Heavy Duty (HD) Truck Market Size, Share, Trends, Growth 2034

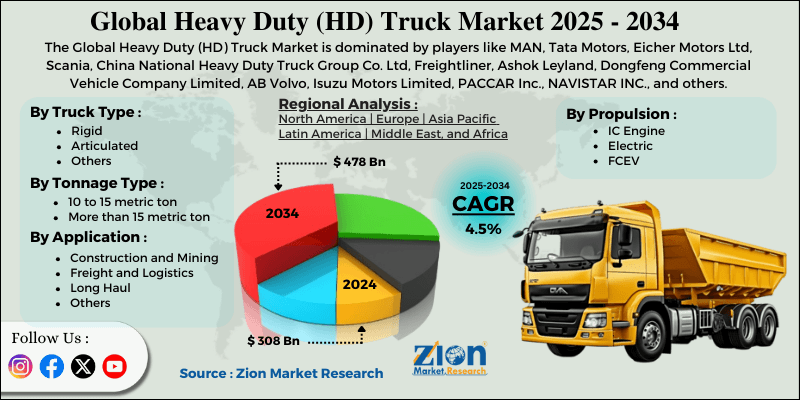

Heavy Duty (HD) Truck Market By Truck Type (Rigid, Articulated, and Others), By Tonnage Type (10 to 15 Metric Ton and More than 15 Metric Ton), By Propulsion (IC Engine, Electric, and FCEV), By Application (Construction and Mining, Freight and Logistics, Long Haul, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

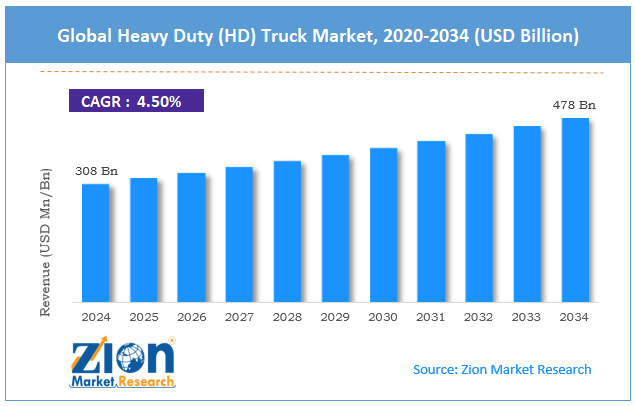

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 308 Billion | USD 478 Billion | 4.5% | 2024 |

Heavy Duty (HD) Truck Industry Perspective:

The global Heavy Duty (HD) Truck market size was worth around USD 308 billion in 2024 and is predicted to grow to around USD 478 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global Heavy Duty (HD) Truck market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- In terms of revenue, the global Heavy Duty (HD) Truck market size was valued at around USD 308 billion in 2024 and is projected to reach USD 478 billion by 2034.

- The rising demand from the construction sector is expected to drive the Heavy Duty (HD) Truck market over the forecast period.

- Based on the truck type, the rigid segment is expected to capture the largest market share over the projected period.

- Based on the tonnage type, the 10 to 15 metric ton segment is expected to capture the largest market share over the projected period.

- Based on the propulsion, the IC Engine segment is expected to capture the largest market share over the projected period.

- Based on the application, the freight and logistics segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Heavy Duty (HD) Truck Market: Overview

Heavy-duty trucks are built for heavy-duty jobs like hauling freight, construction, mining, and other specialized industrial work where load and durability requirements are higher than those of light- and medium-duty trucks. Heavy-duty trucks are those with a GVWR of more than 26,001 pounds (approximately 11,800 kg). Class 7 trucks weigh between 26,001 and 33,000 pounds, and Class 8 trucks weigh more than 33,001 pounds. This includes highway tractors capable of pulling trailers weighing up to 80,000 pounds. Heavy-duty vehicles place greater emphasis on how much they can carry, how much they can haul, and how long they can run than on how comfortable they are to drive and how much fuel they use. Depending on how they are set up and what they can and can't do, they can move or pull tens of thousands of pounds of cargo, like bulk materials, containers, heavy machinery, refrigerated goods, and long-haul freight across regions or countries. Their driveline, cooling, and electrical systems are built to last a long time while carrying heavy loads, typically in harsh environments such as construction sites and mines, or in very hot or cold weather.

Heavy Duty (HD) Truck Market Dynamics

Growth Drivers

How does the surge in freight demand, logistics & e-commerce expansion drive the heavy duty truck market growth?

The Heavy Duty (HD) Truck market is growing due to rising freight demand, primarily driven by the rapid growth of e-commerce and global trade. Online retailers like Amazon and Alibaba have changed expectations, leading to a growing number of packages and freight being shipped worldwide. This makes people want more reliable, time-sensitive freight services and multimodal transportation options that meet high standards for speed and accuracy.

To make their operations more effective and meet increased demand, logistics companies are spending heavily on new technologies such as AI-based route optimization, digital tracking systems, cloud-based platforms, and automated warehouses. There is a growing need for last-mile delivery solutions, which means businesses must change their supply chains to be more flexible, responsive, and able to handle demand fluctuations, especially during peak seasons when e-commerce sales soar.

Restraints

Will the high cost of heavy-duty trucks impede the growth of the heavy duty truck market?

Heavy-duty trucks are expensive, making it hard for many businesses, especially smaller ones and startups, to buy new ones. This slows the industry's growth. Because of their intricate engineering, powerful engines, current safety and emissions-compliance technology, and long-lasting materials that can withstand heavy loads, these vehicles cost a significant amount of money up front. This cost barrier makes it hard for fleets to grow and renew, so many operators have to keep older, less efficient vehicles on the road, slowing overall market growth.

Also, high truck prices are caused by factors such as strict environmental regulations, rising raw material costs (such as steel and aluminum), and taxes on imported parts. These factors make running a business more expensive and the economy less stable, reducing the likelihood of fleet improvements. This makes automobiles depreciate more slowly, delaying investment decisions and hurting manufacturers' profits and their incentives to develop new ideas in the industry.

Opportunities

Does the growing launch of electric trucks offer a potential opportunity for the heavy duty truck industry growth?

The increasing number of electric heavy duty trucks is an excellent opportunity for the sector to flourish, as they help address problems such as high fuel costs, environmental regulations, and sustainability standards. Electric trucks don't need as much diesel fuel, which is expensive and might change in price. Electric vehicles have fewer moving parts than internal combustion engines, which means fleet owners may save money on energy and maintenance.

For instance, in September 2024, Volvo unveiled a new heavy-duty electric truck capable of traveling up to 600 kilometers on a single charge. This was a big step forward for long-distance travel that doesn't pollute the air. This will allow transportation companies to deploy electric trucks on long-distance and interregional routes and to drive a full workday without stopping to charge.

Challenges

High procedural cost for patients poses a major challenge to market expansion

The heavy duty truck market faces many challenges due to stricter environmental and emissions regulations. This is because achieving the more stringent standards is more complex and more expensive. Starting with model year 2027, the US Environmental Protection Agency (EPA) and other governments have established strict limits on the amount of nitrogen oxides (NOx) and greenhouse gases (GHG) that heavy-duty trucks can emit. These restrictions make it more likely that truck companies will develop cleaner, more efficient engines, create better ways to manage emissions, or switch to electric or hydrogen fuel-cell propulsion systems. This will increase the truck's cost at first.

Original equipment manufacturers (OEMs) must invest heavily in research and development to meet these criteria, thereby raising production costs and making trucks more expensive for fleet operators. Raising capital costs could lower demand, especially among smaller logistics companies with thin margins, thereby slowing the sector's sales growth. Also, regulatory uncertainties and possible reevaluations delay decision-making on fleet renewals or expansions, further increasing market uncertainty.

Heavy Duty (HD) Truck Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Heavy Duty (HD) Truck Market |

| Market Size in 2024 | USD 308 Billion |

| Market Forecast in 2034 | USD 478 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 216 |

| Key Companies Covered | MAN, Tata Motors, Eicher Motors Ltd, Scania, China National Heavy Duty Truck Group Co. Ltd, Freightliner, Ashok Leyland, Dongfeng Commercial Vehicle Company Limited, AB Volvo, Isuzu Motors Limited, PACCAR Inc., NAVISTAR INC., and others. |

| Segments Covered | By Truck Type, By Tonnage Type, By Propulsion, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Heavy Duty (HD) Truck Market: Segmentation

The global Heavy Duty (HD) Truck industry is segmented based on truck type, tonnage type, propulsion, application, and region.

Based on the truck type, the global Heavy Duty (HD) Truck market is bifurcated into rigid, articulated, and others. The rigid segment is expected to dominate the market. Rigid trucks feature robust chassis and solid frame construction built to endure harsh conditions and heavy loads. This durability reduces wear and tear, extending vehicle lifespan and reliability for long-term use in construction, mining, and logistics sectors. Thus, these favorable properties foster the industry expansion.

Based on the tonnage type, the global Heavy Duty (HD) Truck industry is bifurcated into 10 to 15 metric ton and more than 15 metric ton. The 10 to 15 metric ton segment holds the major market share. This segment is propelled by its operational flexibility, regulatory compliance advancements, technological innovations, and critical role in supporting growing urban and regional freight logistics.

Based on the propulsion, the global Heavy Duty (HD) Truck market is bifurcated into IC Engine, Electric, and FCEV. The IC Engine segment dominates the market. This expansion is being driven by the continued need for powerful, fuel-efficient, and emission-free heavy-duty engines in the transportation, construction, and mining industries. ICE trucks, particularly Class 8 vehicles with 400-500 horsepower engines, remain essential for long-haul transportation due to their greater hauling capacity and durability.

Based on the application, the global Heavy Duty (HD) Truck industry is divided into construction and mining, freight and logistics, long haul, and others. The freight and logistics segment holds the largest market share over the forecast period. This is driven by the surge in freight volumes and logistics activity, with higher payload capacity, regulatory compliance, and technological innovation collectively driving fleet expansions and upgrades worldwide.

Heavy Duty (HD) Truck Market: Regional Analysis

Why does the Asia Pacific dominate the heavy duty truck market over the projected period?

The Asia Pacific region is expected to dominate the Heavy Duty (HD) Truck market. The region is growing stronger as countries like China, India, Australia, and Southeast Asia become more urbanized and industrialized. The demand for heavy-duty vehicles is rising as more people in construction, mining, manufacturing, and freight logistics rely on them. The World Bank, for instance, states that India is quickly becoming more urban.

By 2036, its towns and cities will contain 600 million people, or 40% of the total population, up from 31% in 2011. Urban regions will make up about 70% of GDP. China is a regional leader, holding most of the market share and aggressively supporting electric and alternative-fuel trucks through infrastructure spending and export-driven programs such as the Belt and Road Initiative and the Regional Comprehensive Economic Partnership (RCEP).

Heavy Duty (HD) Truck Market: Competitive Analysis

The global Heavy Duty (HD) Truck market is dominated by players like:

- MAN

- Tata Motors

- Eicher Motors Ltd

- Scania

- China National Heavy Duty Truck Group Co. Ltd

- Freightliner

- Ashok Leyland

- Dongfeng Commercial Vehicle Company Limited

- AB Volvo

- Isuzu Motors Limited

- PACCAR Inc.

- NAVISTAR INC.

The global Heavy Duty (HD) Truck market is segmented as follows:

By Truck Type

- Rigid

- Articulated

- Others

By Tonnage Type

- 10 to 15 metric ton

- More than 15 metric ton

By Propulsion

- IC Engine

- Electric

- FCEV

By Application

- Construction and Mining

- Freight and Logistics

- Long Haul

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Heavy-duty trucks are built for heavy-duty jobs like hauling freight, construction, mining, and other specialized industrial work where load and durability requirements are higher than those of light- and medium-duty trucks. Heavy-duty trucks are those with a GVWR of more than 26,001 pounds (approximately 11,800 kg).

The heavy duty truck market is primarily driven by the rising demand for freight transportation and the expansion of global logistics networks, which are fueled by rapid growth in e-commerce and international trade.

The heavy duty truck market is restrained by several factors that challenge its growth trajectory. Elevated dealer inventory is suppressing new orders and slowing retail sales, as surplus stock delays fleet replenishment cycles. High interest rates increase financing costs for buyers, making it harder for fleet operators to invest in new trucks.

Based on the truck type, the rigid segment is expected to dominate the Heavy Duty (HD) Truck market growth during the projected period.

The growing technological collaboration and R&D investment pose a major impact factor for the Heavy Duty (HD) Truck industry's growth over the projected period.

The heavy duty truck market is significantly affected by a range of regulatory and environmental factors aimed at enhancing road safety, reducing emissions, and promoting sustainability.

To stay competitive in the Heavy Duty (HD) Truck market, stakeholders should adopt a multi-faceted strategy focusing on technological innovation, operational efficiency, and market adaptability.

According to the report, the global Heavy Duty (HD) Truck market size was worth around USD 308 billion in 2024 and is predicted to grow to around USD 478 billion by 2034.

The global Heavy Duty (HD) Truck market is expected to grow at a CAGR of 4.5% during the forecast period.

The global Heavy Duty (HD) Truck industry growth is expected to be led by the Asia Pacific over the forecast period.

The global Heavy Duty (HD) Truck market is dominated by players MAN, Tata Motors, Eicher Motors Ltd, Scania, China National Heavy Duty Truck Group Co., Ltd, Freightliner, Ashok Leyland, Dongfeng Commercial Vehicle Company Limited, AB Volvo, Isuzu Motors Limited, PACCAR Inc., and NAVISTAR, INC., among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed