Functional Service Providers Market Size, Growth, Global Trends, Forecast 2034

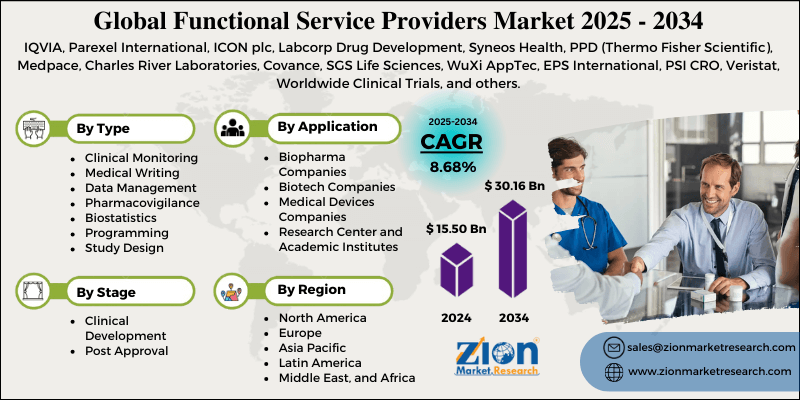

Functional Service Providers Market By Type (Clinical Monitoring, Medical Writing, Data Management, Pharmacovigilance, Biostatistics, Programming, Study Design, and Others), By Stage (Clinical Development, Post Approval), By Application (Biopharma Companies, Biotech Companies, Medical Devices Companies, Research Center and Academic Institutes), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

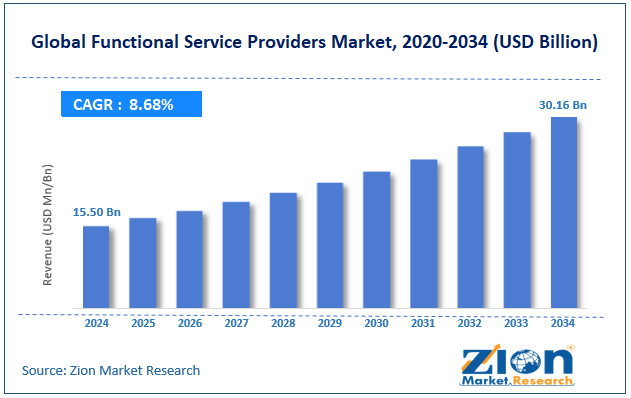

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.50 Billion | USD 30.16 Billion | 8.68% | 2024 |

Functional Service Providers Industry Perspective:

The global functional service providers market size was approximately USD 15.50 billion in 2024 and is projected to reach around USD 30.16 billion by 2034, with a compound annual growth rate (CAGR) of approximately 8.68% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global functional service providers market is estimated to grow annually at a CAGR of around 8.68% over the forecast period (2025-2034)

- In terms of revenue, the global functional service providers market size was valued at around USD 15.50 billion in 2024 and is projected to reach USD 30.16 billion by 2034.

- The functional service providers market is projected to grow significantly due to the increasing demand for cost-effective outsourcing models, stringent regulatory requirements across regions, and the adoption of advanced analytical and digital technologies.

- Based on type, the clinical monitoring segment is expected to lead the market, while the data management segment is expected to grow considerably.

- Based on stage, the clinical development segment is the largest, while the post-approval segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the biopharma companies segment is expected to lead the market compared to the biotech companies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Functional Service Providers Market: Overview

Functional service providers are dedicated outsourcing partners in the pharmaceutical and clinical research sector that handle specific functions like data management, clinical monitoring, pharmacovigilance, biostatistics, or regulatory affairs on behalf of CROs and biopharma companies. The global functional service providers market is projected to experience substantial growth, driven by increasing R&D expenditures in the biotech and pharmaceuticals, the growing complexity of clinical trials, and a shift toward flexible outsourcing models. The worldwide pharmaceutical R&D spending is anticipated to exceed $250 billion by 2026, driving the demand for cost-effective outsourcing models. Leading brands are actively shifting their focus to manage specific functional domains, thereby reducing internal operational costs while maintaining scientific precision and accuracy.

With the advancements in precision medicine, rare disease studies, and biologics, clinical trials are becoming increasingly complex. FSPs offer specialized expertise in managing adaptive designs, multi-country operations, and biomarker-based studies, which aid sponsors in navigating the increasing difficulties of trials. Moreover, unlike conventional full-service outsourcing by CROs, the FSP model enables sponsors to retain strategic control. This flexibility attracts the mid-sized and large biotech firms, resulting in higher adoption worldwide.

Although drivers exist, the global market is challenged by factors such as privacy concerns, data security, and high dependency on vendors. Managing sensitive trial and patient data exposes FSPs to compliance and cybersecurity risks. Lapses or breaches may hamper adoption and erode trust. Additionally, overreliance on FSPs for crucial functions may result in continuity failures or risks to service quality, particularly in long-term clinical programs.

Even so, the global functional service providers industry is well-positioned due to the expansion of RWE services, specialization in orphan drugs and rare diseases, and integration of decentralized clinical trials. Regulators are actively considering RWE (Real-World Evidence) in approvals. FSPs may offer specialized analytics to interpret and collect real-world data from wearables and electronic health records. With more than 7,000 rare diseases affecting small patient populations, sponsors seek advanced outsourcing partners. FSPs offering niche expertise may capture this progressing segment.

Furthermore, following the COVID-19 pandemic, remote monitoring and decentralized trials utilizing telemedicine have seen a rise. FSPs may offer specialized DCT services to cater to the needs of virtual and hybrid trials.

Functional Service Providers Market: Growth Drivers

Decentralized trials, data integration needs, and digital endpoints boost the market growth

The growth of decentralized clinical trials has transformed operational strategies, with more than 50% of the worldwide trials in 2024 integrating at least one digital component. Sponsors are primarily dependent on FSPs to manage complete wearable integration, advanced data analytics pipelines, and eCOA tools. By promising smooth data flow in digital endpoints, functional service providers help reduce regulatory delays and errors. The adoption of patient-generated health data also needs advanced validation architectures, which sponsors may not possess in-house. This digital transformation is offering fresh high-value roles for FSPs as compliance guarantors and data orchestrators.

How is the functional service providers market driven by the rise of biotechs and specialty manufacturers, which in turn drives demand for specialized services?

Biotech now registers for more than 65% of the worldwide clinical pipeline, especially in rare diseases and gene and cell therapies. Nonetheless, a majority of them lack in-house regulatory and clinical infrastructure, increasing the significance of FSP associations for program execution. FSPs offer expert teams that can be embedded directly into sponsor businesses, promising smooth operations. With the rise in orphan drug designations, FDA acceptance for rare diseases increased by 12% in 2023, and specialized proficiency is notably in high demand. This biotech-based outsourcing wave is propelling strong growth prospects for FSP providers globally, impacting the functional service providers market.

Functional Service Providers Market: Restraints

How are regulatory and compliance risks hindering the progress of the functional service providers market?

Operating in highly regulated environments exposes FSPs to compliance-associated intricacies. Non-compliance may lead to audit failures, penalties, or trial delays. For example, in 2022, many mid-sized functional service providers received warning letters or trial holds because of SOP issues or documentation. Regulatory complexity varies across regions, which increases the costs and complexity of global operations. Sponsors may confine the scope of outsourcing to alleviate regulatory risk, restricting FSP industry penetration. Maintaining multi-region compliance raises operational cost and hampers growth, especially for small providers.

Functional Service Providers Market: Opportunities

How does the increasing adoption of cell & gene therapies create promising avenues for the growth of the functional service providers industry?

The growth of advanced therapies, including gene and cell therapies, is generating a significant demand for specialized regulatory and operational support. The international cell and gene therapy industry surpassed $10 billion in 2024, with over 1,000 active clinical trials currently underway. FSPs that offer specialization in managing complex logistics, quality assurance, and regulatory compliance for these therapies are experiencing significant demand. Associating early with biotech innovators enables FSPs to secure long-term contracts. This opportunity enhances the focus of the functional service providers industry on high-value, specialized services.

Functional Service Providers Market: Challenges

The rising cost of skilled talent restricts the market growth

The demand for highly specialized professionals in regulatory, data, and clinical management is surging, resulting in high retention costs and recruitment expenses. Talent surveys indicate that compensation for clinical operations experts increased by 8-10% annually from 2023 to 2024. High turnover may disrupt current programs and negatively impact quality. Functional service providers should continuously invest in incentives and training to retain staff. Managing talent costs while remaining competitive is a continuous operational challenge.

Functional Service Providers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Functional Service Providers Market |

| Market Size in 2024 | USD 15.50 Billion |

| Market Forecast in 2034 | USD 30.16 Billion |

| Growth Rate | CAGR of 8.68% |

| Number of Pages | 214 |

| Key Companies Covered | IQVIA, Parexel International, ICON plc, Labcorp Drug Development, Syneos Health, PPD (Thermo Fisher Scientific), Medpace, Charles River Laboratories, Covance, SGS Life Sciences, WuXi AppTec, EPS International, PSI CRO, Veristat, Worldwide Clinical Trials, and others. |

| Segments Covered | By Type, By Stage, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Functional Service Providers Market: Segmentation

The global functional service providers market is segmented based on type, stage, application, and region.

Based on type, the global functional service providers industry is categorized into clinical monitoring, medical writing, data management, pharmacovigilance, biostatistics, programming, study design, and other services. The clinical monitoring segment is the largest in the market owing to its vital role in patient safety and trial compliance. It encompasses activities such as patient recruitment oversight, protocol adherence, site initiation, and risk-based monitoring. With more than 70-75% of clinical trial costs associated with site management and monitoring, outsourcing this fraction aids pharmaceutical sponsors in cutting costs and accessing specialized expertise. This rising complexity of global, adaptive, and multi-country trials continues to fuel the segmental prominence.

Based on stage, the global functional service providers market is segmented into clinical development and post-approval. The clinical development segment holds a leading share of the market, as a majority of FSP outsourcing occurs during Phase I-III trials, when sponsors require significant support in clinical monitoring, biostatistics, data management, and regulatory documentation. The high price and complexity of worldwide multi-center trials increase the significance of outsourcing to enhance efficiency and reduce timelines.

Based on application, the global market is segmented into biopharmaceutical companies, biotechnology companies, medical device companies, and research centers and academic institutions. The biopharma companies segment holds a dominant share of the market, as they conduct the majority of clinical trials worldwide and have the leading R&D spending. These companies heavily outsource to FSPs for pharmacovigilance, clinical monitoring, and regulatory submissions to decrease costs and schedules. The need to manage large pipelines of biologics and small molecules increases the segment's dominance.

Functional Service Providers Market: Regional Analysis

What gives North America a competitive edge in the global Functional Service Providers Market?

North America is likely to sustain its leadership in the functional service providers market due to the high pharmaceutical R&D spending, large number of clinical trials, and strong presence of leading CROs and FSPs. North America, particularly the United States, leads due to its substantial pharmaceutical R&D investment, which surpassed $100 billion in 2024. Biopharma giants such as Merck, Pfizer, and Johnson & Johnson drive demand for outsourcing in clinical monitoring, pharmacovigilance, and data management. The sheer scale of research pipelines makes FSP associations crucial for scalability and cost efficiency.

Moreover, the United States holds the leading number of registered clinical studies worldwide, with more than 155,000 active trials recorded on ClinicalTrials.gov. The huge trial volume propels the demand for specialized functional outsourcing to handle monitoring, regulatory, and data compliance. This trial concentration strengthens the region's dominance in the FSP market.

North America also houses leaders such as Parexel, IQVIA, Labcorp, and Syneos Health, which offer CRO and FSP services. Their strong client base in biotech and pharmaceutical companies, along with their well-established infrastructure, fuels their regional prominence. Proximity to top sponsors further augments outsourcing adoption in Canada and the United States.

Europe continues to hold the second-highest share in the functional service providers industry, owing to its strong pharmaceutical R&D base, presence of FSP providers and CROs, and growing biotech activity. Europe accounts for nearly 22% of worldwide pharmaceutical R&D, with nations such as Switzerland, the UK, and Germany leading advancements. Key players, such as AstraZeneca, Novartis, and Roche, primarily rely on outsourcing models to enhance trial efficiency. This substantial investment sustains high demand for FSP services in the region.

Furthermore, European nations host global outsourcing leaders, including SGS (Switzerland), ICON plc (Ireland), and Ergomed (UK). Their presence boosts the regional service ecosystem for biotech and biopharma sponsors. These companies' established ecosystems promise Europe's ranking as a key hub for FSP operations. Europe's biotech industry raised more than EUR 30 billion in funding in 2024, with intense activity in gene and cell therapies. Mid- and small-sized biotech companies often lack in-house resources and rely on FSPs for dedicated support.

Functional Service Providers Market: Competitive Analysis

The leading players in the global functional service providers market are:

- IQVIA

- Parexel International

- ICON plc

- Labcorp Drug Development

- Syneos Health

- PPD (Thermo Fisher Scientific)

- Medpace

- Charles River Laboratories

- Covance

- SGS Life Sciences

- WuXi AppTec

- EPS International

- PSI CRO

- Veristat

- Worldwide Clinical Trials

Functional Service Providers Market: Key Market Trends

Integration of advanced analytics and AI:

Machine learning and artificial intelligence are being integrated into data management, biostatistics functions, and pharmacovigilance. FSPs leverage predictive analytics for patient recruitment, real-time trial insights, and safety monitoring. This trend improves efficiency while reducing schedules and costs for sponsors.

Expansion of flexible models and strategic partnerships:

Sponsors prefer long-term, strategic partnerships with FSPs over transactional outsourcing. Flexible engagement models enable biotech and pharmaceutical companies to maintain oversight while scaling resources as needed. This association-based approach is becoming a defining trend in the global market.

The global functional service providers market is segmented as follows:

By Type

- Clinical Monitoring

- Medical Writing

- Data Management

- Pharmacovigilance

- Biostatistics

- Programming

- Study Design

- Others

By Stage

- Clinical Development

- Post Approval

By Application

- Biopharma Companies

- Biotech Companies

- Medical Devices Companies

- Research Center and Academic Institutes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Functional service providers are dedicated outsourcing partners in the pharmaceutical and clinical research sector that handle specific functions like data management, clinical monitoring, pharmacovigilance, biostatistics, or regulatory affairs on behalf of CROs and biopharma companies.

The global functional service providers market is projected to grow due to the increasing complexity of clinical trials, rising cases of chronic and rare diseases, and a growing focus on faster drug development and shorter time-to-market.

According to study, the global functional service providers market size was worth around USD 15.50 billion in 2024 and is predicted to grow to around USD 30.16 billion by 2034.

The CAGR value of the functional service providers market is expected to be approximately 8.68% from 2025 to 2034.

Key opportunities supporting the growth of the functional service providers market include the adoption of decentralized clinical trials, growing demand in emerging markets, speedy growth of biotech and advanced therapies, increasing reliance on real-world evidence, and integration of AI-driven solutions.

Market trends and consumer preferences in the functional service providers market are evolving toward flexible outsourcing models, decentralized trials, digital and AI-driven solutions, and long-term strategic collaborations for cost and efficiency gains.

Macroeconomic factors, including inflationary pressures, healthcare spending, rising R&D investments, and shifts in the global supply chain, will shape outsourcing demand, driving both opportunities and cost challenges in the functional service providers market.

North America is expected to lead the global functional service providers market during the forecast period.

The key players profiled in the global functional service providers market include IQVIA, Parexel International, ICON plc, Labcorp Drug Development, Syneos Health, PPD (Thermo Fisher Scientific), Medpace, Charles River Laboratories, Covance, SGS Life Sciences, WuXi AppTec, EPS International, PSI CRO, Veristat, and Worldwide Clinical Trials.

The report examines key aspects of the functional service providers market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed