High Throughput Screening Market Size, Share, Trends, Growth and Forecast 2032

High Throughput Screening Market By Application (Toxicology Assessment, Target Identification and Validation, Primary and Secondary Screening, and Others); By Technology (Bioinformatics, Label-Free Technology, Lab-on-a-Chip, Cell-Based Assays, Ultra-High-Throughput Screening); By Product and Services (Software, Instruments, Reagent and Assay Kits, Consumables and Accessories and Services); By End Users (CROs, Government and Academic Institutes, Biotechnology and Pharmaceutical Companies, and Other): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024- 2032

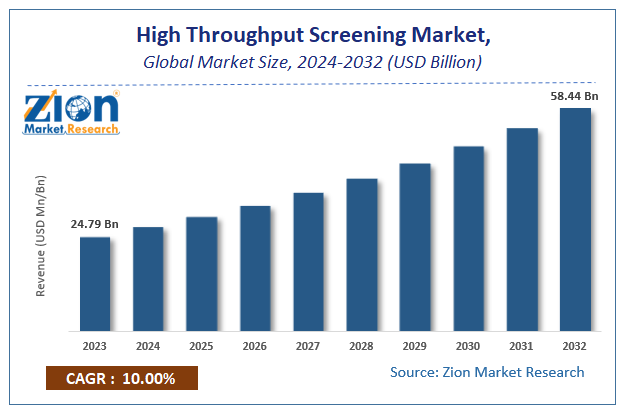

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.79 Billion | USD 58.44 Billion | 10% | 2023 |

High Throughput Screening Industry Perspective:

The global high throughput screening market size was worth around USD 24.79 billion in 2023 and is predicted to grow to around USD 58.44 billion by 2032 with a compound annual growth rate (CAGR) of roughly 10.00% between 2024 and 2032.

High Throughput Screening Market: Overview

The report covers forecast and analysis for the high throughput screening market on a global and regional level. The study provides historic data from 2018 along with forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the high throughput screening market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the high throughput screening market on a global as well as regional level.

In order to give the users of this report a comprehensive view on the high throughput screening market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the high throughput screening market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, regional expansion of major participants involved in the high throughput screening market on global and regional basis.

High Throughput Screening Market: Growth Drivers

High throughput screening (HTS) is used for carrying out chemical, genetic and pharmacological tests. These tests are used to detect drugs presence, drug trails, and drug design and drug interactions. It uses many devices such as detectors, control software, and instruments to analyze the bimolecular and genetic interactions. It is a process by which compounds are tested for activators (agonists) or inhibitors (antagonists). Receptors and metabolic enzymes can also be tested. The numbers of leads, i.e. those compounds that produce the desired effect and which are active at low concentration, are detected. Many drugs such as mevastatin and cyclosporin A have been detected using HTS tests. The main task of the HTS is to detect lead compounds. Directions are then given for its optimization.

The increased penetration of the high throughput screening is largely due to the increasing number of drug screening requirements, stem cell research, toxicological studies, R&D programs initiated by governments and research centers, technological advancements in HTS found by biotechnology companies, increase in research and venture capital investments. However, the high cost of techniques and the lack of trained professionals to handle HTS software may inhibit the growth of this market.

High Throughput Screening Market: Segmentation

Based on product and services market is segmented into software, instruments, reagent and assay kits, service, accessories and consumables. Reagents and assay kits are the most used products and services of products for HTS tests due to the increasing number of assays development, continuous use of reagents for HTS tests, the rising R&D expenditure, high incidence of diseases and increased continued government support for research in drugs detection and recovery.

Based on technology, market is segmented into lab-on-a-chip, cell-based assays, ultra-high throughput screening, label-free technology and bioinformatics. 'Cell based assays segment is further split into perfusion cell culture, 2D cell culture, and 3D Cell culture. Label-free technology segment will grow at a highest CAGR over the forecast period. This high growth is attributed to advantages offered by label-free technology. Label-free technology can be used to study diverse cell types and targets. Also, probability of drug attrition due to toxicity can be reduced; complex biological pathways can be studied using simple methods using label-free technology. Cell based assay technology held the largest market share in 2022.

These high throughput screenings are used for various applications such as primary and secondary screening, target identification and validation, toxicology assessment and other applications. Target identification & validation segment held largest market share in 2018 as a result of increase in the number of prospective drug targets for screening. Contract research organizations (CROs), academic and government institutes, pharmaceutical and biotechnology companies and others are significant end users for the high throughput screening market. Pharmaceutical and biotechnology companies held significant market share in 2018 in terms of revenue. Large share is attributed to the increasing use of HTS technologies by biotech and pharmaceutical companies for drug discovery and toxicology studies.

High Throughput Screening Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Throughput Screening Market |

| Market Size in 2023 | USD 24.79 Billion |

| Market Forecast in 2032 | USD 58.44 Billion |

| Growth Rate | CAGR of 10% |

| Number of Pages | 126 |

| Key Companies Covered | Axxam, Corning, Thermo Fisher Scientific, Bio-Rad, Danaher, Hamilton, Agilent, Tecan, Merck Group, PerkinElmer, BioTek and Aurora Biomed among others |

| Segments Covered | By Application, By Technology, By Product And Services, By End-Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Throughput Screening Market: Regional Analysis

North America is seen to be the significant contributor to the market share, mainly due to the emphasis placed on research and development in pharmaceutical companies, the adoption of drug detection techniques, government support and funding and large number of companies producing HTS products and services. European markets have a large share of the market due to advancements in chemical testing, development of software and hardware that can automate testing, government initiatives for drug testing, R&D by various research centers and increase in utilization of data processing software for HTS. Asia Pacific region has experienced rising popularity of high throughput screening techniques.

The pharmaceutical industry has shifted from traditional approaches of using only one compound and low throughput, to automated processes using robotic systems and high throughput screening. Compounds found in different areas of biology are tested. The techniques used are simple, efficient and of particularly low cost. Middle East and Africa region will experience sluggish growth in the years to come. Latin America is projected to exhibit moderate growth for the high throughput screening market during the forecast period.

High Throughput Screening Market: Competitive Analysis

The global high throughput screening market is dominated by players like:HealthStream

- Axxam

- Corning

- Thermo Fisher Scientific

- Bio-Rad

- Danaher

- Hamilton

- Agilent

- Tecan

- Merck Group

- PerkinElmer

- BioTek

- Aurora Biomed

The report segment of global high throughput screening market as follows:

Global High Throughput Screening Market: By Product and Services

- Reagents & Assay Kits

- Instruments

- Consumables & Accessories

- Software

- Services

Global High Throughput Screening Market: By Technology

- Cell-based Assays

- 2D Cell Culture

- 3D Cell Culture

- Perfusion Cell Culture

- Lab-on-a-chip (LOC)

- Ultra-high-throughput Screening

- Bioinformatics

- Label-free Technology

Global High Throughput Screening Market: By Application

- Target Identification & Validation

- Primary and Secondary Screening

- Toxicology Assessment

- Other Applications

Global High Throughput Screening Market: By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations

- Other End Users

Global High Throughput Screening Market: By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global high throughput screening market a compound annual growth rate (CAGR) of roughly 10.00% between 2024 and 2032.

The market share is primarily attributed to North America, which is characterised by a significant number of companies producing HTS products and services, the adoption of drug detection techniques, government support and funding, and the emphasis on research and development in pharmaceutical companies. Advancements in chemical testing, the development of software and hardware that can automate testing, government initiatives for drug testing, R&D by various research centres, and the increased utilisation of data processing software for HTS have all contributed to the significant market share that European markets have. The prevalence of high-throughput screening techniques has been on the rise in the Asia Pacific region.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed