Gas Chromatography (GC) Market Size, Share, Growth & Forecast 2034

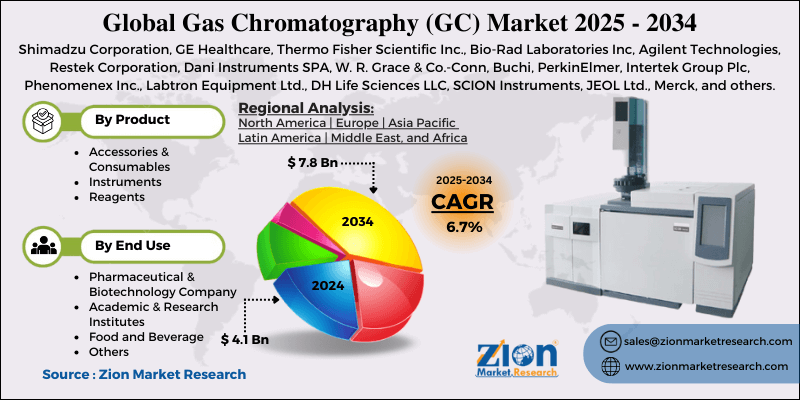

Gas Chromatography (GC) Market By Product (Accessories & Consumables, Instruments, and Reagents), By End-use (Pharmaceutical & Biotechnology Company, Academic & Research Institutes, Food and Beverage, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

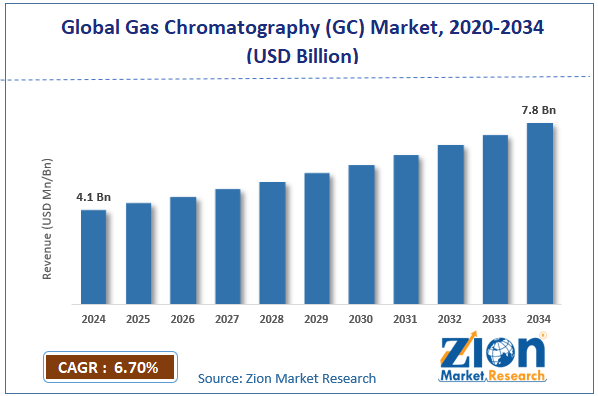

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.1 Billion | USD 7.8 Billion | 6.7% | 2024 |

Gas Chromatography (GC) Industry Perspective:

The global Gas Chromatography (GC) market size was worth around USD 4.1 billion in 2024 and is predicted to grow to around USD 7.8 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.7% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global Gas Chromatography (GC) market is estimated to grow annually at a CAGR of around 6.7% over the forecast period (2025-2034).

- In terms of revenue, the global Gas Chromatography (GC) market size was valued at around USD 4.1 billion in 2024 and is projected to reach USD 7.8 billion by 2034.

- Increasing pharmaceutical & biotechnology is expected to drive the Gas Chromatography (GC) market over the forecast period.

- Based on the product, the reagents segment is expected to hold the largest market share over the forecast period.

- Based on the end-use, the pharmaceutical & biotechnology segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Gas Chromatography (GC) Market: Overview

Gas chromatography is a group of analytical separation methods used to look at volatile chemicals in the gas phase. In gas chromatography, a sample's parts are dissolved in a solvent and then vaporized to separate the analytes by splitting the sample into two phases: stationary and mobile. The mobile phase is a gas that doesn't react with other chemicals and moves analyte molecules through a heated column. One of the rare types of chromatography that doesn't need the mobile phase to interact with the analyte is gas chromatography.

The stationary phase could be a solid adsorbent (GSC) or a liquid on an inert support (GLC). The Gas Chromatography (GC) Market is being driven by the growth in pharma & biotechnology sectors, stricter regulatory & quality assurance requirements, environmental monitoring & sustainability concerns, technological advancements, expanding applications & industries, and consumables & after-market needs. However, the high initial cost & operational expenses are expected to hamper the market growth.

Gas Chromatography (GC) Market Dynamics

Growth Drivers

Why does the growth in the pharma & biotechnology sectors drive the gas chromatography market growth?

The growth in the pharma & biotechnology sectors is expected to drive the Gas Chromatography (GC) market during the forecast period. Regulatory agencies, such as the FDA and EMA, are increasingly pressuring pharmaceutical companies to demonstrate that their medications are pure, effective, stable, and safe. GC is commonly employed for residual solvent analysis in Active Pharmaceutical Ingredients (APIs) and completed pharma products, impurity profiling—particularly for volatile or semi-volatile impurities—and stability testing or shelf-life studies to identify degradation and volatile by-products. The increase of Biologics, Biosimilars, and Personalized Medicine is also favorable to the market. GC is usually employed for small molecules and volatile or semi-volatile chemicals.

However, the expansion of biotech (biologics, peptides, ADCs, etc.) means that more complicated quality control procedures, impurity profiling, and other approaches are needed. In some circumstances, GC-MS and hyphenated methods are being used. Personalized medicine and biomarker discovery are on the rise, and GC (often with MS) is being utilized for metabolic profiling, volatile biomarkers, and other applications.

Restraints

How do the high investment and maintenance costs hinder the gas chromatography market growth?

The high costs of the equipment and maintenance for gas chromatography (GC) systems make it challenging for businesses to use them. Research facilities with restricted resources, as well as academic and small-scale labs, can't afford high-end GC systems that have mass spectrometry (GC-MS) features. To have a full GC system, it's necessary to buy the instrument and basic equipment, like gas cylinders, detectors, columns, and data analysis software. The original capital costs and the ongoing costs of maintenance, supplies, annual service, and buying calibration gas all add up to a lot of extra costs for running the business.

Operating expenses go up since users have to pay for regular maintenance and the occasional replacement of critical parts like detectors and columns. Since there aren't enough skilled individuals available, small labs and businesses cannot utilize GC instruments because they struggle to find personnel with the necessary skills. Therefore, the high initial and maintenance costs might be hampering the Gas Chromatography (GC) Industry.

Opportunities

Why do the rising product launch offers a potential opportunity for the growth of the gas chromatography industry?

The increasing product launches are expected to offer a lucrative opportunity for the Gas Chromatography (GC) market. For instance, in June 2025, PEAK Scientific introduced its newest GC instrument product line, Intura, at ASMS 2025 in Baltimore, MD. The hydrogen, nitrogen, and zero air generators are a premium, on-demand option for labs aiming to improve productivity and analytical quality.

Following on from - and expanding on - its flagship GC package, the Precision series, PEAK has designed and manufactured a line of generators that provide GC labs with flexibility in flow rate, gas type, pressure, and other parameters. Intura is intended for labs that require high-purity carrier and detector gas in a compact, space-saving package for their GC.

Challenges

Why does the regulatory & standards complexity pose a major challenge to market expansion?

Gas chromatography (GC) plays a crucial role in adhering to regulations and interpreting complex standards in the pharmaceutical and biotechnology industries. It is very important to make sure that drug products are safe, effective, and of high quality in line with the strict rules set by groups like the FDA, EMA, and ICH. To meet regulatory criteria, GC laboratories must verify their techniques by showing that they are specific, accurate, repeatable, and sensitive. This validation process is quite thorough and hard, and it often requires a lot of paperwork and strict quality controls.

Compliance includes keeping an eye on how packaging interacts, cleaning validation to stop cross-contamination, and environmental rules for emissions. This makes GC's operations complicated and regulated from all sides. As guidelines change, the pharmaceutical industry has to keep updating its GC methods and equipment to meet new requirements and suggestions, which makes things more complicated.

Gas Chromatography (GC) Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gas Chromatography (GC) Market |

| Market Size in 2024 | USD 4.1 Billion |

| Market Forecast in 2034 | USD 7.8 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 214 |

| Key Companies Covered | Shimadzu Corporation, GE Healthcare, Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc, Agilent Technologies, Restek Corporation, Dani Instruments SPA, W. R. Grace & Co.-Conn, Buchi, PerkinElmer, Intertek Group Plc, Phenomenex Inc., Labtron Equipment Ltd., DH Life Sciences LLC, SCION Instruments, JEOL Ltd., Merck, and others. |

| Segments Covered | By Product, By End-use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gas Chromatography (GC) Market: Segmentation

The global Gas Chromatography (GC) industry is segmented based on product, end-use, and region.

Based on the product, the global Gas Chromatography (GC) market is bifurcated into accessories & consumables, instruments, and reagents. The reagents are expected to capture the largest market share over the projected period. Columns, liners, septa, and derivatization agents have a limited lifespan and must be replaced frequently to provide accurate findings. A varied set of reagents is required for a variety of applications and sample types. This variant guarantees a stable supply of reagents and a consistent revenue stream for reagent makers.

Furthermore, high-performance GC analyses require highly specific and pure reagents to eliminate interference from impurities and assure accurate results, and reagents meet these requirements.

Based on the end-use, the global Gas Chromatography (GC) industry is bifurcated into pharmaceutical & biotechnology companies, academic & research institutes, food and beverage, and others. The pharmaceutical & biotechnology company segment holds the major market share. Pharmaceutical and biotechnology businesses are among the main end users, contributing significantly to GC market revenues due to the crucial requirement for chromatography in drug development, quality control, regulatory adherence, and impurity profiling.

Furthermore, advances in GC equipment and consumables enable improved impurity identification and biosimilar medicine quality testing, driving global demand from pharmaceutical and biotech companies. Therefore, driving the Gas Chromatography (GC) industry.

Gas Chromatography (GC) Market: Regional Analysis

Why does North America dominate the gas chromatography market over the projected period?

North America is expected to dominate the global gas chromatography market over the projected period. The regional market growth is driven by several factors, such as a strict regulatory environment and the presence of a large pharmaceutical and biotech sector. The EPA, FDA, and other U.S. agencies, as well as similar Canadian agencies, regularly enforce strict rules for monitoring the environment (air, water, and soil), food safety, drug purity, and other aspects. The GC and GC-MS are very important tools for reaching these standards. New laws and monitoring programs, such as finding PFAS in drinking water and controlling volatile organic compounds, are making labs alter their testing methods.

In addition, North America, especially the United States, is a leader in the worldwide pharmaceutical R&D and biotech industry. These businesses require gas chromatography for tasks such as identifying new drugs, determining the presence of impurities, assessing their stability, and more. These companies have a lot of funds; therefore, they keep buying new analytical tools, like GC instruments, consumables, and accessories. Thus, the aforementioned facts drive the Gas Chromatography (GC) market.

Gas Chromatography (GC) Market: Competitive Analysis

The global Gas Chromatography (GC) market is dominated by players like:

- Shimadzu Corporation

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc

- Agilent Technologies

- Restek Corporation

- Dani Instruments SPA

- W. R. Grace & Co.-Conn

- Buchi

- PerkinElmer

- Intertek Group Plc

- Phenomenex Inc.

- Labtron Equipment Ltd.

- DH Life Sciences LLC

- SCION Instruments

- JEOL Ltd.

- Merck

The global Gas Chromatography (GC) market is segmented as follows:

By Product

- Accessories & Consumables

- Instruments

- Reagents

By End-use

- Pharmaceutical & Biotechnology Company

- Academic & Research Institutes

- Food and Beverage

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Gas chromatography is a group of analytical separation methods used to look at volatile chemicals in the gas phase. In gas chromatography, a sample's parts are dissolved in a solvent and then vaporized to separate the analytes by splitting the sample into two phases: stationary and mobile.

The Gas Chromatography (GC) Market is being driven by the growth in pharma & biotechnology sectors, stricter regulatory & quality assurance requirements, environmental monitoring & sustainability concerns, technological advancements, expanding applications & industries, and consumables & after-market needs.

The high initial cost & operational expenses are expected to hamper the gas chromatography market growth.

Based on the end-use, the pharmaceutical & biotechnology company segment is expected to dominate the industry growth during the projected period.

The increasing pharmaceutical sector and growing innovation is are major impacting factors for the industry growth over the projected period.

According to the report, the global Gas Chromatography (GC) market size was worth around USD 4.1 billion in 2024 and is predicted to grow to around USD 7.8 billion by 2034.

The global Gas Chromatography (GC) market is expected to grow at a CAGR of 6.7% during the forecast period.

The global Gas Chromatography (GC) industry growth is expected to be driven by the North American region. It is currently the world’s highest-revenue-generating market, due to the presence of major players and the growing pharmaceutical sector.

The global Gas Chromatography (GC) market is dominated by players like Shimadzu Corporation, GE Healthcare, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc, Agilent Technologies, Restek Corporation, Dani Instruments SPA, W. R. Grace & Co.-Conn, Buchi, PerkinElmer, Intertek Group Plc, Phenomenex Inc., Labtron Equipment Ltd., DH Life Sciences, LLC, SCION Instruments, JEOL Ltd., and Merck, among others.

The gas chromatography market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed