5G Core Network Market Size, Share, Trends, Growth & Forecast 2034

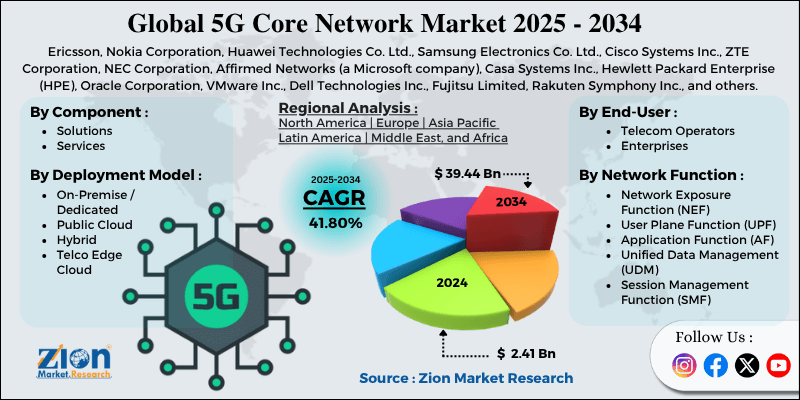

5G Core Network Market By Component (Solutions, Services), By Deployment Model (On-Premise / Dedicated, Public Cloud, Hybrid, Telco Edge Cloud), By Network Function (Network Exposure Function [NEF], User Plane Function [UPF], Application Function [AF], Unified Data Management [UDM], Session Management Function [SMF], and Others), By End-User (Telecom Operators, Enterprises), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

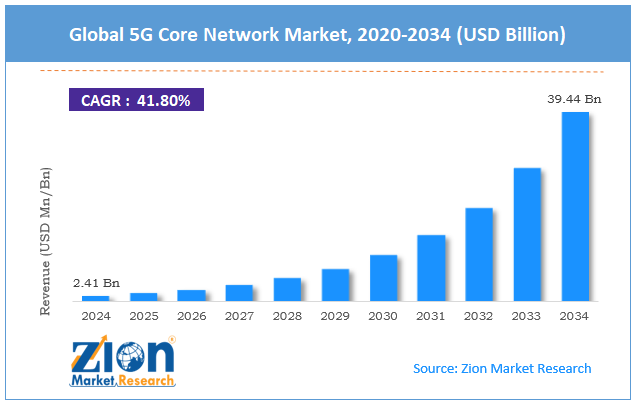

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.41 Billion | USD 39.44 Billion | 41.80% | 2024 |

5G Core Network Industry Perspective:

The global 5G core network market size was approximately USD 2.41 billion in 2024 and is projected to reach around USD 39.44 billion by 2034, with a compound annual growth rate (CAGR) of roughly 41.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global 5G core network market is estimated to grow annually at a CAGR of around 41.80% over the forecast period (2025-2034)

- In terms of revenue, the global 5G core network market size was valued at around USD 2.41 billion in 2024 and is projected to reach USD 39.44 billion by 2034.

- The 5G core network market is projected to grow significantly owing to increasing demand for low-latency and high-speed networks, growing investments in 5G infrastructure by telecom operators, and surging mobile data traffic and enhanced broadband needs.

- Based on component, the solutions segment is expected to lead the market, while the services segment is expected to grow considerably.

- Based on the deployment model, the on-premise/dedicated segment is the dominant segment, while the public cloud segment is projected to witness sizable revenue growth over the forecast period.

- Based on network function, the User Plane Function (UPF) segment is expected to lead the market compared to the Session Management Function (SMF) segment.

- Based on end-user, the telecom operators segment leads the market, while the enterprises segment is projected to grow considerably.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

5G Core Network Market: Overview

The 5G core network is a crucial component of the 5G architecture, enabling advanced connectivity, low latency, and high-speed data transmission. Built on a service-based and cloud-native framework, it supports network slicing, seamless integration, and virtualization with edge computing. The global 5G core network market is projected to witness substantial growth, driven by the rising demand for high-speed connectivity, the proliferation of smart devices and IoT, and the growing implementation of network slicing. The increase in mobile data consumption and surging demand for low-latency communication are driving the adoption of 5G core networks. With average worldwide mobile data traffic exceeding 120 EB per month in 2024, operators are upgrading to 5G cores to support reliability and faster speeds.

Moreover, the growing number of connected IoT devices is projected to hit 30 billion by 2030, needing flexible, scalable, and effective core networks. The 5G core allows massive machine-type communications (mMTC), backing smart cities, smart homes, and industrial IoT applications. Furthermore, network slicing enables operators to create customized visual networks tailored to specific uses, such as autonomous driving, gaming, and telemedicine. This capability enhances monetization potential and drives 5G core investments in various industries.

Although drivers exist, the global market is hindered by factors such as high initial deployment and integration costs, as well as the complexity of transitioning from legacy networks. Building a 5G core comprises significant capital expenditure for software, spectrum, and hardware upgrades. Smaller operators experience challenges because of low ROI in early deployment stages. Likewise, migrating from 4G EPC (Evolved Packet Core) to 5G Core is technically challenging, needing multi-vendor integration and reconfiguration. This notably increases operational risks and delays deployment.

Even so, the global 5G core network industry is well-positioned due to the expansion of private 5G networks, integration with edge computing, and adoption of automation and AI in network management. Businesses are deploying private 5G cores for low-latency and secure operations in factories, campuses, and ports. This creates lucrative opportunities for equipment integrators and vendors. The convergence of 5G core and edge computing enhances real-time processing for latency-sensitive applications, creating new growth opportunities in the healthcare, gaming, and automotive industries. Additionally, AI-based network orchestration and predictive maintenance can reduce operational costs and enhance network performance, making them notable drivers of improvement.

5G Core Network Market Dynamics

Growth Drivers

How do network slicing and customized services drive the 5G core network market?

5G core network allows network slicing, aiding operators to partition a single physical network into multiple virtual networks custom-made to specific use cases. This flexibility is essential for businesses needing dedicated security and bandwidth for smart cities, IoT, and enterprise applications. Huawei has lately presented its potential to transform business services. The ability to offer differentiated services through slicing is driving the global adoption of these services, which in turn influences the 5G core network market.

How does increasing investment in private 5G networks propel the 5G core network market growth?

Private 5G networks are gaining prominence in industries such as logistics, manufacturing, energy, and healthcare, creating a strong demand for dedicated 5G core networks. Siemens has recently partnered with Deutsche Telekom to deploy private 5G networks for smart factories in Germany, with a focus on enhanced security and operational efficiency. These business-driven investments are compelling network providers to offer flexible and scalable 5G core solutions that can manage high device densities and accommodate modified network management requirements.

Restraints

Compatibility with legacy networks adversely impacts the market progress

Integrating 5G core networks with current hybrid and 4G/LTE network architectures presents significant technical challenges. The 2025 report states that nearly 45% of telecom operators face operational complexities during the migration from 4G to 5G standalone networks, leading to7 service disruptions and increased costs. Recently, Vodafone UK reported delays in 5G core deployment due to compatibility issues with legacy infrastructure in rural regions. These technical barriers limit smooth adoption, mainly for operators with extensive 2G/3G/4G legacy systems.

Opportunities

How do cloud-native and virtualized network deployments present favorable prospects for the 5G core network market expansion?

Cloud-native 5G core networks enable operators to deploy software-defined and scalable frameworks, decreasing operational costs while improving flexibility. In May 2025, Ericsson deployed its cloud-native 5G core platform with Vodafone Spain, allowing faster rollout of services. Cloud-native opportunities in the 5G core network industry also include edge computing integration, which supports latency-sensitive applications such as virtual reality, augmented reality, and autonomous vehicles. Vendors that offer virtualized solutions and automated orchestration can gain a competitive benefit.

Challenges

Regulatory and spectrum allocation hurdles limit the market growth

Fluctuating regulations, compliance requirements, and spectrum licensing needs influence the global market. According to the GSMA 2025 data, nearly 30% of operators experience rollout delays due to the intricacies of spectrum allocation and regulatory approvals. India has postponed its 5G standalone spectrum auctions due to policy changes, which will impact operators' deployment plans. Regulatory uncertainty surges operational complexity and slows industry growth. Balancing policies and spectrum access remains a vital challenge, particularly in developing regions.

5G Core Network Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 5G Core Network Market |

| Market Size in 2024 | USD 2.41 Billion |

| Market Forecast in 2034 | USD 39.44 Billion |

| Growth Rate | CAGR of 41.80% |

| Number of Pages | 216 |

| Key Companies Covered | Ericsson, Nokia Corporation, Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Cisco Systems Inc., ZTE Corporation, NEC Corporation, Affirmed Networks (a Microsoft company), Casa Systems Inc., Hewlett Packard Enterprise (HPE), Oracle Corporation, VMware Inc., Dell Technologies Inc., Fujitsu Limited, Rakuten Symphony Inc., and others. |

| Segments Covered | By Component, By Deployment Model, By Network Function, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

5G Core Network Market: Segmentation

The global 5G core network market is segmented based on component, deployment model, network function, end-user, and region.

Based on the component, the global 5G core network industry is divided into solutions and services. The solutions segment leads the market due to the high demand for core network equipment, cloud-native solutions, and software necessary for upgrading and deploying 5G networks.

On the other hand, the services segment follows, driven by network design, consulting, integration, and managed services, which support operators in maintaining and implementing 5G cores.

Based on the deployment model, the global market is segmented into on-premise / dedicated, public cloud, hybrid, and telco edge cloud. The on-premise/dedicated segment holds leadership, as telecom operators prefer deploying 5G cores in their own data centers for enhanced control, compliance, and security, primarily for URLLC and mission-critical applications.

Conversely, the public cloud segment holds a second-leading rank due to its cost efficiency, scalability, and flexibility, enabling operators and businesses to quickly manage and deploy 5G core functions without incurring significant infrastructure investments.

Based on network function, the global 5G core network market is segmented into network exposure function (NEF), user plane function (UPF), application function (AF), unified data management (UDM), session management function (SMF), and others. The user plane function (UPF) segment has held a dominant share, as it manages high-volume data traffic, forwarding, and routing, thereby increasing its significance for high-throughput and ultra-low-latency 5G services.

Nonetheless, the Session Management Function (SMF) segment holds a secondary position, as it manages session establishment, policy enforcement, and mobility, which are crucial for effective service delivery and network reliability.

Based on end-user, the global market is segmented into telecom operators and enterprises. The telecom operators segment registered a leading share, as they are primary buyers of 5G core solutions to deploy nationwide networks, offer 5G services to consumers and businesses, and support massive connectivity.

However, the enterprises segment holds a second-leading rank because of the rising adoption of private 5G networks for smart manufacturing, industrial automation, logistics applications, and healthcare.

5G Core Network Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global 5G Core Network Market?

The Asia Pacific is likely to sustain its leadership in the 5G core network market due to the rapid deployment of 5G networks, high mobile data consumption, and the strong presence of telecom equipment vendors. Economies in the Asia Pacific, particularly those of South Korea, China, and Japan, are actively rolling out 5G networks. China alone registered over 2.1 million 5G base stations in 2024, covering more than 70% of urban areas, which fuels the demand for robust 5G core infrastructure. This large-scale deployment ranks the region as a leader. The region also boasts a vast and tech-savvy population that consumes substantial volumes of mobile data.

With more than 1.5 billion mobile subscribers in APAC and an average monthly data consumption of 12 GB per user, telecom operators are heavily investing in 5G cores to manage this growing traffic effectively. Additionally, major 5G core solution providers, such as ZTE, Huawei, and Samsung, have headquarters in the region, supporting faster deployment and cost-efficient solutions. This local vendor dominance boosts the adoption and decreases dependency on imports.

North America continues to hold the second-highest share in the 5G core network industry, thanks to early 5G customization, high investment by telecom operators, and high smartphone penetration and data demand. Canada and the United States are the leaders in deploying 5G networks, giving them a forerunning rank in core network adoption. By 2024, the United States is expected to have more than 250 million 5G subscribers, creating robust demand for advanced 5G core solutions. Leading operators, such as AT&T, T-Mobile, and Verizon, have invested billions in upgrading their core networks to 5G technology.

In 2023 alone, North American operators spent nearly $15 billion on 5G infrastructure, fueling the industry growth. Additionally, North America has the highest smartphone user penetration worldwide, registering more than 80%, along with growing mobile traffic of nearly 10 GB per user/month. This strengthens the need for high-capacity 5G cores to maintain service quality.

5G Core Network Market: Competitive Analysis

The leading players in the global 5G core network market are:

- Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- ZTE Corporation

- NEC Corporation

- Affirmed Networks (a Microsoft company)

- Casa Systems Inc.

- Hewlett Packard Enterprise (HPE)

- Oracle Corporation

- VMware Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Rakuten Symphony Inc.

5G Core Network Market: Key Market Trends

Adoption of cloud-native 5G core architecture:

Telecom operators are primarily deploying containerized and cloud-native 5G cores to enhance flexibility, scalability, and resource efficiency. This facilitates the speedy deployment of services, enhanced support for virtualized network functions (VNFs), and easier network upgrades.

Network slicing for customized services:

Network slicing is gaining prominence as operators create multiple virtual networks on a single 5G core to cater to particular use cases. Industries such as gaming, healthcare, and manufacturing benefit from customized latency, reliability, and bandwidth, which improve monetization opportunities.

The global 5G core network market is segmented as follows:

By Component

- Solutions

- Services

By Deployment Model

- On-Premise / Dedicated

- Public Cloud

- Hybrid

- Telco Edge Cloud

By Network Function

- Network Exposure Function (NEF)

- User Plane Function (UPF)

- Application Function (AF)

- Unified Data Management (UDM)

- Session Management Function (SMF)

- Others

By End-User

- Telecom Operators

- Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The 5G core network is a crucial component of the 5G architecture, enabling advanced connectivity, low latency, and high-speed data transmission. Built on a service-based and cloud-native framework, it supports network slicing, seamless integration, and virtualization with edge computing.

The global 5G core network market is projected to grow due to the rapid adoption of IoT and connected devices, the increasing use of cloud-native and virtualized network architectures, and the integration of machine learning and AI in network management.

According to study, the global 5G core network market size was worth around USD 2.41 billion in 2024 and is predicted to grow to around USD 39.44 billion by 2034.

The CAGR value of the 5G core network market is expected to be approximately 41.80% from 2025 to 2034.

Emerging trends and innovations in the 5G Core Network Market include network slicing, cloud-native architecture, AI-driven automation, edge computing integration, and enhanced cybersecurity.

Asia Pacific is expected to lead the global 5G core network market during the forecast period.

The key players profiled in the global 5G core network market include Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Cisco Systems, Inc., ZTE Corporation, NEC Corporation, Affirmed Networks (a Microsoft company), Casa Systems, Inc., Hewlett Packard Enterprise (HPE), Oracle Corporation, VMware, Inc., Dell Technologies Inc., Fujitsu Limited, and Rakuten Symphony, Inc.

Stakeholders should adopt strategic partnerships, cloud-native deployments, AI-driven optimization, network slicing solutions, and continuous innovation to stay competitive in the market.

Key investment and partnership opportunities in the 5G Core Network Market include private 5G deployments, collaborations with cloud providers, edge computing integration, and network slicing solutions.

The report examines key aspects of the 5G core network market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed