Medical Oxygen Gas Cylinders Market Size, Share, Growth, Analysis, and Forecast 2032

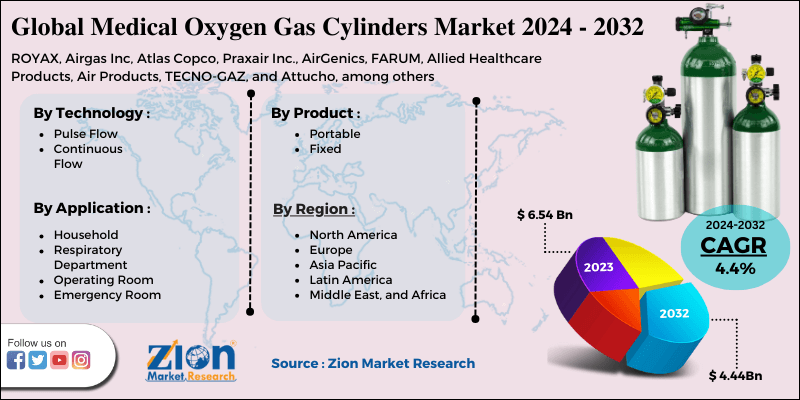

Medical Oxygen Gas Cylinders Market By Technology (Pulse Flow and Continuous Flow), By Application (Household, Respiratory Department, Operating Room, and Emergency Room), By Product (Portable and Fixed): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

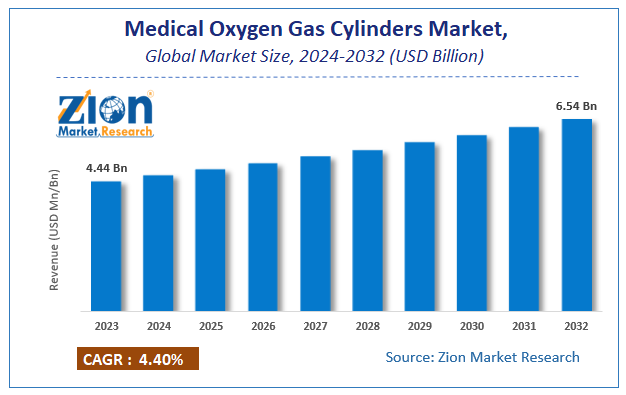

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.44 Billion | USD 6.54 Billion | 4.4% | 2023 |

Medical Oxygen Gas Cylinders Market Insights

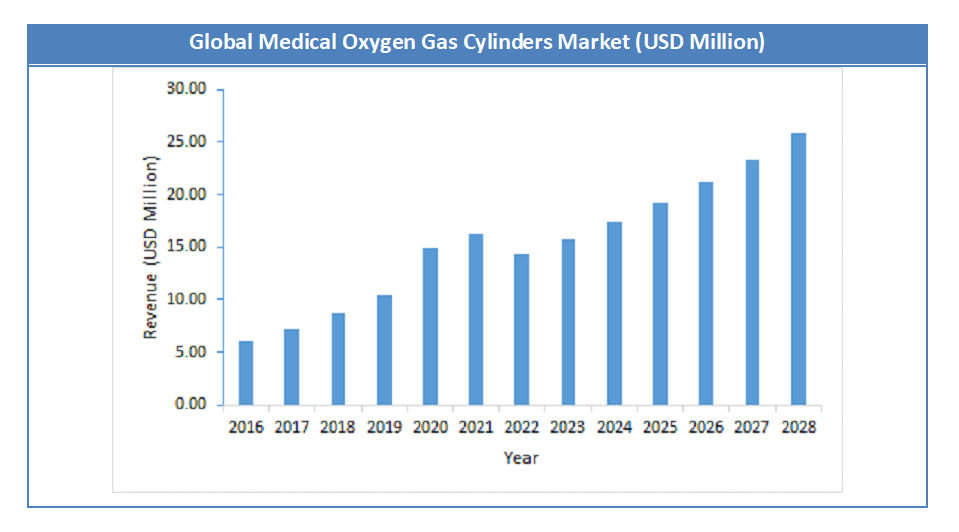

According to Zion Market Research, the global Medical Oxygen Gas Cylinders Market was worth USD 4.44 Billion in 2023. The market is forecast to reach USD 6.54 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.4% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Medical Oxygen Gas Cylinders Market industry over the next decade.

The medical oxygen gas cylinder is a re-inflatable, transportable cylinder for storing high-pressure liquefied oxygen gas. They are great for personal health care, hospitals, combat rescue, home care, nursing homes, and first-aid stations. High-pressure steel seamless oxygen gas cylinders are produced with various specifications using modern methods and first-class manufacturing equipment. Due to different technical breakthroughs, the medical gas and equipment industry has grown tremendously. In the coming years, factors such as rising frequency of chronic diseases, rising incidence of respiratory diseases as a result of high tobacco use and rising pollution levels, rapid growth in the geriatric population, rising incidence of preterm births, and rising demand for home healthcare are expected to drive market growth. Industry expansion in growing countries across APAC, as well as technology advances, are likely to provide a diverse variety of opportunities for market players.

Growth Factors

The major growth factors of the Medical Oxygen Gas Cylinders Market are: The present situation with the Covid-19 pandemic, the current Covid-19 pandemic crisis is a primary driving force behind the global market's expansion. The rising number of Covid-19 patients worldwide, particularly in India, has resulted in a shortage of medical oxygen gas cylinders. As a result, government and non-government organizations are establishing new plants to meet the growing demand for medical oxygen cylinders, which is driving the global market forward. Millions of people have been infected by the new coronavirus all across the world. In severe situations, the infection can lead to pneumonia and breathing difficulties. As a result, patients are placed on ventilators, resulting in an increase in demand for medical oxygen gas cylinders. The oxygen value chain's vendors are working tirelessly to increase the supply of medical oxygen gas cylinders. Furthermore, there is a high need for portable medical oxygen cylinders for patients receiving treatment at home. As a result of the increase of Covid-19 cases, demand for medical oxygen gas cylinders is increasing, boosting the global medical oxygen gas cylinders market to new heights during the pandemic.

Increasing the frequency of COPD and other lung disorders, another important factor driving market expansion is the rising prevalence of COPD and other lung diseases. In 2017, about 16 million adults in the United States were diagnosed with COPD, over 9 million with chronic bronchitis, and 3.5 million with emphysema, according to the US government. Furthermore, COPD is the cause of approximately 7 million emergency department visits in the United States each year. The use of supplemental oxygen for a long time has increased the survival rate of COPD patients. As a result, the increased frequency of COPD and other lung disorders, as well as COPD patients' reliance on oxygen therapy products, are driving up demand for oxygen concentrators and cylinders.

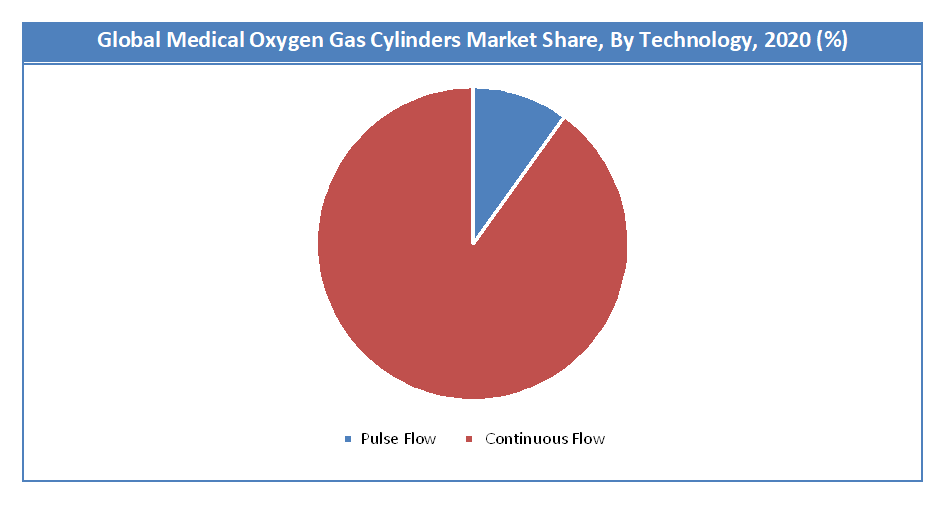

Technology Segment Analysis :

Based on technology, market is segmented into Pulse Flow and Continuous Flow. In 2020, continuous flow had the highest revenue share of 90%. The use of medical oxygen concentrators is predicted to increase due to rapid technological advancements in new product development. Furthermore, the segment's growth is expected to be aided by the continued usage of respiratory equipment for oxygen therapy. Continuous flow oxygen concentrators are most commonly used by the elderly and bedridden patients. Furthermore, because the devices are not equipped with breath detecting technology, they are less expensive than pulse flow technology. Due to technological advancements, pulse flow technology in oxygen concentrators is expected to grow at the fastest rate over the forecast period. The method is more efficient and convenient than continuous flow, and it is mostly utilised by patients who require 450 to 1250 mL of oxygen per minute in short pulses. It is best for people that lead an active lifestyle. As a result, working professionals, frequent flyers, and athletes with COPD or other breathing problems are increasingly turning to concentrators that use this technology.

Application Segment Analysis

Based on application, market is segmented into Households, Respiratory Departments, Operating Rooms, and Emergency Room. With a revenue share of 58 percent in 2020, the home care segment dominated the entire oxygen cylinders market in terms of revenue. Over the projected period, the segment is predicted to rise due to increased demand for home healthcare oxygen therapies, as well as rising need for pure oxygen and technological improvements such as miniaturization of these medical equipment. The category is being driven by an improving standard of living and an increase in the use of home-based therapy, particularly in developed nations such as North America and Europe. Furthermore, nations with a substantial geriatric population, such as Germany, Japan, Italy, Monaco, and Austria, are likely to drive segment growth during the projected period.

Regional Segment Analysis

North America will account for 34.4% of total revenue in 2020. One of the major elements driving market expansion is the region's growing geriatric population. Due to a weakened immune system and a limited oxygen intake capacity, this group is prone to a variety of respiratory illnesses. Furthermore, government initiatives such as the Federal Aviation Administration's (FAA) authorization of the use of portable oxygen concentrators during air travel and the rising prevalence of severe chronic obstructive pulmonary disease due to unhealthy lifestyles are contributing to regional market growth.

The Asia Pacific region is projected to grow at a CAGR of 13.3% over the forecast period.

Factors supporting market expansion in this region include the present pandemic situation with rising Covid-19 cases, increased government initiatives to meet the expanding need for medical oxygen gas cylinders, and major investment in healthcare infrastructure development. The rapidly growing geriatric population and the frequency of lung illnesses are two key factors driving regional market expansion. By 2050, one out of every four inhabitants in the region are expected to be over 60 years old. In the region's most developed countries, living and health standards have dramatically improved. Over the projection period, factors such as increased life expectancy, healthcare expenditure, and awareness of new technologies are likely to contribute to regional market growth.

Medical Oxygen Gas Cylinders Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Oxygen Gas Cylinders Market |

| Market Size in 2023 | USD 4.44 Billion |

| Market Forecast in 2032 | USD 6.54 Billion |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 140 |

| Key Companies Covered | ROYAX, Airgas Inc, Atlas Copco, Praxair Inc., AirGenics, FARUM, Allied Healthcare Products, Air Products, TECNO-GAZ, and Attucho, among others |

| Segments Covered | By Technology, By Application , By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Market Players & Competitive Landscape

Some of key players in Medical Oxygen Gas Cylinders market are

- ROYAX,

- Airgas Inc,

- Atlas Copco,

- Praxair Inc.,

- AirGenics,

- FARUM,

- Allied Healthcare Products,

- Air Products,

- TECNO-GAZ, and Attucho, among others.

The global Medical Oxygen Gas Cylinders market is segmented as follows:

By Technology

- Pulse Flow

- Continuous Flow

By Application

- Household

- Respiratory Department

- Operating Room

- Emergency Room

By Product

- Portable

- Fixed

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Medical Oxygen Gas Cylinders market was valued at USD 4.44 Billion in 2023.

The global Medical Oxygen Gas Cylinders market is expected to reach USD 6.54 Billion by 2032, with an anticipated CAGR of around 4.4% from 2024 to 2032.

Some of the key factors driving the global Medical Oxygen Gas Cylinders market growth are The present situation with the Covid-19 pandemic, the current Covid-19 pandemic crisis is a primary driving force behind the global market's expansion and Increasing frequency of COPD and other lung disorders.

North America will account for 34.4% of total revenue in 2020. One of the major elements driving market expansion is the region's growing geriatric population. the Asia Pacific region is estimated to account for the largest share of the worldwide medical oxygen gas cylinders market.

Some of the major companies operating in the Medical Oxygen Gas Cylinders market are ROYAX, Airgas Inc, Atlas Copco, Praxair Inc., AirGenics, FARUM, Allied Healthcare Products, Air Products, TECNO-GAZ, and Attucho, among others.

List of Contents

Market InsightsGrowth FactorsTechnology Segment Analysis :Application Segment AnalysisRegional Segment AnalysisThe Asia Pacific region is projected to grow at a CAGR of 13.3% over the forecast period.Report ScopeKey Market Players Competitive LandscapeThe global market is segmented as follows:By TechnologyBy ApplicationBy ProductBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed