Healthcare Decision Support System Market Size, Share, Trends, Growth 2034

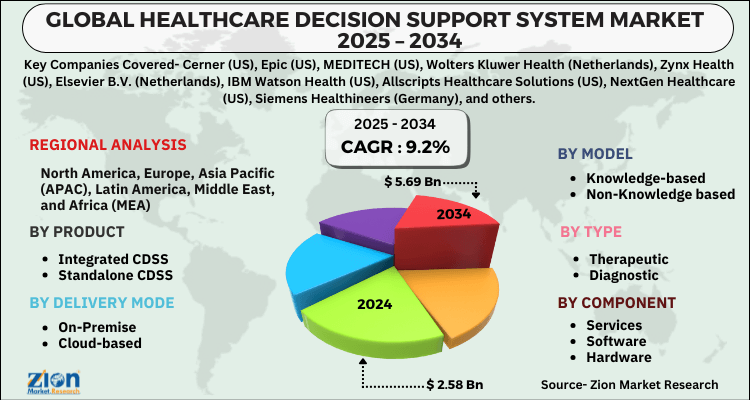

Healthcare Decision Support System Market By Product (Integrated CDSS, Standalone CDSS). By Delivery Mode (On-Premise, Cloud-based). By Model (Knowledge-based, Non-Knowledge based) By Type (Therapeutic, Diagnostic). By Component (Services, Software, Hardware). By Application (Advanced CDSS, Conventional CDSS). By Level of Interactivity (Active CDSS, Passive CDSS). By Settings (In-Patient, Ambulatory care settings) And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

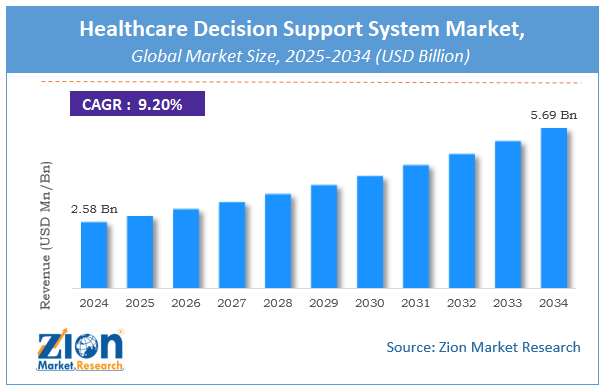

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.58 Billion | USD 5.69 Billion | 9.2% | 2024 |

Healthcare Decision Support System Industry Perspective:

The Healthcare Decision Support System Market was worth around USD 2.58 Billion in 2024 and is estimated to grow to about USD 5.69 Billion by 2034, with a compound annual growth rate (CAGR) of approximately 9.2 percent over the forecast period.

The report analyzes the Healthcare Decision Support System Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Healthcare Decision Support System Market

Healthcare Decision Support System Market: Overview

A healthcare decision support system (HDSS) is designed to improve healthcare delivery by merging clinical expertise, patient information, and other health data into medical decisions. Factors such as the increasing prevalence of chronic diseases globally, as well as technological advancements in big data processing such as the use of machine learning and artificial intelligence (AI) in understanding critical insights, will drive the growth of this market during the forecast period. HDSS has become an important tool in the fight against COVID-19 because it demonstrated how healthcare teams can stay up to date on the most recent COVID information and intelligence, thereby improving the quality of care provided.

Rapid advances in biotechnology and bioinformatics are promoting improvements and optimizations in data storage, management, and analytics platforms, which will drive the future growth of the HDSS market. With pharmaceutical errors, doctors must make effective and efficient clinical decisions in order to achieve evidence-based clinical outcomes and avoid misdiagnosis during any medical process, fuelling the market's rise in the next years.

Key Insights

- As per the analysis shared by our research analyst, the global healthcare decision support system market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2025-2034).

- Regarding revenue, the global healthcare decision support system market size was valued at around USD 2.58 Billion in 2024 and is projected to reach USD 5.69 Billion by 2034.

- The healthcare decision support system market is projected to grow at a significant rate due to rising demand for data-driven clinical decisions, increasing adoption of AI and big data analytics, regulatory pressure for improved patient outcomes, and the need to reduce healthcare costs.

- Based on Product, the Integrated CDSS segment is expected to lead the global market.

- On the basis of Delivery Mode, the On-Premise segment is growing at a high rate and will continue to dominate the global market.

- Based on the Model, the Knowledge-based segment is projected to swipe the largest market share.

- By Type, the Therapeutic segment is expected to dominate the global market.

- In terms of Component, the Services segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Healthcare Decision Support System Market: Driver

Medication errors are becoming more common.

A medication error is an unintentional failure in the drug treatment process that has the potential to harm patients' health. Prescription, dispensing, storage, preparation, and administration errors are the most common preventable causes of unwanted adverse events, posing a significant public health cost. When patients and healthcare providers have access to complete and accurate EHRs that provide a comprehensive patient illness history, proper care is ensured. Such records can help improve diagnosis, minimize errors, save time, and even shorten patient wait times. To obtain quality treatment, hospitals and physicians must deploy and successfully use HDSS and its accompanying technologies, which is boosting their adoption around the world.

Healthcare Decision Support System Market: Restraint

Concerns about data security in relation to cloud-based HDSS

A risk with cloud-based HDSS is that data hosted by the user is not as secure as data stored on-premise. Patient information is deemed sensitive and requires a high level of privacy to ensure that it is only accessed by authorized users. The public cloud suffers from the same security issues as traditional IT systems and is hence not recommended. Private clouds provide greater access protocols, data security, and systems, but they are not widely used in the healthcare sector due to higher initial expenses. Because of the requirement to access patient data across many departments, major data security risks have arisen. This will create security gaps, which hackers can exploit to obtain access to critical information. As a result, many hospitals continue to select off-the-shelf solutions over cloud-based solutions, stifling market growth in the coming years.

Healthcare Decision Support System Market: Segmentation Analysis

The global healthcare decision support system market is segmented based on Product, Delivery Mode, Model, Type, Component, and region.

Based on Product, the global healthcare decision support system market is divided into Integrated CDSS, Standalone CDSS.

On the basis of Delivery Mode, the global healthcare decision support system market is bifurcated into On-Premise, Cloud-based.

By Model, the global healthcare decision support system market is split into Knowledge-based, Non-Knowledge based.

In terms of Type, the global healthcare decision support system market is categorized into Therapeutic, Diagnostic.

By Component, the global Healthcare Decision Support System market is divided into Services, Software, Hardware.

Recent Developments

- In 2020, Zynx Health has announced that it has significantly expanded and upgraded the publicly available COVID-19 clinical decision support available on its website, zynxhealth.com. The most recent additions to the Zynx Health material include suggestions from groups such as the Infectious Diseases Society of America, it is projected to achieve substantial advancements in the worldwide Centers for Disease Control and Prevention and the World Health Organization.

Healthcare Decision Support System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare Decision Support System Market |

| Market Size in 2024 | USD 2.58 Billion |

| Market Forecast in 2034 | USD 5.69 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 147 |

| Key Companies Covered | Cerner (US), Epic (US), MEDITECH (US), Wolters Kluwer Health (Netherlands), Zynx Health (US), Elsevier B.V. (Netherlands), IBM Watson Health (US), Allscripts Healthcare Solutions (US), NextGen Healthcare (US), Siemens Healthineers (Germany), and others. |

| Segments Covered | By Product, By Delivery Mode, By Model, By Type, By Component, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Healthcare Decision Support System Market: Regional Landscape

North America is likely to represent a significant share of the worldwide Healthcare decision support systems market because of the increased adoption of clinical decision systems by a greater number of healthcare institutions. Furthermore, the introduction of new technologies to link existing data handling systems such as EHR and clinical decision systems is providing predictive scenarios for patients, resulting in improved patient experience and treatment.

The Asia Pacific has enormous potential for global Healthcare decision support system growth because of the continuously growing patient population and the growing demand for software aid in managing this growing patient population. Furthermore, increased collaboration between healthcare institutions and information technology firms for the development of new systems is likely to drive the expansion of global clinical decision support systems in the Asia Pacific.

Healthcare Decision Support System Market: Competitive Landscape

Some of the main competitors dominating the Healthcare Decision Support System Market include -

- Cerner (US)

- Epic (US)

- MEDITECH (US)

- Wolters Kluwer Health (Netherlands)

- Zynx Health (US)

- Elsevier B.V. (Netherlands)

- IBM Watson Health (US)

- Allscripts Healthcare Solutions (US)

- NextGen Healthcare (US)

- Siemens Healthineers (Germany)

Healthcare Decision Support System Market is segmented as follows:

By Product

- Integrated CDSS

- Standalone CDSS

By Delivery Mode

- On-Premise

- Cloud-based

By Model

- Knowledge-based

- Non-Knowledge based

By Type

- Therapeutic

- Diagnostic

By Component

- Services

- Software

- Hardware

By Application

- Advanced CDSS

- Conventional CDSS

By Level of Interactivity

- Active CDSS

- Passive CDSS

By Settings

- In Patient

- Ambulatory care settings

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

A Healthcare Decision Support System (HDSS) is a computer-based tool designed to assist healthcare professionals in making clinical decisions by providing evidence-based recommendations, patient-specific data analysis, and alerts for potential risks

The global healthcare decision support system market is expected to grow due to increasing demand for data-driven clinical decisions, advancements in AI and big data analytics, rising healthcare digitalization, and growing focus on improving patient outcomes and reducing medical errors.

According to a study, the global healthcare decision support system market size was worth around USD 2.58 Billion in 2024 and is expected to reach USD 5.69 Billion by 2034.

The global healthcare decision support system market is expected to grow at a CAGR of 9.2% during the forecast period.

North America is expected to dominate the healthcare decision support system market over the forecast period.

Leading players in the global healthcare decision support system market include Cerner (US), Epic (US), MEDITECH (US), Wolters Kluwer Health (Netherlands), Zynx Health (US), Elsevier B.V. (Netherlands), IBM Watson Health (US), Allscripts Healthcare Solutions (US), NextGen Healthcare (US), Siemens Healthineers (Germany), among others.

The report explores crucial aspects of the healthcare decision support system market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed