Global Hexamethylenediamine Market Size, Share, Growth Analysis Report - Forecast 2034

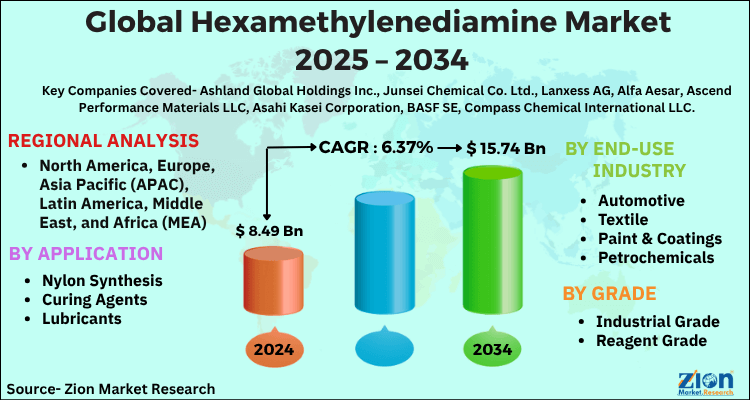

Hexamethylenediamine Market By Application (Nylon Synthesis (Nylon 6,6), Coatings, Adhesives, Water Treatment Chemicals, Lubricants), By End-user (Automotive, Textile, Chemical, Construction, Electronics), By Grade (Industrial Grade, Reagent Grade), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

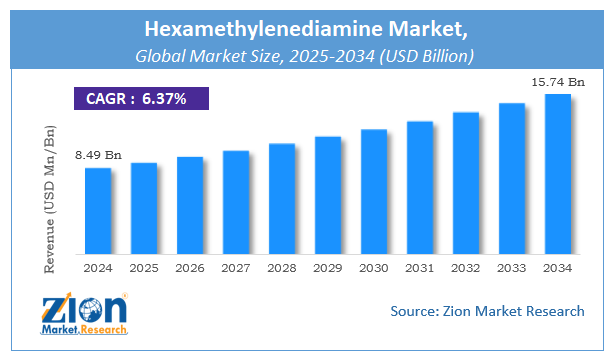

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.49 Billion | USD 15.74 Billion | 6.37% | 2024 |

Global Hexamethylenediamine Market: Industry Perspective

The global hexamethylenediamine market size was worth around USD 8.49 Billion in 2024 and is predicted to grow to around USD 15.74 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.37% between 2025 and 2034. The report analyzes the global hexamethylenediamine market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hexamethylenediamine industry.

The report analyzes the global hexamethylenediamine market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hexamethylenediamine industry.

Global Hexamethylenediamine Market: Overview

Hexamethylenediamine is an organic compound with the chemical formula C6H16N2. It is also known as HMDA or 1,6-diaminohexane. Hexamethylenediamine is a diamine, meaning it contains two amino groups (-NH2) attached to a six-carbon chain. It is a colorless liquid with a strong amine odor.

Hexamethylenediamine is primarily used as a building block in the production of various polymers, particularly nylon-6,6. It is a key monomer in the synthesis of this type of nylon, which finds applications in textiles, engineering plastics, and other industrial products. In the nylon-6,6 polymerization process, hexamethylenediamine reacts with adipic acid to form the repeating units of the polymer chain.

Apart from its role in nylon production, hexamethylenediamine is also used as a curing agent for epoxy resins, a corrosion inhibitor, a crosslinking agent in certain coatings, and a chemical intermediate in the synthesis of pharmaceuticals and other organic compounds. The hexamethylenediamine market is driven by the demand for nylon-6,6 and its applications in various industries. Factors such as industrial growth, regional dynamics, and environmental considerations shape the market landscape, while competitive strategies and technological advancements contribute to its growth and evolution.

Global Hexamethylenediamine Market: Growth Drivers

Increasing hexamethylenediamine demand for the production of lubricants drives the market growth

One of the key factors fueling the hexamethylenediamine market's expansion is the rising demand for hexamethylenediamine in the manufacture of lubricants. The hexamethylenediamine market has expanded as a result of rising demand for the automotive industry, chainsaw oil, engine oil, grease, and other lubricants. Equally important and steadily expanding year over year is the market for engine oils, which are primarily needed to lubricate internal combustion engines (ICEs) to guarantee that powertrains operate smoothly.

With the aftermarket included, the use of engine oil in developing nations like India exceeds 2.5 billion liters annually and is increasing by 2.0% to 2.5% annually. Grease formulations guard against moisture contamination, false brinelling at -55 degrees Fahrenheit, fretting corrosion, and other hazards. Thus, this is expected to drive market growth during the forecast period.

Restraints:

Availability of substitutes hinders the market growth

Although hexamethylenediamine is a key component in the production of nylon-6,6, there are alternative materials available in the market. Some of these alternatives, such as bio-based or recycled materials, are gaining attention due to their environmental benefits. The availability of such alternatives may pose a challenge to the growth of the hexamethylenediamine industry.

Opportunities:

Technological advancements and product innovations along with growing government support offer a significant opportunity

The hexamethylenediamine market has significantly benefited from technological development and product innovation. The advent of new manufacturing methods as a consequence of ongoing research and development has increased product quality while lowering production costs. For instance, improved yields and lower energy use have been made possible through the development of more effective catalysts and manufacturing techniques.

These developments have been made possible by publicly financed research initiatives like the materials science grants offered by the National Science Foundation. The hexamethylenediamine market has grown significantly as a result of government efforts and policies, which have been quite important. Governments in many areas have encouraged manufacturers to participate in the creation and development of HMDA by providing favorable legislation, subsidies, and tax incentives.

Government programs that support eco-friendly products and lower carbon footprints have also increased demand for hexamethylenediamine. For instance, the Green Deal of the European Union has encouraged the use of ecologically friendly products, such as HMDA, leading to increasing market demand.

Challenges:

Volatility in raw material price and environmental concerns poses a major challenge to the market growth

Hexamethylenediamine production relies on raw materials such as adiponitrile. Fluctuations in the prices of these raw materials can impact the overall production cost of hexamethylenediamine. Price volatility can affect the profitability of manufacturers and hinder the hexamethylenediamine industry growth. Additionally, hexamethylenediamine is a chemical compound, and its production and handling pose environmental and health risks if not managed properly. Stringent environmental regulations and concerns about worker safety may impose compliance costs on manufacturers, affecting production and supply. Therefore, volatility in raw material prices and environmental concerns poses a major challenge to the growth of the market over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global hexamethylenediamine market is estimated to grow annually at a CAGR of around 6.37% over the forecast period (2025-2034).

- Regarding revenue, the global hexamethylenediamine market size was valued at around USD 8.49 Billion in 2024 and is projected to reach USD 15.74 Billion by 2034.

- The hexamethylenediamine market is projected to grow at a significant rate due to rising due to its critical use in nylon 6,6 production and applications in automotive, textiles, and coatings industries.

- Based on Application, the Nylon Synthesis (Nylon 6 segment is expected to lead the global market.

- On the basis of End-user, the Automotive segment is growing at a high rate and will continue to dominate the global market.

- Based on the Grade, the Industrial Grade segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Hexamethylenediamine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hexamethylenediamine Market |

| Market Size in 2024 | USD 8.49 Billion |

| Market Forecast in 2034 | USD 15.74 Billion |

| Growth Rate | CAGR of 6.37% |

| Number of Pages | 218 |

| Key Companies Covered | Ashland Global Holdings Inc., Junsei Chemical Co. Ltd., Lanxess AG, Alfa Aesar, Ascend Performance Materials LLC, Asahi Kasei Corporation, BASF SE, Compass Chemical International LLC, Chengdu Dacheng Chemical Co. Ltd., DuPont de Nemours Inc., Evonik Industries AG, Dow Inc., Merck KgaA, INVISTA, Daejungche Chemicals & Metals Co. Ltd., Meryer (Shanghai) Chemical Technology Co. Ltd., Radici Partecipazioni SpA, Shenma Industrial Co. Ltd., Genomatica Inc. and Rennovia Inc. among others., and others. |

| Segments Covered | By Application, By End-user, By Grade, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Hexamethylenediamine Market: Segmentation

The global hexamethylenediamine industry is segmented based on application, end-use industry, grade, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on the application, the global market is bifurcated into nylon synthesis, curing agents, lubricants, biocides, intermediate for coatings, adhesives, water treatment chemicals, and others. Nylon synthesis is expected to dominate the market over the forecast period.

The primary application of hexamethylenediamine is in the production of nylon-6,6. Hexamethylenediamine reacts with adipic acid to form the repeating units of the nylon-6,6 polymer chain. Nylon-6,6 is widely used in the textile industry for the production of fibers, yarns, and fabrics. Hexamethylenediamine plays a critical role in the synthesis of nylon fibers used in various textile applications, including apparel, home furnishings, and industrial textiles. Moreover, Nylon-6,6 finds extensive use in the automotive industry due to its high strength, heat resistance, and durability.

It is used in various components such as engine covers, fuel lines, airbag fabrics, and other interior and exterior parts. The automotive sector represents a significant end-use segment for hexamethylenediamine. In addition, the need for nylon 66 is anticipated to rise along with the popularity of electric cars. Over the next several years, it's expected that the strict regulations and shifting pollution standards will further open up opportunities for electric vehicles.

Growing numbers of buyers choose to purchase electric vehicles with cutting-edge technologies rather than automobiles with engines that produce more pollution than they do. For instance, according to the IEA, sales of electric vehicles worldwide (excluding two- and three-wheelers) are projected to reach 125 million in 2030 under the New Policies Scenario. According to the EV30@30 Scenario, over 70% of Chinese vehicle sales in 2030 are anticipated to be EVs. Additionally, EVs account for 50% of vehicles sold in Europe, 37% in Japan, 30% in Canada and the US, and 29% in India. Thereby, driving the segment growth.

Based on the end-use industry, the global hexamethylenediamine industry is divided into automotive, textile, paint & coatings, petrochemicals, and others. The automotive segment is expected to hold a significant market share over the forecast period. Nylon is employed in automotive applications ranging from the structural and decorative components of the car to the electronic parts since it is less expensive to use than metals, allows for lighter components, and increases fuel efficiency while lowering pollutants. Research has shown that a 10% reduction in an automobile's weight may increase fuel economy by 6% to 8%. Thus, this is expected to drive the growth of the segment over the forecast period.

By Grade, the global hexamethylenediamine market is split into Industrial Grade, Reagent Grade.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Hexamethylenediamine Market: Regional Analysis

The hexamethylenediamine market demonstrates varied regional dynamics, with Asia-Pacific leading due to its strong nylon 6,6 production base and growing automotive and textile industries, particularly in China and India. North America follows closely, driven by established manufacturing infrastructure and demand from the automotive and aerospace sectors. Europe shows steady growth, supported by advancements in engineering plastics and coatings, though regulatory pressures regarding environmental impact may moderate expansion. Meanwhile, regions like Latin America and the Middle East & Africa are witnessing gradual market development, propelled by emerging industrial activities and infrastructure projects, albeit at a smaller scale compared to major markets.

The global hexamethylenediamine market is dominated by players like:

- Ashland Global Holdings Inc.

- Junsei Chemical Co. Ltd.

- Lanxess AG

- Alfa Aesar

- Ascend Performance Materials LLC

- Asahi Kasei Corporation

- BASF SE

- Compass Chemical International LLC

- Chengdu Dacheng Chemical Co. Ltd.

- DuPont de Nemours Inc.

- Evonik Industries AG

- Dow Inc.

- Merck KgaA

- INVISTA

- Daejungche Chemicals & Metals Co. Ltd.

- Meryer (Shanghai) Chemical Technology Co. Ltd.

- Radici Partecipazioni SpA

- Shenma Industrial Co. Ltd.

- Genomatica Inc. and Rennovia Inc. among others.

Global Hexamethylenediamine Market: Segmentation Analysis

The global hexamethylenediamine market is segmented as follows:

By Application

- Nylon Synthesis

- Curing Agents

- Lubricants

- Biocides

- Intermediate for Coatings

- Adhesives

- Water Treatment Chemicals

- Others

By End-use Industry

- Automotive

- Textile

- Paint & Coatings

- Petrochemicals

- Others

By Grade

- Industrial Grade

- Reagent Grade

Global Hexamethylenediamine Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Hexamethylenediamine is an organic compound with the chemical formula C6H16N2. It is also known as HMDA or 1,6-diaminohexane. Hexamethylenediamine is a diamine, meaning it contains two amino groups (-NH2) attached to a six-carbon chain. It is a colorless liquid with a strong amine odor.

The global hexamethylenediamine market is expected to grow due to rising due to its critical use in nylon 6,6 production and applications in automotive, textiles, and coatings industries.

According to a study, the global hexamethylenediamine market size was worth around USD 8.49 Billion in 2024 and is expected to reach USD 15.74 Billion by 2034.

The global hexamethylenediamine market is expected to grow at a CAGR of 6.37% during the forecast period.

Asia-Pacific is expected to dominate the hexamethylenediamine market over the forecast period.

Leading players in the global hexamethylenediamine market include Ashland Global Holdings Inc., Junsei Chemical Co. Ltd., Lanxess AG, Alfa Aesar, Ascend Performance Materials LLC, Asahi Kasei Corporation, BASF SE, Compass Chemical International LLC, Chengdu Dacheng Chemical Co. Ltd., DuPont de Nemours Inc., Evonik Industries AG, Dow Inc., Merck KgaA, INVISTA, Daejungche Chemicals & Metals Co. Ltd., Meryer (Shanghai) Chemical Technology Co. Ltd., Radici Partecipazioni SpA, Shenma Industrial Co. Ltd., Genomatica Inc. and Rennovia Inc. among others., among others.

The report explores crucial aspects of the hexamethylenediamine market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed