Folding Furniture Market Size, Share, Growth, Opportunities 2034

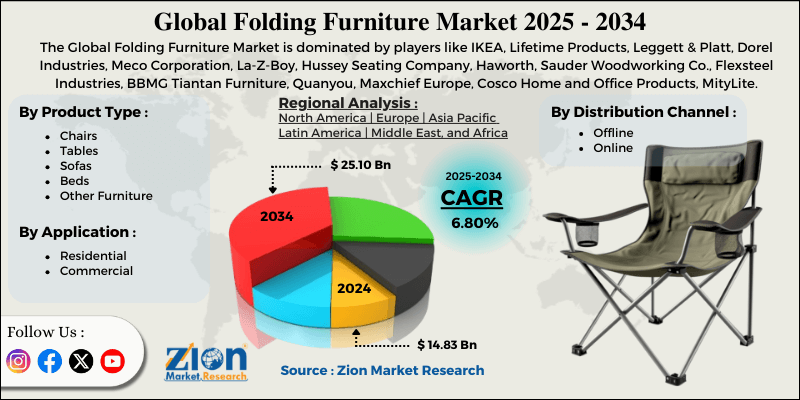

Folding Furniture Market By Product Type (Chairs, Tables, Sofas, Beds, and Other Furniture), By Application (Residential, Commercial), By Distribution Channel (Offline, Online), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

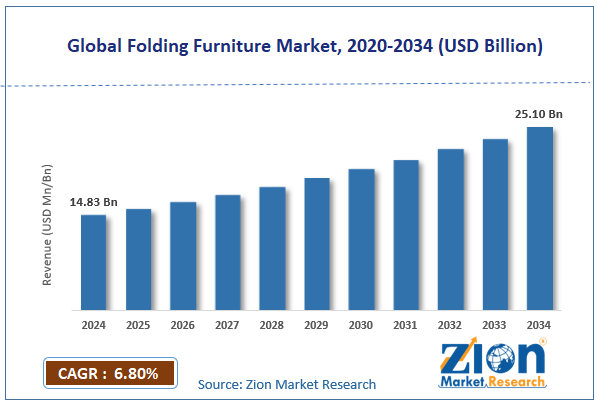

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.83 Billion | USD 25.10 Billion | 6.80% | 2024 |

Folding Furniture Industry Perspective:

What will be the size of the global folding furniture market during the forecast period?

The global folding furniture market size was around USD 14.83 billion in 2024 and is projected to reach USD 25.10 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global folding furniture market is estimated to grow annually at a CAGR of around 6.80% over the forecast period (2025-2034)

- In terms of revenue, the global folding furniture market size was valued at around USD 14.83 billion in 2024 and is projected to reach USD 25.10 billion by 2034.

- The folding furniture market is projected to grow significantly, driven by increasing demand for multifunctional furniture, greater e-commerce penetration, and demand for sustainable, eco-friendly products.

- Based on product type, the chairs segment is expected to lead the market, while the tables segment is expected to grow considerably.

- Based on application, the residential segment is the dominating segment, while the commercial segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the offline segment is expected to lead the market, followed by the online segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Folding Furniture Market: Overview

Folding furniture is specially designed to be space-saving, practical, and easy to store, making it suitable for offices, homes, and outdoor use. It can be folded and unfolded quickly and easily, allowing individuals to arrange it as needed and fold it when not in use. They are sturdy and lightweight, and stand out for their convenience and versatility. The global folding furniture market is poised for notable growth, driven by urbanization, smaller living spaces, changing consumer lifestyles, and increasing demand for affordable furniture. Growing urbanization has led to a shortage of residential space, particularly in metropolitan regions. Folding furniture allows efficient space utilization without affecting functionality. This makes it ideal for compact homes and apartments.

Moreover, modern consumers prefer portability, convenience, and multi-functional products. Folding furniture supports well with mobile and dynamic lifestyles. This preference is mainly strong among younger demographics. Furthermore, cost-effective furniture solutions are gaining prominence among cost-conscious buyers. These furniture solutions are priced lower than traditional furniture. This backs elevated adoption among first-time homeowners and students.

Nevertheless, the global market faces limitations due to durability concerns, limited aesthetic appeal, and fluctuations in raw material prices. Folding mechanisms may wear down faster than fixed furniture. Consumers associate folding furniture with low strength. This perception may hamper long-term adoption. Some folding furniture lacks premium design elements. This may reduce its appeal for luxury interiors. Design compromises may impact consumer preference. Similarly, volatility in wood, metal, and plastic prices affects production costs. Manufacturers may experience pricing instability, thus reducing profit margins.

Still, the global folding furniture industry benefits from several favorable factors, such as the development of smart folding furniture, the adoption of sustainable materials, and modular and customizable designs. Integrating technology adds functional value to items. Features like adjustable settings and charging ports increase appeal, thus creating premium industry segments. Eco-friendly materials may appeal to green consumers. Sustainable manufacturing enhances brand credibility and supports long-term industry growth. Additionally, offering customization improves user satisfaction. Modular folding furniture meets different spatial needs, opening higher-margin opportunities.

Folding Furniture Market: Dynamics

Growth Drivers

How does e‑commerce growth and online accessibility augment the folding furniture market?

The growth of e-commerce has transformed consumer access to folding furniture, enabling products to reach a wider audience more easily. Online platforms allow buyers to explore a broader range of designs, make purchases from home, and compare prices. Digital advancements like 3D visualization and augmented reality help consumers access functionality before buying. Small manufacturers now compete worldwide through online sales channels. Easy return policies and convenient home delivery encourage consumer confidence. E-commerce remains a leading driver of growth in the folding furniture market.

How does commercial and institutional adoption fuel the folding furniture market?

Folding furniture is broadly adopted in hotels, educational institutions, event venues, and offices, where flexible layouts are crucial. Institutions and businesses prefer furniture that is easy to store and portable for multi-functional spaces. The post-pandemic recovery of the events and hospitality sectors has further increased demand. Hybrid work models and co-working spaces are increasingly adopting foldable chairs, desks, and partitions to maximize flexibility. These commercial applications create large-volume sales opportunities. Institutional demand balances residential growth, expanding total industry potential.

Restraints

Competition from traditional furniture adversely impacts the market progress

Conventional furniture remains the default choice for many consumers owing to its long-term durability, perceived luxury, and familiarity. Fixed dining sets, sofas, and beds dominate commercial and residential markets. Folding furniture should overcome entrenched habits and demonstrate comparable value. Robust competition from established brands hampers new entrants' market share. Changing consumer preferences is challenging and a gradual process.

Opportunities

How are customization and premium furniture offerings advantageous for the development of the folding furniture market?

Consumers are showing a surge of interest in customizable, stylish furniture that fits personal interiors and needs. Premium folding furniture with bespoke finishes, sizes, and materials appeals to designers and households. High-class, aesthetic offerings allow brands to command higher prices and distinguish themselves. Customization strengthens customer satisfaction and brand loyalty. This trend supports growth in premium market segments, ultimately driving the folding furniture industry.

Challenges

Consumer resistance to change is a key hindrance to market growth

Several consumers still prefer traditional furniture because of cultural norms or familiarity. Convincing them to adopt folding solutions requires demonstration, education, and effective communication of value. Marketing campaigns are crucial for underscoring the long-term benefits of multi-functionality and space efficiency. Cultural attachment to conventional furniture slows adoption. Changing consumer mindsets remains a long-term challenge for market growth.

Folding Furniture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Folding Furniture Market |

| Market Size in 2024 | USD 14.83 Billion |

| Market Forecast in 2034 | USD 25.10 Billion |

| Growth Rate | CAGR of 6.80% |

| Number of Pages | 213 |

| Key Companies Covered | IKEA, Lifetime Products, Leggett & Platt, Dorel Industries, Meco Corporation, La-Z-Boy, Hussey Seating Company, Haworth, Sauder Woodworking Co., Flexsteel Industries, BBMG Tiantan Furniture, Quanyou, Maxchief Europe, Cosco Home and Office Products, MityLite, and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Folding Furniture Market: Segmentation

The global folding furniture market is segmented based on product type, application, distribution channel, and region.

Why is the Chairs segment projected to dominate the folding furniture market?

Based on product type, the global folding furniture industry is divided into chairs, tables, sofas, beds, and other furniture. The chairs segment holds a dominating share of the market, nearly 36%. This growth is backed by their broader use in offices, homes, events, and outdoor spaces. Their portability, versatility, and ease of storage make them essential for commercial and residential needs. This broad applicability sustains chairs as the leading product category worldwide.

Conversely, the tables segment holds the second-leading share, with nearly 29% of the total market. This is fueled by demand for space-saving surfaces in work, dining, and recreational settings. They are popular in compact living environments and for temporary use in multipurpose interiors or at events. Their balance of adaptability and functionality backs sustained industry growth.

What factors help the Residential segment lead the folding furniture market?

Based on application, the global folding furniture market is segmented into residential and commercial. The residential segment leads the worldwide market, registering for 65% of the share. Smaller living spaces and high urbanization are fueling demand for space-saving solutions such as folding beds, chairs, and tables. These things are favored for their portability, convenience, and ability to optimize the space in compact apartments and homes.

However, the commercial segment ranks second in the market with 35% share. It serves schools, offices, hotels, and event venues. Folding furniture is valued for its flexibility, quick setup, and easy storage, allowing commercial spaces to adapt to temporary layouts and changing needs.

What are the key reasons for the leadership of the Offline segment in the folding furniture market?

Based on the distribution channel, the global market is segmented into offline and online. The offline segment holds the largest share, accounting for 65% of the total market. Consumers prefer to see and test folding furniture in person before buying. Physical stores also offer personalized assistance and immediate availability.

Nonetheless, the online segment holds second place with 40% of the total market, driven by brand websites, e-commerce platforms, and online marketplaces. Wider selection, convenience, and doorstep delivery appeal to consumers, mainly tech-savvy and young buyers. Online sales are surging as digital adoption worldwide increases.

Folding Furniture Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Folding Furniture Market?

Asia Pacific is projected to maintain its dominant position with a 7-8% CAGR in the global folding furniture market, driven by significant market share and growth, rapid urbanization and space constraints, and rising disposable incomes and the rise of the middle class. APAC holds a strong position in the global market, accounting for 31-40% of total revenue over the past year, making it the leading regional contributor. The region’s high dominance indicates strong demand in both the commercial and residential sectors, driven by the need for space-efficient furniture. This also ranks Asia Pacific as a key hub for consumption and production worldwide. Urbanization in nations like Japan, China, India, and Southeast Asia has led to higher-density housing and smaller living spaces. Consumers are choosing folding furniture and multi-functional pieces to maximize utility in compact urban homes. These space pressures majorly drive regional industry demand.

Additionally, surging disposable incomes and an expanding middle class in APAC are driving spending on modern, convenient home furniture. A growing shift toward functional, modern interiors is driving purchases of versatile furniture solutions. This consumer trend supports sustained regions market growth.

Why does North America rank second in the global Folding Furniture Market?

North America maintains its position as the second-largest region, with a 5-6% CAGR in the global folding furniture industry, driven by high market share and consumer demand, compact living trends, and strong consumer spending and retail infrastructure. North America maintains a steady market share, accounting for 27-40% of overall revenue. This is attributed to the strong adoption in offices, homes, and institutions. In Canada and the U.S., space-efficient furniture solutions are broadly used in multi-functional interiors and urban apartments. This dominant position underscores the region’s established and mature consumer base.

Moreover, rapid urbanization and the growth of smaller living spaces, particularly in metropolitan cities, have driven demand for space-saving, versatile furniture in North America. Folding tables, chairs, and multi-functional units help improve limited interiors without sacrificing comfort. This trend is a key propeller of sustained consumer interest and industry growth.

Furthermore, high disposable incomes and strong retail networks lead to higher spending on quality furniture, comprising folding items with enhanced functionality and modern design. North American consumers are willing to pay a premium for aesthetics, durability, and convenience. Well-established online and offline channels also make a broad range of products well accessible.

Folding Furniture Market: Competitive Analysis

The leading players in the global folding furniture market are:

- IKEA

- Lifetime Products

- Leggett & Platt

- Dorel Industries

- Meco Corporation

- La-Z-Boy

- Hussey Seating Company

- Haworth

- Sauder Woodworking Co.

- Flexsteel Industries

- BBMG Tiantan Furniture

- Quanyou

- Maxchief Europe

- Cosco Home and Office Products

- MityLite

What are the key trends in the global Folding Furniture Market?

Integration of smart & modular features:

Folding furniture is transforming beyond basic collapsible forms to comprise modular elements and smart functions. Examples comprise wireless charging, adjustable heights, configurable layouts, and built-in USB ports. These innovations cater to urban users who prefer multi-functionality and convenience.

Space‑saving & multifunctional design demand:

Smaller living spaces and urbanization continue to fuel demand for multi-functional and compact furniture that maximizes utility. Folding products that transform into dining sets, workstations, or storage solutions are especially famous. This trend reflects lifestyle changes and the increasing demand for flexible interior layouts.

The global folding furniture market is segmented as follows:

By Product Type

- Chairs

- Tables

- Sofas

- Beds

- Other Furniture

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed