these risks.

IDI Contact Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IDI Contact Technology Market |

| Market Size in 2024 | USD 16.39 Billion |

| Market Forecast in 2034 | USD 35.66 Billion |

| Growth Rate | CAGR of 10.20% |

| Number of Pages | 215 |

| Key Companies Covered | Smiths Interconnect, Yokowo Co. Ltd., Johnstech International, QA Technology Company Inc., Everett Charles Technologies (ECT), INGUN Prüfmittelbau GmbH, Cohu Inc., ISC Interconnect Systems Inc., Loranger International Corporation, Ironwood Electronics, SyNeo, Ardent Concepts Inc., Micro Contact Solutions, QA Technology Inc., IDI (Interconnect Devices Inc.), and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IDI Contact Technology Market: Segmentation

The global IDI contact technology market is segmented based on type, application, and region.

Based on type, the global IDI contact technology industry is divided into chatbots and virtual assistants, Artificial Intelligence (AI) solutions, Robotic Process Automation (RPA), and others. The Artificial Intelligence (AI) solutions segment has registered a leading industry share because IDI contact technologies are extensively used in data processing hardware, semiconductor testing, and AI chip development, all of which require high-performing interconnects for reliability and speed. The rapid growth of AI-driven computing, data center infrastructure, and machine learning accelerators has increased the demand for advanced contact systems that ensure stable signal integrity during high-speed processing.

On the other hand, the Robotic Process Automation (RPA) segment ranks second because it relies on highly reliable test interfaces and electronic components for automation control and hardware systems. The current digital transformation and industrial trends have elevated the use of IDI contacts in testing automation devices, robotic control modules, and electronic assembly lines, fueling the segment's dominance.

Based on application, the global IDI contact technology market is segmented into customer support and service, sales and marketing, e-commerce and retail, financial services, and others. The customer support and service segment holds leadership since IDI contact technologies are widely used in interconnect and testing systems for servers, devices, and communication hardware that support enterprise-level customer support platforms. Reliable electrical connections promise continuous operation of call centers, communication servers, and CRM hardware, which is vital for large-scale operations.

Conversely, the financial services segment holds a second-leading share since the sector largely depends on high-speed and secure data processing and transaction systems. IDI contact technologies allow reliable interconnects in data centers, servers, and automated teller machines, promising high integrity and minimal downtime for critical financial operations.

IDI Contact Technology Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global IDI Contact Technology Market?

Asia Pacific is likely to sustain its leadership in the IDI contact technology market due to a strong semiconductor manufacturing base, the rapid growth of automotive electronics, and the expansion of consumer electronics manufacturing. APAC, led by South Korea, Taiwan, and China, registers for more than 70% of worldwide semiconductor production in 2024. The region's dominance in chip manufacturing fuels high demand for IDI contact technologies used in interconnect and testing applications. These contacts are crucial in high-volume production environments, promising reliability and accuracy during wafer assembly and testing.

In 2025, the region is also experiencing a rise in EVs and automotive electronics production, with EV sales reaching 12 million units in China alone. IDI contact technologies are broadly used in ECUs. Battery testing systems and sensors, backing the reliability of automotive electronic components. This trend majorly drives the market for high-performing interconnect solutions.

Furthermore, APAC holds leadership in IoT devices, wearable, and smartphone manufacturing, producing over 60% of the worldwide consumer electronics. IDI contacts allow reliable and compact connections in miniaturized devices, meeting the demand for high-density circuits. Asia's high production volumes create continuous demands for advanced testing and interconnect solutions.

North America continues to secure the second-highest share in the IDI contact technology industry due to the advanced electronics and semiconductor industry, the growth of data centers, and the rising automotive electronics and EV market. North America, led by Canada and the United States, holds a strong electronics and semiconductor industry, accounting for over 20% of the worldwide semiconductor revenue in 2024. IDI contact solutions are crucial in semiconductor assembly, testing, and interconnect applications, promising low-resistance and high-speed connections.

The region’s focus on high-performance chip development supports steady demand for modernized contact solutions. Also, the United States automotive industry is speedily adopting autonomous and electric vehicles, with EV sales anticipated to surpass 2.5 million units by 2025. IDI contact technologies are used in sensors, battery management systems, and ECU testing, offering reliable electrical connectivity. The growing integration of electronics in vehicles fuels the need for high-quality interconnect solutions.

Additionally, North America houses leading hyperscale data centers and cloud service providers, with investments surpassing USD 40 billion in 2024. IDI contacts are crucial for server interconnects, AI chip testing, and high-speed data transfer, allowing reliable and efficient operation. The rising demand for cloud computing, edge devices, and AI directly supports the industry growth.

IDI Contact Technology Market: Competitive Analysis

The leading players in the global IDI contact technology market are:

- Smiths Interconnect

- Yokowo Co. Ltd.

- Johnstech International

- QA Technology Company Inc.

- Everett Charles Technologies (ECT)

- INGUN Prüfmittelbau GmbH

- Cohu Inc.

- ISC Interconnect Systems Inc.

- Loranger International Corporation

- Ironwood Electronics

- SyNeo

- Ardent Concepts Inc.

- Micro Contact Solutions

- QA Technology Inc.

- IDI (Interconnect Devices Inc.)

IDI Contact Technology Market: Key Market Trends

Miniaturization and high-density interconnects:

The industry is experiencing a trend towards more compact electronic devices that require high-density contact solutions. IDI contacts are redesigned for micro-scale applications in wearables, smartphones, and IoT devices. This trend allows effective space utilization while maintaining optimal electrical performance.

Advanced materials and sustainability initiatives:

Manufacturers are actively investing in eco-friendly and high-performance materials, such as recyclable components and gold-plated alloys. IDI contacts are emphasizing corrosion resistance, durability, and environmental compliance. This trend addresses growing sustainability needs and longer product lifecycles in electronics manufacturing.

The global IDI contact technology market is segmented as follows:

By Type

- Chatbots and Virtual Assistants

- Artificial Intelligence (AI) Solutions

- Robotic Process Automation (RPA)

- Others

By Application

- Customer Support and Service

- Sales and Marketing

- E-commerce and Retail

- Financial Services

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

IDI (Interconnect Devices, Inc.) contact technology is an advanced spring-loaded and precision interconnect solution that establishes reliable electrical connections in electronic testing, connector systems, and semiconductor packaging. These contacts promise continual performance under high-cycle operations and harsh environments, increasing their significance in diverse industries.

The global IDI contact technology market is projected to grow due to mounting demand for high-speed data transmission, increasing adoption of advanced semiconductor testing, and the expansion of data centers and cloud computing applications.

According to study, the global IDI contact technology market size was worth around USD 16.39 billion in 2024 and is predicted to grow to around USD 35.66 billion by 2034.

The CAGR value of the IDI contact technology market is expected to be around 10.20% during 2025-2034.

Emerging trends in the IDI Contact Technology Market include AI and 5G adoption, miniaturized high-density interconnects, advanced materials, automotive electronics integration, and sustainable design innovations.

Asia Pacific is expected to lead the global IDI contact technology market during the forecast period.

China is a key contributor to the global IDI Contact Technology Market due to its dominant electronics, semiconductor, and automotive manufacturing sectors.

The key players profiled in the global IDI contact technology market include Smiths Interconnect, Yokowo Co., Ltd., Johnstech International, QA Technology Company, Inc., Everett Charles Technologies (ECT), INGUN Prüfmittelbau GmbH, Cohu, Inc., ISC Interconnect Systems, Inc., Loranger International Corporation, Ironwood Electronics, SyNeo, Ardent Concepts, Inc., Micro Contact Solutions, QA Technology Inc., and IDI (Interconnect Devices, Inc.).

Investment and partnership opportunities exist in EV and automotive electronics, AI and semiconductor testing, collaborative R&D for advanced interconnect solutions, and high-speed data centers.

The report examines key aspects of the IDI contact technology market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed