Health Care Provider Management Market Size, Share, Trends and Forecast, 2034

Health Care Provider Management Market By Deployment Mode (Cloud-Based, On-Premises), By End User (Private Payers, Public Payers), Functionality (Provider Data Management, Credentialing, Network Management, Contract Management, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

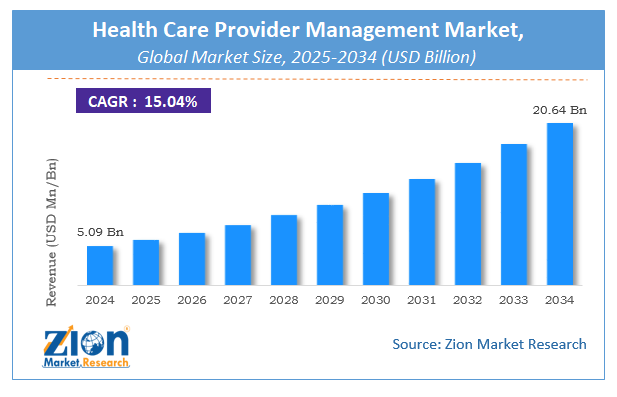

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.09 Billion | USD 20.64 Billion | 15.04% | 2024 |

Global Health Care Provider Management Market Size

The global health care provider management market size was worth around USD 5.09 Billion in 2024 and is predicted to grow to around USD 20.64 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 15.04% between 2025 and 2034. The report analyzes the global health care provider management market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the health care provider management industry.

Health Care Provider Management: Overview

Health care providers may access patient status and results through prompt reporting thanks to the healthcare provider network management solution, which offers payers powerful analytics tools and nearly real-time transaction data. Providers can spot suspect reimbursement claims hidden among the billions of accurate ones using machine learning and real-time data. To administer care-management programs, clinicians can forecast hospitalization, readmission, and illness progression by monitoring patient information. Compared to searching numerous systems, the provider network management system saves companies time and money by integrating patient data such as treatment plans, lab test results, authorizations, and medical bills.

The system also has data storage and analysis tools, enabling service providers to spot potential growth areas. Payers can better control costs, collaborate more effectively with providers, and give members the knowledge they need to make wise medical decisions when they have fast access to reliable network data. Payer organizations are now required to efficiently manage their provider networks to lower operating costs while simultaneously enhancing benefit coverage and raising customer satisfaction levels. A provider network of management software has a high price. High-quality treatment costs are high, yet spending more money does not always equate to higher standards of care or greater health.

COVID-19 Impact:

To guarantee that patients receive the care they require at an affordable price throughout the crisis. Payers will play a crucial role. Although many payer organizations struggle to operate efficiently, businesses that choose provider network management technology are doing well. Additionally, the epidemic has led to significant worries and worsening economic challenges for customers, companies, and communities. There is a chance for greater market turbulence given the continuous strain on supply and demand. Both businesses and people may deal with liquidity issues, such as a credit crunch. The use of provider network management solutions is essential for healthcare insurance providers because it makes it possible to manage provider networks more effectively, process claims more precisely, and lessen provider burden while cutting costs & errors. Payers can manage clients' risks in real-time, thanks to these technologies.

Key Insights

- As per the analysis shared by our research analyst, the global health care provider management market is estimated to grow annually at a CAGR of around 15.04% over the forecast period (2025-2034).

- Regarding revenue, the global health care provider management market size was valued at around USD 5.09 Billion in 2024 and is projected to reach USD 20.64 Billion by 2034.

- The health care provider management market is projected to grow at a significant rate due to demand for efficient provider credentialing, regulatory compliance, cost control, and integration of healthcare IT systems to streamline operations.

- Based on Deployment Mode, the Cloud-Based segment is expected to lead the global market.

- On the basis of End User, the Private Payers segment is growing at a high rate and will continue to dominate the global market.

- Based on the Functionality, the Provider Data Management segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Global Health Care Provider Management Market Growth Drivers

Adoption of government regulations to drive market growth

Payer organizations are now required to efficiently manage their provider networks to lower operating costs while simultaneously enhancing benefit coverage and raising customer satisfaction levels. This is made necessary by the implementation of healthcare mandates like the Patient Protection and Affordable Care Act (PPACA), which includes Medical Loss Ratio (MLR) and Administrative Loss Ratio (ALR). Payers are turning to provider network management due to strict federal regulations, increased workload due to an expanding customer base, and a growing demand to reduce operational and administrative costs.

Health Care Provider Management Market: Restraints

Infrastructure issues in developing nations to hamper market expansion

One of the main obstacles to the adoption of HCIT systems is cost. A provider of network management software has a high price. For provider network management systems, the cost of maintenance and software updates may exceed the cost of the software. Support and maintenance costs, which account for nearly 30% of the total cost of ownership, include software upgrades (in response to changing user requirements). Additionally, to enhance the effectiveness of provider network management systems, training for end users is required due to the absence of internal IT experience in the healthcare sector. The cost of owning these systems consequently rises as a result of this, which further restraints the market growth.

Global Health Care Provider Management Market: Opportunity

Sophisticated data analytics to offer market growth opportunities

Payers encounter many difficulties in managing medical loss ratios and maintaining provider networks because of the changing nature of the healthcare sector. As a result, healthcare payers increasingly emphasize leveraging cutting-edge IT tools like data analytics. Payers must employ data analytics to retain current members and establish efficient care management systems emphasizing managing medical loss ratios. Payers can use analytics for propensity-score shaping, unbiased predictive modeling, clustering, and optimization. Several payers have started employing analytics tools to improve fact-based decision-making, extensively utilizing data, enabling statistical and quantitative analysis, and applying prediction models. This boosts efficiency in tasks like provider contracting.

Health Care Provider Management: Segmentation

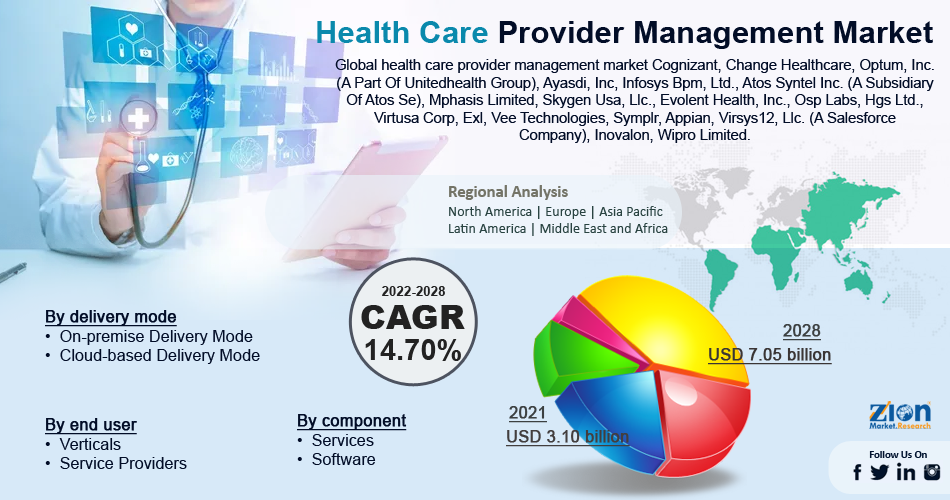

The global health care provider management market is segregated based on component, delivery mode, end user, and region.

Based on components, the market is divided into services and software. In the component segment of the healthcare provider network management market in 2021, provider network management platforms/software held the highest share. In terms of market share, the services segment is anticipated to dominate the worldwide healthcare provider network management market during the forecast period. The low cost of services in healthcare systems, as well as advancements in claims auto adjudication rates, operational efficacy, and provider relationships, are responsible for the huge proportion of this market. Internal services and external services are additional categories for the services section.

Based on delivery mode, the market is divided into on-premise delivery mode and cloud-based delivery mode. The on-premise delivery method segment dominated the healthcare provider network management market in 2021. On the other side, the segment for cloud-based delivery modes is anticipated to record the highest CAGR during the projected period. Fewer capital expenditures primarily drive the market for cloud-based solutions; operational costs are spent and increased scalability, flexibility, and affordability.

The market is divided into verticals and service providers based on the end user. In the health care provider management market's end-use sector, service providers held the lion's share in 2021. Services utilized by customers in both developed and developing countries are increasing considerably, though the software is also gaining traction.

Recent Developments

- Change Healthcare bought the Prometheus analytics division in 2020, expanding its solution portfolio.

Health Care Provider Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Health Care Provider Management Market |

| Market Size in 2024 | USD 5.09 Billion |

| Market Forecast in 2034 | USD 20.64 Billion |

| Growth Rate | CAGR of 15.04% |

| Number of Pages | 255 |

| Key Companies Covered | Optum, Cerner Corporation, Allscripts Healthcare Solutions, eClinicalWorks, McKesson Corporation, Athenahealth, GE Healthcare, Epic Systems Corporation, NextGen Healthcare, Meditech, and others. |

| Segments Covered | By Deployment Mode, By End User, By Functionality, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Landscape

North America was the largest geographic market in 2034.

The health care provider management market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. North America dominated the geographic component of the market. The Patient Protection and Affordable Act (PPACA) in the United States, the region's rapidly expanding IT sector, and the growing emphasis on lowering healthcare costs all contribute to the region's strong market growth. The market is predicted to grow due to rising innovation in healthcare expenses, service inquiries, patient care plans, growing attention to federal mandates in the U.S., and rising emphasis on enhancing the quality of care by effectively using payer reporting requirements. Due to the significance and need for healthcare in China, India, and Japan due to their enormous populations and geriatric populations with ailments, Asia Pacific is anticipated to see the quickest increase during the forecast period.

Competitive Landscape

- Cognizant

- Change Healthcare

- Optum, Inc. (A Division Of UnitedHealth Group)

- Ayasdi, Inc.

- Infosys Bpm, Ltd.

- Atos Syntel Inc. (A Division Of Atos Se)

- Mphasis Limited

- Skygen USA, L.L.C.

- Evolent Health, Inc.

- Osp Labs

- Hgs Ltd.

- Virtusa Corp, Exl

- Vee Technologies

- Symplr.

Global Health Care Provider Management Market is segmented as follows:

By component

- Services

- Software

By delivery mode

- On-premise Delivery Mode

- Cloud-based Delivery Mode

By end user

- Verticals

- Service Providers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global health care provider management market is expected to grow due to the need for streamlined operations, regulatory compliance, and enhanced patient-provider coordination.

According to a study, the global health care provider management market size was worth around USD 5.09 Billion in 2024 and is expected to reach USD 20.64 Billion by 2034.

The global health care provider management market is expected to grow at a CAGR of 15.04% during the forecast period.

North America is expected to dominate the health care provider management market over the forecast period.

Leading players in the global health care provider management market include Optum, Cerner Corporation, Allscripts Healthcare Solutions, eClinicalWorks, McKesson Corporation, Athenahealth, GE Healthcare, Epic Systems Corporation, NextGen Healthcare, Meditech, among others.

The report explores crucial aspects of the health care provider management market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed